Surviving Spouse Templates

Are you a surviving spouse looking for assistance? Our webpage is here to help you navigate the various forms and resources available to you. Whether you need to apply for license plates, property tax exemptions, widow benefits, or awards for you and your children, we have you covered.

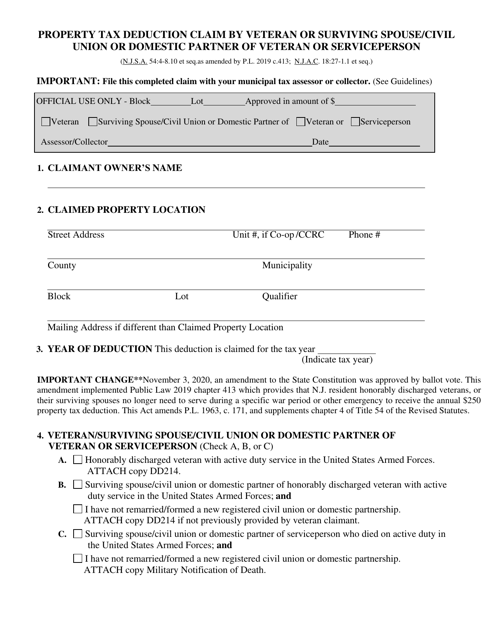

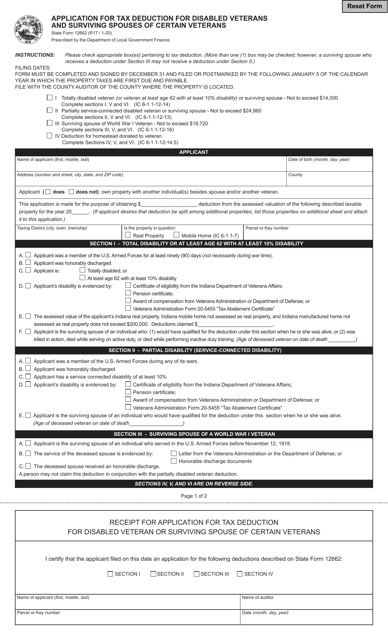

As a surviving spouse, you may be eligible for certain benefits and exemptions that can help ease your financial burdens. Our webpage provides a comprehensive collection of documents that pertain to your specific situation. We understand that each state may have different requirements and procedures, which is why we provide information and forms from various states, including Texas, New Jersey, Rhode Island, Illinois, and Ohio.

Our webpage serves as your one-stop resource for all your needs as a surviving spouse. From application forms to addendums, we have compiled everything you need to make the process as smooth as possible. We understand that dealing with paperwork and legal matters can be overwhelming, which is why we aim to simplify the process for you.

Don't worry if you are unsure about the specific document you need. Our webpage provides alternate names for this collection of documents, ensuring that you can easily find what you are looking for. We strive to make the navigation process as hassle-free as possible, so you can focus on what matters most – taking care of yourself and your family.

Take advantage of our webpage dedicated to surviving spouses like yourself. We are here to support you every step of the way, providing the information and resources you need to access the benefits and exemptions you are entitled to.

Documents:

128

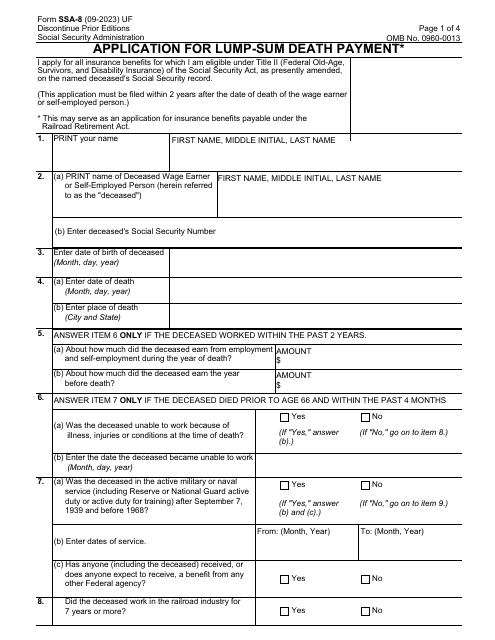

This legal document is filled out by survivors of wage earners and self-employed individuals to apply for a death payment of $255.

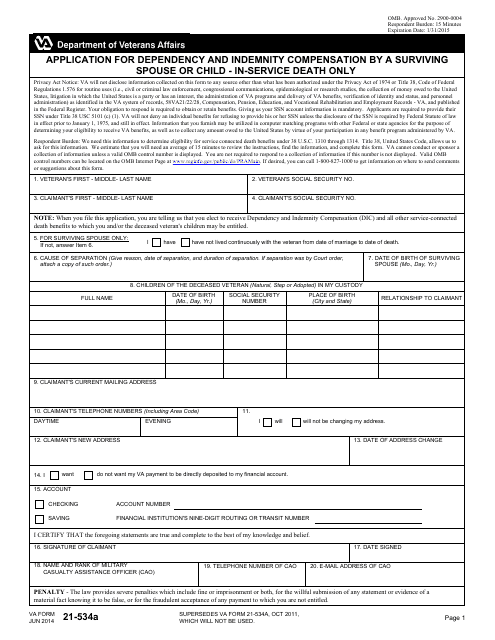

This document was required to make sure the surviving spouses and children of veterans are eligible to receive benefits for the service members who died during active duty service. The form is now replaced by VA Form 21P-534A.

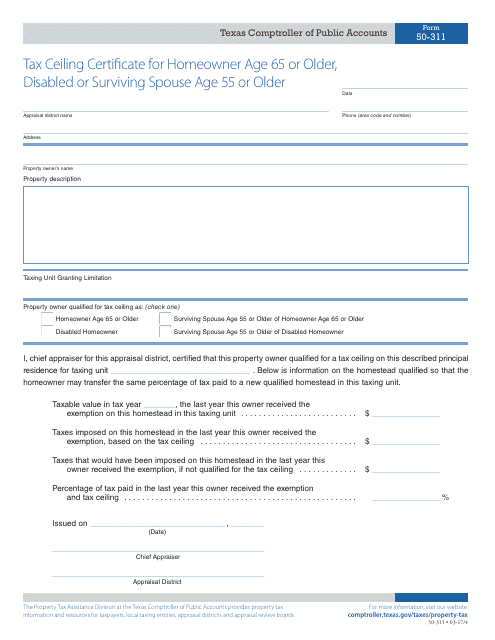

This form is used for homeowners in Texas who are age 65 or older, disabled, or surviving spouse age 55 or older to apply for a tax ceiling certificate. This document helps eligible individuals receive property tax relief.

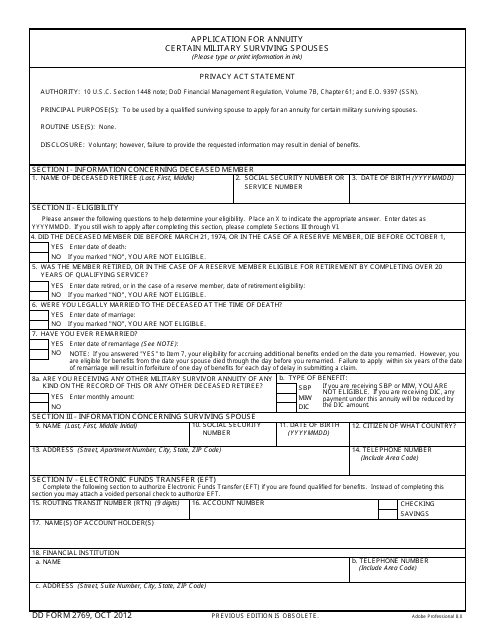

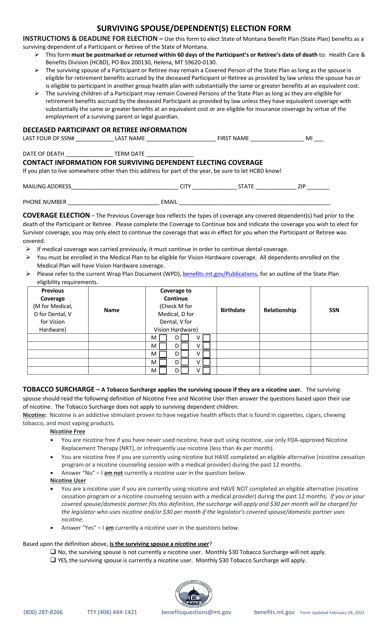

This form is used for military surviving spouses to apply for annuity benefits.

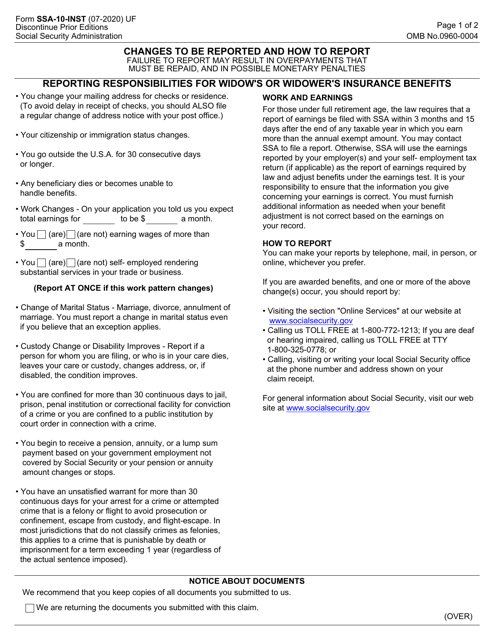

This form is used by the Social Security Administration (SSA) to inform the recipient of widow's or widower's insurance benefits about what changes to report to the SSA and how. The document lists changes to be reported and the means to report them.

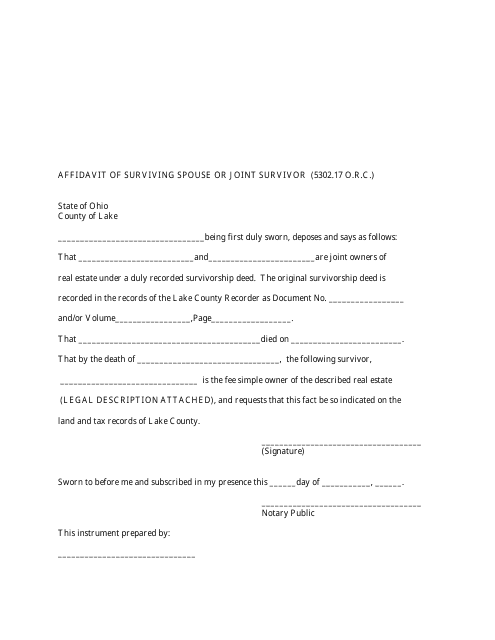

This form is used for the surviving spouse or joint survivor to provide a sworn statement in the County of Lake, Ohio.

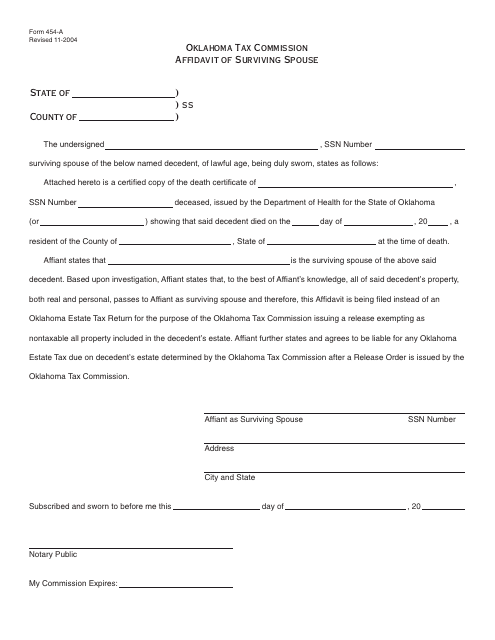

This form is used for a surviving spouse in Oklahoma to declare their status in order to claim certain benefits or rights.

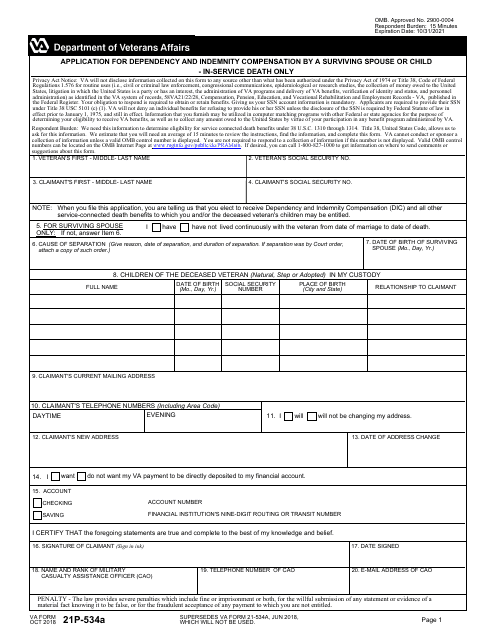

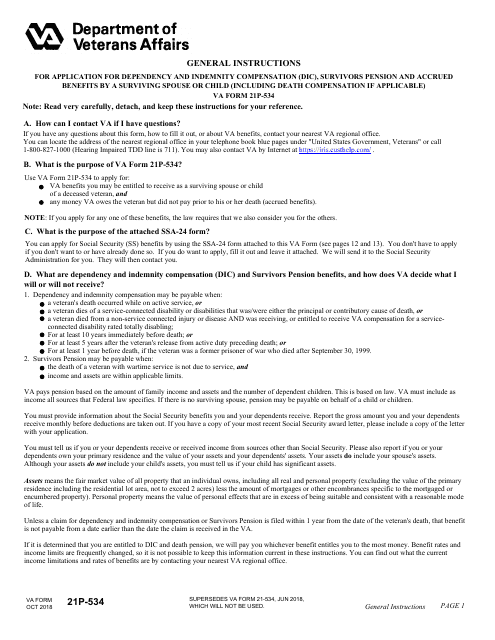

The purpose of this form is to determine the eligibility of a surviving spouse or child for benefits, as well as their eligibility for dependency and indemnity compensations, death pension, and death compensation. Use this form if you are a surviving spouse or child of a veteran who perished during active duty service.

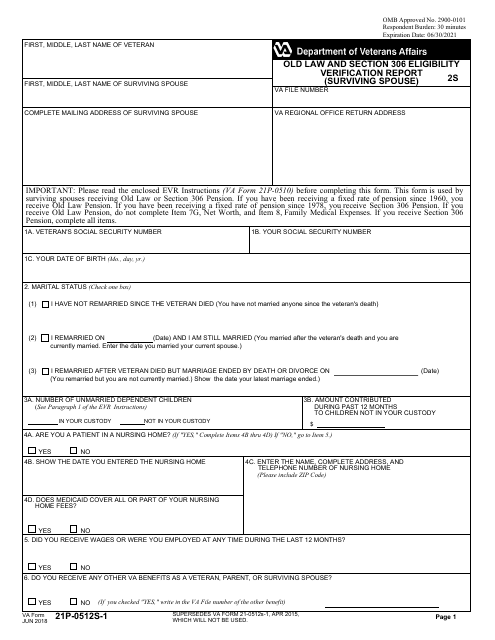

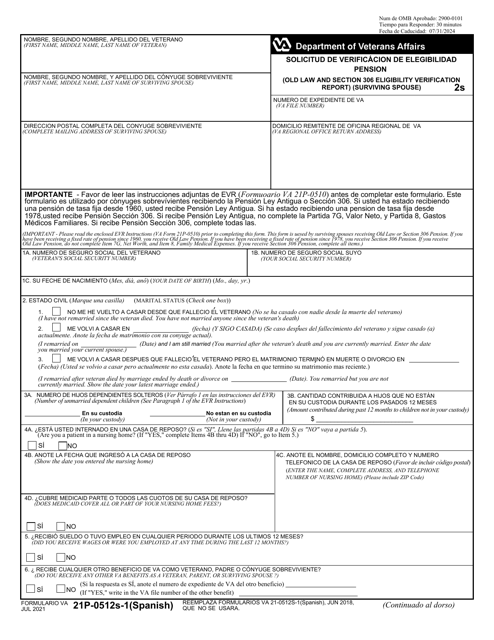

This form is used for verifying the eligibility of a surviving spouse under the old law and Section 306 for certain benefits.

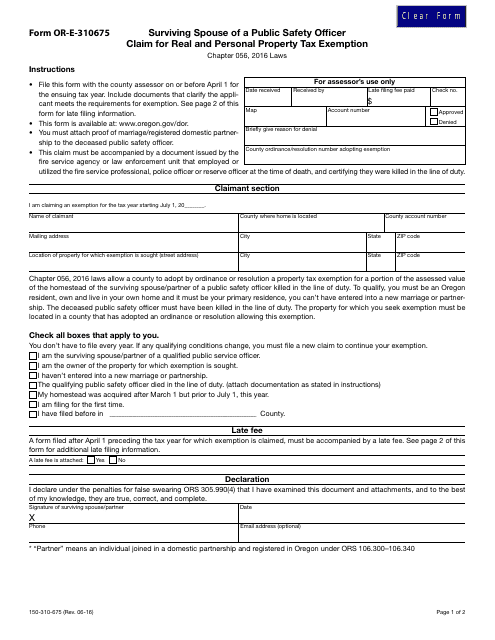

This form is used for a surviving spouse of a public safety officer to claim a real and personal property tax exemption in the state of Oregon.

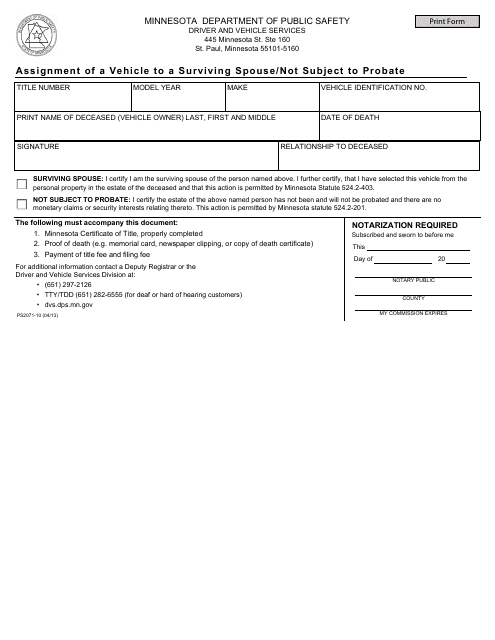

This form is used for assigning a vehicle to a surviving spouse in Minnesota without the need for probate.

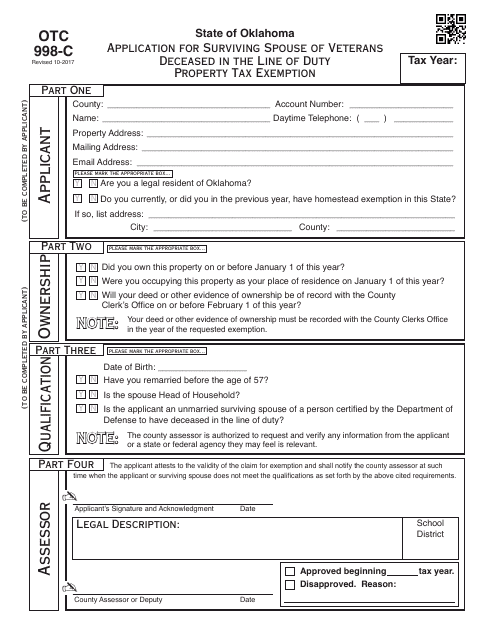

This form is used for applying for a property tax exemption in Oklahoma for surviving spouses of veterans who died in the line of duty.

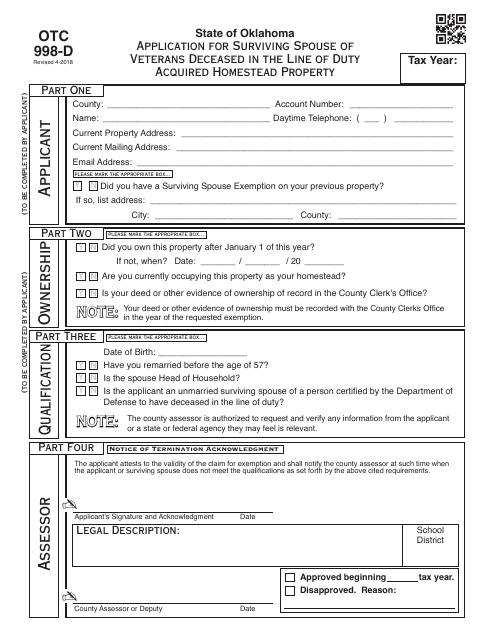

This form is used for applying for the OTC998-D program in Oklahoma, which provides property tax exemptions for surviving spouses of veterans who acquired homestead property.

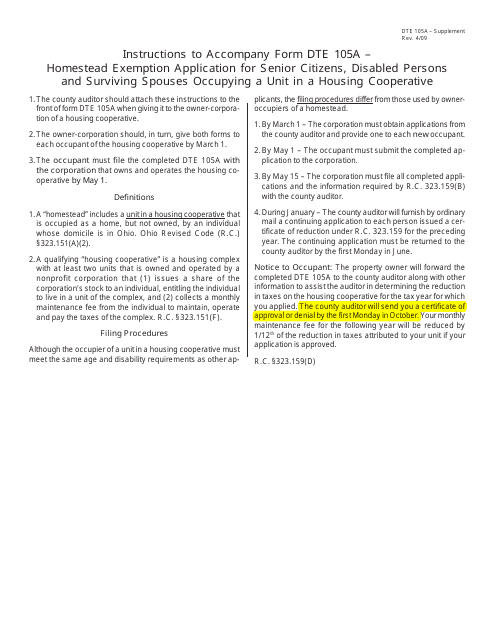

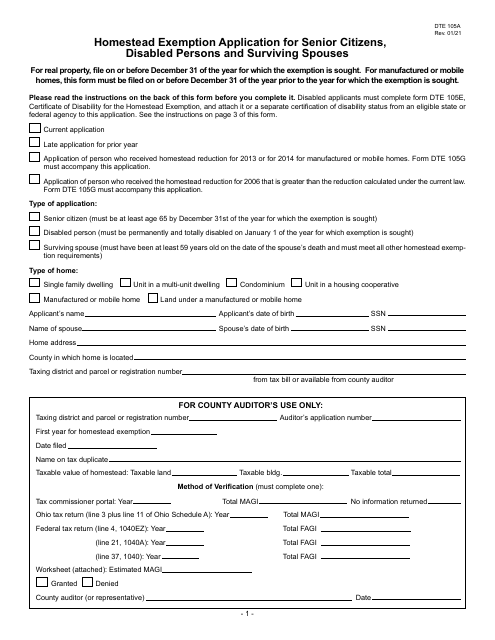

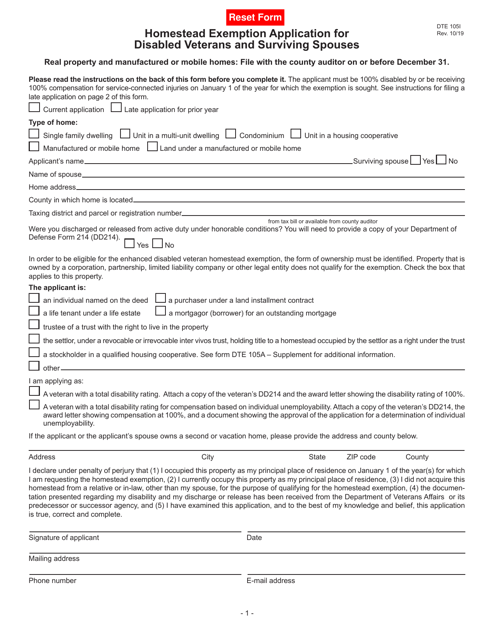

This form is used for applying for the Homestead Exemption in Ohio for senior citizens, disabled persons, and surviving spouses who live in a housing cooperative. It provides instructions on how to complete the application.

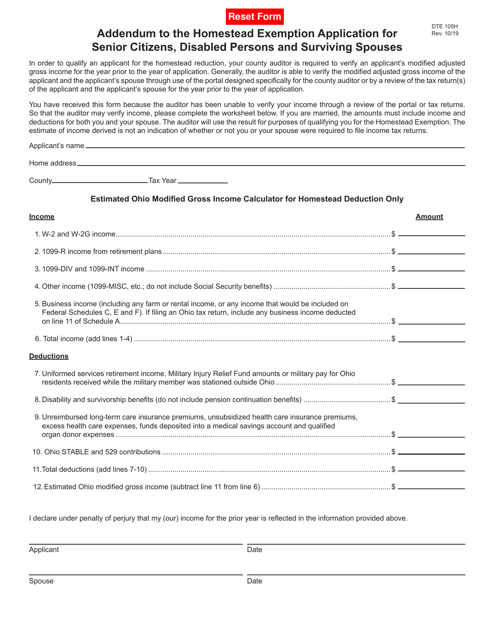

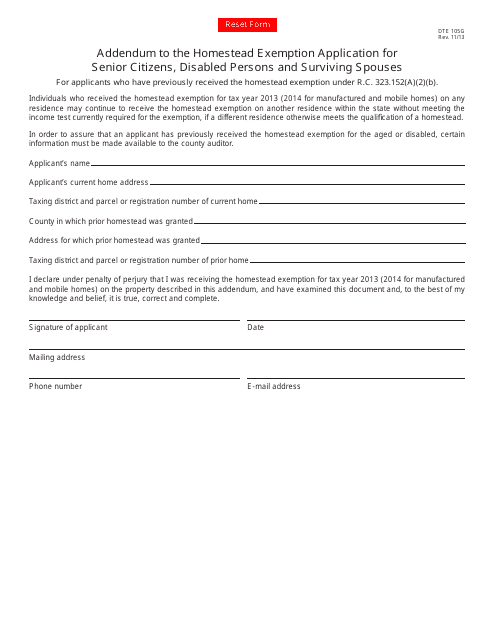

This form is used as an addendum to the Homestead Exemption Application for Senior Citizens, Disabled Persons, and Surviving Spouses in Ohio. It provides additional information and updates to the original application.

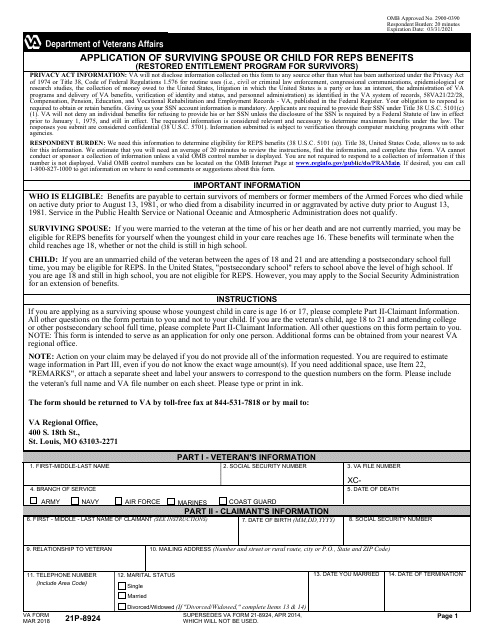

This Form is used for applying for Reps Benefits under the Restored Entitlement Program for Survivors by the surviving spouse or child.

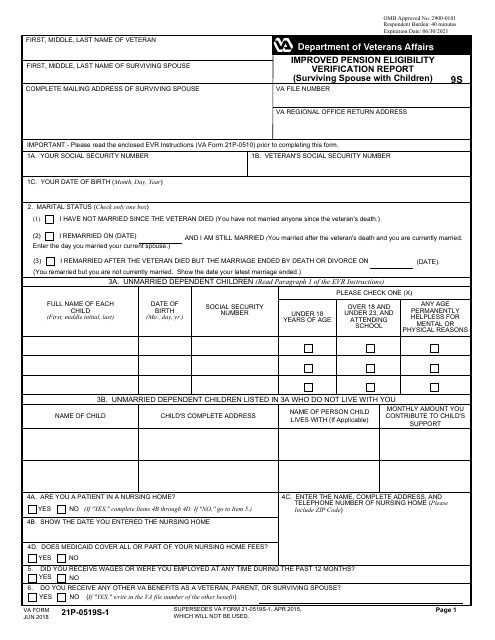

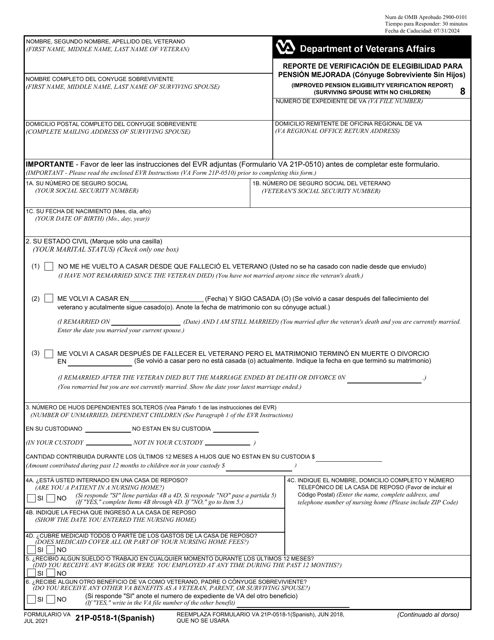

This document is used for verifying the eligibility of a surviving spouse with children for an improved pension under VA benefits. It includes details about the spouse's income and expenses.

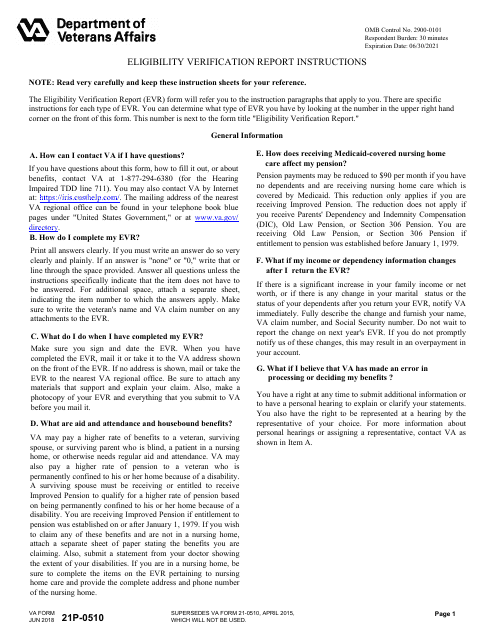

This form is used for verifying eligibility for improved pension benefits. It provides instructions on how to complete VA Form 21P-0510.

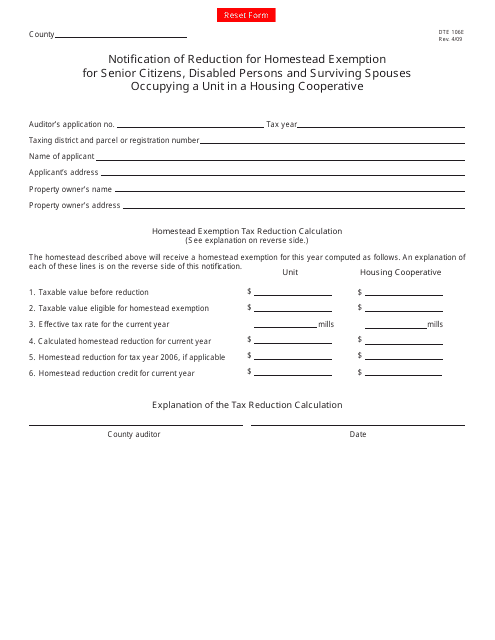

This form is used to notify the reduction of homestead exemption for senior citizens, disabled persons, and surviving spouses who live in a unit in a housing cooperative in Ohio.

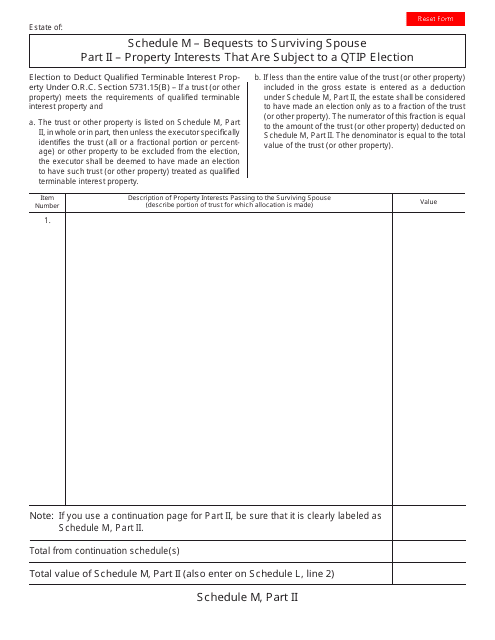

This document is used for reporting bequests to a surviving spouse in the state of Ohio.

This Form is used for a surviving spouse in Florida to transfer the certificate of title for a motor vehicle after the death of their spouse.

This form is used by a surviving spouse or child of a deceased veteran to claim the Department of Veterans Affairs (VA) benefits they may be entitled to.

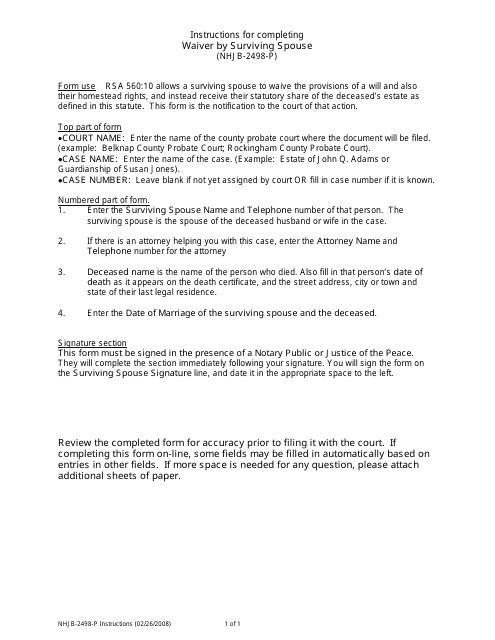

This form is used for survivors in New Hampshire to waive certain rights and benefits after the death of their spouse.

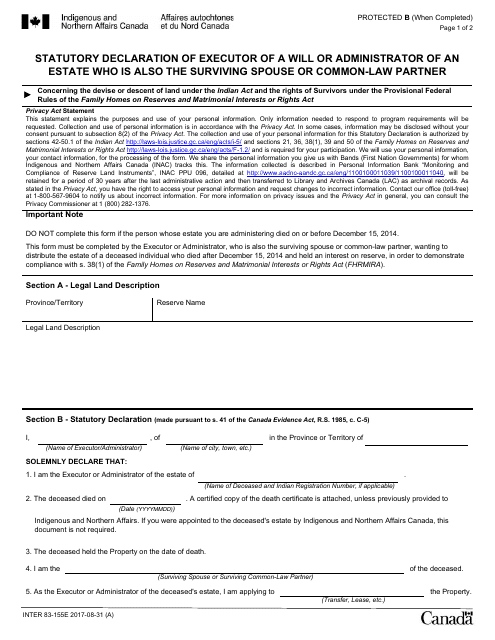

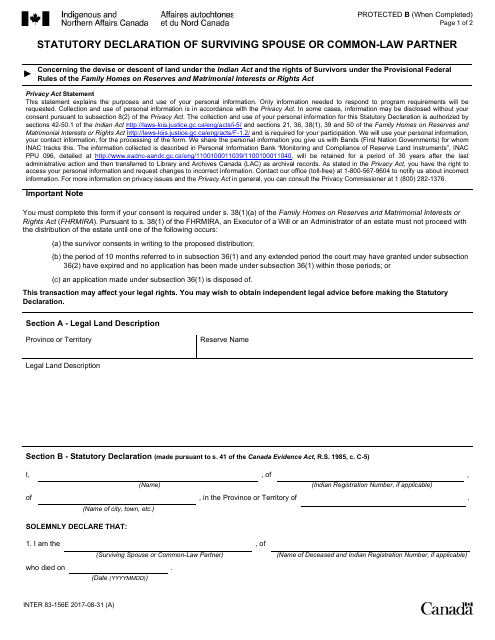

This form is used for the statutory declaration of an executor or administrator of an estate in Canada who is also the surviving spouse or common-law partner.

This form is used for declaring the surviving spouse or common-law partner in Canada.

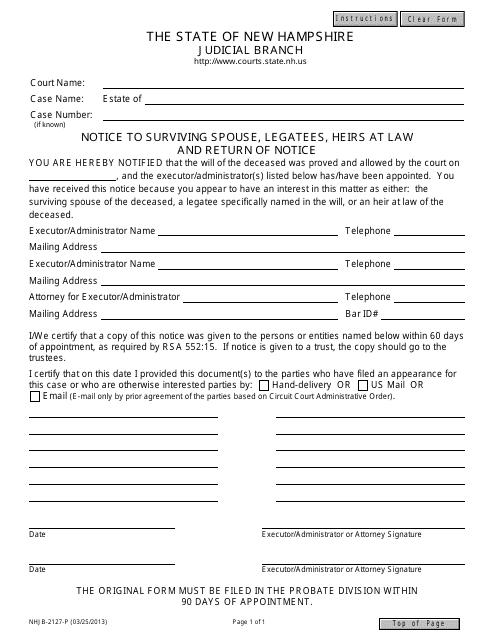

This Form is used for providing notice to surviving spouse, legatees, and heirs at law about the probate proceedings in the state of New Hampshire. It also includes a return of notice for record-keeping purposes.

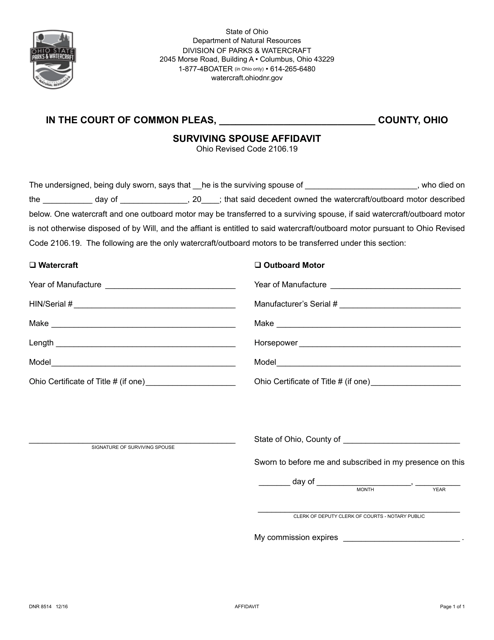

This form is used for filing an affidavit by a surviving spouse in Ohio.

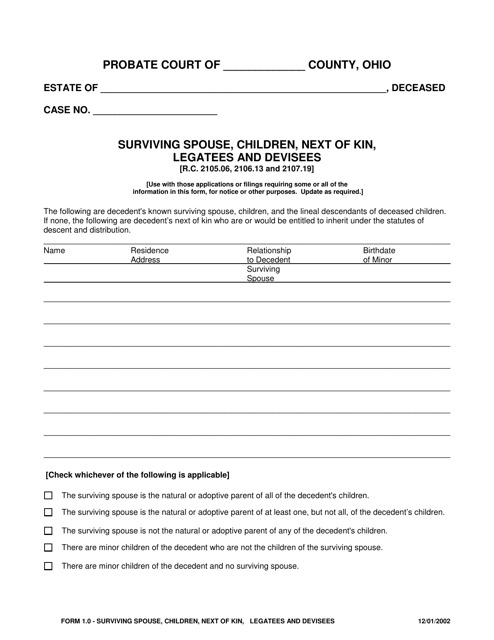

This Form is used for identifying the surviving spouse, children, next of kin, legatees, and devisees in the state of Ohio.

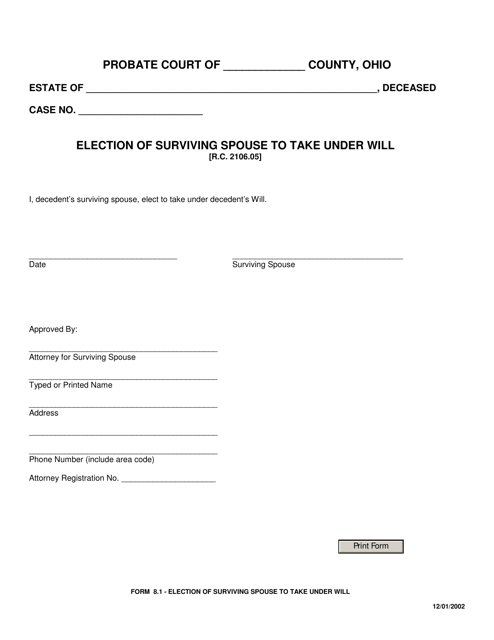

This document is used for the surviving spouse to elect to take under the will in the state of Ohio.

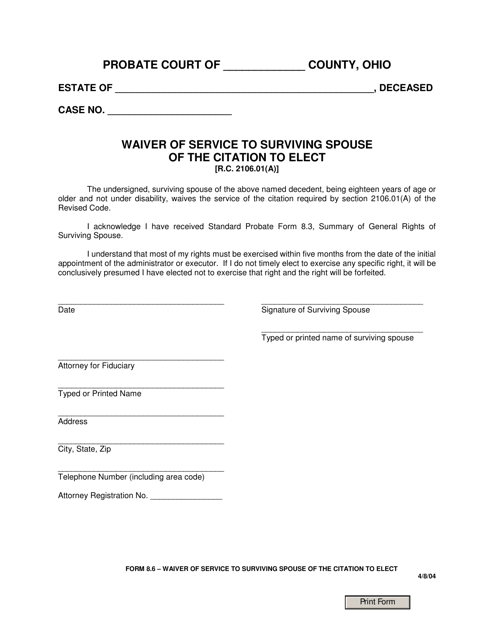

This form is used for waiving the requirement of serving the surviving spouse with a citation to elect in the state of Ohio.