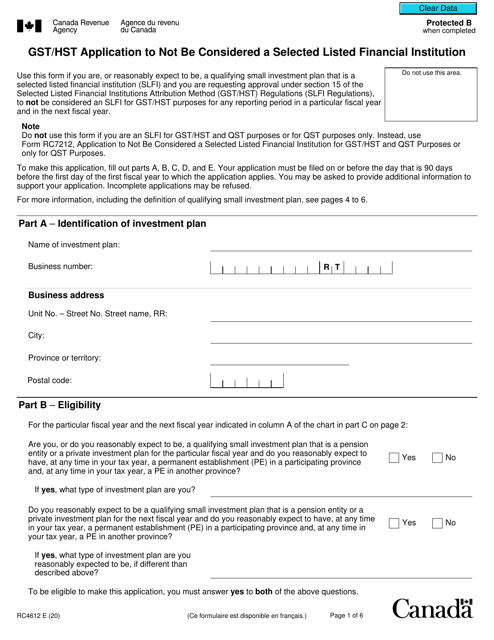

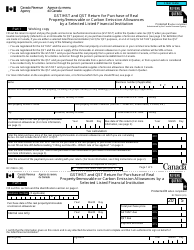

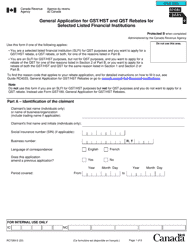

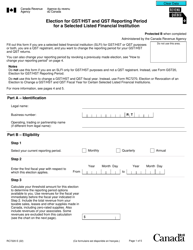

Form RC4612 Gst / Hst Application to Not Be Considered a Selected Listed Financial Institution - Canada

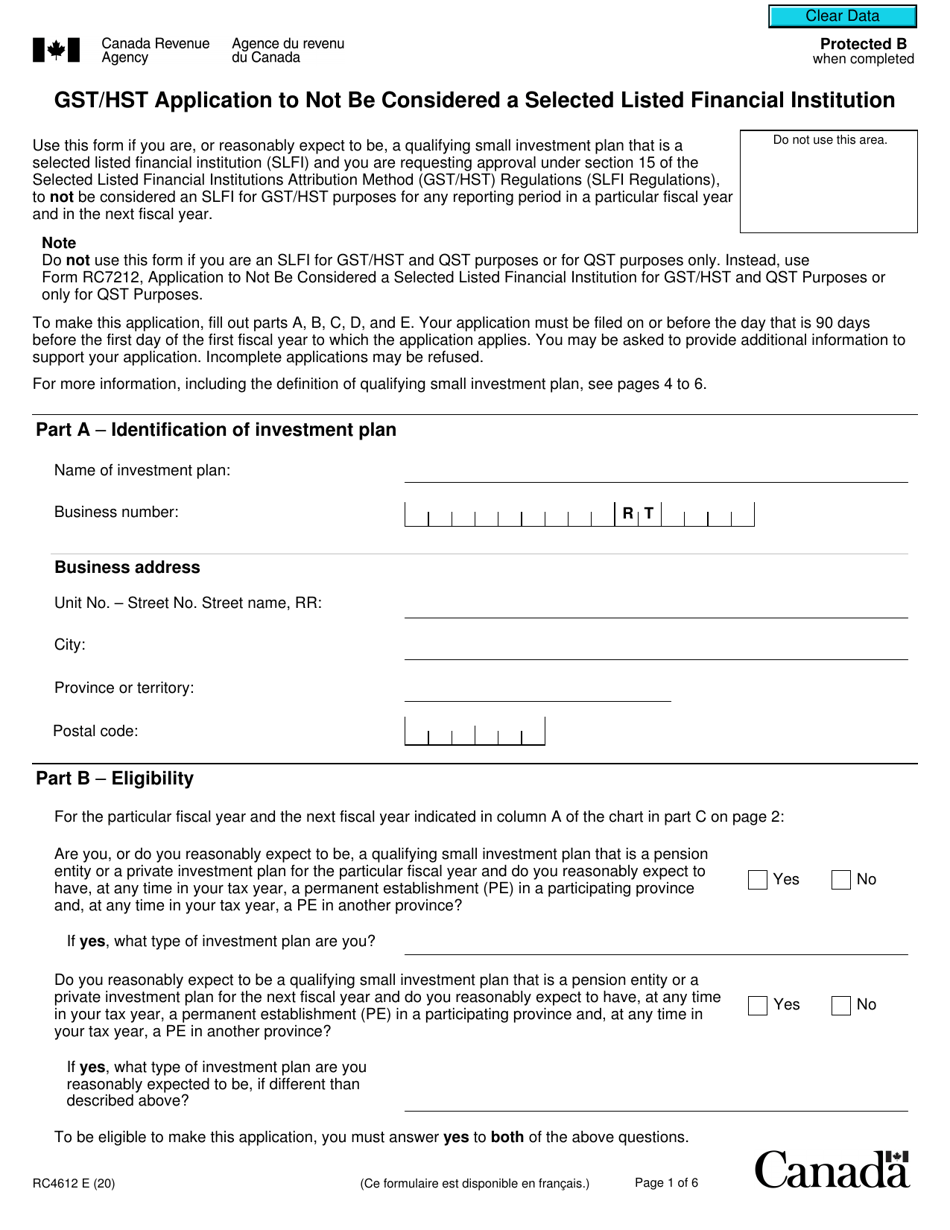

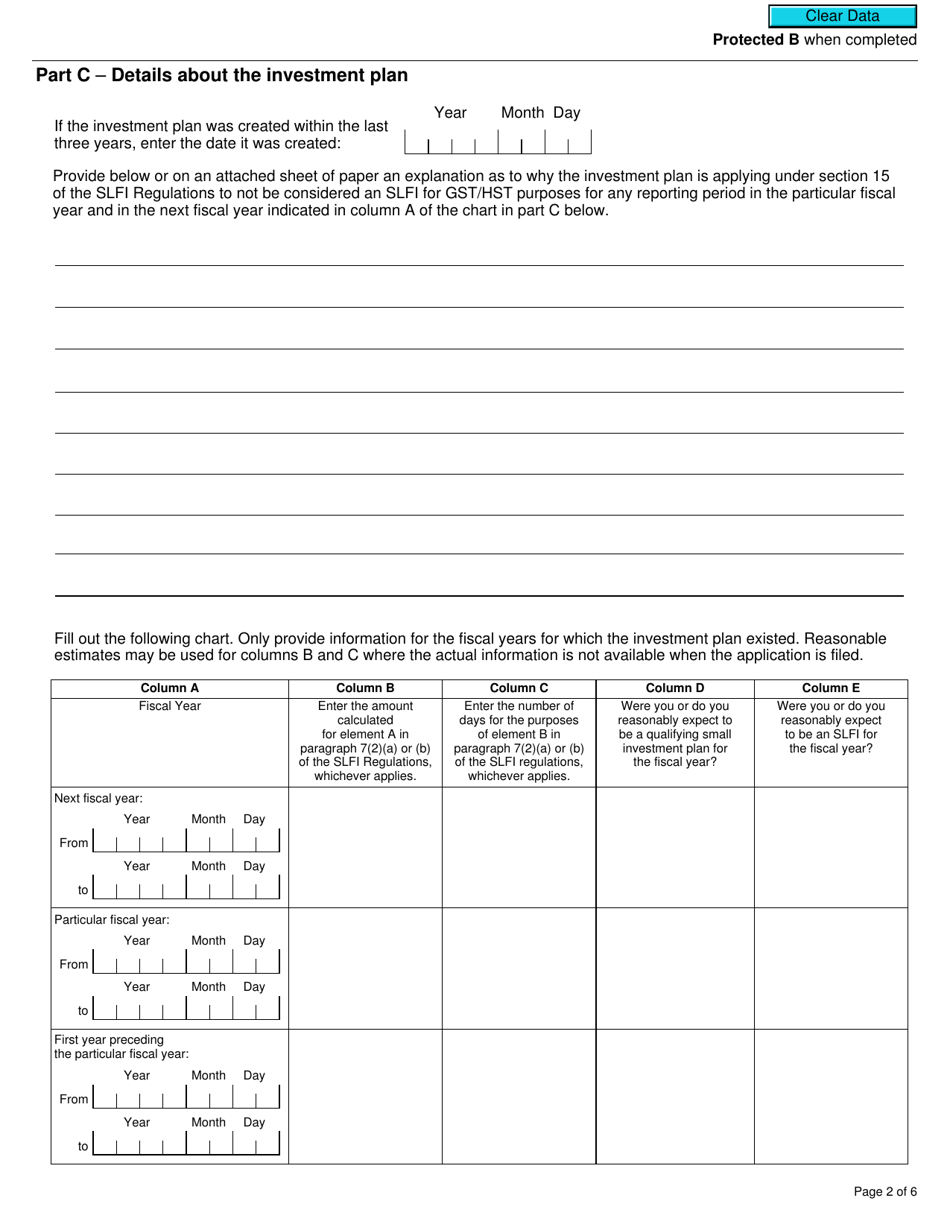

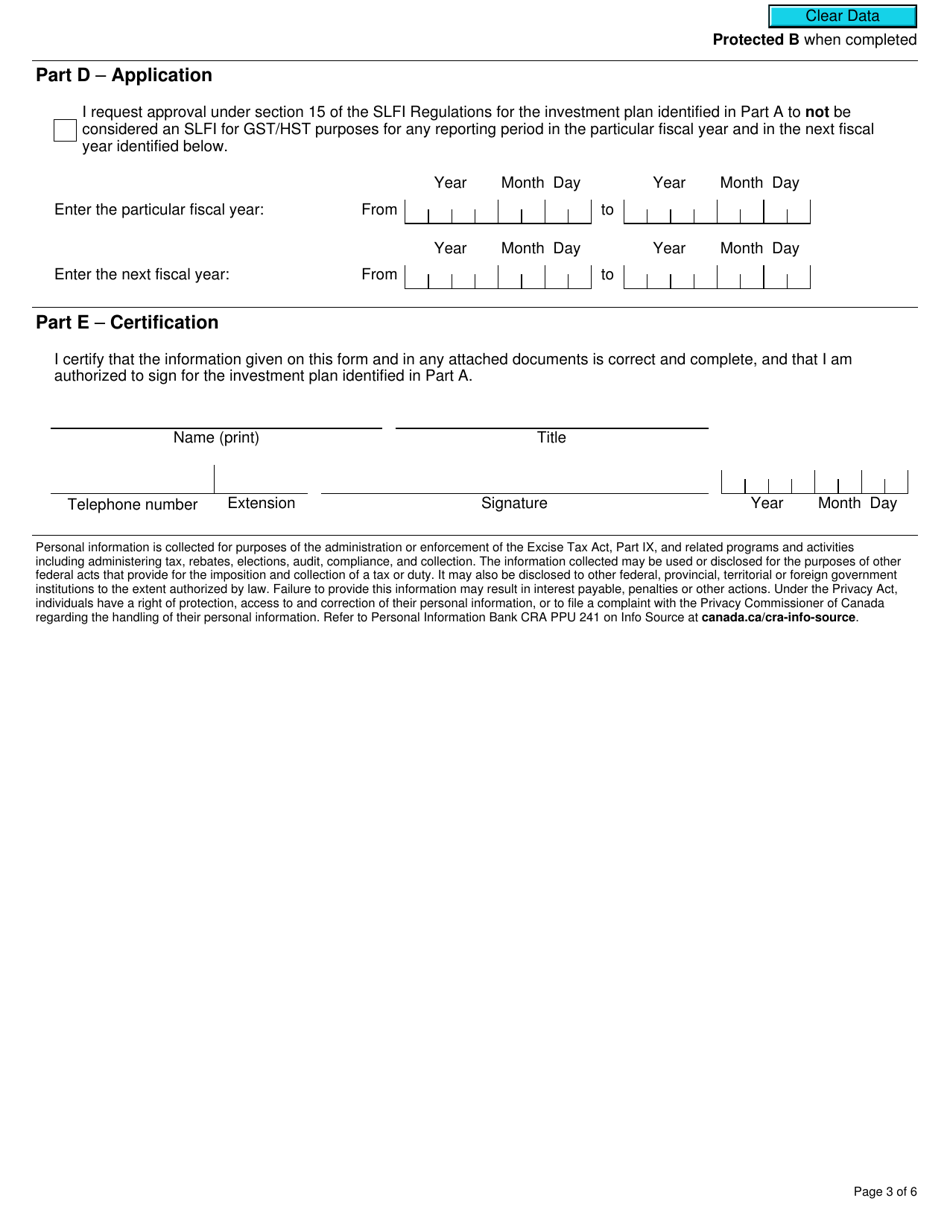

Form RC4612 - GST/HST Application to Not Be Considered a Selected Listed Financial Institution is used in Canada for applying for an exemption from being considered a Selected Listed Financial Institution for Goods and Services Tax/Harmonized Sales Tax (GST/HST) purposes.

The Gst/Hst Application to Not Be Considered a Selected Listed Financial Institution (Form RC4612) is filed by financial institutions in Canada to apply for an exemption from certain Goods and Services Tax/Harmonized Sales Tax (GST/HST) requirements.

Form RC4612 Gst/Hst Application to Not Be Considered a Selected Listed Financial Institution - Canada - Frequently Asked Questions (FAQ)

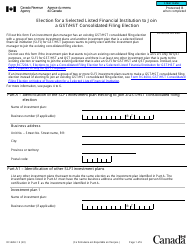

Q: What is RC4612?

A: RC4612 is a GST/HST application form for not being considered a selected listed financial institution in Canada.

Q: What does GST/HST stand for?

A: GST stands for Goods and Services Tax, and HST stands for Harmonized Sales Tax.

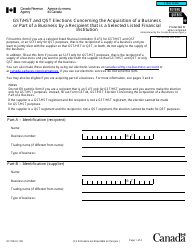

Q: What is a selected listed financial institution?

A: A selected listed financial institution is an institution that is required to comply with certain GST/HST rules.

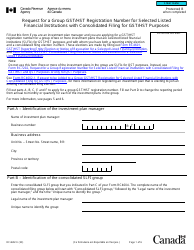

Q: Why would someone want to use form RC4612?

A: Someone may want to use form RC4612 to apply for an exemption from being considered a selected listed financial institution.

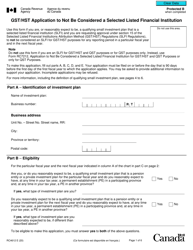

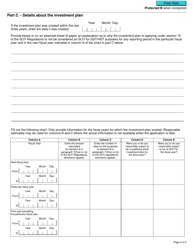

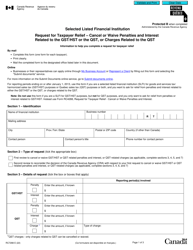

Q: Are there any eligibility criteria for using form RC4612?

A: Yes, there are eligibility criteria that need to be met in order to use form RC4612. It is recommended to refer to the instructions provided with the form for more details.

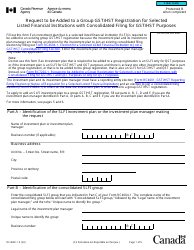

Q: Is there a deadline for submitting form RC4612?

A: The deadline for submitting form RC4612 may vary depending on individual circumstances. It is advisable to check the instructions provided with the form or contact the Canada Revenue Agency for specific deadlines.