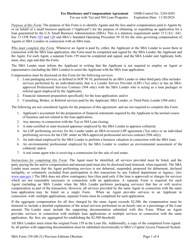

SBA Form 159D Fee Disclosure Form and Compensation Agreement for Agent Services in Connection With an SBA Disaster Assistance Loan

What Is SBA Form 159D?

SBA Form 159D, Fee Disclosure Form and Compensation Agreement is a form used by business owners to indicate that they hired an agent for assistance with their Small Business Administration (SBA) disaster loan application

The latest version of the form was released by the SBA on August 1, 2021 , with all previous editions obsolete. An updated SBA Form 159D fillable version is available for download and digital filing below. The previously used SBA Form 159 (7a) is no longer hosted on the SBA website.

Disaster loans are provided to businesses of all sizes as well as to private non-profit organizations, renters, and homeowners. This type of loan is used for replacing or repairing real estate, personal property, machinery, and equipment, along with any inventory and business assets that were damaged or destroyed in a declared disaster. To qualify for the disaster loan, the applicant has to be in an affected area as stated by a disaster declaration.

SBA Form 159, Fee Disclosure and Compensation Agreement

The SBA Form 159 is a form closely related to the SBA 159D. The purpose of both forms are similar, however, the SBA Form 159 is used in connection with the 7(a) and 504 loan programs. Depending on the program, the form requires the signatures of the SBA Lender or the Certified Development Company representative for certification.

SBA Form 159D Instructions

There are several types of disaster loans. Victims of a disaster can apply for home and personal property loans. Business owners can apply for Business Physical Disaster Loans. If the business has suffered an economic injury regardless of the physical damage, the owner may qualify for an Economic Injury Disaster Loan (EIDL). If a small business is unable to meet its operating expenses because an essential employee is a military reservist called to active duty, the business owner can apply for a Military Reservists Economic Injury Loan for assistance with the operating expenses.

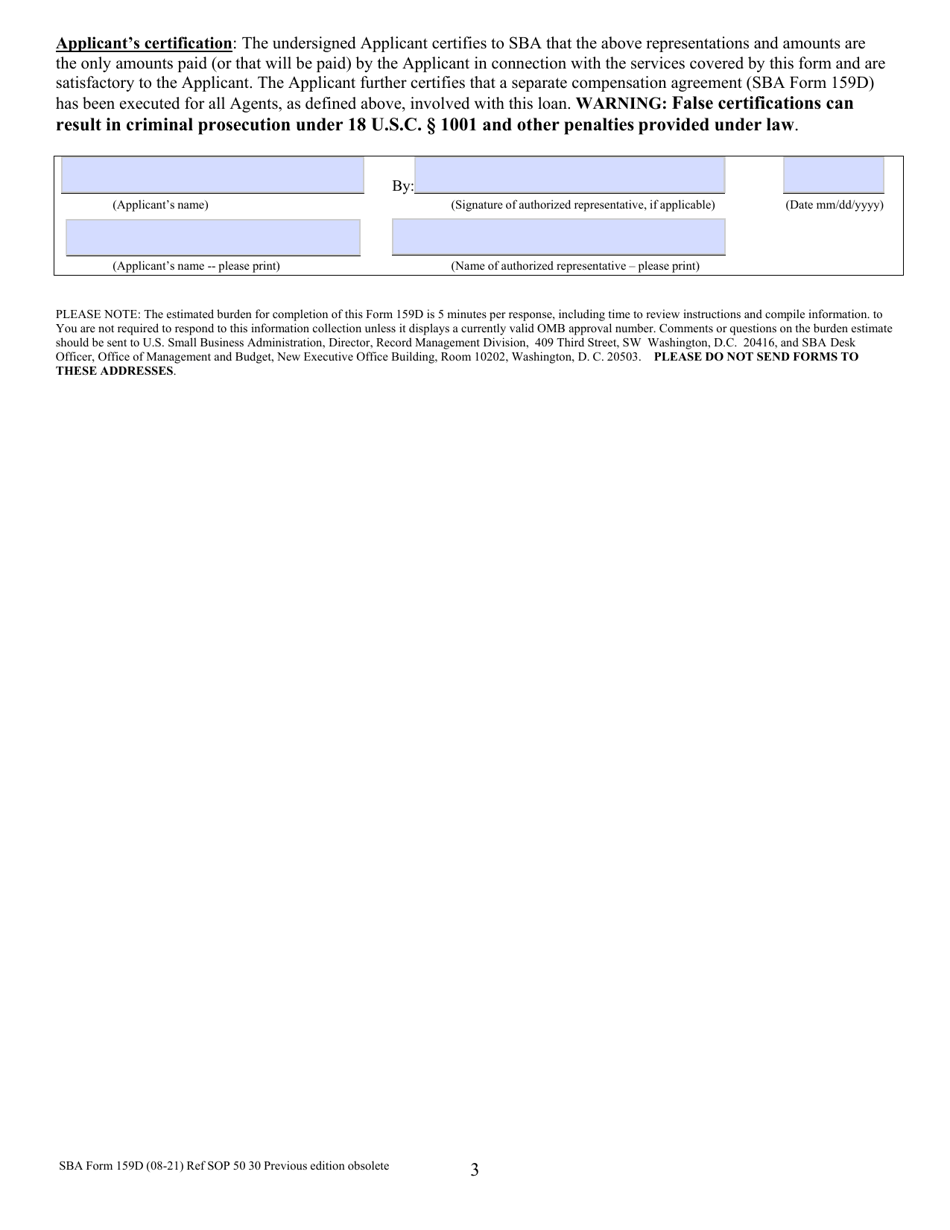

This SBA 159D should be filed if the applicant has hired any professional for assistance with an SBA disaster loan application. However, if the business owner uses the services of an accountant or any other professional in the normal course of business and not related to the loan, the form is not required. Filling guidelines and additional information can be found below.

How to Fill Out SBA Form 159D?

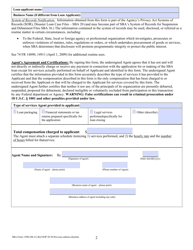

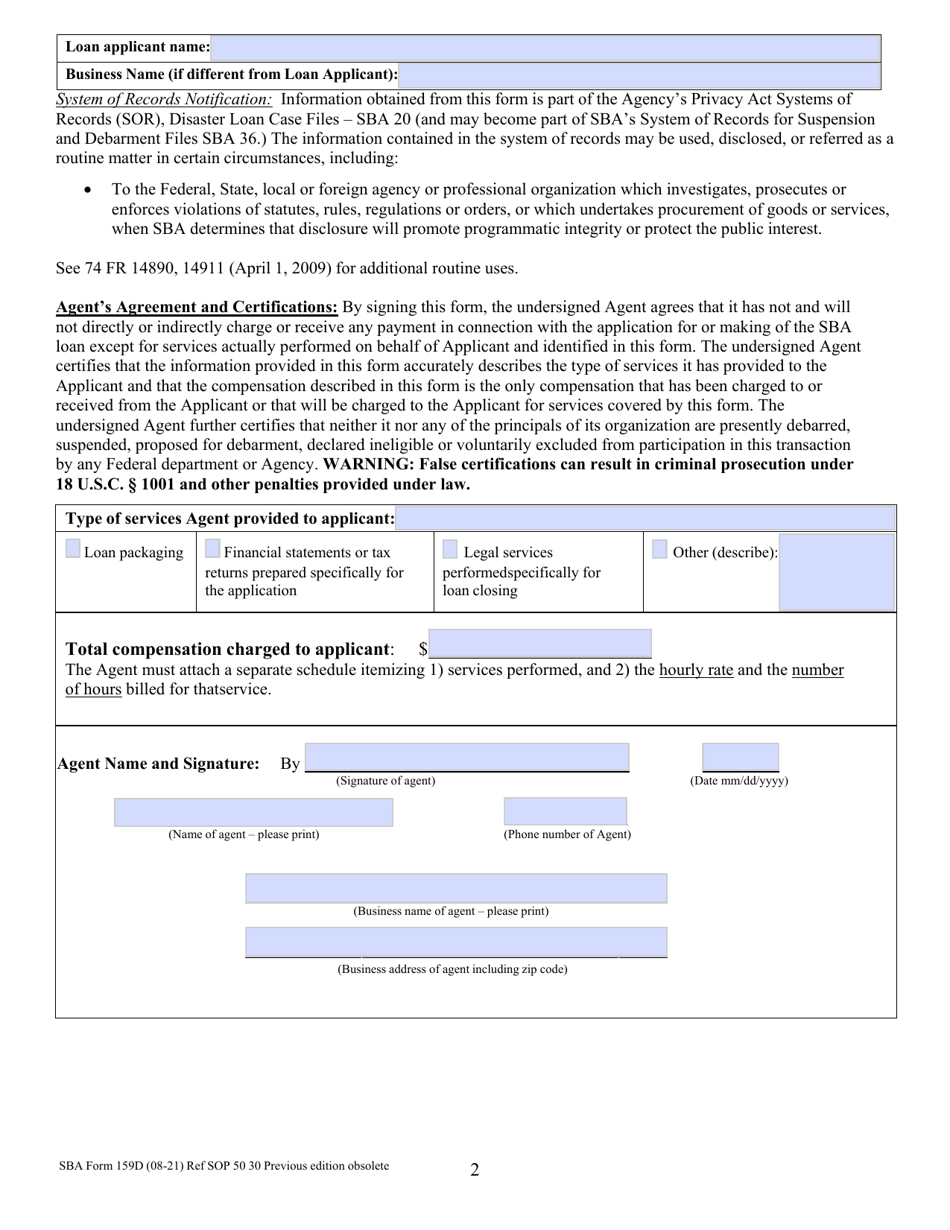

- The first two lines of the form require the applicant's own name and the name of their business. The applicant's name should be written as it appears on the loan application. If they applied with their business name, the business name line should be left blank.

- Next, the form requires the type of service the agent provided to the applicant. If the provided service is not on the list, the applicant has to check "Other" and name the service.

- The line below the service type chart requires the total amount the applicant paid for the agent's services. If this sum exceeds 500$ or 2500$ depending on the type of loan, the agent must provide the following information: the type of service, their hourly rate and the number of billed hours. This should be provided on a separate sheet and attached to the form.

- The next block of the form requires the agent's certification. The agent has to provide their personal name, business name and business address along with their phone number before signing and dating the form.