Employer Taxes Templates

Documents:

95

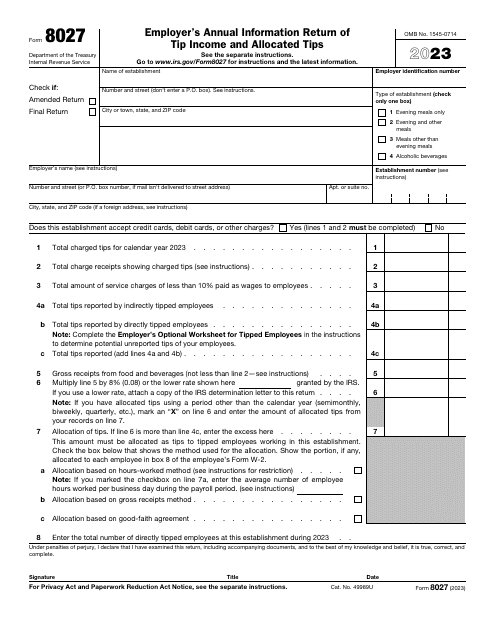

Every year, this form is filled out by employers wishing to report to the Internal Revenue Service (IRS) the receipts and tips their employee received, as well as to determine allocated tips.

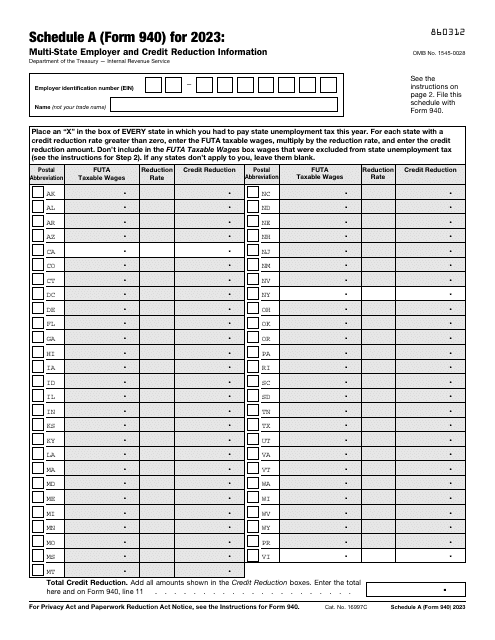

This is a supplementary form used by a taxpayer to figure out their annual federal unemployment tax.

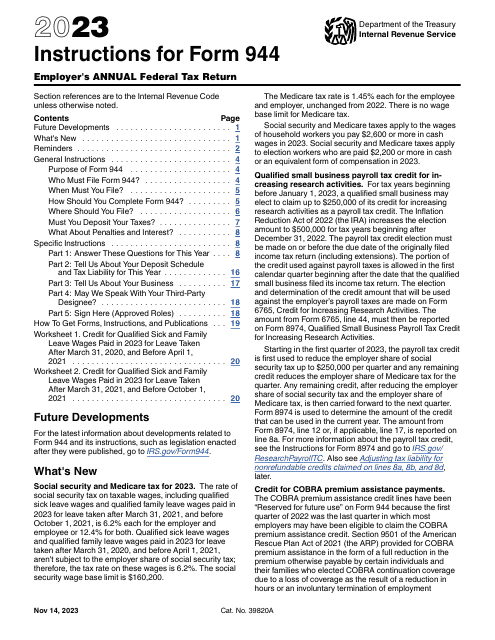

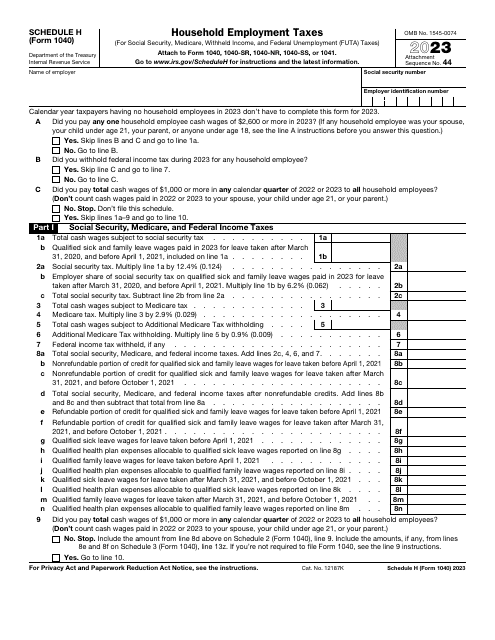

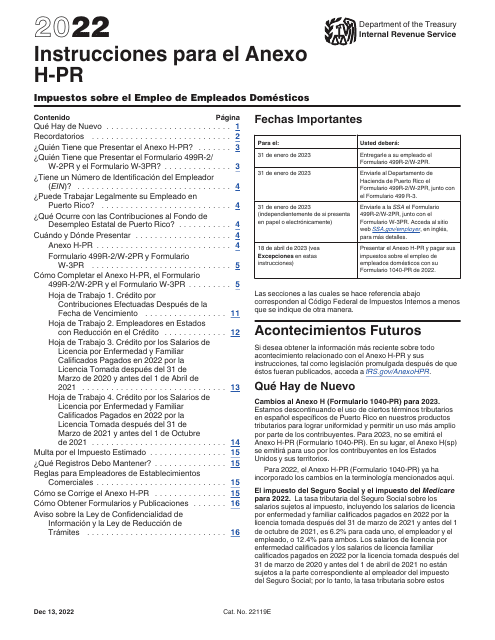

This is a supplementary document that has to be attached to a tax return, if the taxpayer employed people that worked in their house helping the owner to manage the place in a certain capacity.

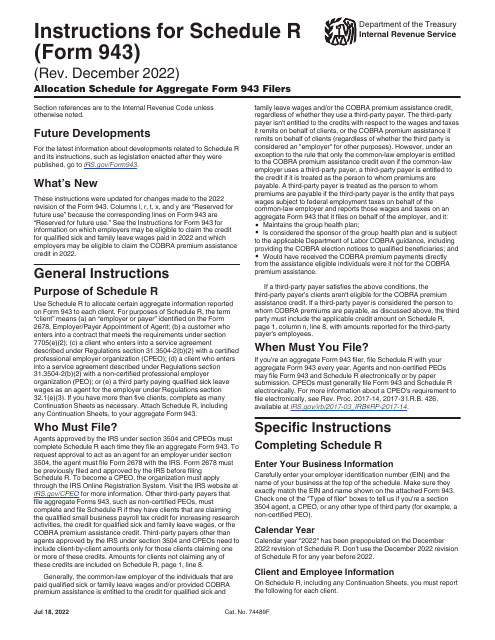

This form is used for allocating wages and taxes for employers who file an Aggregate Form 943 with the IRS. It provides instructions on how to accurately report employee wages and taxes for agricultural workers.

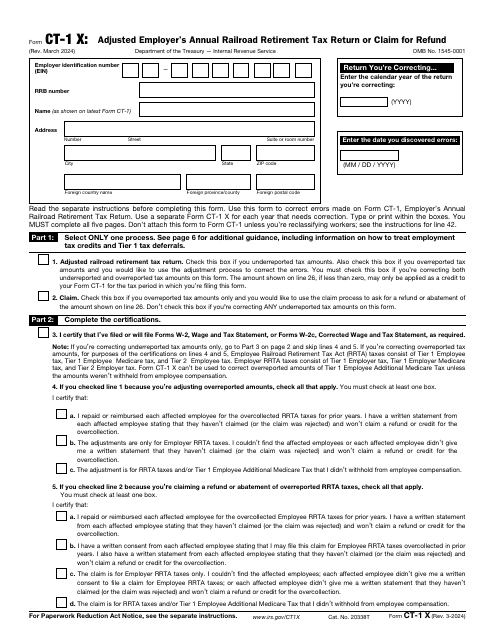

This is a formal document used by railroad industry employers to correct errors they have noticed upon filing IRS Form CT-1, Employer's Annual Railroad Retirement Tax Return.

This is a formal instrument used by taxpayers that need to fix the mistakes they have discovered upon filing IRS Form 941, Employer's Quarterly Federal Tax Return.