Fill and Sign Legal Forms and Templates

Documents:

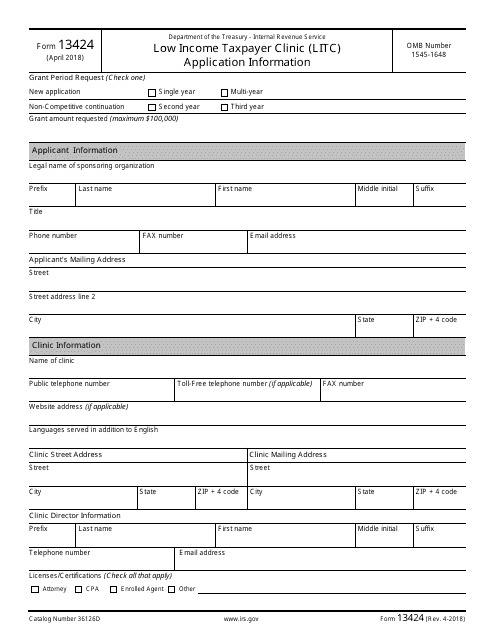

152222

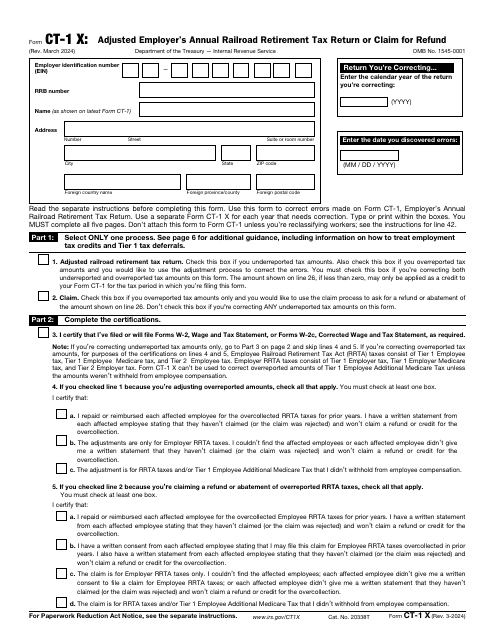

This is a formal document used by railroad industry employers to correct errors they have noticed upon filing IRS Form CT-1, Employer's Annual Railroad Retirement Tax Return.

This form is filed to report American Samoa wages and withheld taxes. It is not used for reporting income taxes in the United States. IRS Form W-2, Wage and Tax Statement is used in these cases.

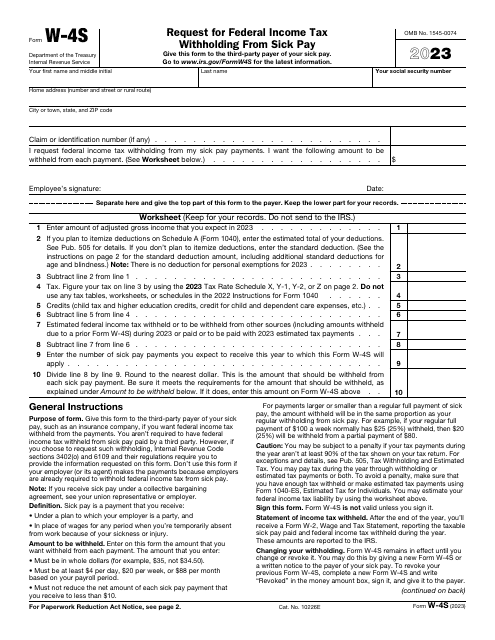

Use this document to report the amount of withheld wages and taxes to the employee and appropriate authorities. The form is also known as a W-2 and is one of the crucial annual tax documents.

This form is filed to report Guam wages and tax deductions. The document was issued by the Internal Revenue Service (IRS), which can send you this form in a paper format, if you wish.

This document is designed to inform the Internal Revenue Service (IRS) about the United States Virgin Islands salaries and the amount of taxes deducted from them. This document was issued by the IRS, which can send you this form in a paper format, if you wish.

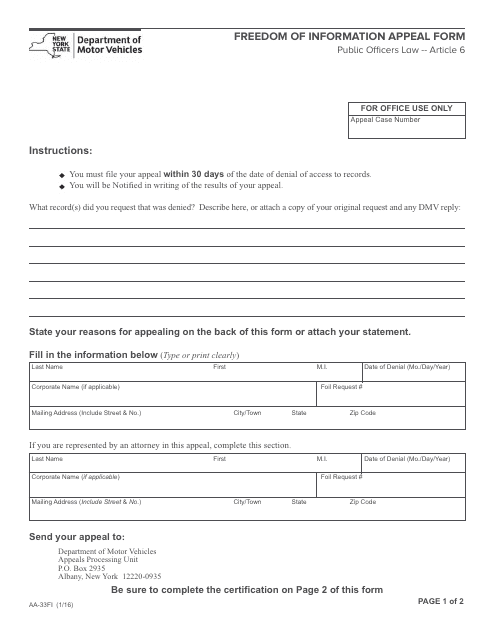

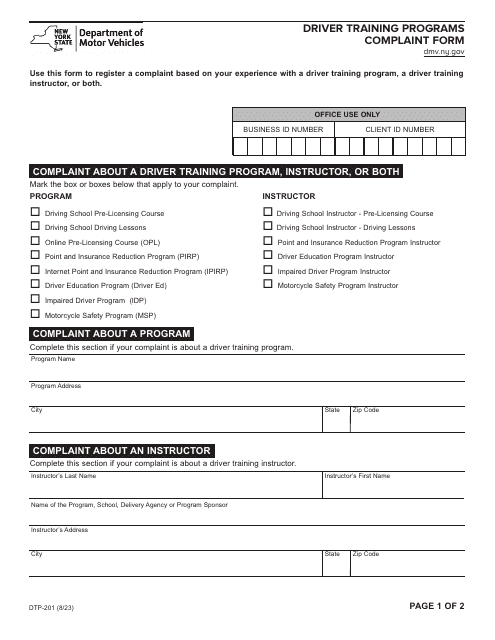

This form is used for submitting an appeal to request additional information from a government agency in the state of New York.

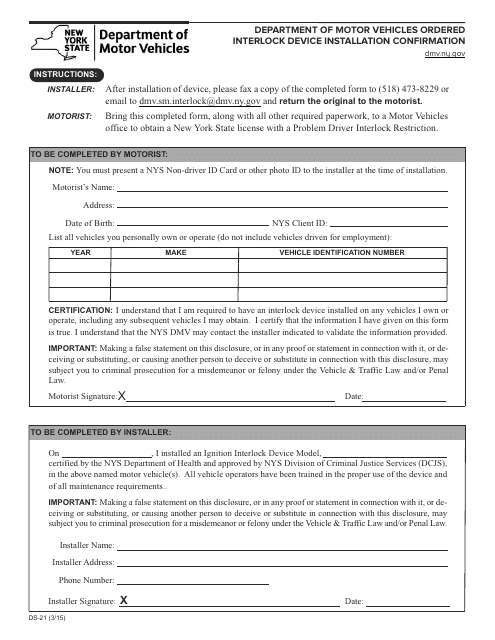

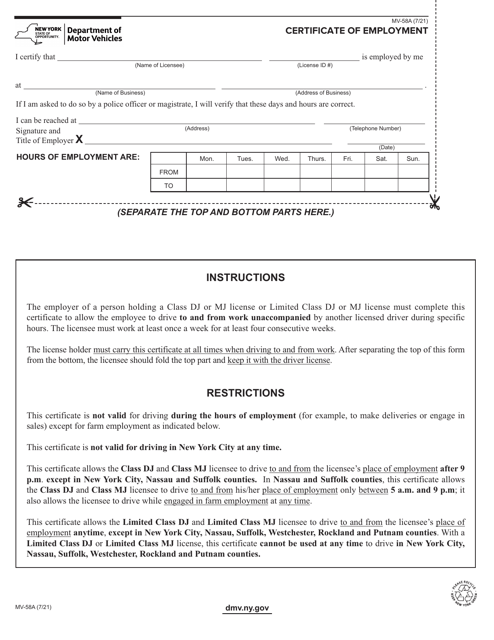

This Form is used for confirming the installation of an interlock device ordered by the Department of Motor Vehicles in New York.

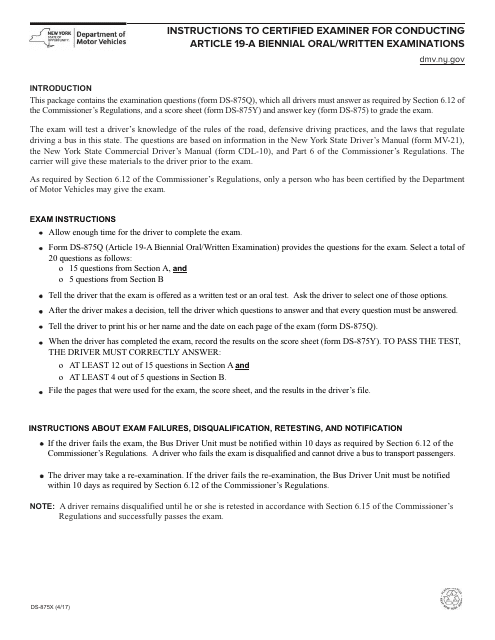

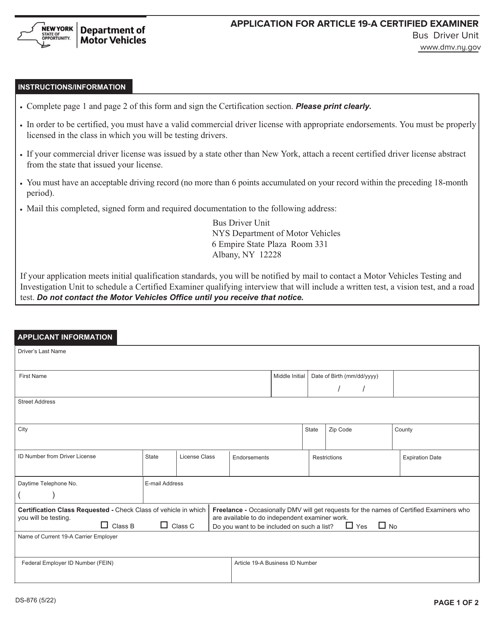

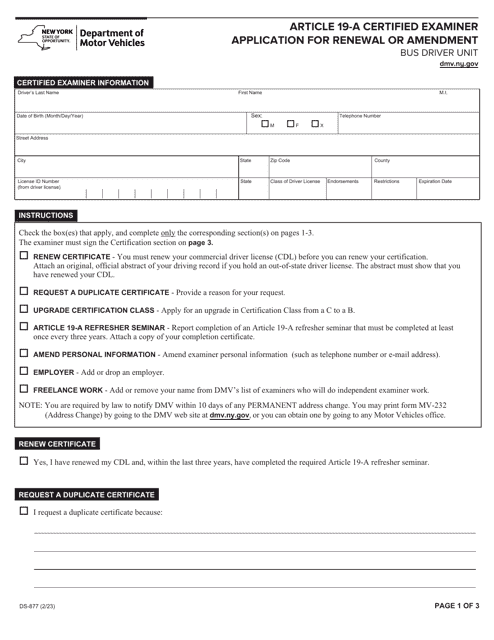

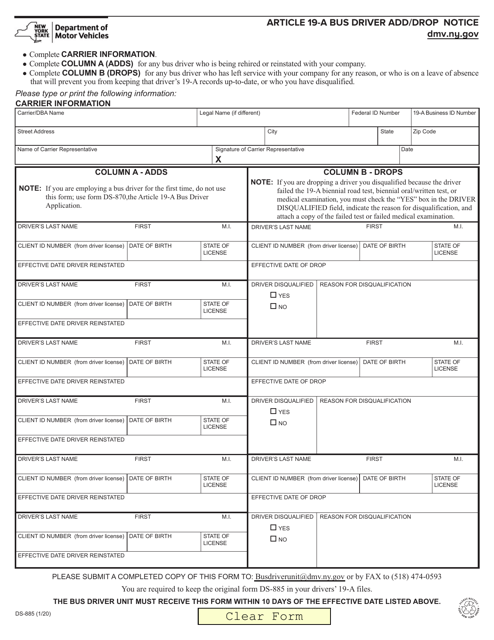

This document provides instructions to certified examiners in New York for conducting Article 19-a biennial examinations. These examinations are conducted for certain commercial drivers to ensure their fitness to operate vehicles.

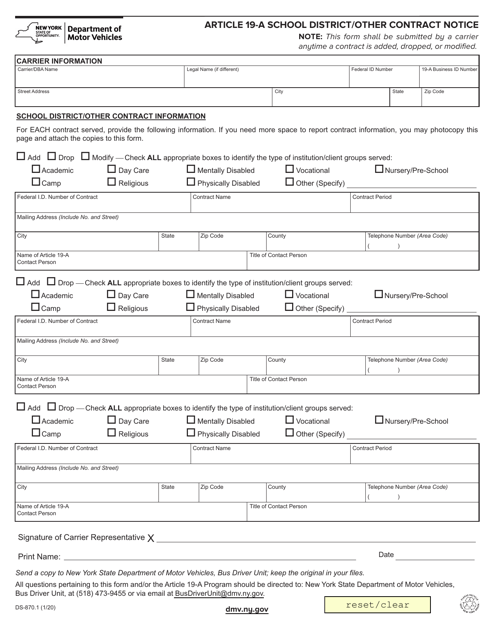

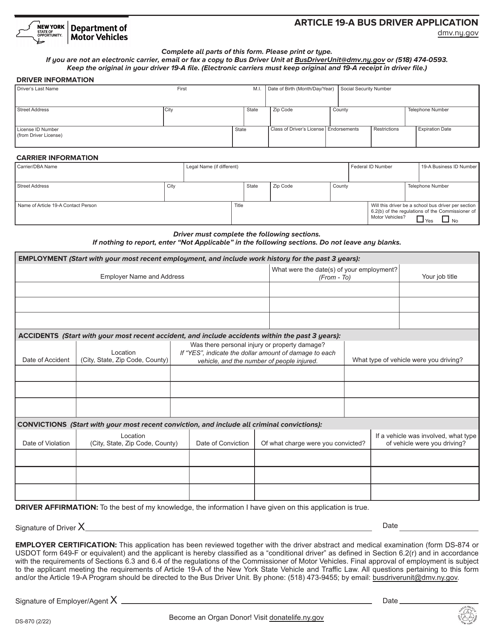

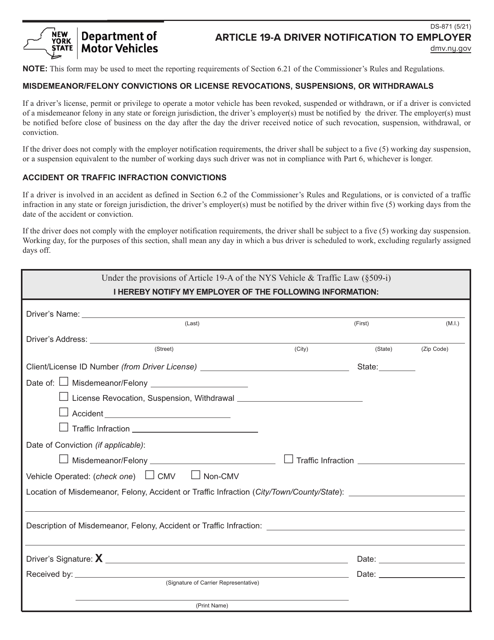

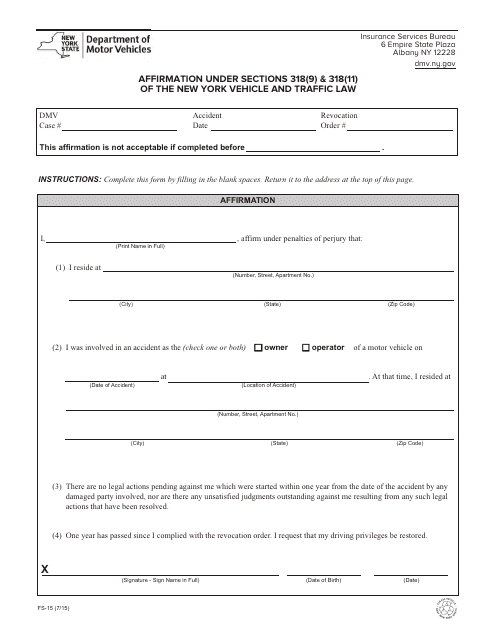

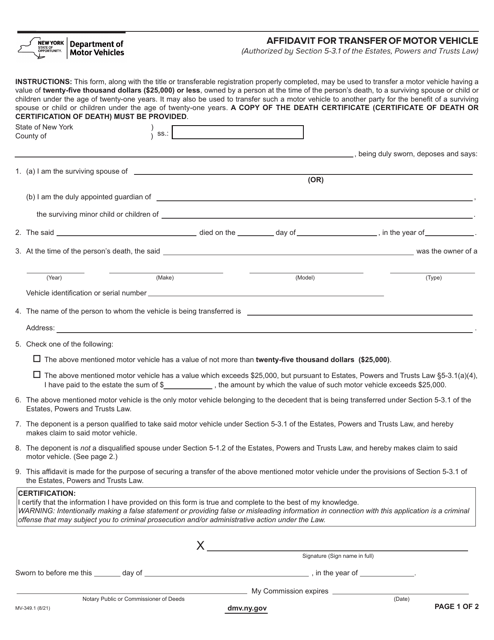

This document is used for affirming certain sections of the New York Vehicle and Traffic Law.

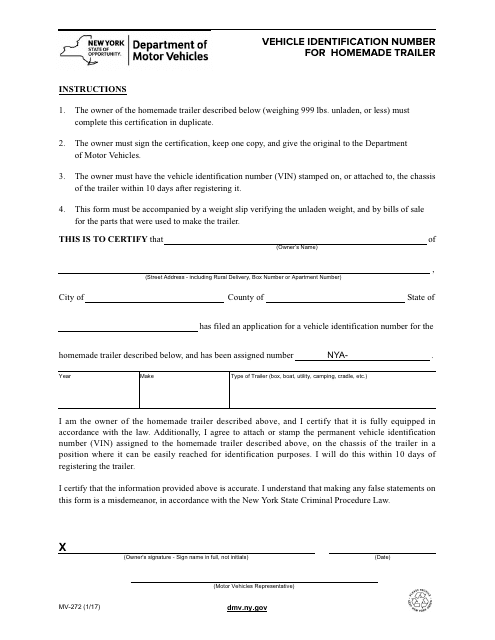

This Form is used for registering and obtaining a vehicle identification number (VIN) for a homemade trailer in the state of New York.

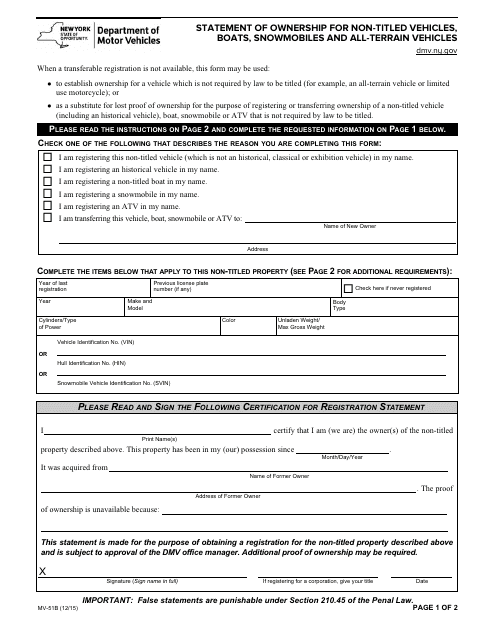

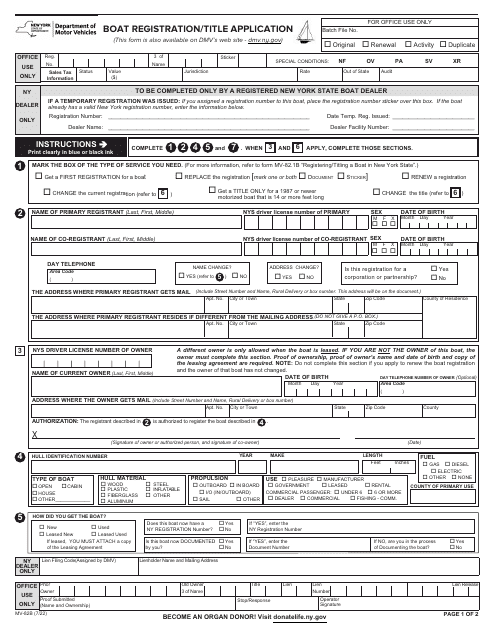

This Form is used for submitting a statement of ownership for non-titled vehicles, boats, snowmobiles, and all-terrain vehicles in New York.

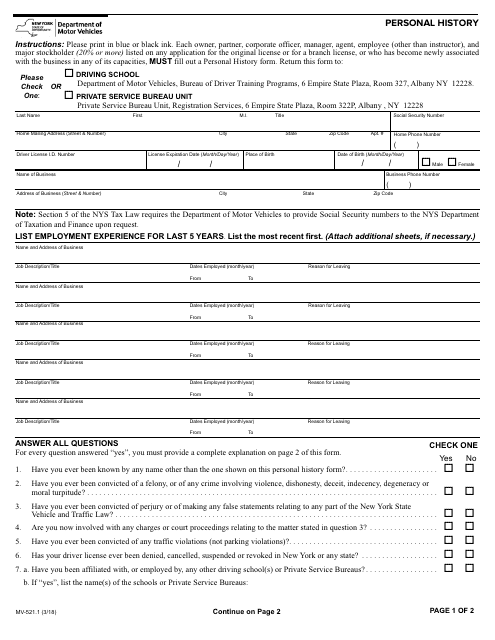

This Form is used for providing personal history information in the state of New York.

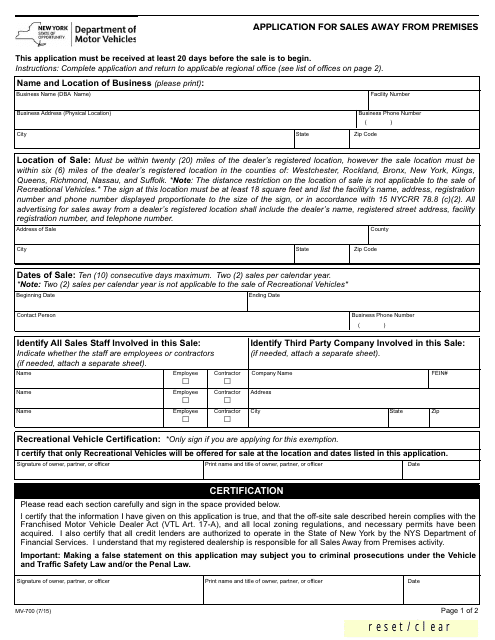

This form is used for applying for sales away from premises in the state of New York.