Tax Code Templates

Looking for information about tax codes? Discover everything you need to know about the tax code in the USA, Canada, and other countries. Whether you're an individual or a business, understanding the tax code is essential to ensure you comply with the law and make the most of available deductions and credits.

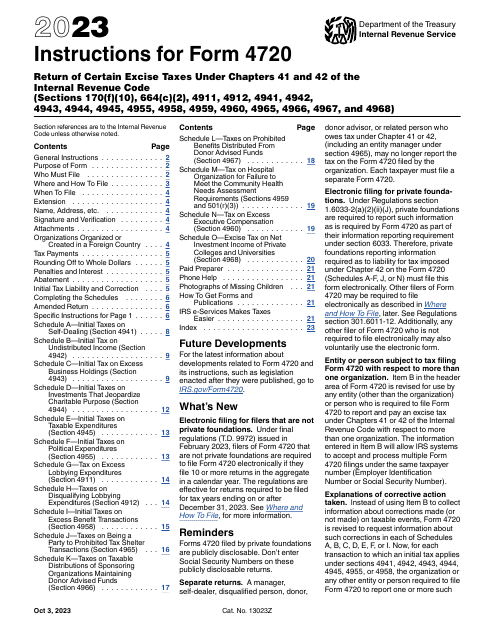

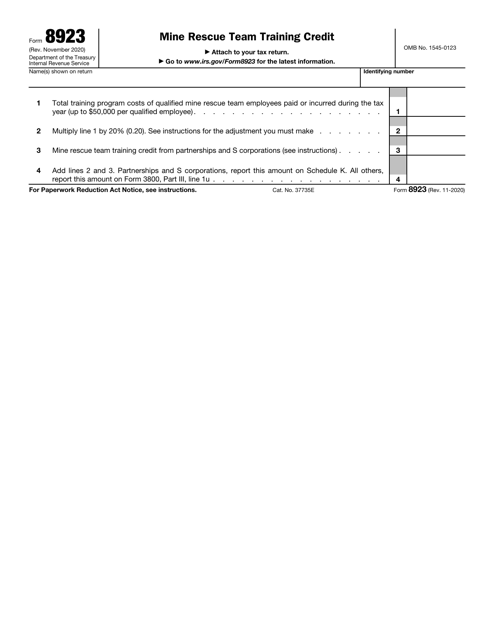

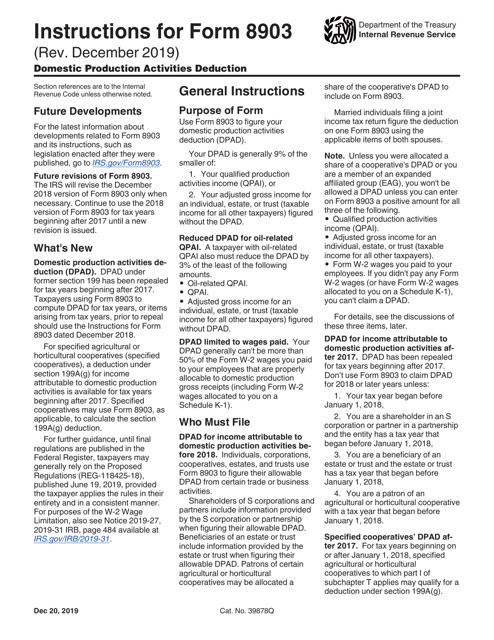

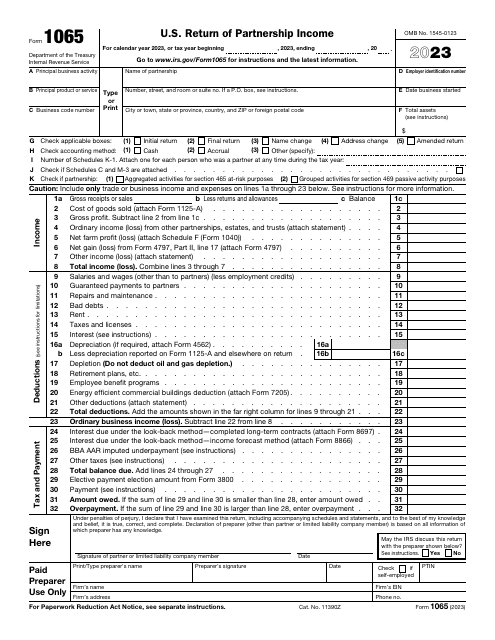

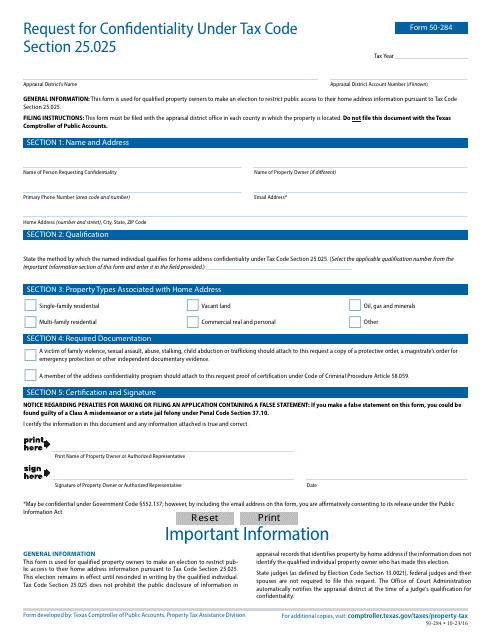

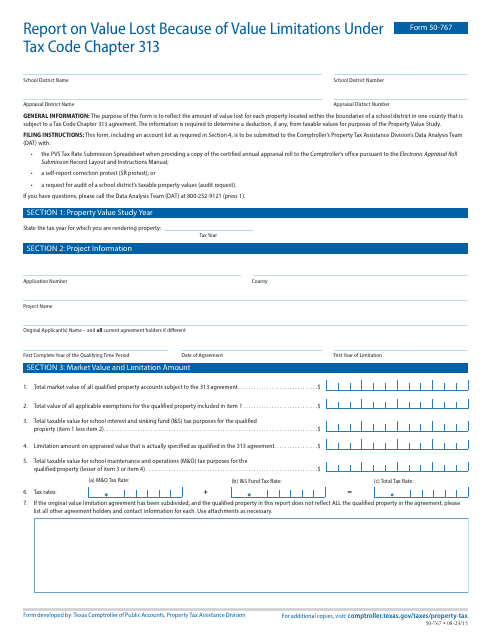

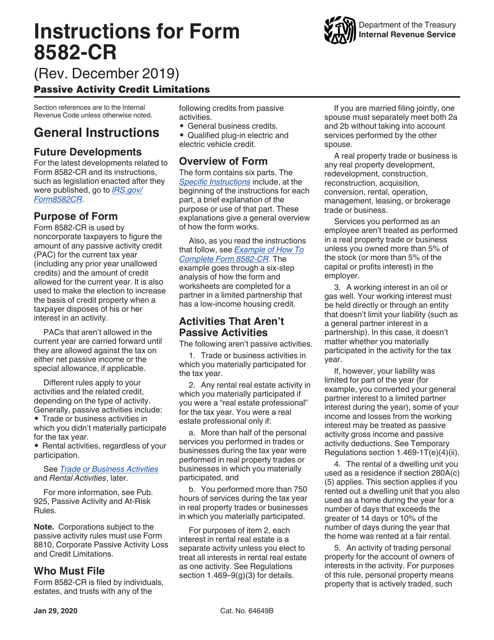

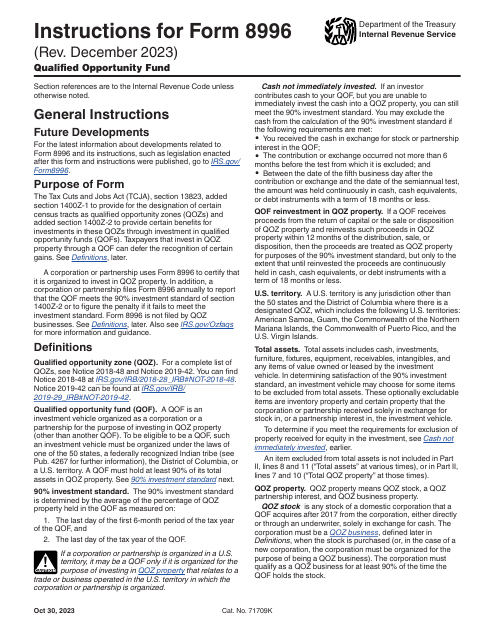

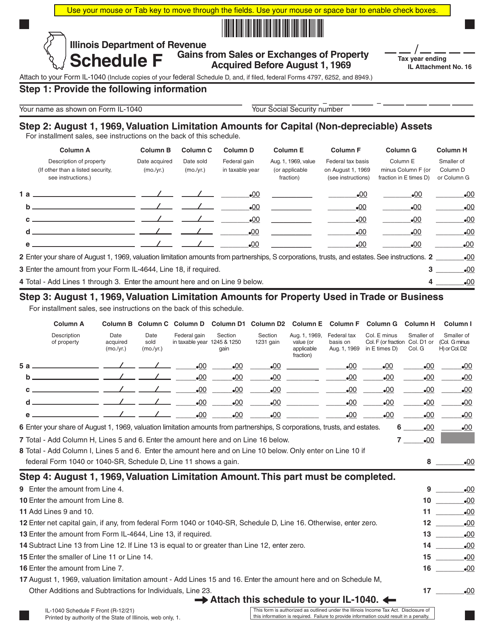

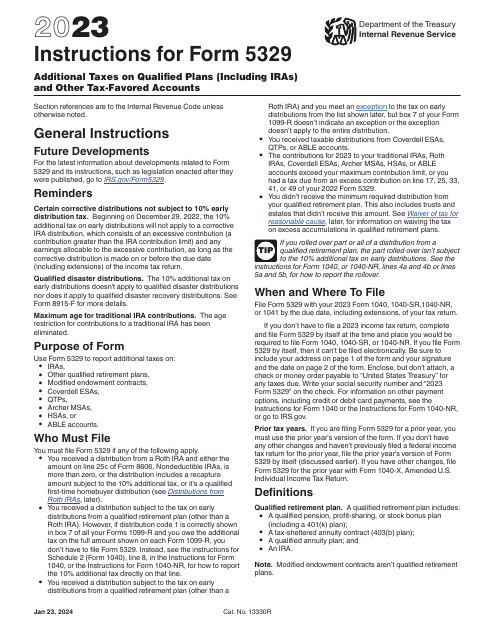

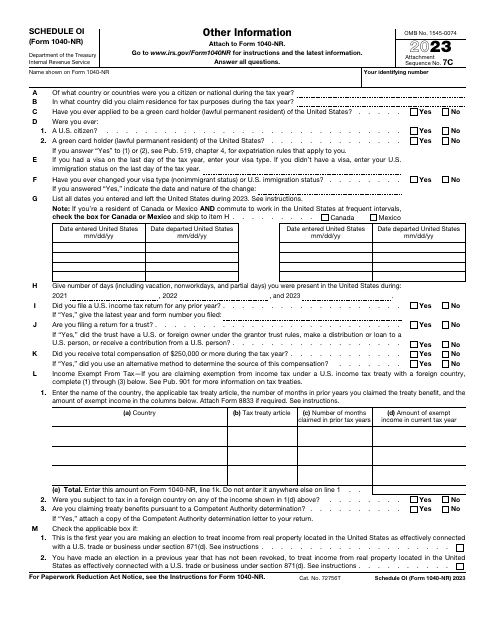

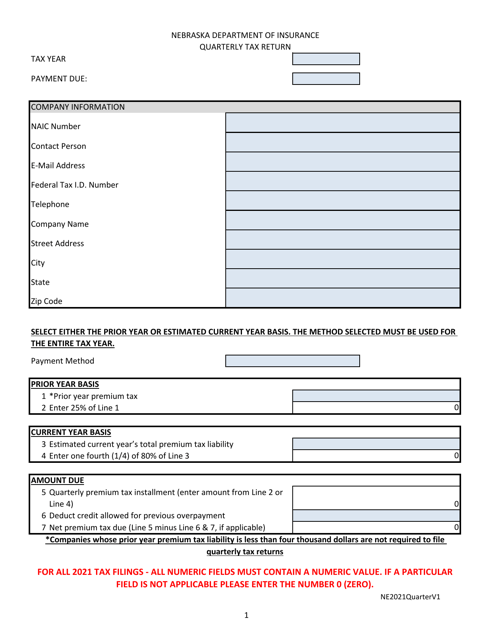

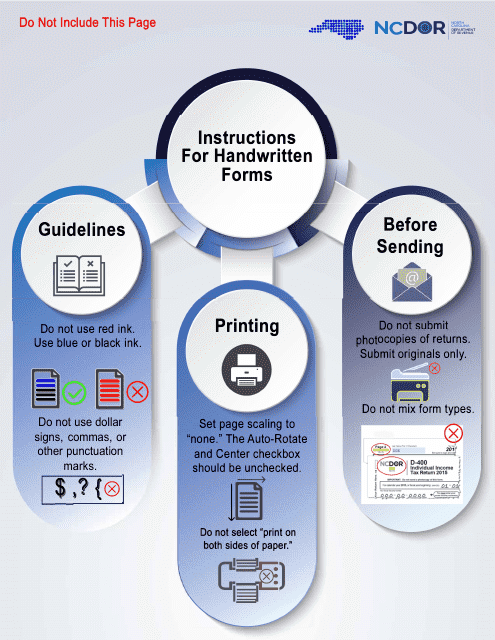

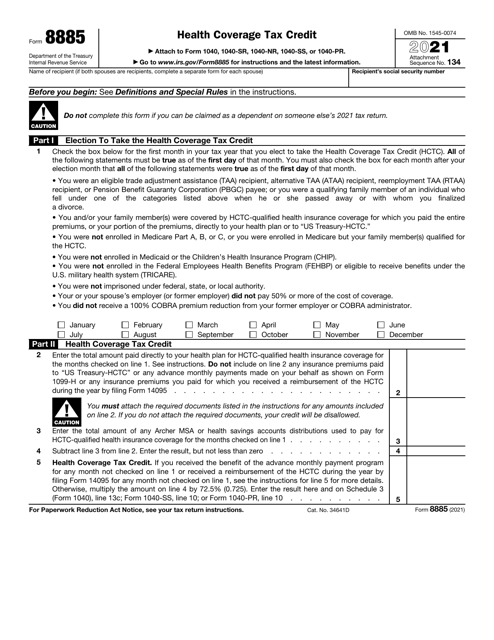

Explore a wide range of tax code resources, including forms and instructions, that cover various tax-related topics. From filing your federal and state tax returns to claiming refunds and reporting business income, these documents provide guidance and help you navigate the complexities of the tax system.

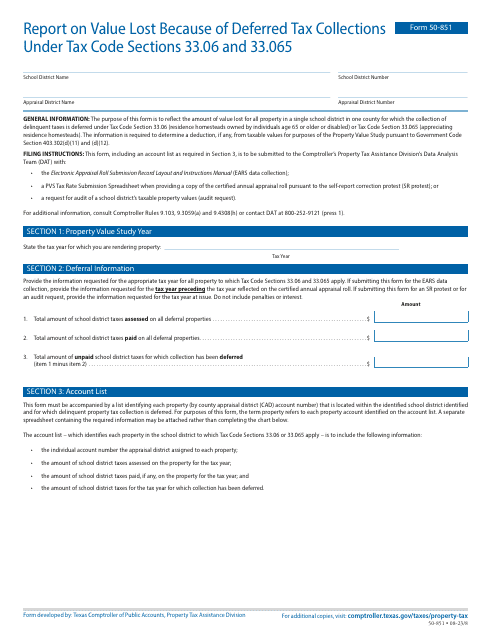

Discover the IRS Form 941-X, which allows employers to adjust their quarterly federal tax returns or claim refunds. Or dive into the Form 50-767, which outlines the calculations for value limitations under Tax Code Chapter 313 in Texas.

For business owners, explore instructions for the Form CT-3 General Business CorporationFranchise Tax Return in New York, ensuring you fulfill your tax obligations in the state.

Additionally, find the necessary documents like the Attachment J.2 Tax Certification Affidavit in Washington, D.C., and instructions for the IRS Form 990-T for exempt organizations with business income.

Our comprehensive collection of tax code resources covers different jurisdictions and provides valuable insights and guidance for individuals and businesses alike. Stay informed and make the most of the available deductions and credits to optimize your tax situation.

Documents:

62

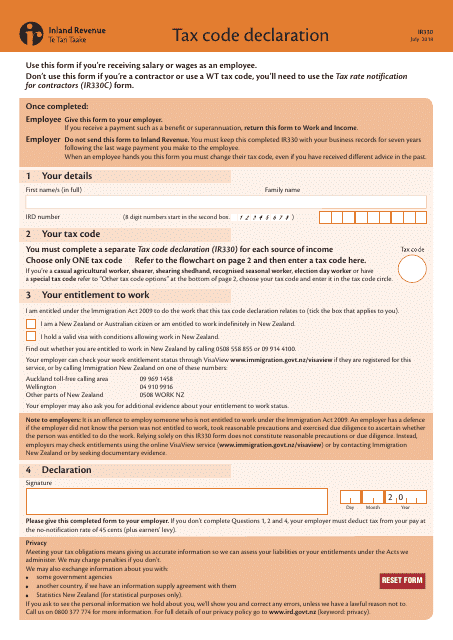

This Form is used for declaring your tax code in New Zealand.

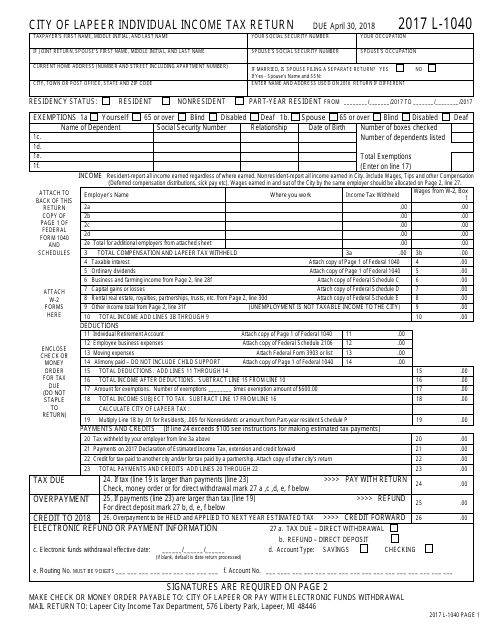

This Form is used for filing your individual income tax return in the CITY OF LAPEER, Michigan.

This document provides information about tax exemptions available to benevolent and charitable institutions in the state of Maine. It outlines the eligibility criteria and the process for obtaining these exemptions.

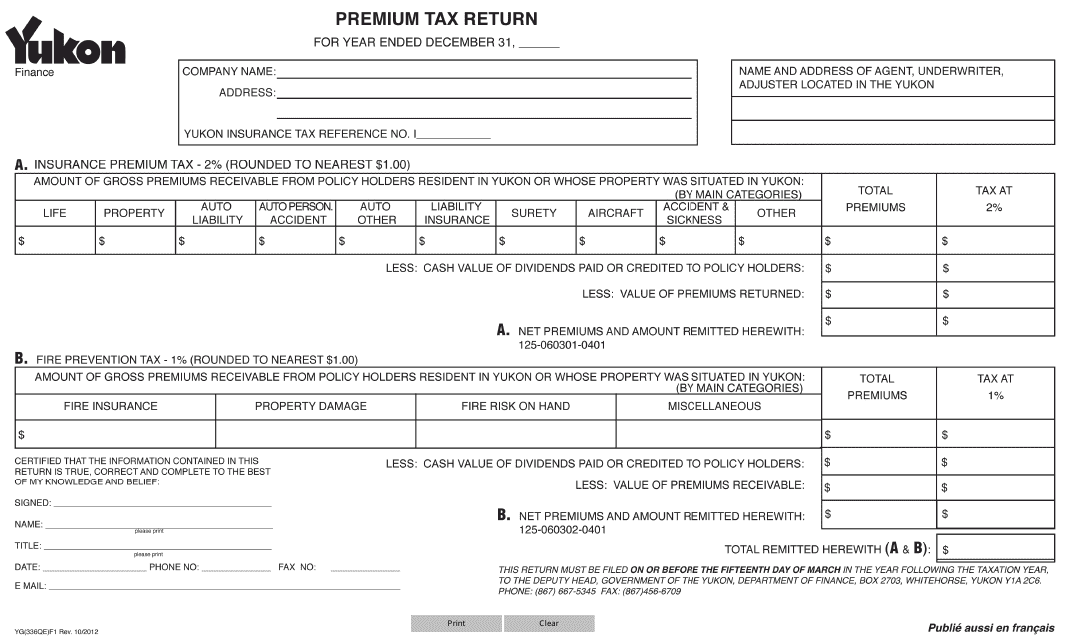

This form is used for filing premium tax returns in Yukon, Canada.

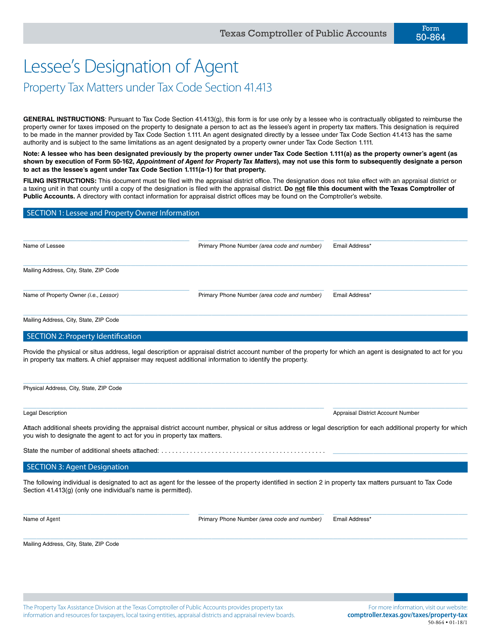

This form is used for a lessee to designate an agent for property tax matters under Tax Code Section 41.413 in the state of Texas.

Use this form to report information on deductions, credits, and income relevant to the operation of a partnership to the Internal Revenue Service (IRS).

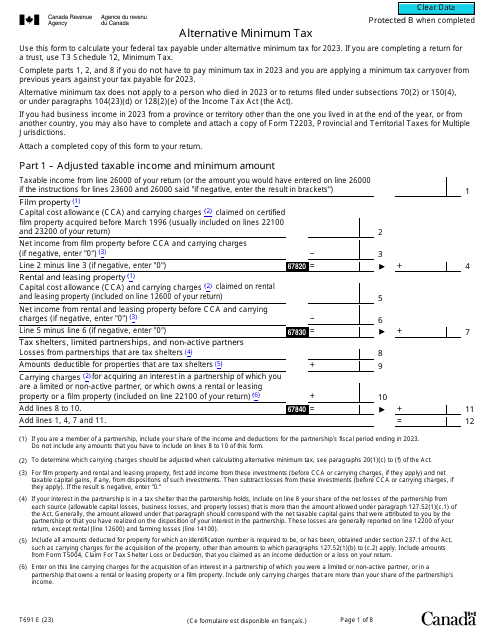

This is an IRS form used by taxpayers to calculate the amount of alternative minimum tax they owe to the government.

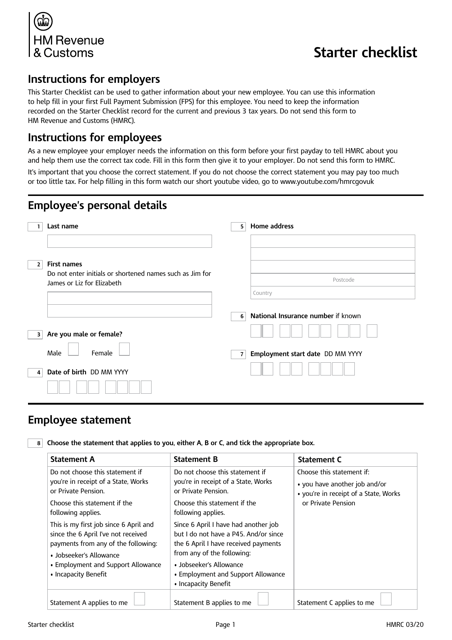

Employers may use this form to collect information about their employees, their previous employment, and the pension and benefits they are entitled to.

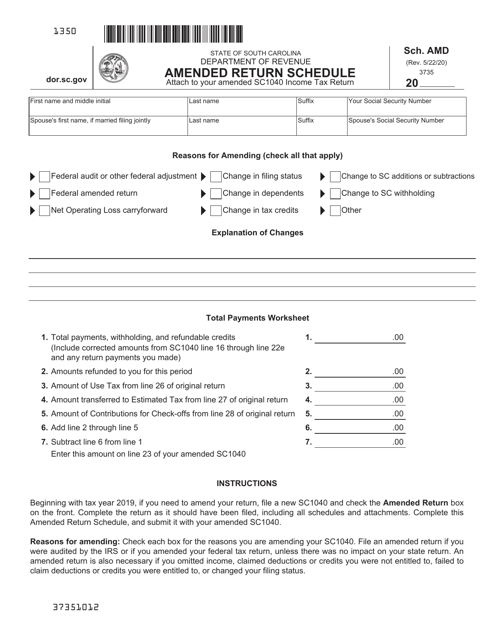

This is a formal instrument used by taxpayers that need to fix the mistakes they have discovered upon filing IRS Form 941, Employer's Quarterly Federal Tax Return.