Employer Taxes Templates

Documents:

95

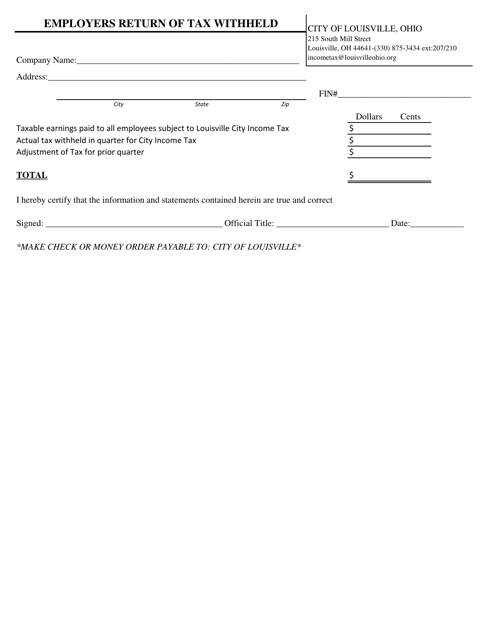

This type of document is used by employers in the City of Louisville, Ohio to report the taxes withheld from their employees' pay.

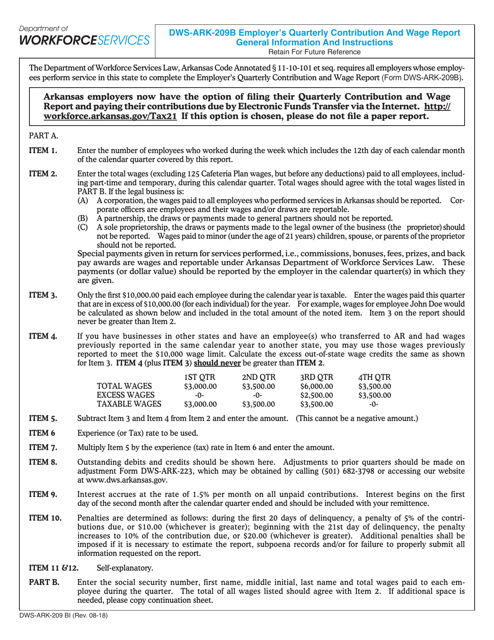

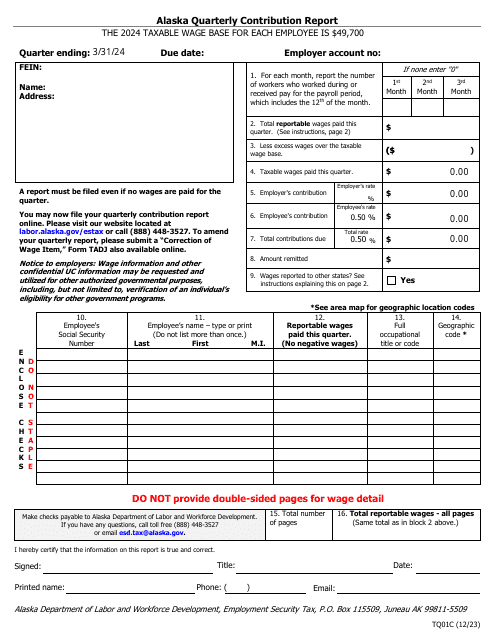

This document is used by employers in Arkansas to report their quarterly contributions and wages. It provides detailed instructions on how to fill out Form DWS-ARK-209B.

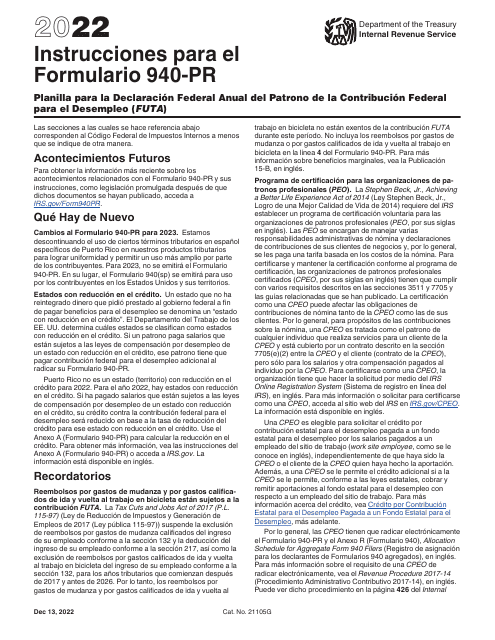

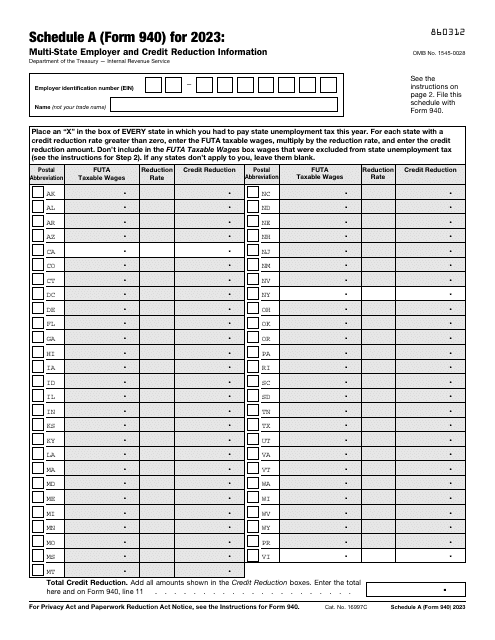

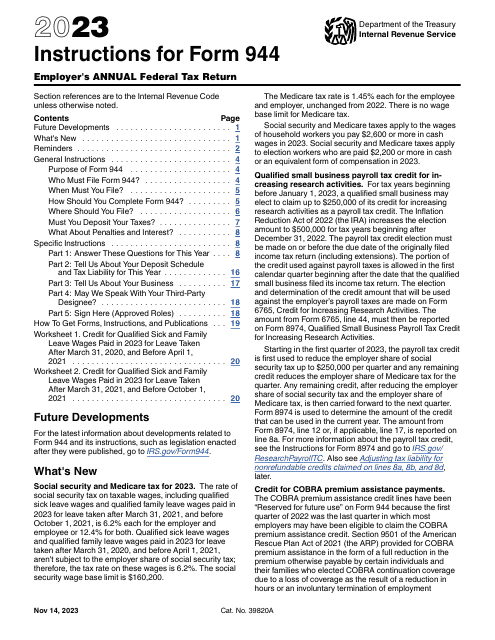

This is a supplementary form used by a taxpayer to figure out their annual federal unemployment tax.

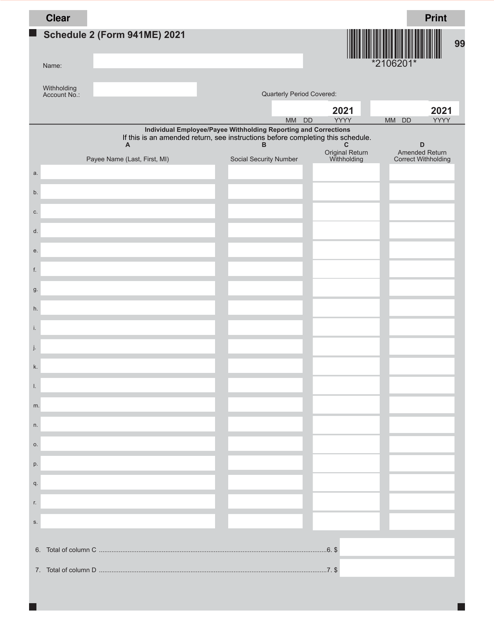

This is a formal instrument used by taxpayers that need to fix the mistakes they have discovered upon filing IRS Form 941, Employer's Quarterly Federal Tax Return.

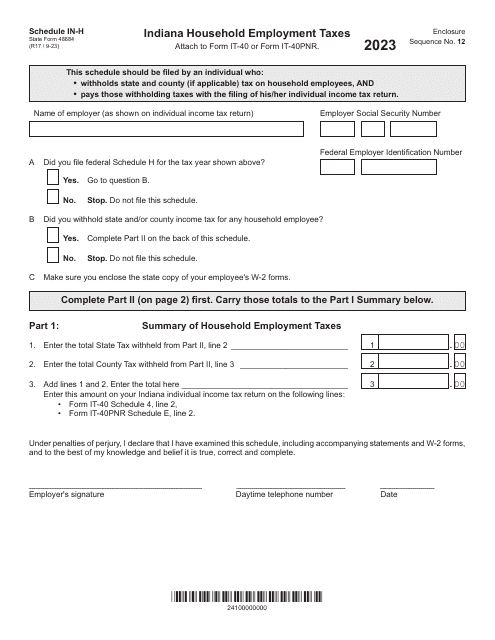

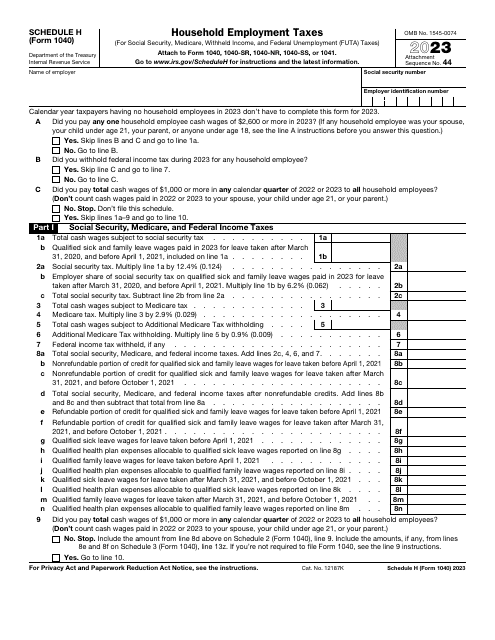

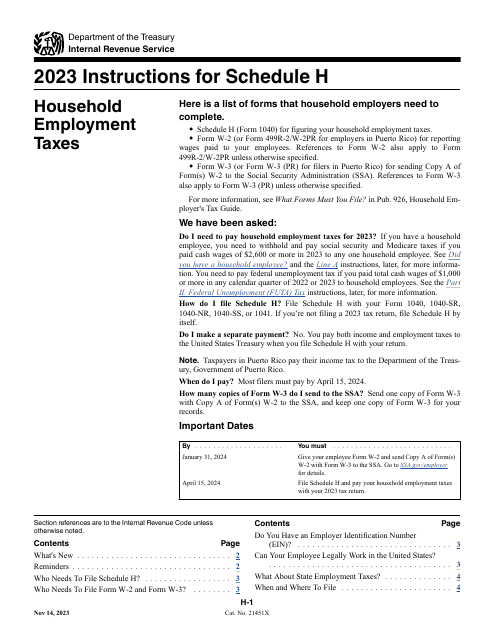

This is a supplementary document that has to be attached to a tax return, if the taxpayer employed people that worked in their house helping the owner to manage the place in a certain capacity.

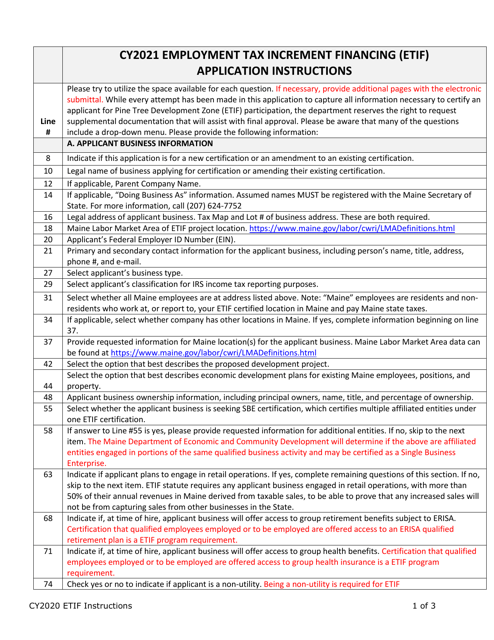

This form is used for applying for the Employment Tax Increment Financing (ETIF) Program Business Certification in Maine. It provides instructions and guidelines for businesses to complete the application process.

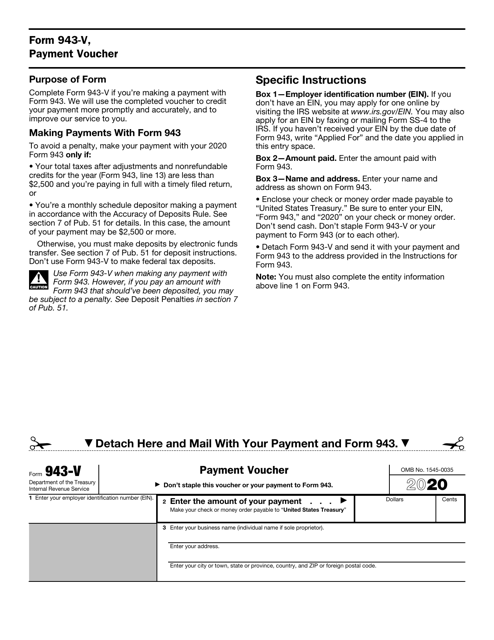

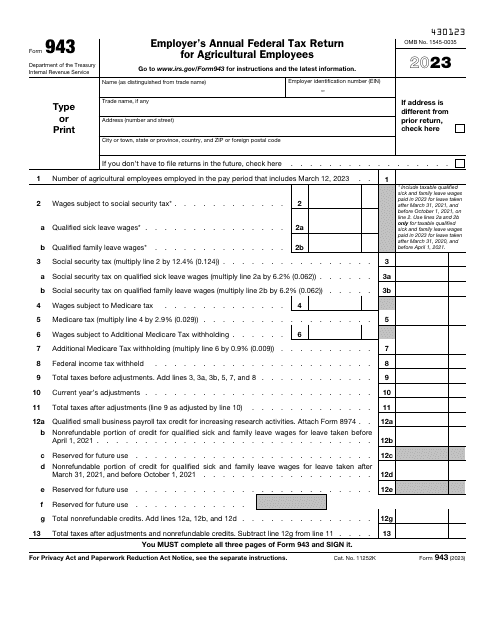

This form is used for making payment vouchers for IRS Form 943.

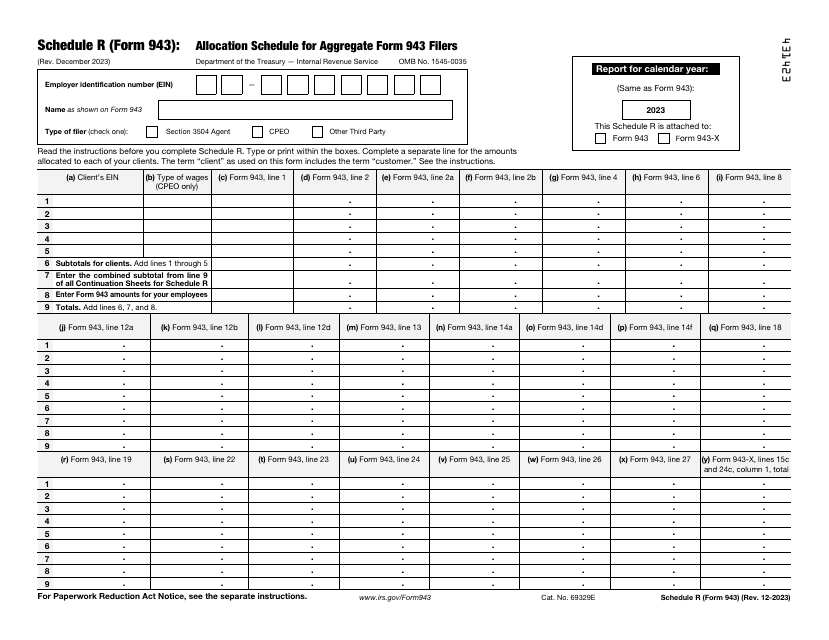

If you paid wages in the reported tax year to one or more farm workers, file this form for your annual federal tax return in case the wages you paid to your farmworkers were subject to the federal income, Medicare, or social security tax withholdings.

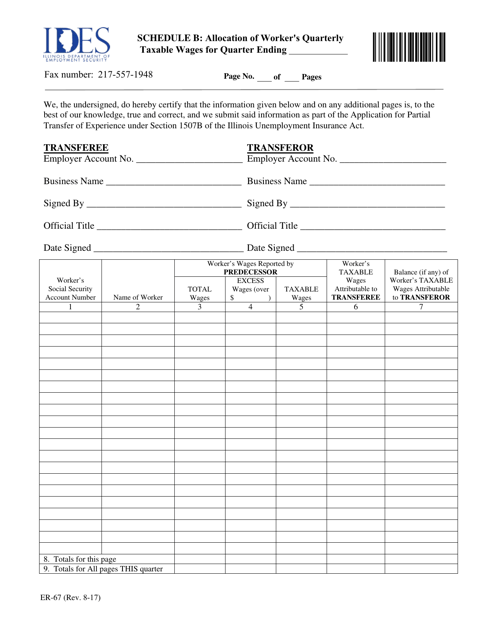

This Form is used for allocating worker's quarterly taxable wages in Illinois.

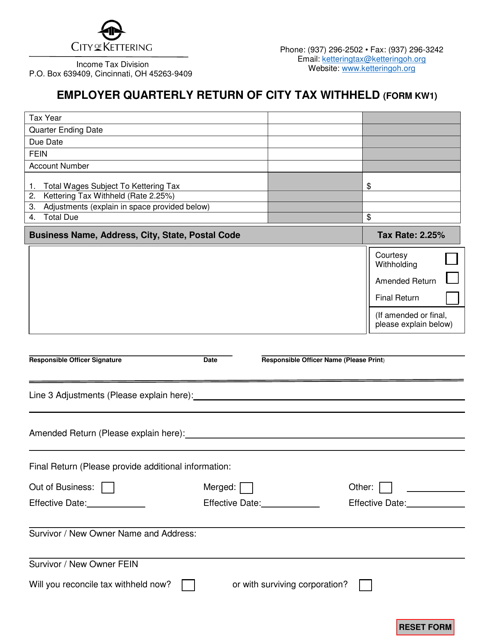

This form is used for employers in Kettering, Ohio to report the amount of city tax withheld from employee wages on a quarterly basis.

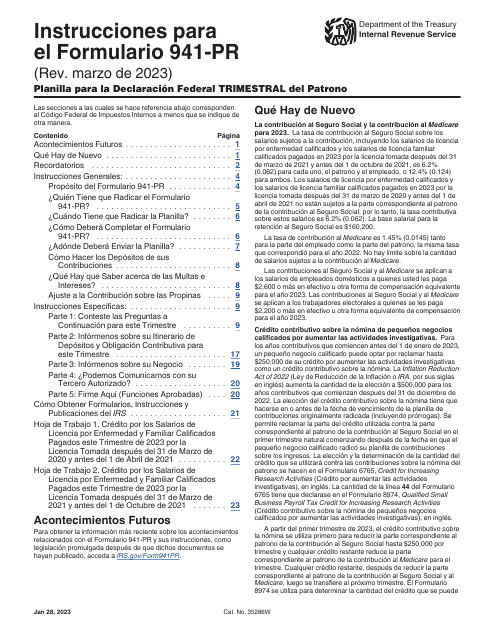

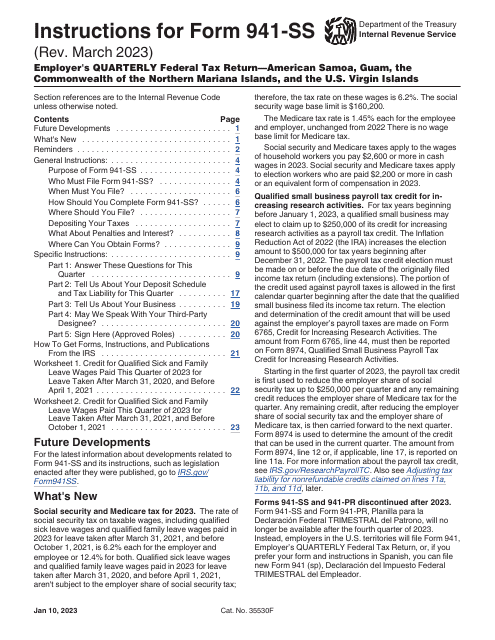

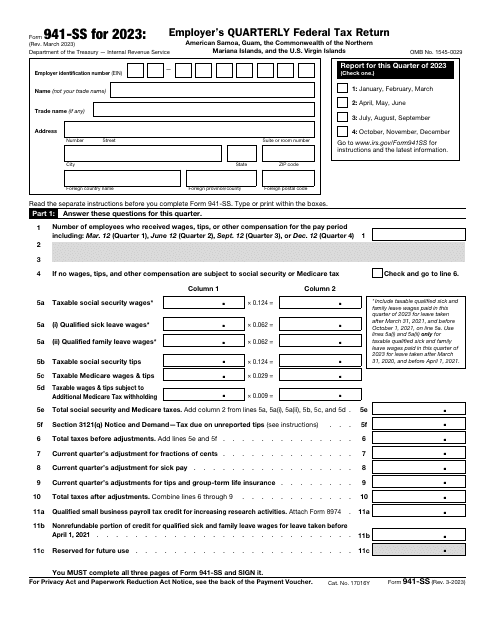

This document, otherwise known as the Employer's Quarterly Federal Tax Return, is a form downloaded to report about your social security and Medicare taxes. This form is used only if the official place of business is located within the specified territories.

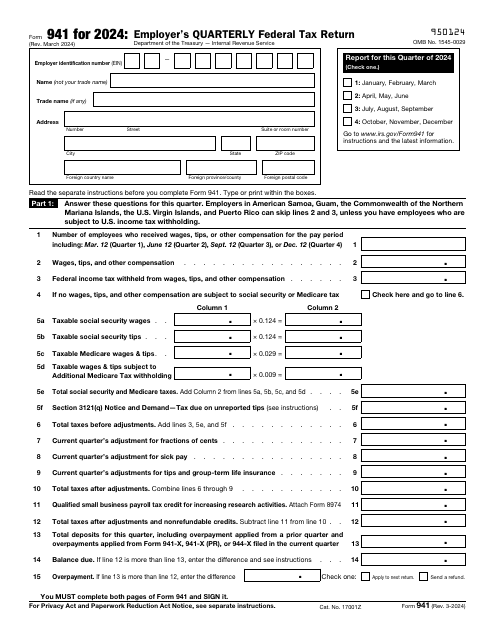

This is a formal statement used by companies to tell tax organizations about the salaries and tips their employees have received over the course of the previous quarter and the tax already subtracted from the workers' salaries.

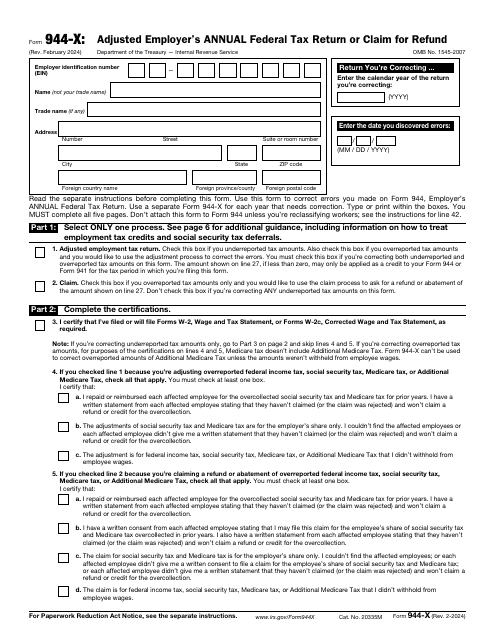

This is a fiscal form used by employers that learned about the need to correct a previously filed IRS Form 944, Employer's Annual Federal Tax Return.

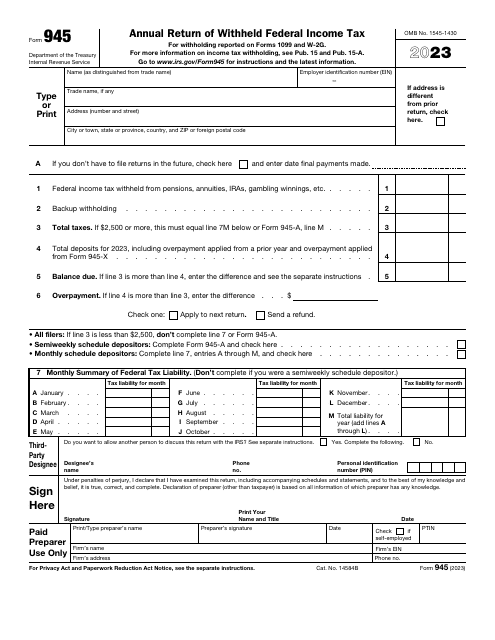

This is a fiscal form taxpayers are obliged to prepare and submit to provide information about nonpayroll payments subject to tax and confirm they are paying an accurate amount of tax for the last year.