Economic Development Templates

Documents:

174

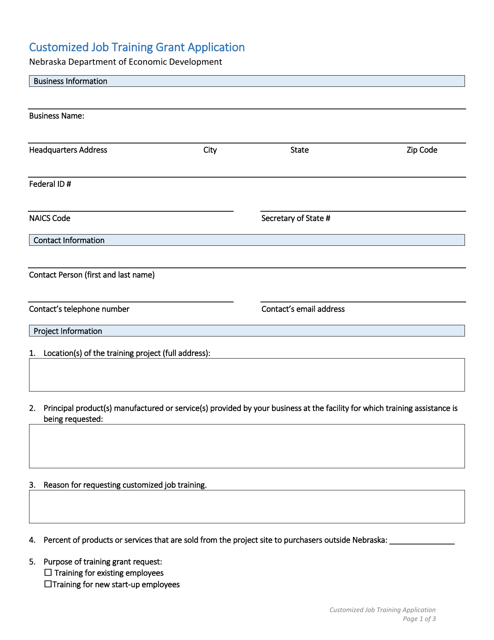

This document is used for applying for a customized job training grant in the state of Nebraska.

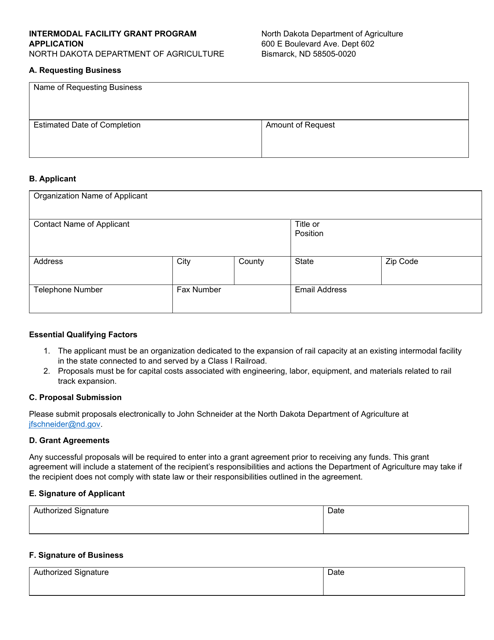

This document is used for applying for the Intermodal Facility Grant Program in North Dakota.

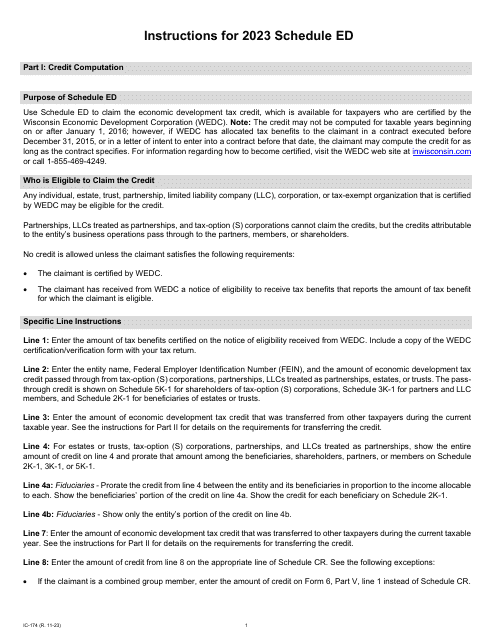

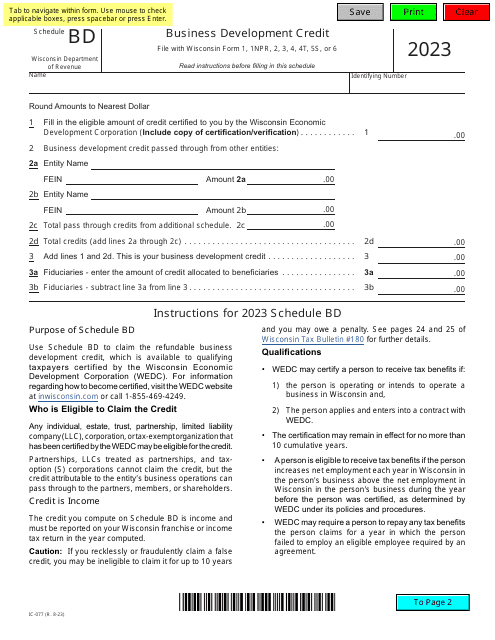

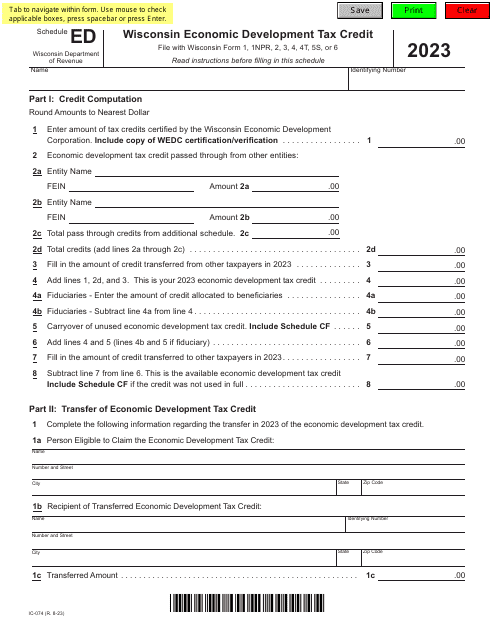

Instructions for Form IC-074 Schedule ED Wisconsin Economic Development Tax Credit - Wisconsin, 2023

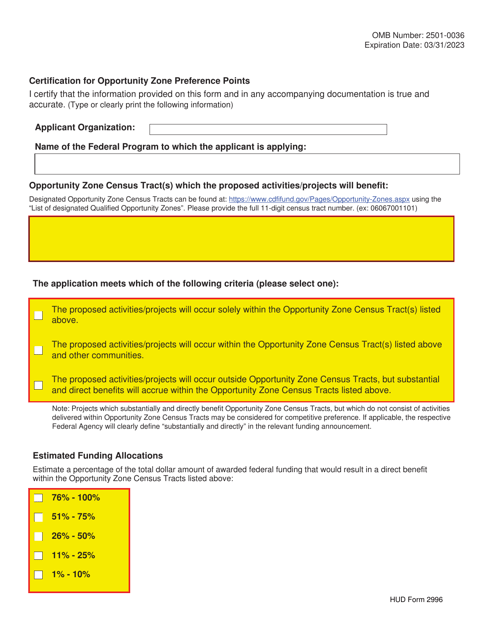

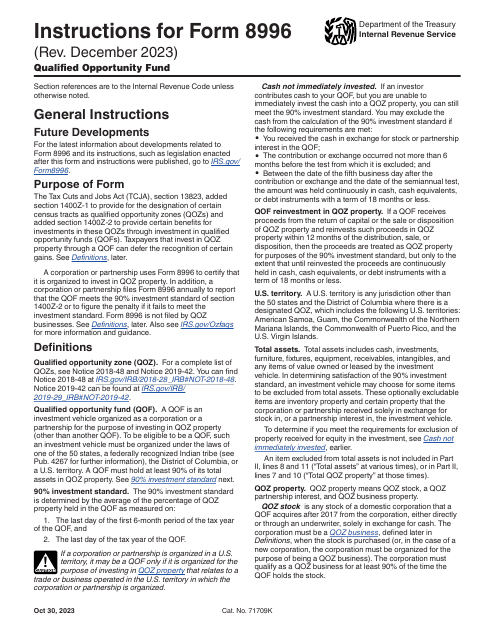

This form is used for certifying eligibility for preference points related to Opportunity Zones.

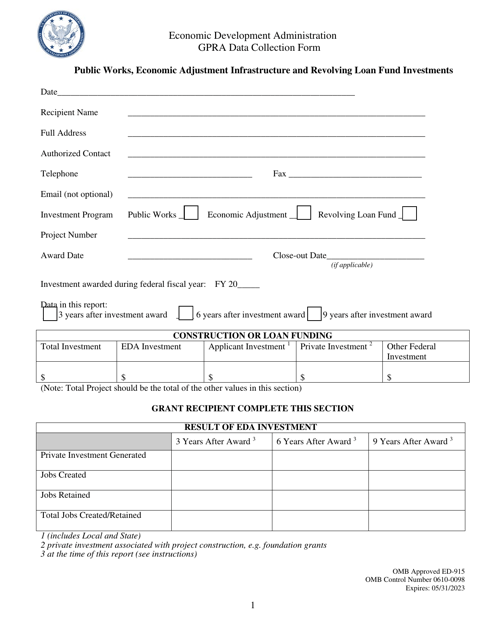

This Form is used for collecting GPRA (Government Performance and Results Act) data for public works, economic adjustment, infrastructure, and revolving loan fund investments.

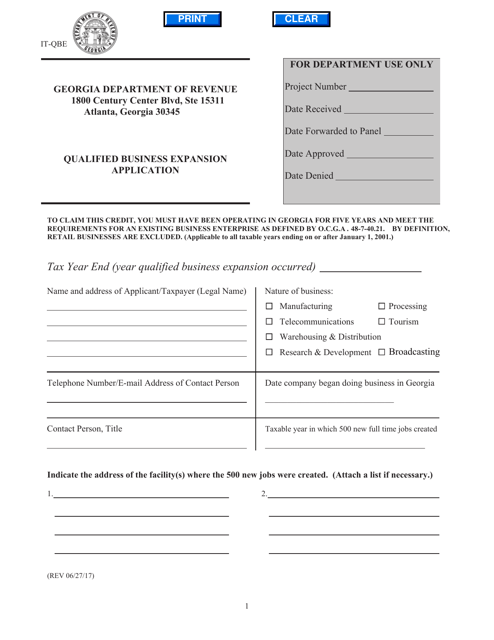

This form is used for submitting a Qualified Business Expansion Application in Georgia, United States. It is required for businesses seeking tax incentives for expanding their operations in the state.

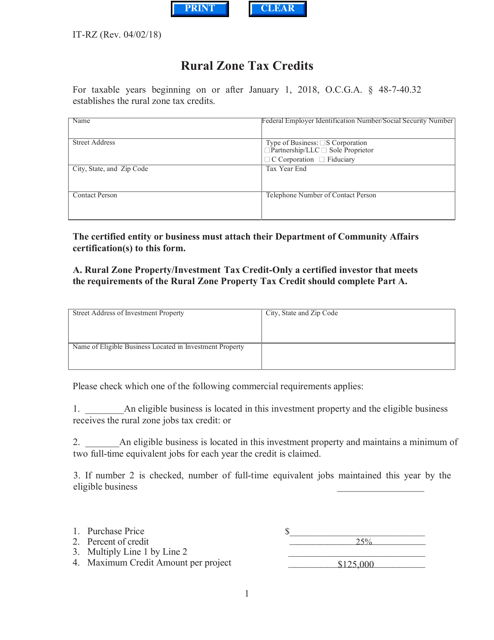

This form is used for claiming rural zone tax credits in the state of Georgia. It allows eligible individuals or businesses to receive tax credits for certain expenses incurred within designated rural zones.

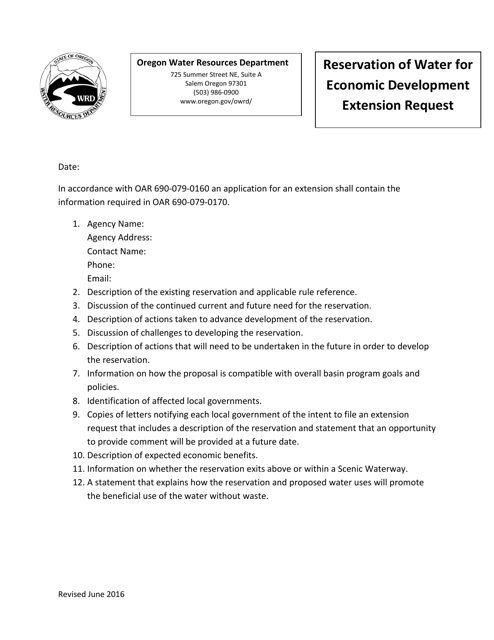

This document is used to request an extension for the reservation of water in Oregon for economic development purposes.

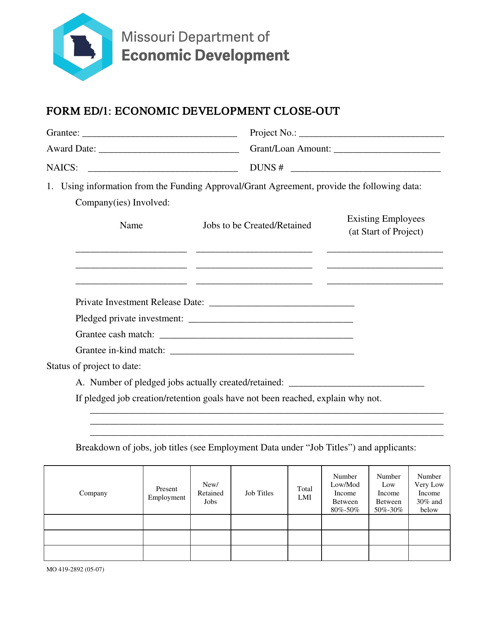

This form is used for economic development close-out in the state of Missouri. It is used to document the final details and outcomes of an economic development project.

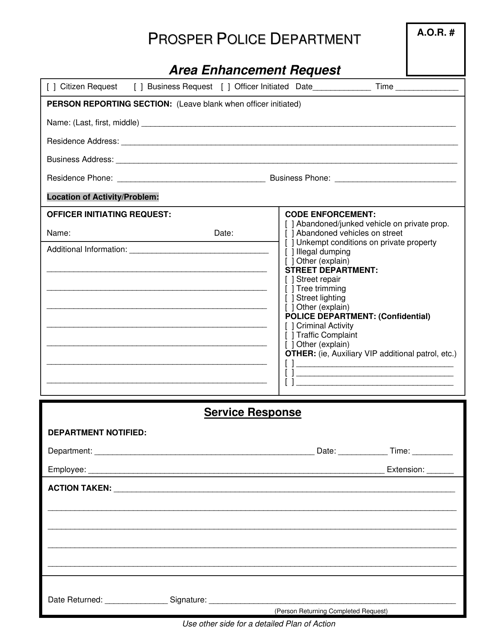

This Form is used for submitting an area enhancement request to the Town of Prosper, Texas. It allows residents to propose improvements or changes to public areas in the town.

This document addresses the challenge of reskilling in America and explores potential solutions to help individuals gain new skills and adapt to changing job market demands.

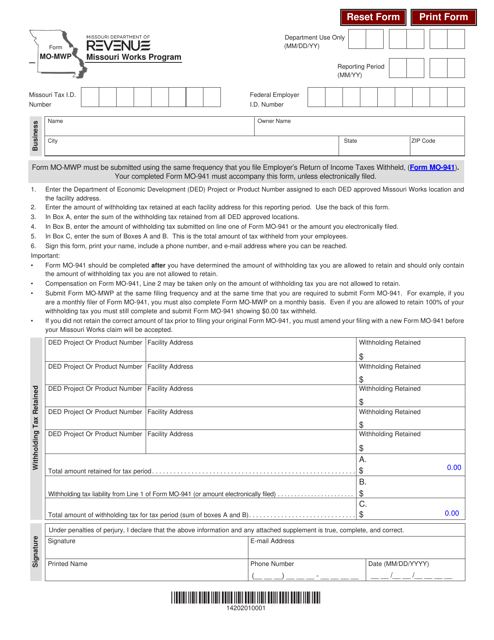

This Form is used for applying to the Missouri Works Program, which is a program designed to attract and retain businesses in Missouri by providing incentives and tax benefits.

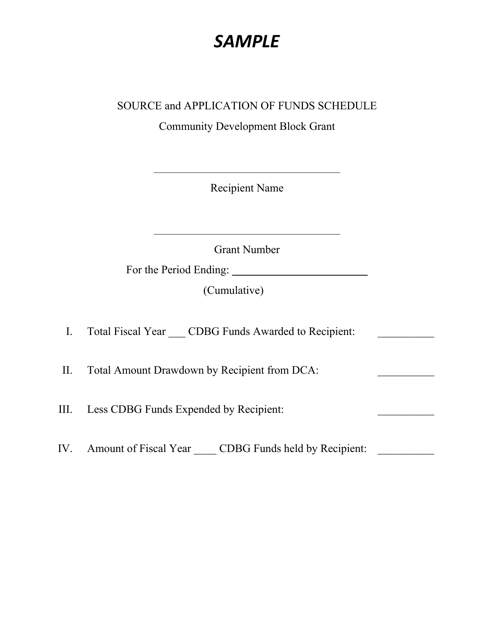

This document is used for tracking the source and application of funds for Community Development Block Grant projects in Georgia, United States. It provides detailed information on how funds are acquired and utilized to support community development initiatives.

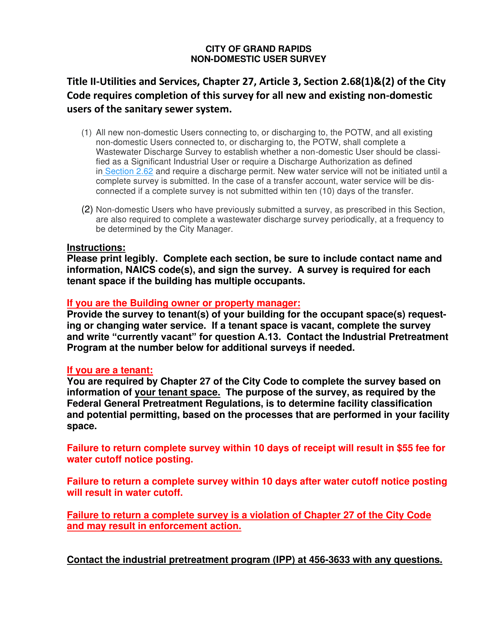

This survey is for non-domestic users of services provided by the City of Grand Rapids, Michigan. It aims to gather feedback and improve the services offered to businesses and organizations in the city.

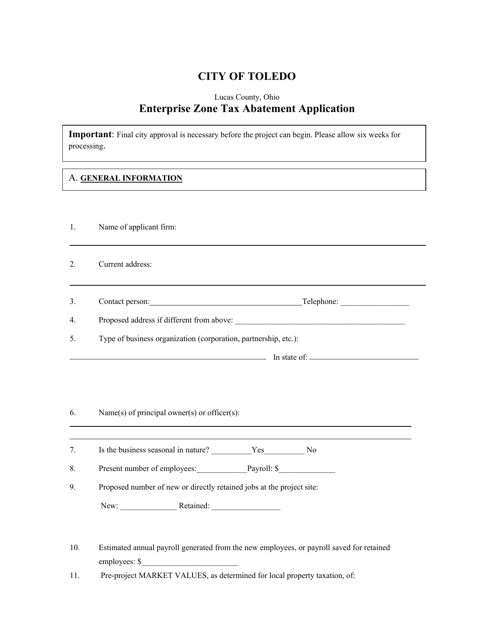

This document is an application for a tax abatement in the Enterprise Zone in Toledo, Ohio. The tax abatement is a program that allows businesses to receive a reduction or exemption from certain taxes for a specified period of time in order to promote economic development in the designated area.

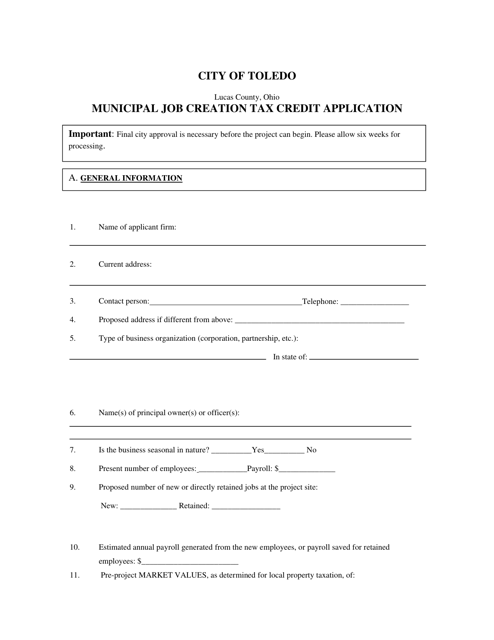

This document is an application form for the Municipal Job Creation Tax Credit in the City of Toledo, Ohio. This tax credit is aimed at encouraging job creation by providing financial benefits to businesses that meet certain criteria.

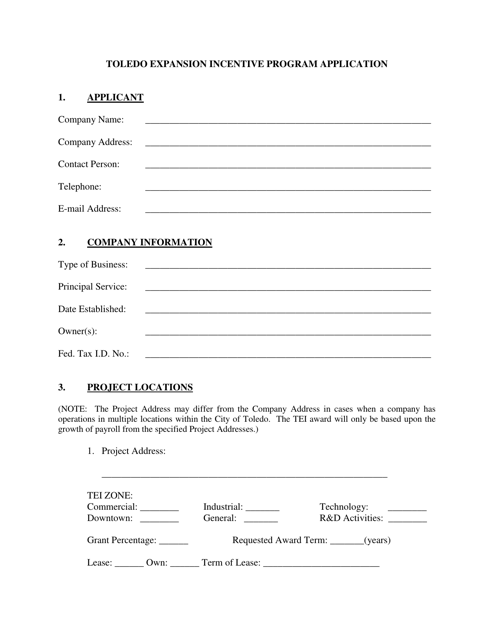

This document is the application form for the Toledo Expansion Incentive Program in the City of Toledo, Ohio. It is used by businesses seeking incentives for expanding their operations in Toledo.

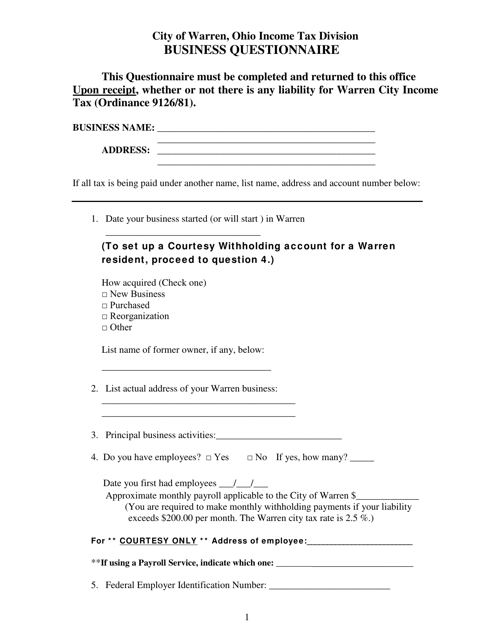

This questionnaire is used by the City of Warren, Ohio to gather information from businesses in the area.

This Form is used for applying for revolving loan funds in the City of Warren, Ohio.

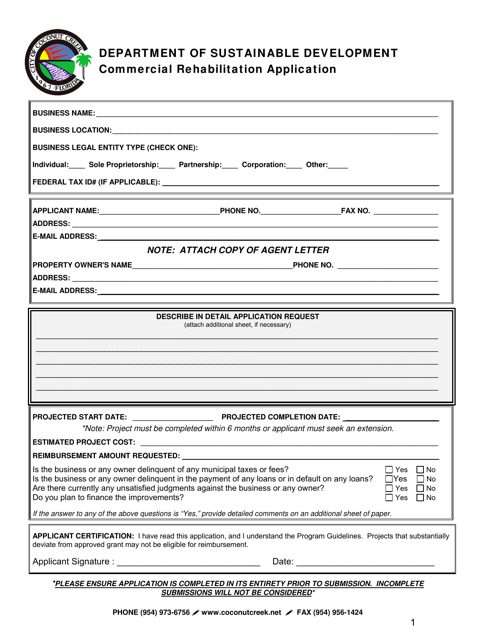

This document is a Commercial Rehabilitation Application form used by the City of Coconut Creek, Florida.

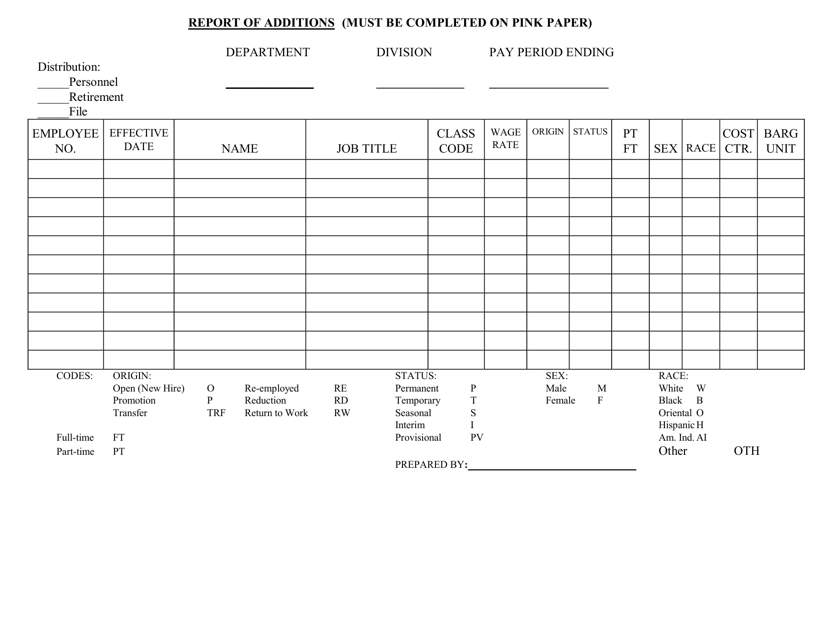

This document provides a report of all the additions made to the City of Flint, Michigan. It includes information on new buildings, infrastructure projects, and any recent developments in the city.

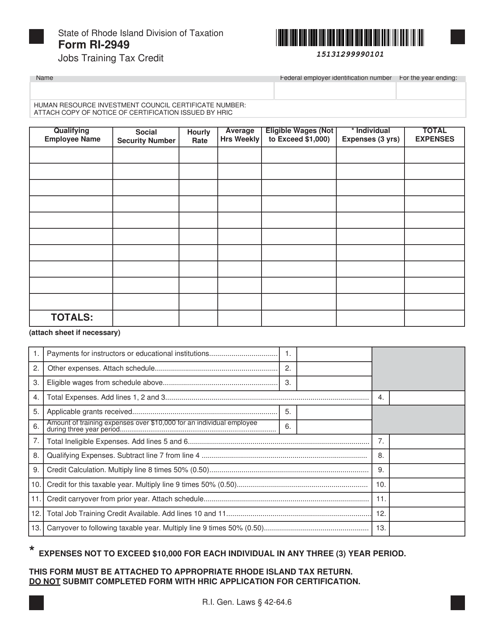

This form is used for claiming the Jobs Training Tax Credit in Rhode Island. It provides businesses with a tax credit for the costs of training employees for new or expanded job opportunities.

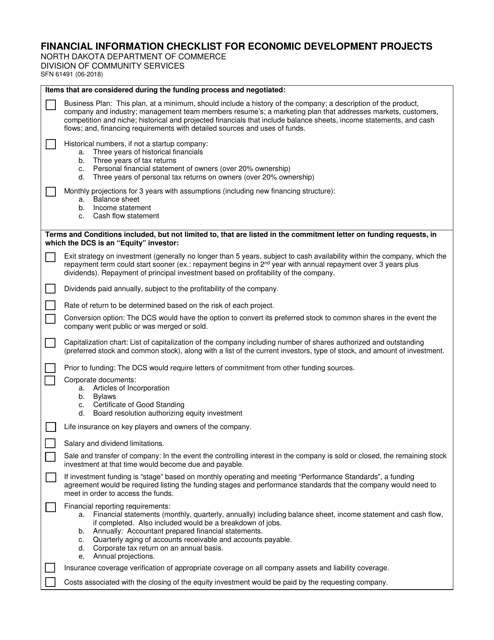

This form is used for gathering financial information for economic development projects in North Dakota.

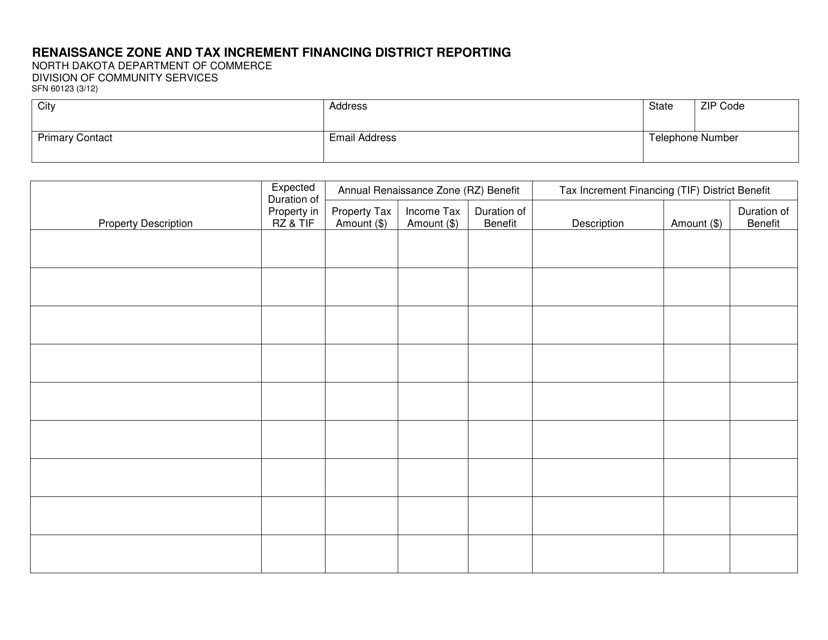

This form is used for reporting Renaissance Zones and Tax Increment Financing Districts in North Dakota.

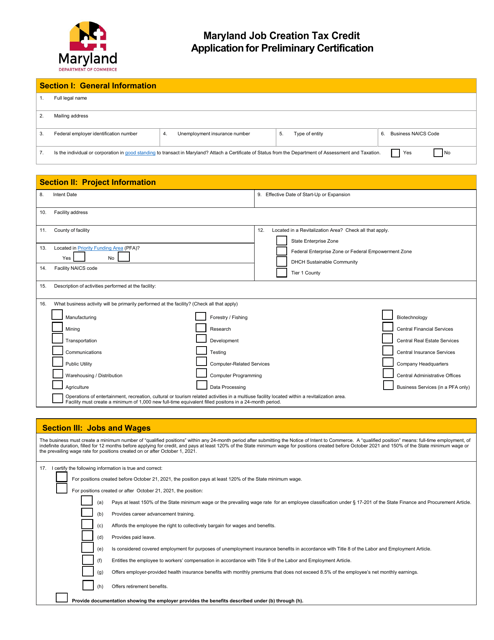

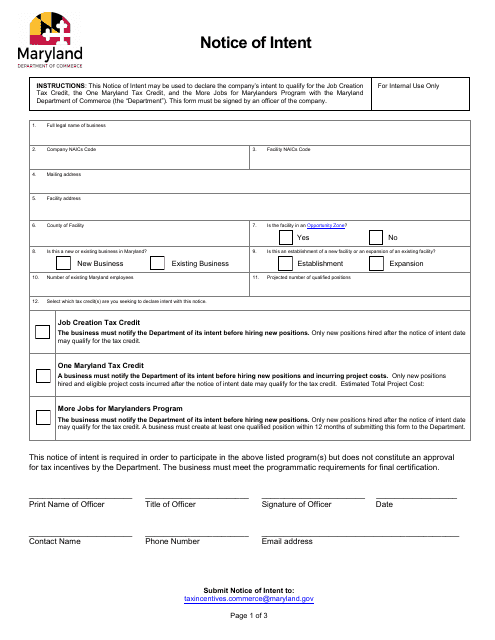

This Form is used for applying for preliminary certification for the Maryland Job Creation Tax Credit.

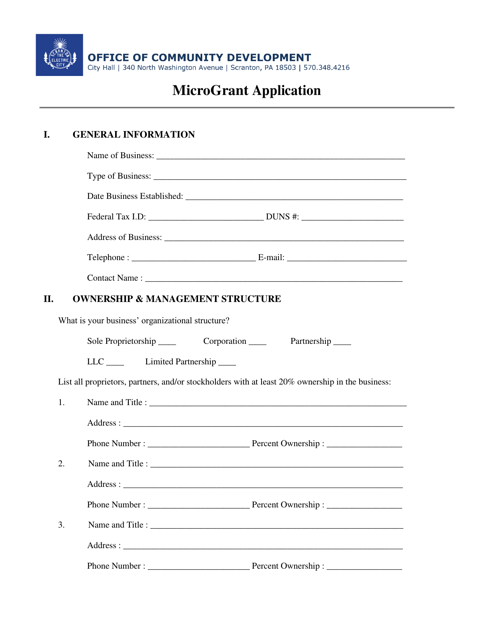

This document is an application form for individuals or organizations seeking a microgrant from the City of Scranton, Pennsylvania.