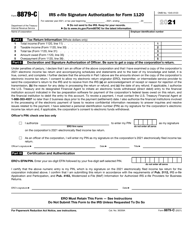

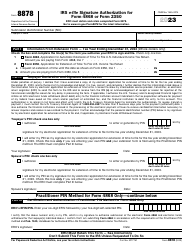

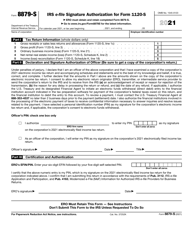

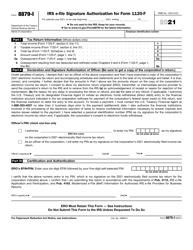

IRS Form 8879-C IRS E-File Signature Authorization for Form 1120

What Is IRS Form 8879-C?

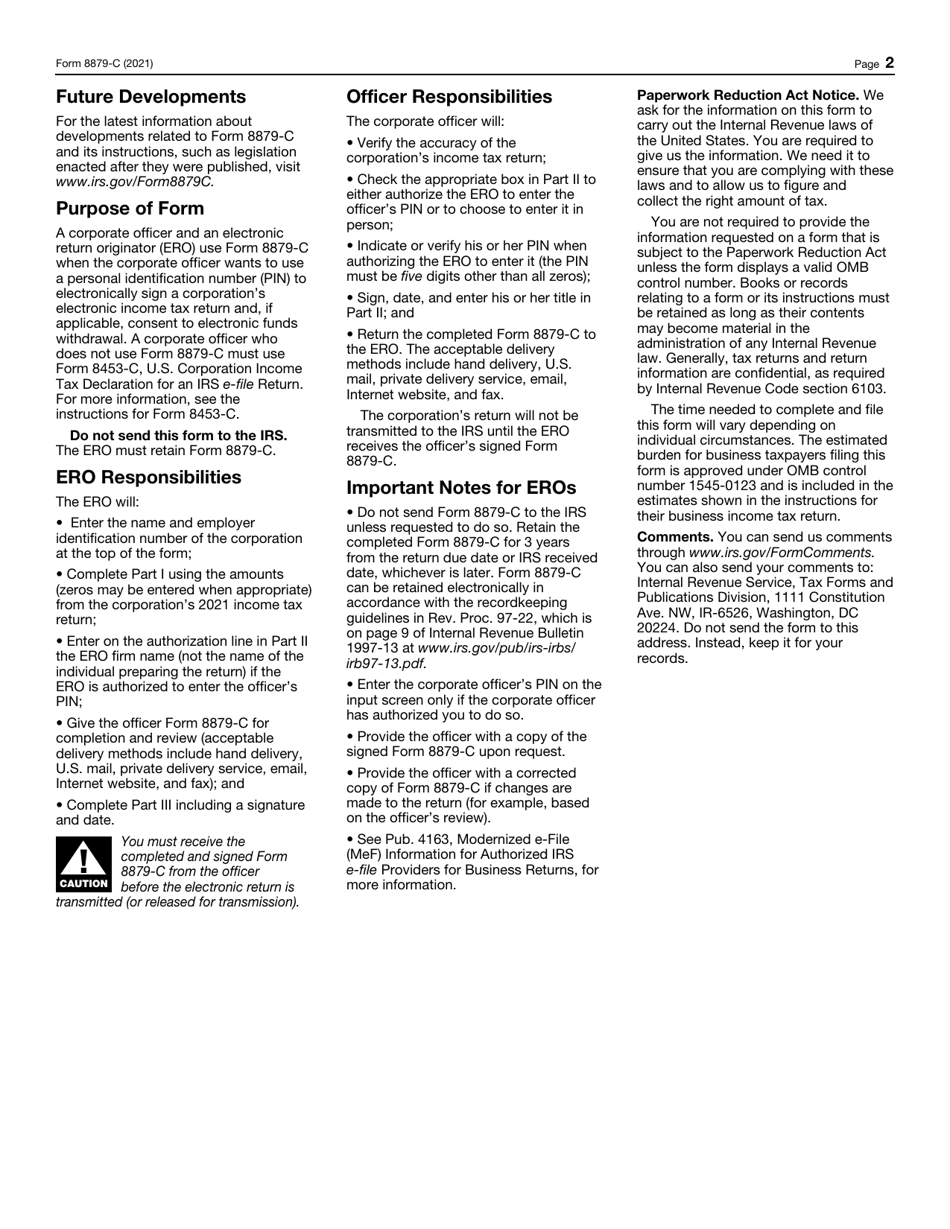

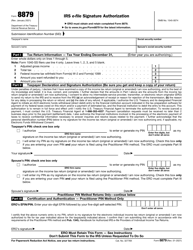

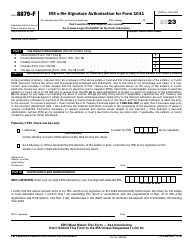

IRS Form 8879-C, IRS E-File Signature Authorization for Form 1120 , is a fiscal document corporations use to create personal identification numbers in order to let electronic return originators sign tax returns on their behalf. Additionally, this instrument allowed individuals and entities that acted in the name of the taxpayer to withdraw electronic funds whenever necessary.

This authorization was issued by the Internal Revenue Service (IRS) in 2021 - it is no longer valid and it was replaced by IRS Form 8879-CORP, E-file Authorization for Corporations.

You can download an IRS Form 8879-C fillable version through the link below.

It specified the tax year covered in the paperwork, identified the corporation by its name and employer identification number, summarized the details from the main income statement of the taxpayer, and confirmed the officer with authority to make crucial decisions on behalf of the company decided to permit the designated agent to enter their identification number and initiate electronic funds withdrawals by signing the form, indicating the title of the officer, and recording the actual date.

The originator of the electronic return was not required to submit Form 8879-C to the IRS - the copy of the document was supposed to remain in the records of the person or entity responsible for preparing tax documentation the way they agreed with the corporation that released the authorization. The document was retained for at least three years after tax authorities received a tax return from the corporation.