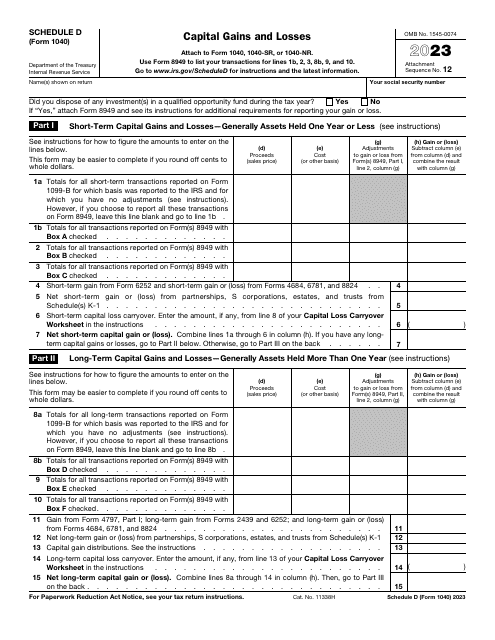

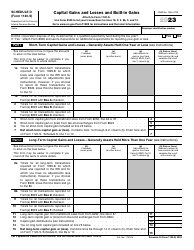

IRS Form 1040 Schedule D Capital Gains and Losses

What Is IRS Form 1040 Schedule D?

IRS Form 1040 Schedule D, Capital Gains and Losses , is a supplementary document taxpayers have to attach to their tax return to outline capital gains and losses that were the result of property sales.

Alternate Name:

- Tax Form 1040 Schedule D.

When you are collecting information about the gains or losses realized from the sale of capital assets, you need to fill out this instrument - in most cases, a taxpayer is obliged to report how much they gained or lost after disposing of residential property, bonds, and stock among other capital assets they may use as an investment or for private purposes.

This schedule was issued by the Internal Revenue Service (IRS) in 2023 - previous editions of the document are now outdated. An IRS Form 1040 Schedule D fillable version is available for download below.

The document is a supplement to IRS Form 1040, U.S. Individual Income Tax Return

Form 1040 Schedule D Instructions

Taxpayers that got rid of various capital assets (houses, apartments, cars, collectibles) have a responsibility to inform tax authorities about the outcome of the transaction - let the IRS know how much you have earned or lost in the deal. Follow these Form 1040 Schedule D instructions to describe your long- and short-term gains and losses:

-

Write down your full name and social security number - make sure these details match the information you have included on your regular tax return.

-

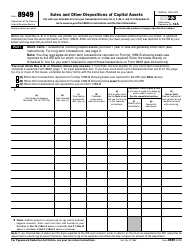

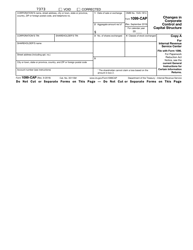

Confirm whether you have disposed of investments in entities whose purpose is to secure financing for qualified opportunity zones by checking the box . If your answer is affirmative, you have to fill out IRS Form 8949, Sales and other Dispositions of Capital Assets, and provide more information about the gains or losses.

-

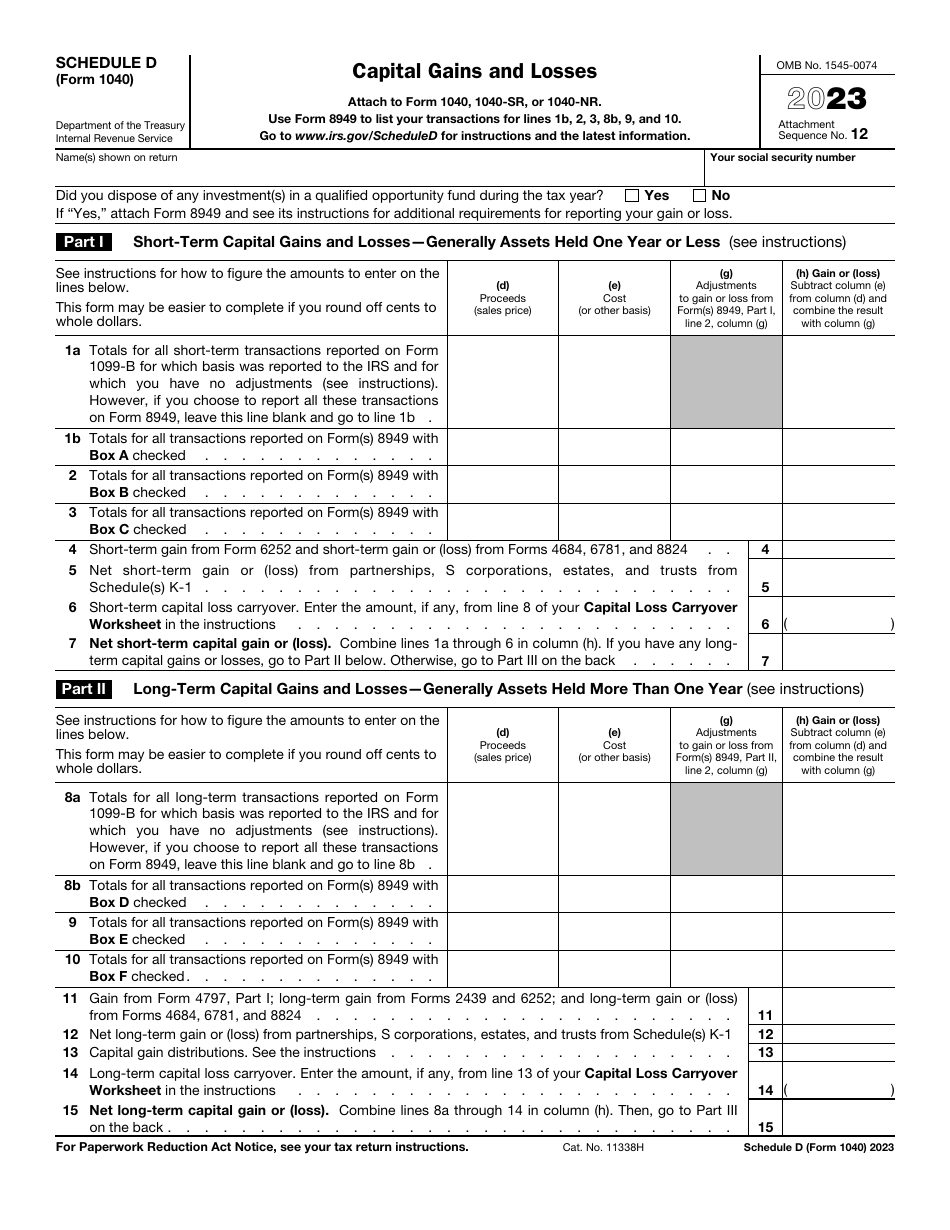

Elaborate on short-term gains and losses - their holding period is usually twelve months or less . You have to indicate the sales price of every property, its cost, adjustments you may have included on IRS Form 8949, and calculate the gain or loss for each item. Ensure you take all types of gains and losses into account when filling out the paperwork - installment income, losses you have suffered due to theft, estimated values of investments, and asset exchanges.

-

List your capital gains and losses whose holding period exceeds twelve months . Once again, you have to consider all proceeds from sales, the cost of every transaction, gain or loss adjustments, and the total amount of gain or loss. Note that you must record the gains or losses of trusts, estates, partnerships, and S corporations if you earned or lost money during the calendar year covered in the form, enter the amount of capital gain distributions, and use the formulas in the document to specify how big the gain or loss was before you proceed with the summary of results.

-

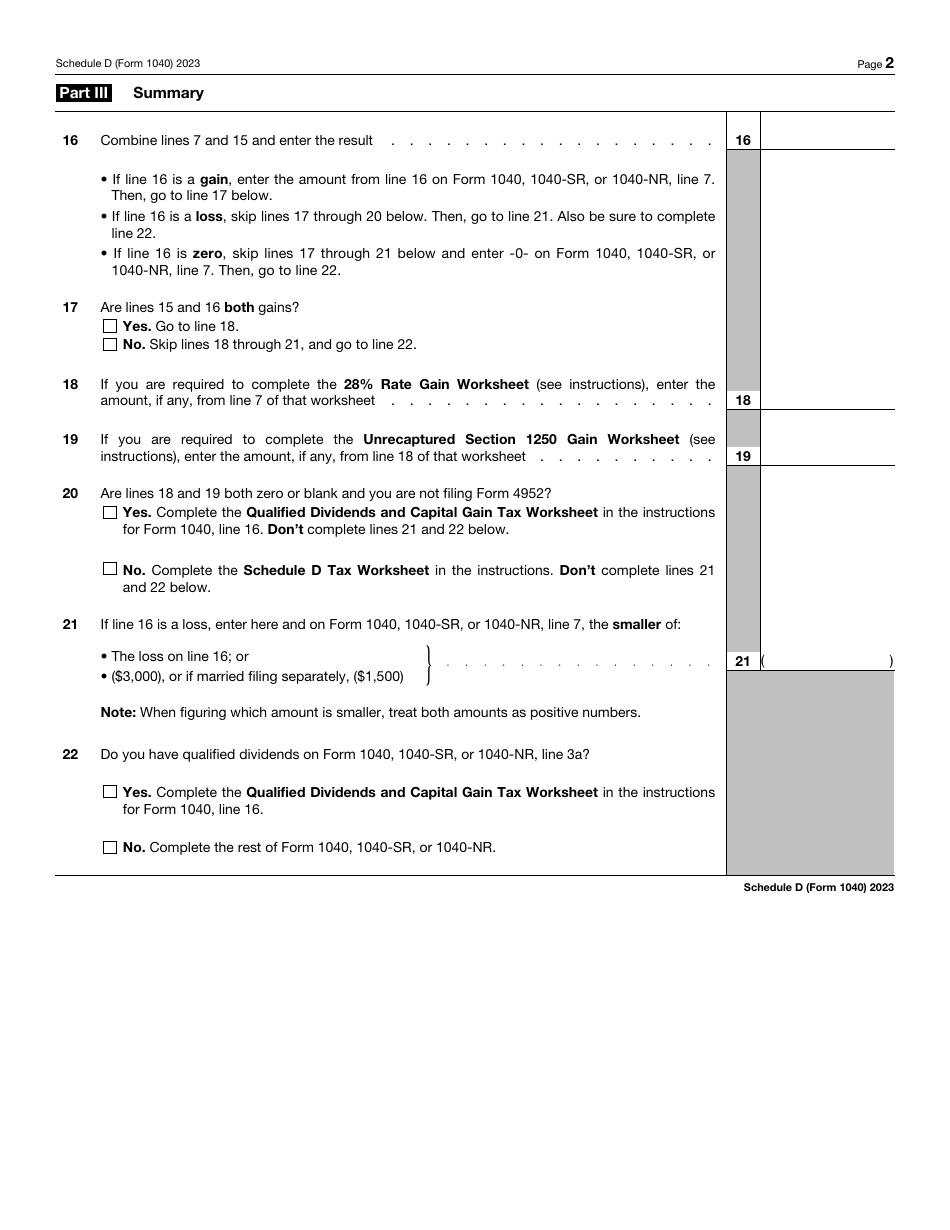

Summarize the numbers you computed on the first page of the schedule including results you got after making calculations on gain worksheets . When the form is prepared, enclose it with IRS Form 1040, U.S. Individual Income Tax Return.