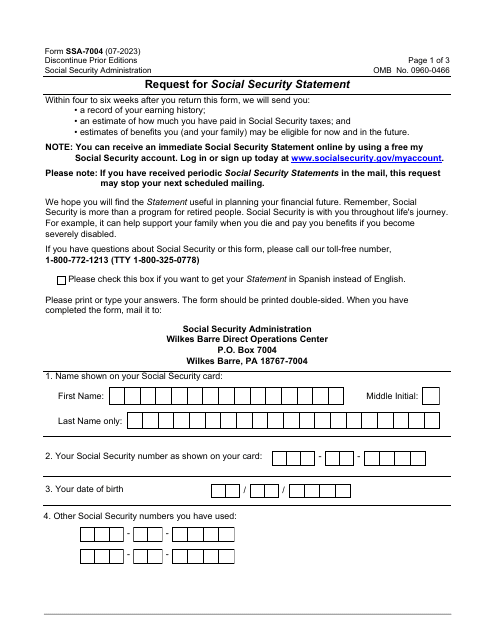

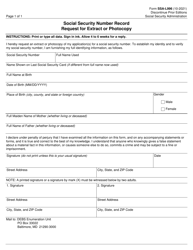

Form SSA-7004 Request for Social Security Statement

What Is Form SSA-7004?

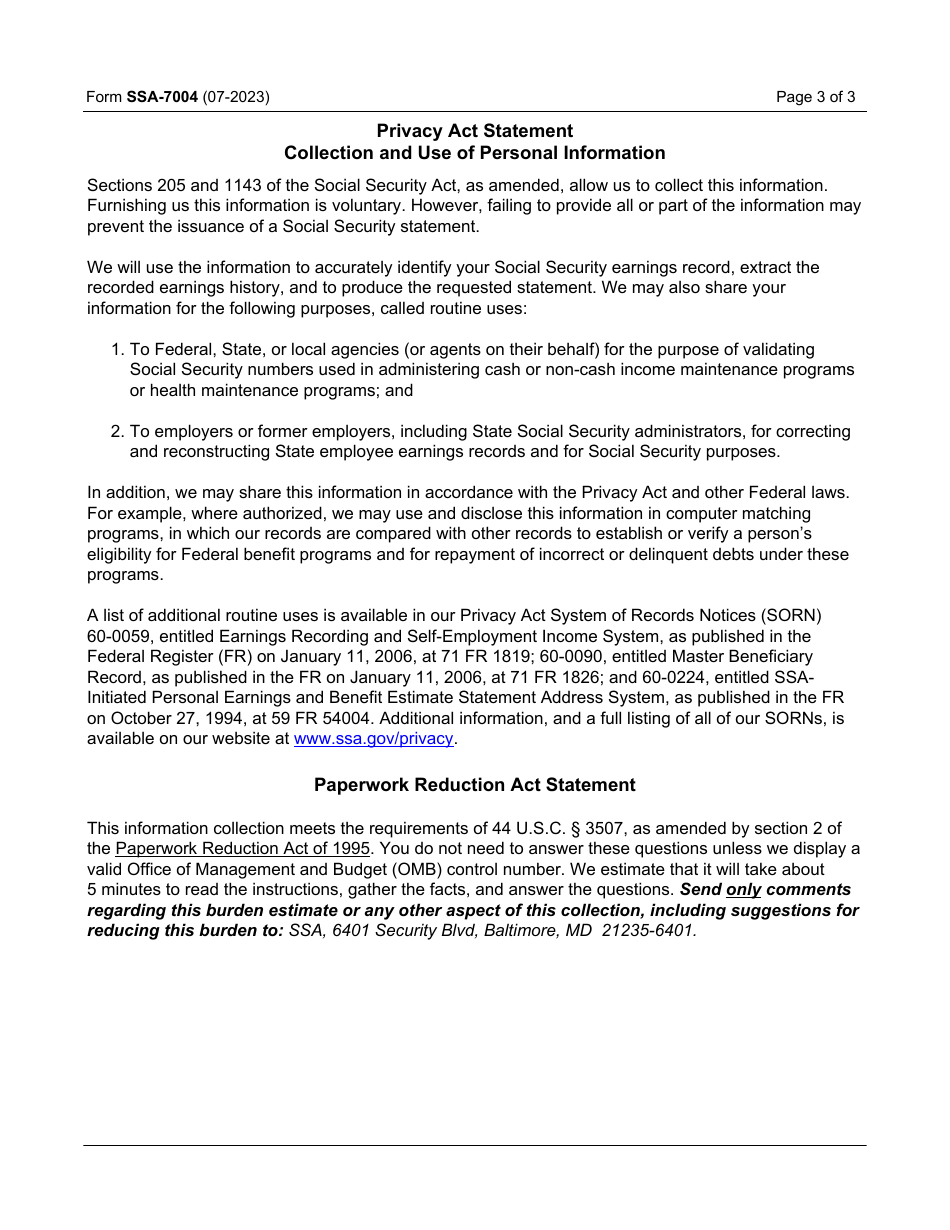

Form SSA-7004, Request for Social Security Statement , is a form used to request information about the individual's earning history, estimates of their and their family members' eligibility for the Social Security benefits. It is also used for the estimation of taxes paid in Social Security. The most recent version of the Social Security Form SSA-7004 was issued by the U.S. Social Security Administration (SSA) on July 1, 2023 . An SSA-7004 printable form is available below for download.

Alternate Names:

- SSA Form 7004;

- Social Security Statement Request Form.

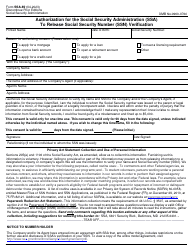

The SSA mails the Social Security Statement annually to workers aged 60 and to those who do not receive Social Security benefits three years prior to their birthday. If an individual files Form SSA-7004, the mailing schedule will change. The Social Security statements will be sent annually after the date the request was processed.

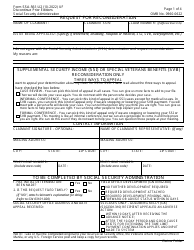

File Form SSA-7004-SM, Request for Earnings and Benefit Estimate Statement, in order to have the SSA send you a record of your earnings and an estimate of your Social Security taxes, as well as estimates of benefits you and your family members may be eligible for. Use Form SSA-7004-SM-OP1, Request for Social Security Statement , in order to request a statement from the SSA electronic system.

How to Fill Out SSA-7004 Form?

A Social Security Statement Request Form can be obtained from a local Social Security office, requested by phone or online via My Social Security account. Any person aged 25 and older who has a Social Security Number (SSN) can file the request.

The statement contains information about the benefits, the individual's eligibility for these benefits, and a description of the eligibility criteria. These benefits include retirement payments, disability benefits, and family survivors' payments. Also, the Statement contains eligibility for Medicare at the age of 65. The information provided in the request is used by the SSA to calculate eligibility and credits the individual has earned. The Social Security statement will be mailed within six weeks after the request was filed.

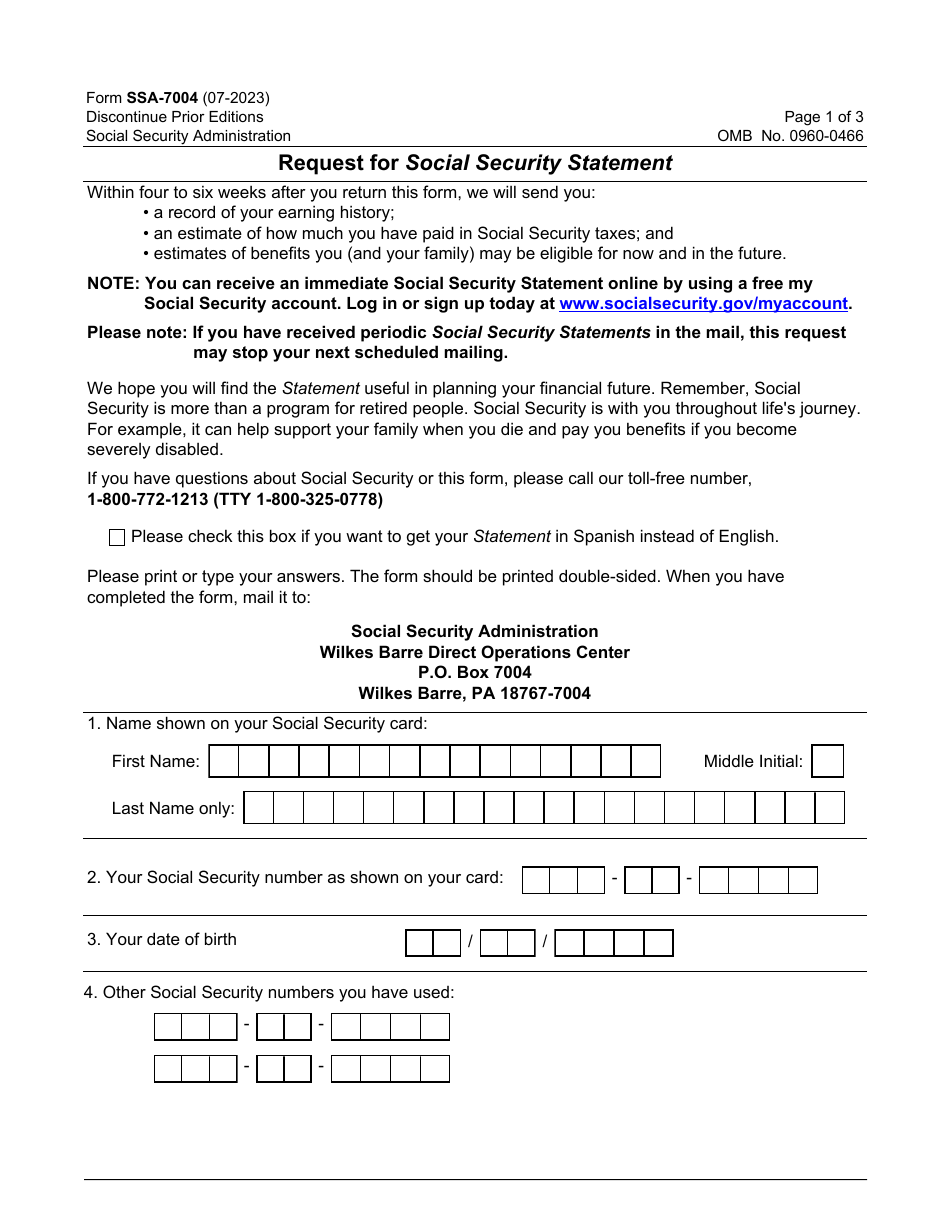

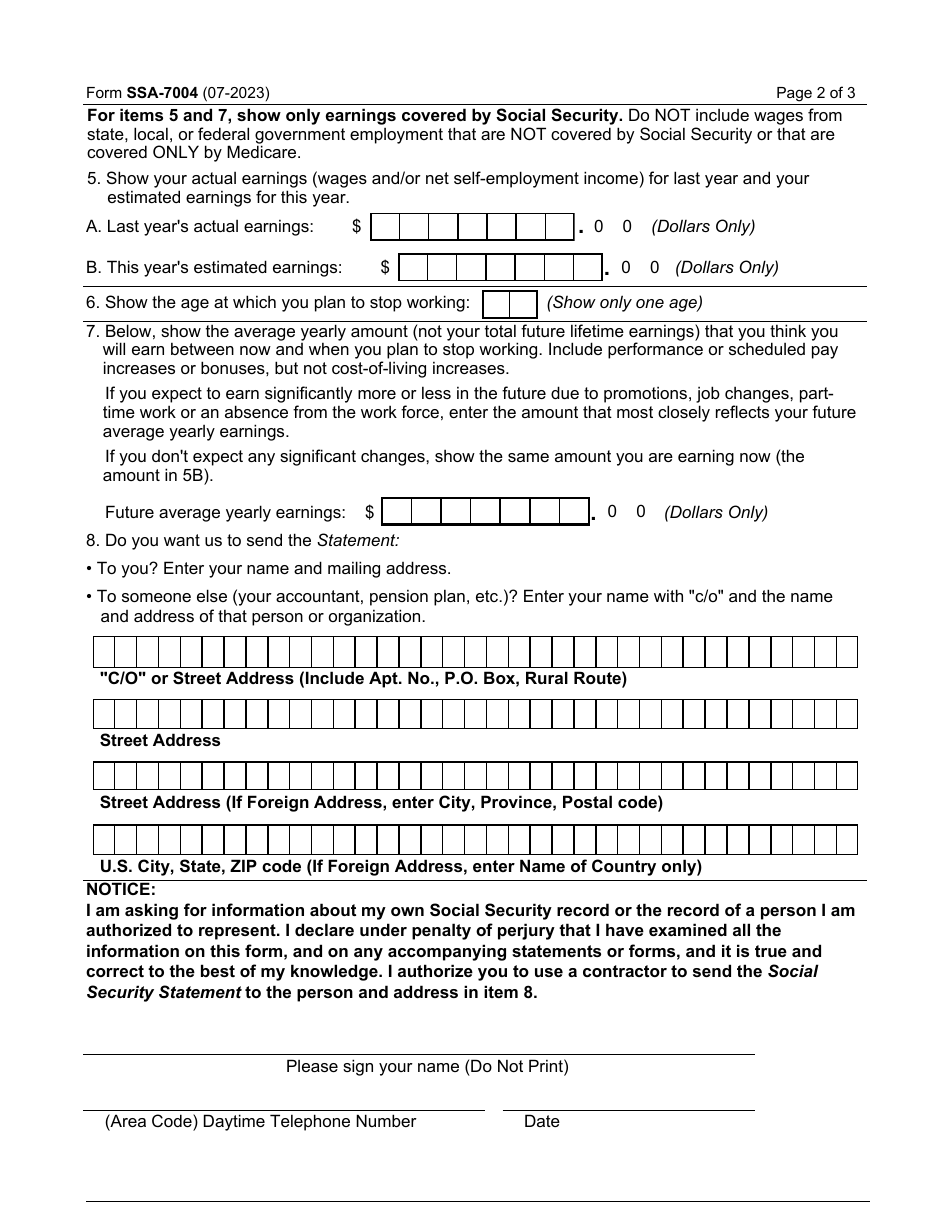

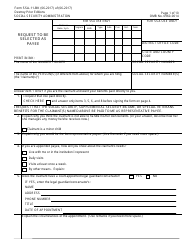

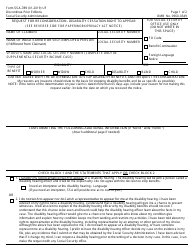

Please refer to the instructions below when filling out Form SSA-7004:

- Blocks 1 through 5 are self-explanatory. For Items 6 and 8, show only the earnings that are covered by Social Security.

- Provide the number of your actual earnings the previous year in Block 6A. Enter the estimated amount of earnings this year in Block 6B.

- Enter the age you plan to stop working in Block 7.

- Enter the average yearly income between the current year and the year you are planning to retire in Block 8. If you do not expect any changes, enter the number you entered in Block 6B.

- Indicate whether you want your Social Security Statement mailed to you or to another person or organization in Block 9. If you want the statement to be mailed to you, enter your mailing address. If you want the statement to be mailed to another person or organization, enter your name (with c/o) and the mailing address of the person or organization.

- Sign the form with your name, provide your daytime phone number and date the form. Mail the completed form to the Social Security Administration Wilkes Barre Data Operations Center P.O. Box 7004 Wilkes Barre, Pennsylvania 18767-7004.