Tax Code Templates

Documents:

62

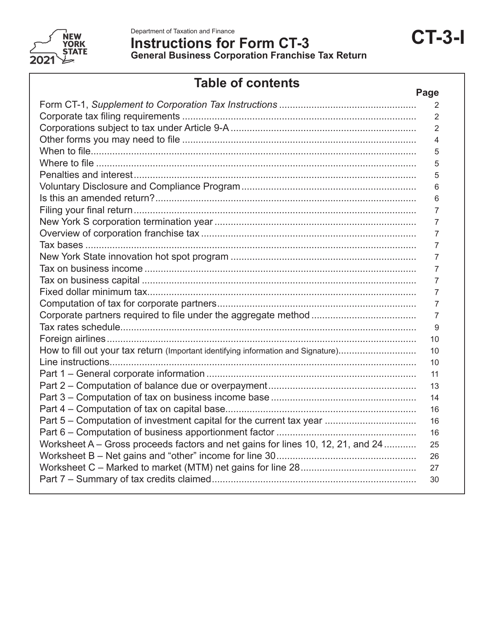

This form is used for filing the General Business Corporation Franchise Tax Return in the state of New York. It provides instructions on how to correctly complete and submit the form.

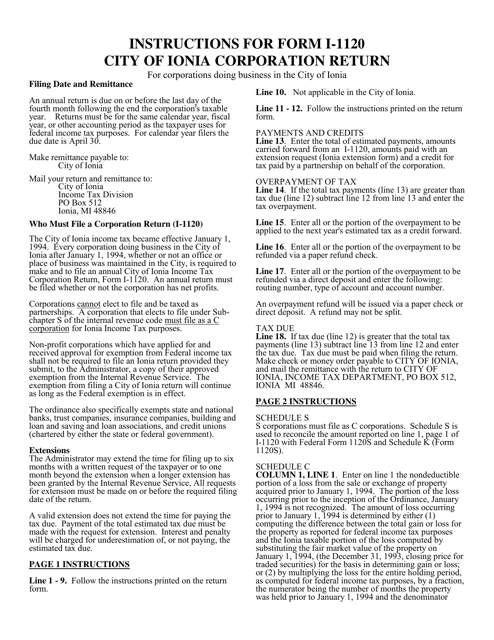

This Form is used for filing the Corporation Income Tax Return for businesses in the City of Ionia, Michigan. It includes instructions on how to accurately report income, deductions, and credits for the tax year.

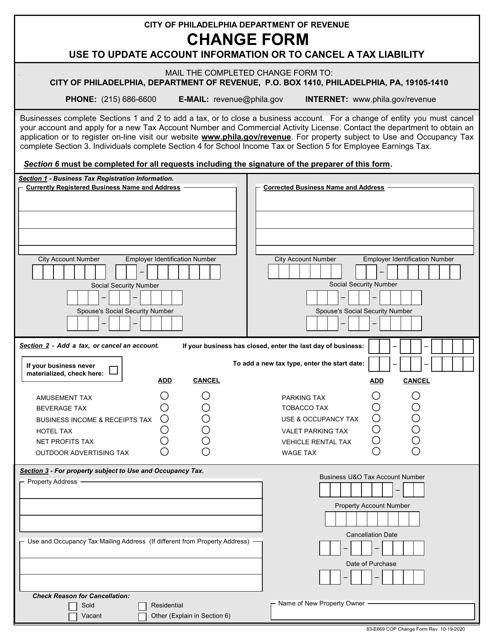

This form is used for changing your tax account information with the City of Philadelphia, Pennsylvania.

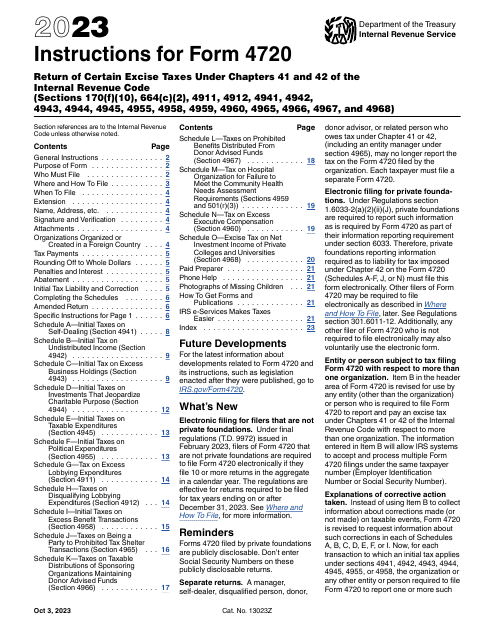

This form is also known as the IRS itemized deductions form. It belongs to the IRS 1040 series. This document is used in order to calculate the amount of your itemized deductions.

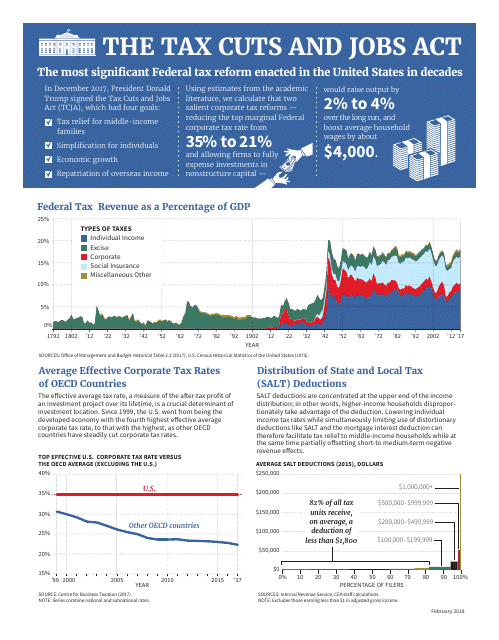

This document explains the Tax Cuts and Jobs Act, a law in the United States that made changes to the tax code with the goal of promoting economic growth and job creation.

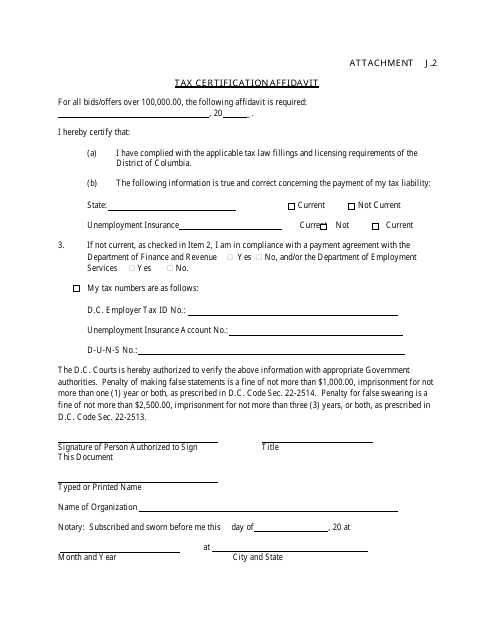

This document is for certifying tax information in Washington, D.C. It is used to confirm details related to tax obligations.

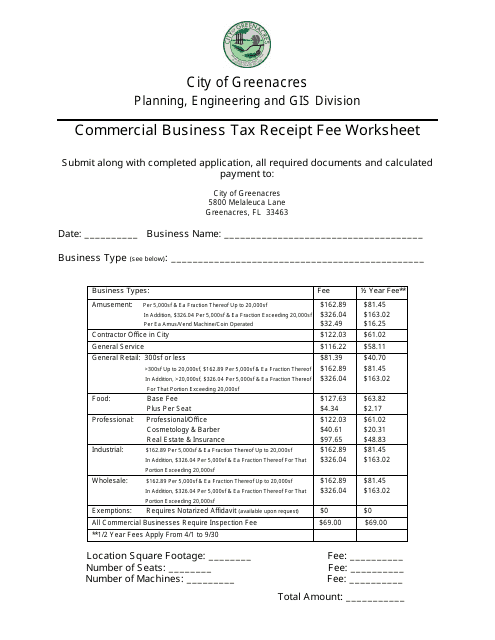

This document is used for calculating the fee for a commercial business tax receipt in the City of Greenacres, Florida.

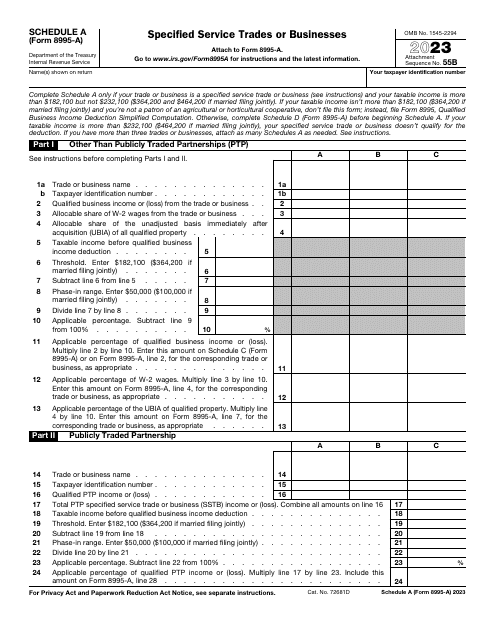

This is a supplementary IRS form used by taxpayers in order to claim a business deduction after reporting your business income.

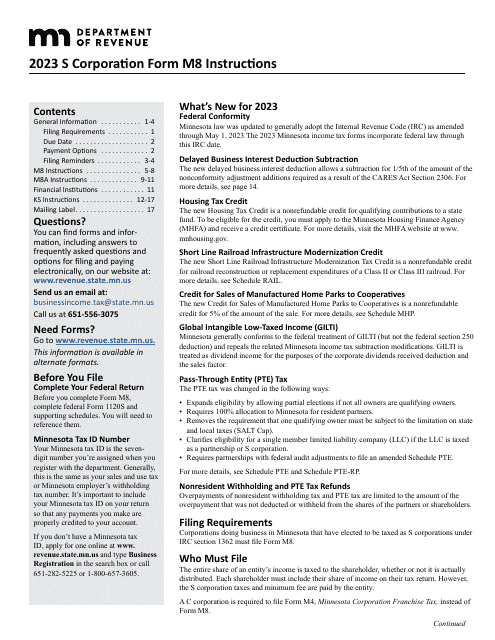

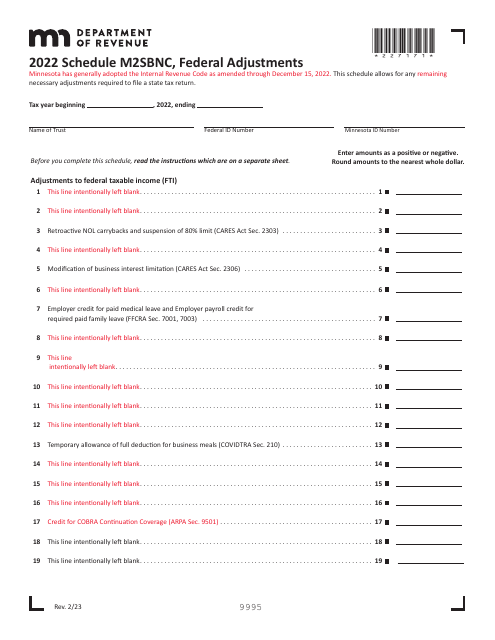

This document is used for reporting federal adjustments made on the Minnesota state tax return. It is specifically for businesses (M2SBNC) in Minnesota.