Fill and Sign Legal Forms and Templates

Documents:

152222

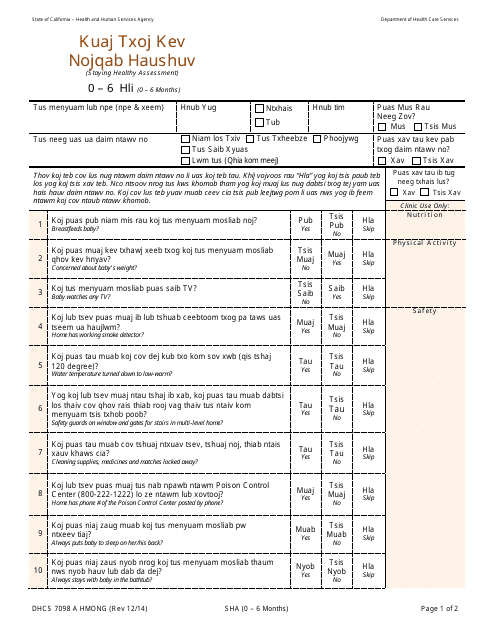

This form is used for the Staying Healthy Assessment for infants aged 0-6 months in California, with a specific version available in the Hmong language.

This Form is used for reporting a partner's share of income or loss from an electing large partnership. It is specifically for the partner's use only.

This Form is used for reporting income and expenses of electing large partnerships in the United States.

This is a document you may use to figure out how to properly complete IRS Form 6765

This form is used for reporting the alternative tax on qualifying shipping activities to the IRS. It provides instructions on how to calculate and report the tax owed related to shipping activities.

This document provides instructions for various IRS forms including W-8BEN, W-8BEN-E, W-8ECI, W-8EXP, and W-8IMY. These forms are used to certify the foreign status of the taxpayer and claim eligibility for tax treaty benefits, exemption from withholding, or reduced withholding rates. The instructions guide taxpayers on how to complete these forms correctly and provide required information to the IRS.