Surviving Spouse Templates

Documents:

128

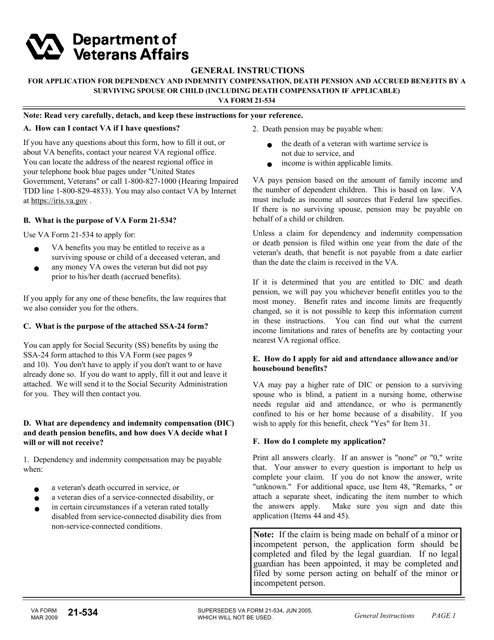

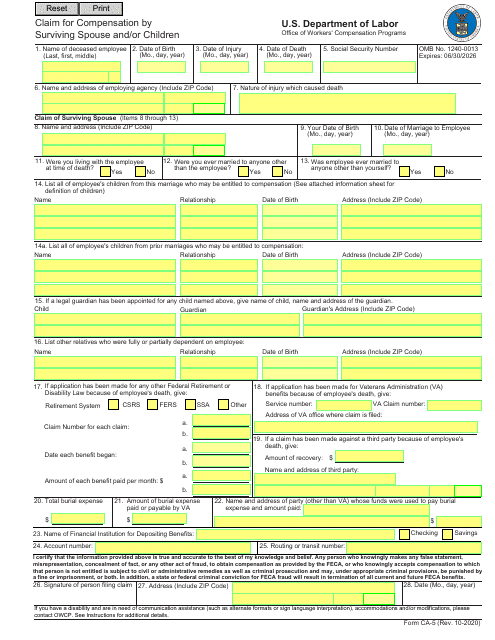

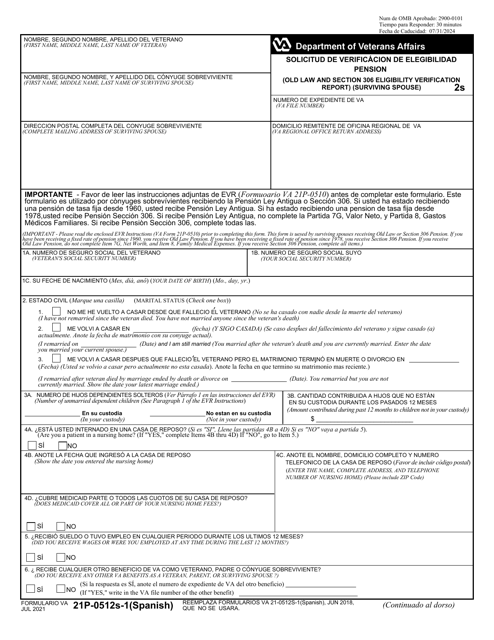

This form was used to apply for the Department of Veterans Affairs (VA) benefits or any money the VA owed to veterans that had not been paid prior to their death.

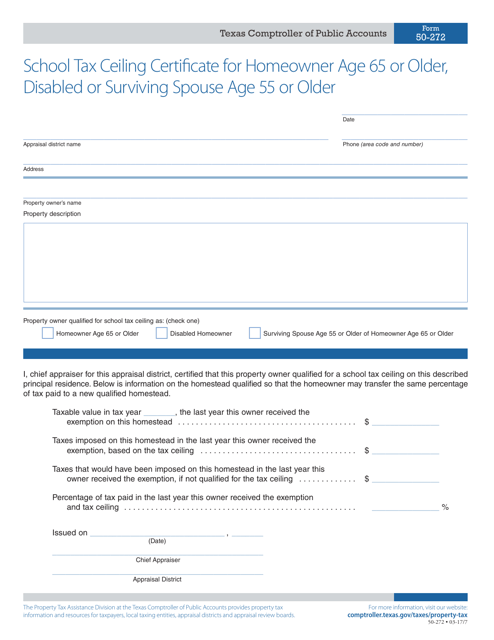

This form is used for homeowners in Texas who are age 65 or older, disabled, or surviving spouse age 55 or older to certify their eligibility for a school tax ceiling.

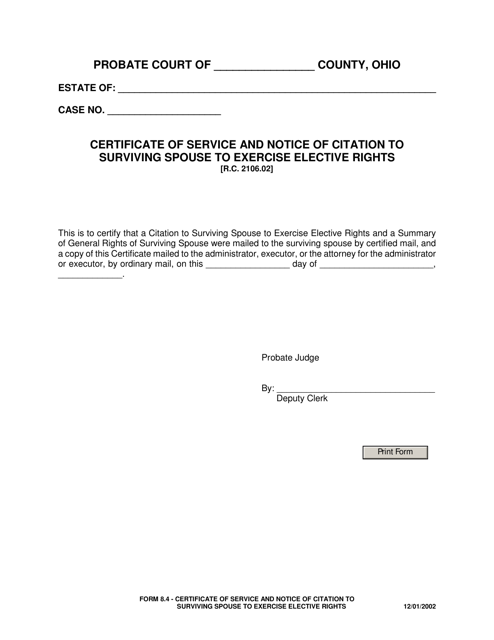

This Form is used for notifying the surviving spouse in Ohio about their rights to exercise elective rights and includes a certificate of service.

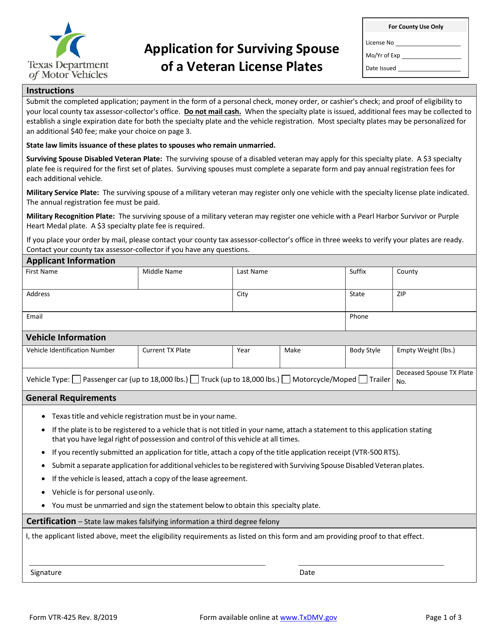

This form is used for applying for surviving spouse of a veteran license plates in Texas.

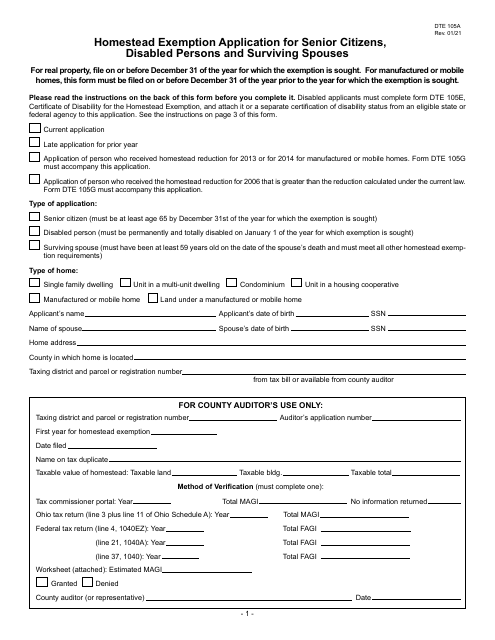

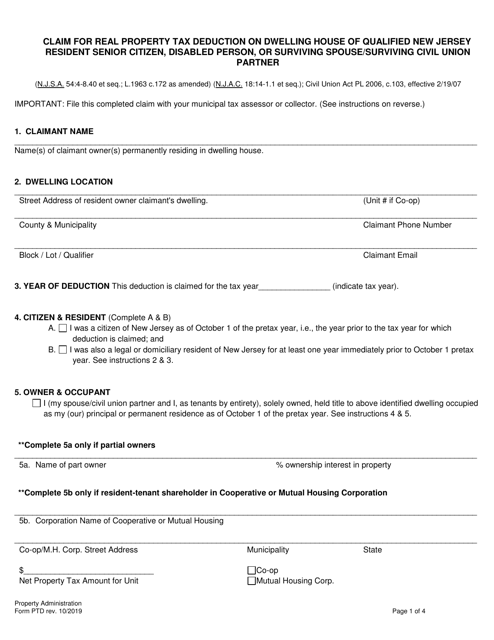

This Form is used for claiming a real property tax deduction on a dwelling house in New Jersey for qualified senior citizens, disabled persons, or surviving spouse/surviving civil union partners.

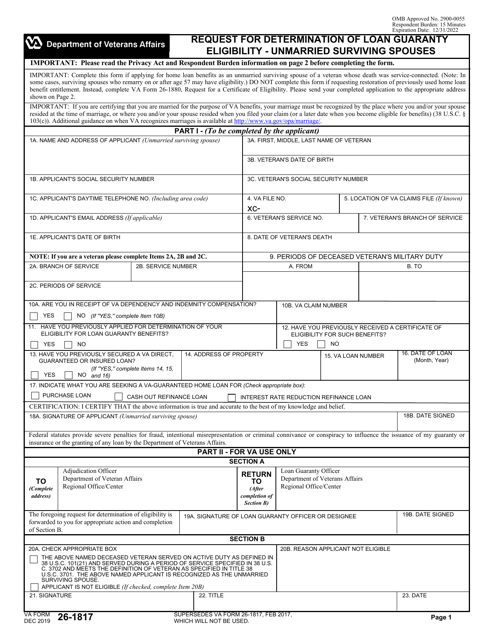

VA Form 26-1817 Request for Determination of Loan Guaranty Eligibility - Unmarried Surviving Spouses

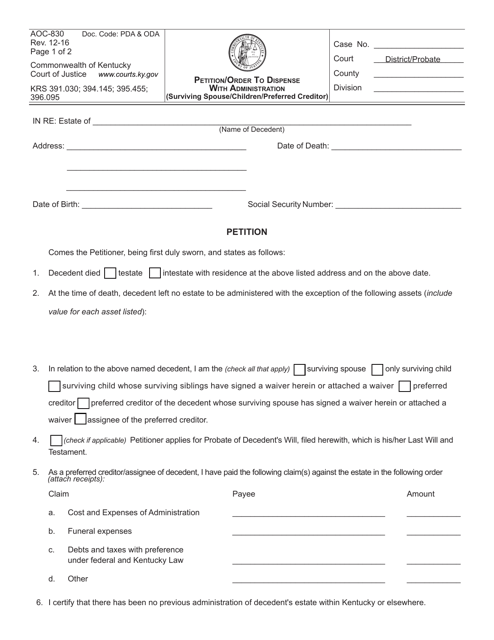

This is a legally binding document used in Kentucky to settle a small estate in the absence of a will.

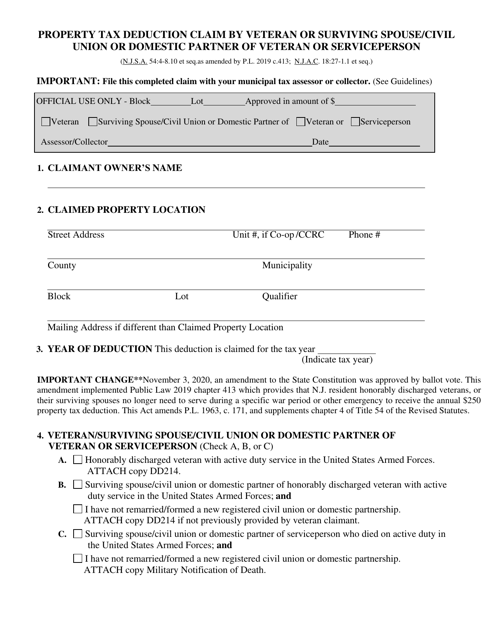

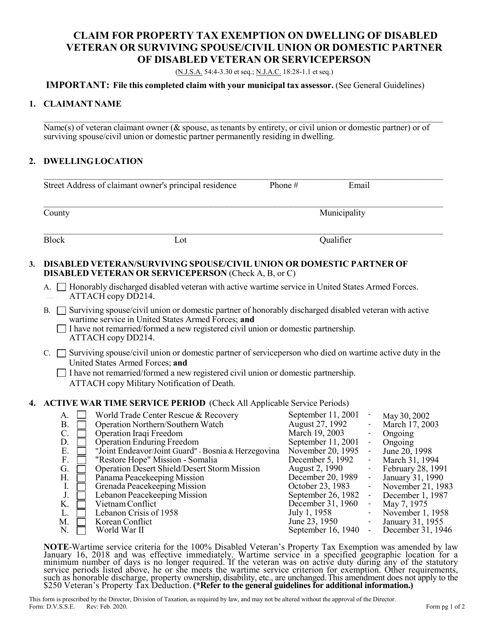

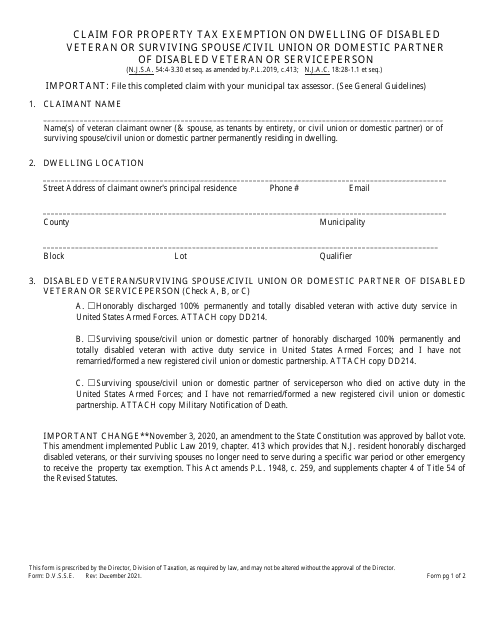

This form is used for claiming property tax exemption on the dwelling of a disabled veteran or surviving spouse or civil union or domestic partner of a disabled veteran or serviceperson in New Jersey.

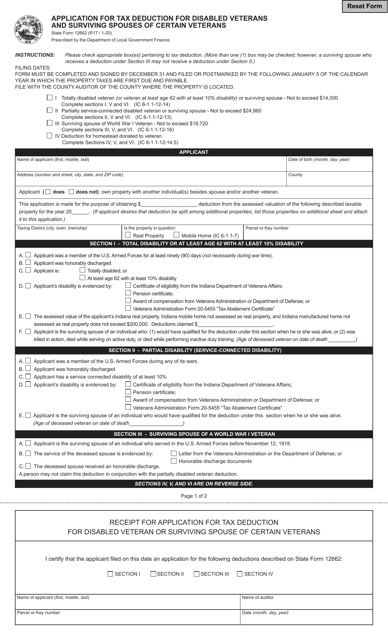

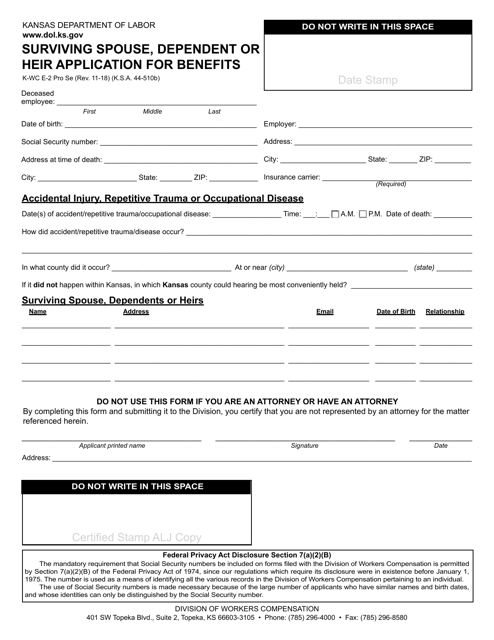

This form is used for surviving spouses, dependents, or heirs in Kansas to apply for benefits.

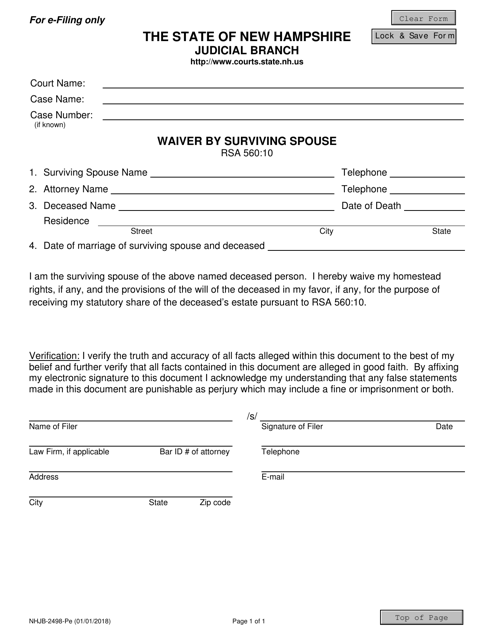

This form is used for waiving the interest of the surviving spouse in an estate in the state of New Hampshire.

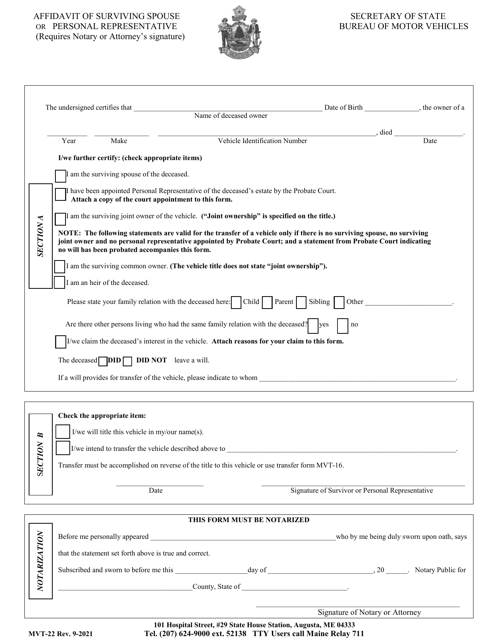

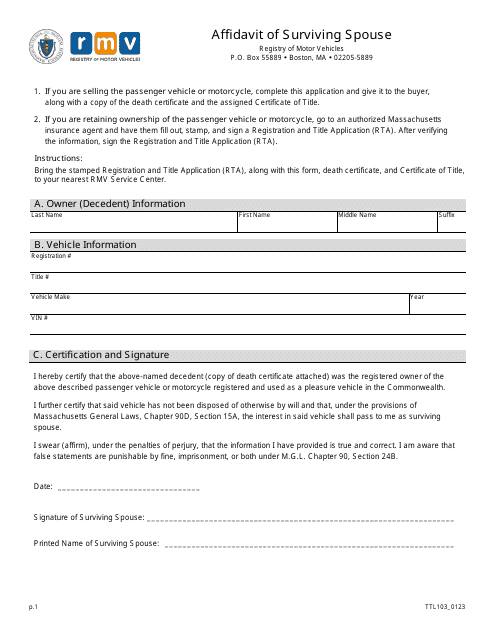

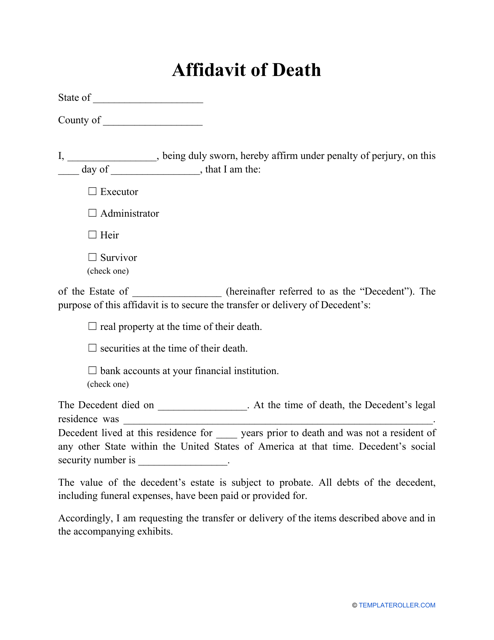

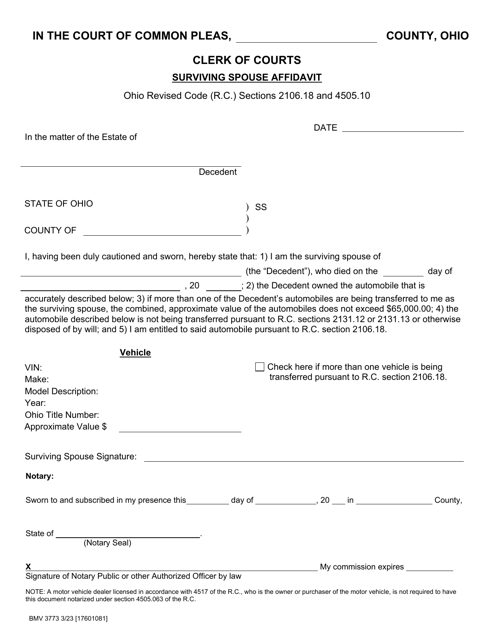

This form is filed by an heir or successor of a deceased person in order to certify under oath that the individual indicated in the affidavit has passed away.

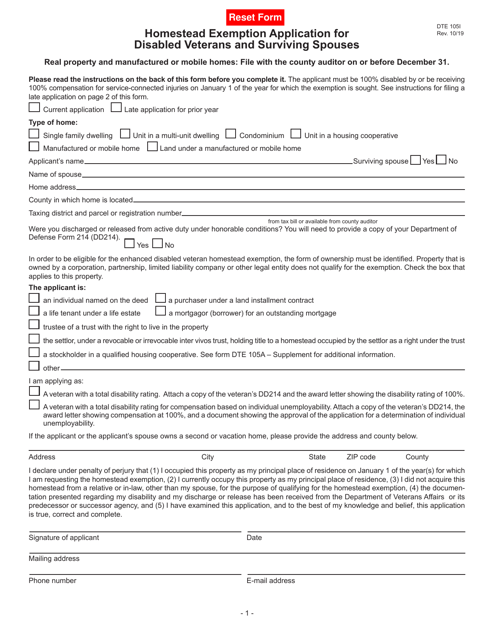

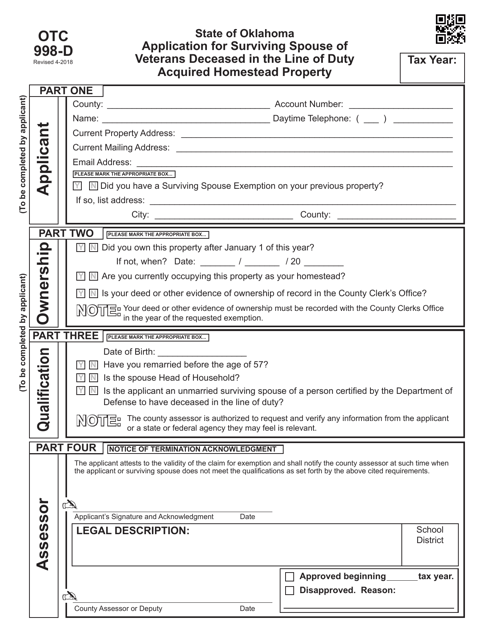

This form is used for surviving spouses of veterans who acquired homestead property in Oklahoma through the line of duty.

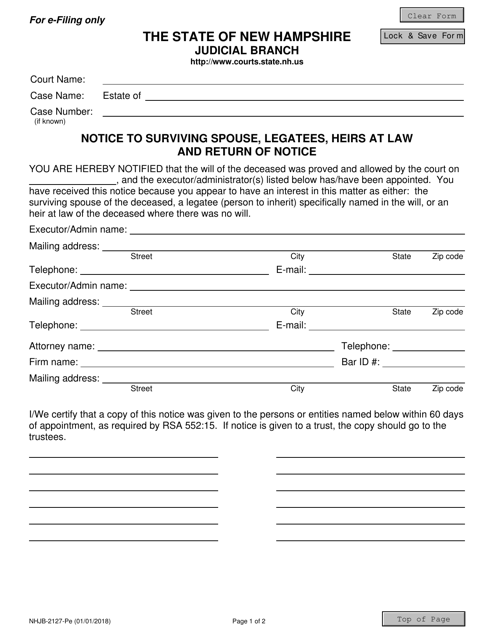

This form is used for notifying the surviving spouse, legatees, and heirs at law about the probate proceeding in New Hampshire. It also includes a return of notice section.

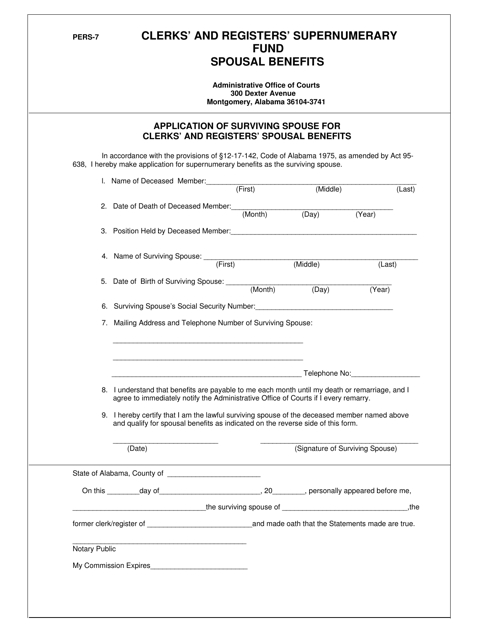

This form is used for surviving spouses in Alabama to apply for Clerks' and Registers' Spousal Benefits.

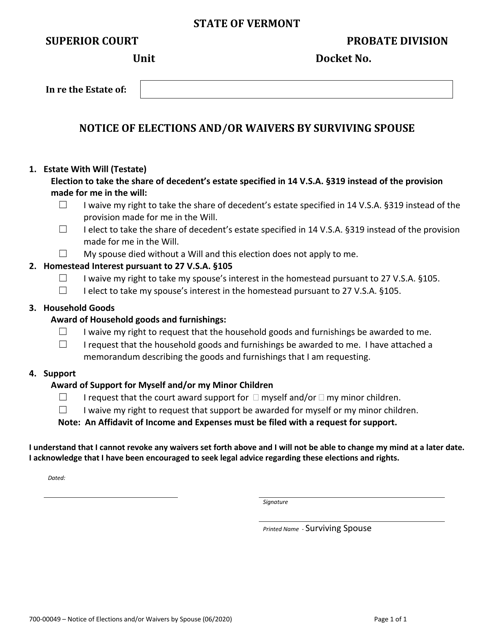

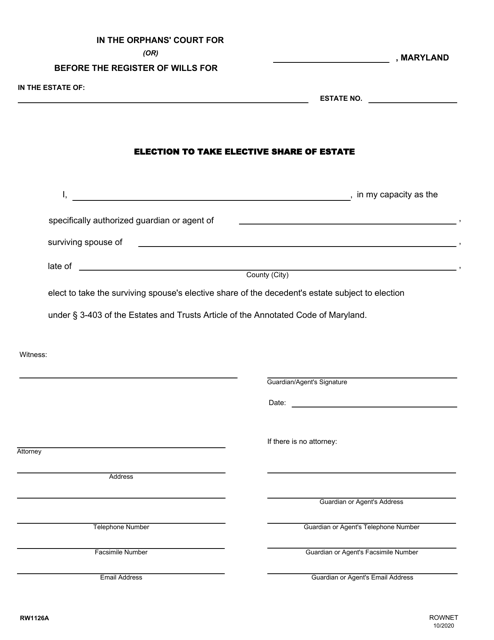

This form is used for electing to take the elective share of an estate in the state of Maryland. It is a legal document that allows a surviving spouse to claim a portion of the deceased spouse's estate, even if they were not included in the will.

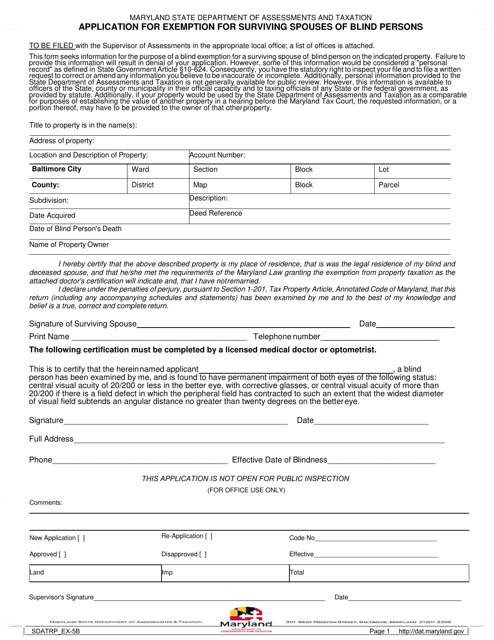

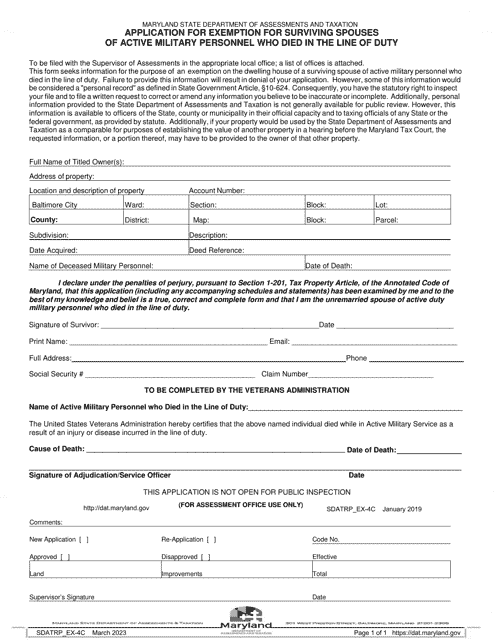

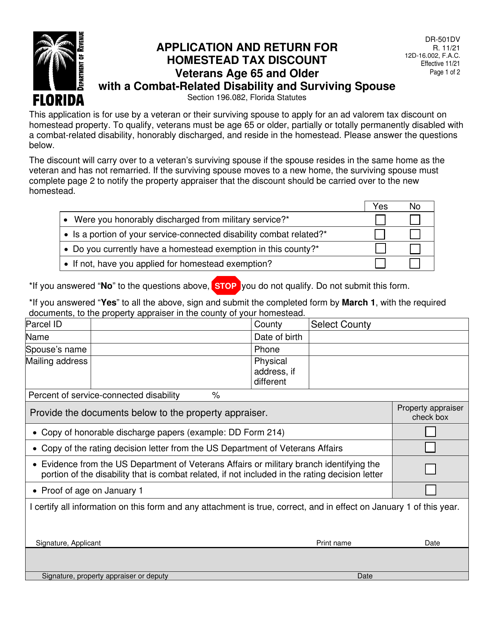

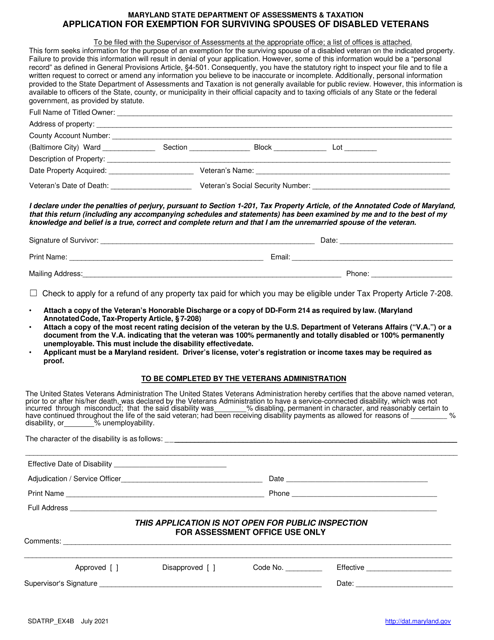

This form is used for applying for exemption for surviving spouses of disabled veterans in Maryland. It provides a way for eligible individuals to claim a tax exemption on their property.