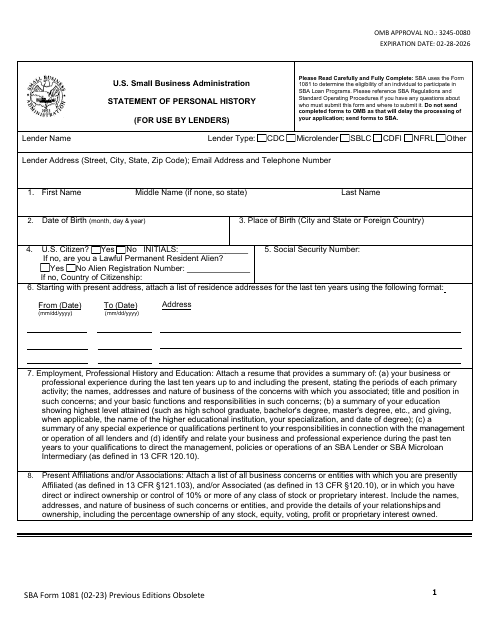

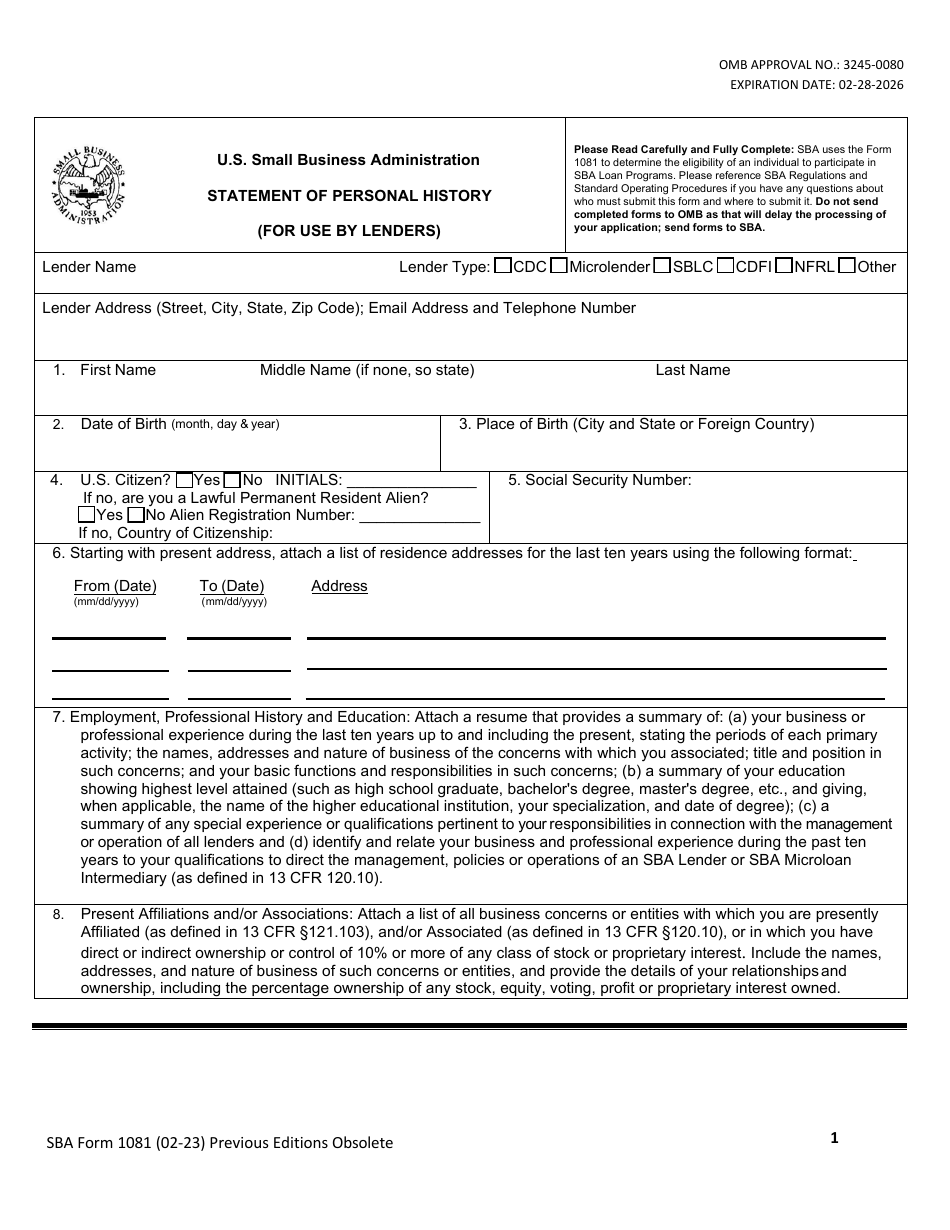

SBA Form 1081 Statement of Personal History (For Use by Lenders)

What Is SBA Form 1081?

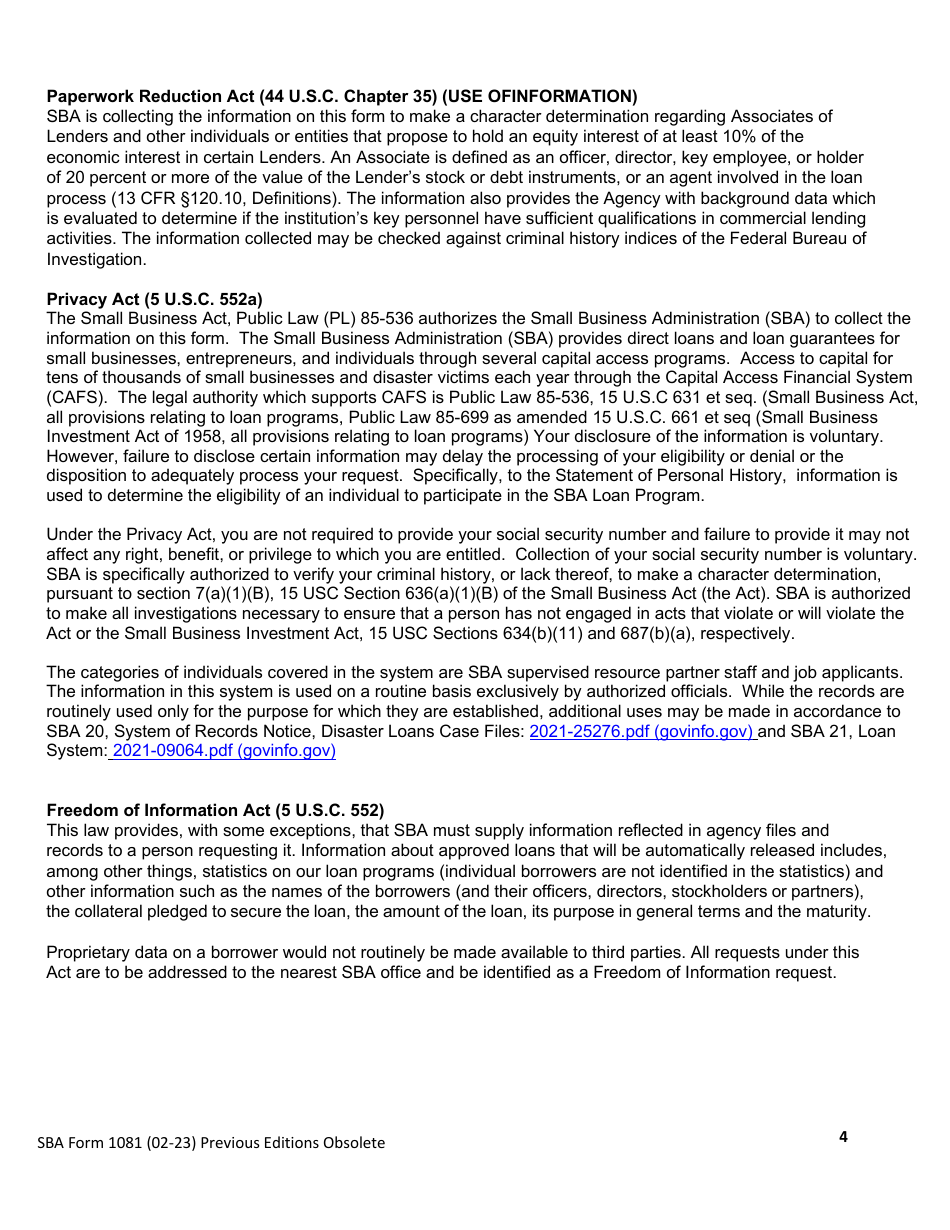

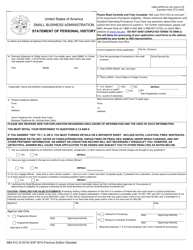

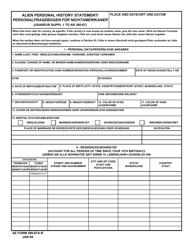

SBA Form 1081, Statement of Personal History for Non-bank Lenders, CDCs and Micro-Lenders is a form used by the Small Business Administration (SBA) as a part of its assessment to determine the eligibility of an individual to participate in the SBA loan programs. The latest version of the form was released by the SBA on February 1, 2023 , with all previous editions obsolete. An up-to-date SBA Form 1081 fillable version is available for download below or can be found through the SBA website.

One of the eligibility requirements to qualify for an SBA loan is that an individual and individual's business partners meet the SBA's definition of «good character». This is based on the SBA's assessment of behavior, integrity, candor, and all past criminal records. Along with the SBA 1081, the SBA Form 912, Statement of Personal History covers the criminal history portion of this assessment. Both forms must be filled out by all loan guarantors, business owners, directors, and officers.

SBA Statement of Personal History

The SBA 1081 Form must be submitted with the following information about the lender:

- The lender's name, address, and email address;

- Their full name, date of birth, place of birth, citizenship, social security number;

- Their list of residential addresses for the last ten years;

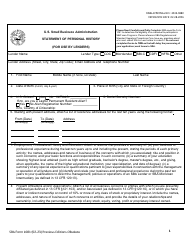

- The next section - Employment, Professional History and Education - requires a resume that provides a summary of business or professional experience, information about the business that is associated with the applicant; the title and position, basic functions and responsibilities; education showing highest level attained; any special experience or qualifications pertinent to responsibilities in connection with the management or operation of the lender; and business and professional experience to direct the management, policies or operations of an SBA Lender or SBA Microloan Intermediary;

- Present Affiliations and/or Associations requires a list of all business concerns or entities associated with the applicant must be attached.

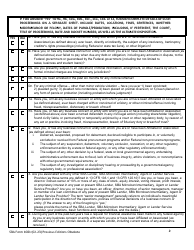

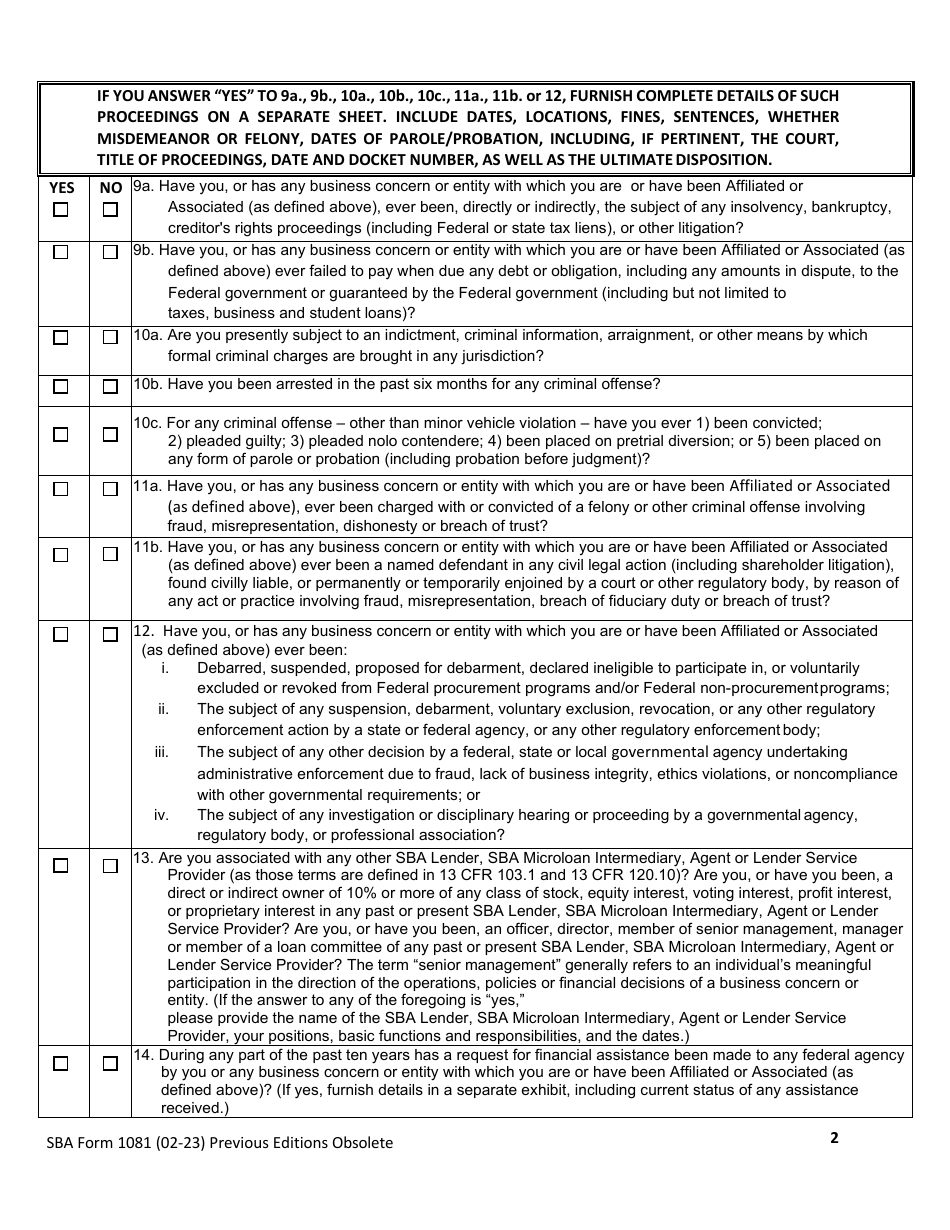

An applicant must notify the SBA of any of the following occurs:

- Insolvency, bankruptcy, creditor's rights proceedings or other litigation;

- Failure to pay when due any debt or obligation to the federal government;

- Felony or other criminal offense involving fraud, misrepresentation, dishonesty or breach of trust;

- Arrest in the past six months for any criminal offense;

- Indictment, arraignment, criminal information, or other means by which formal criminal charges are brought in any jurisdiction;

- Conviction, guilty plea, nolo contendere plea, pretrial diversion, any form of parole or probation;

- Any civil legal action, civil liability by reason of any act or practice involving fraud, misrepresentation, breach of fiduciary duty or breach of trust.

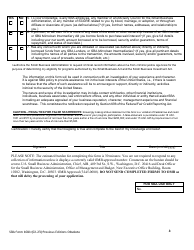

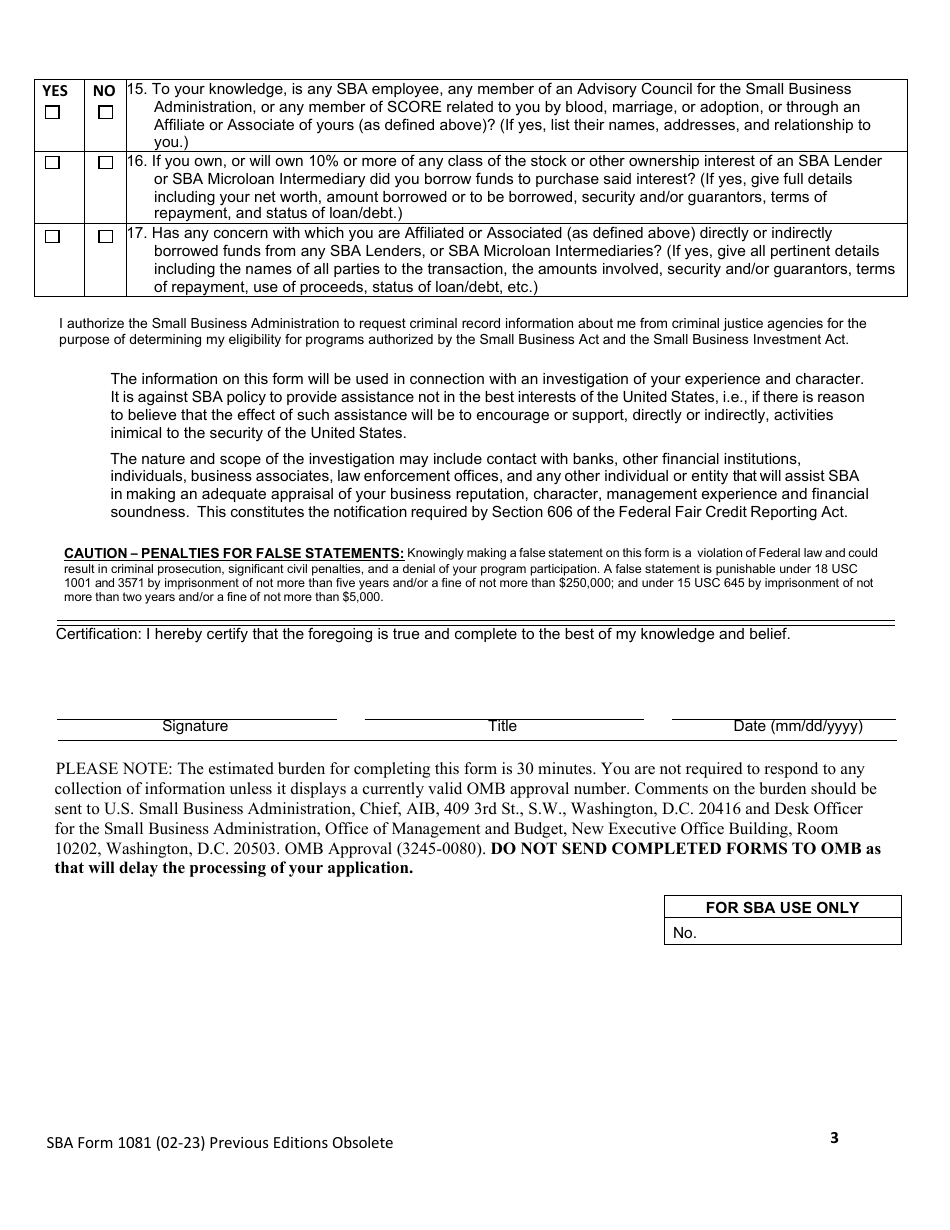

An applicant must also acknowledge any association with or relation to any other SBA lender or lender service providers. The information on the form is used in connection with an investigation of the lender's character and experience, which may include contact with banks and other financial institutions, business associates, individuals, and law enforcement offices to make an adequate evaluation of the character and business reputation.