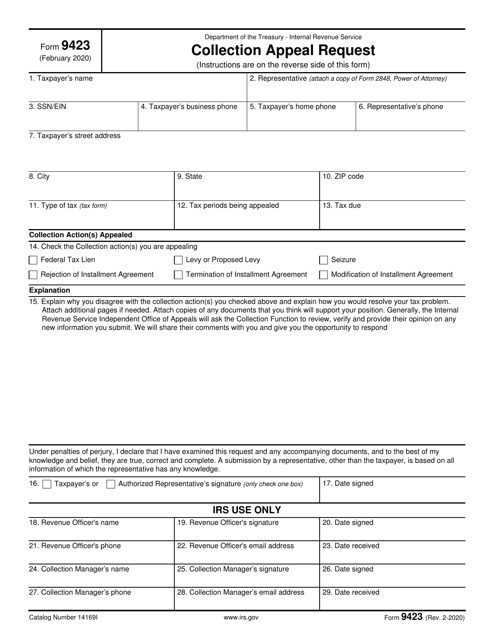

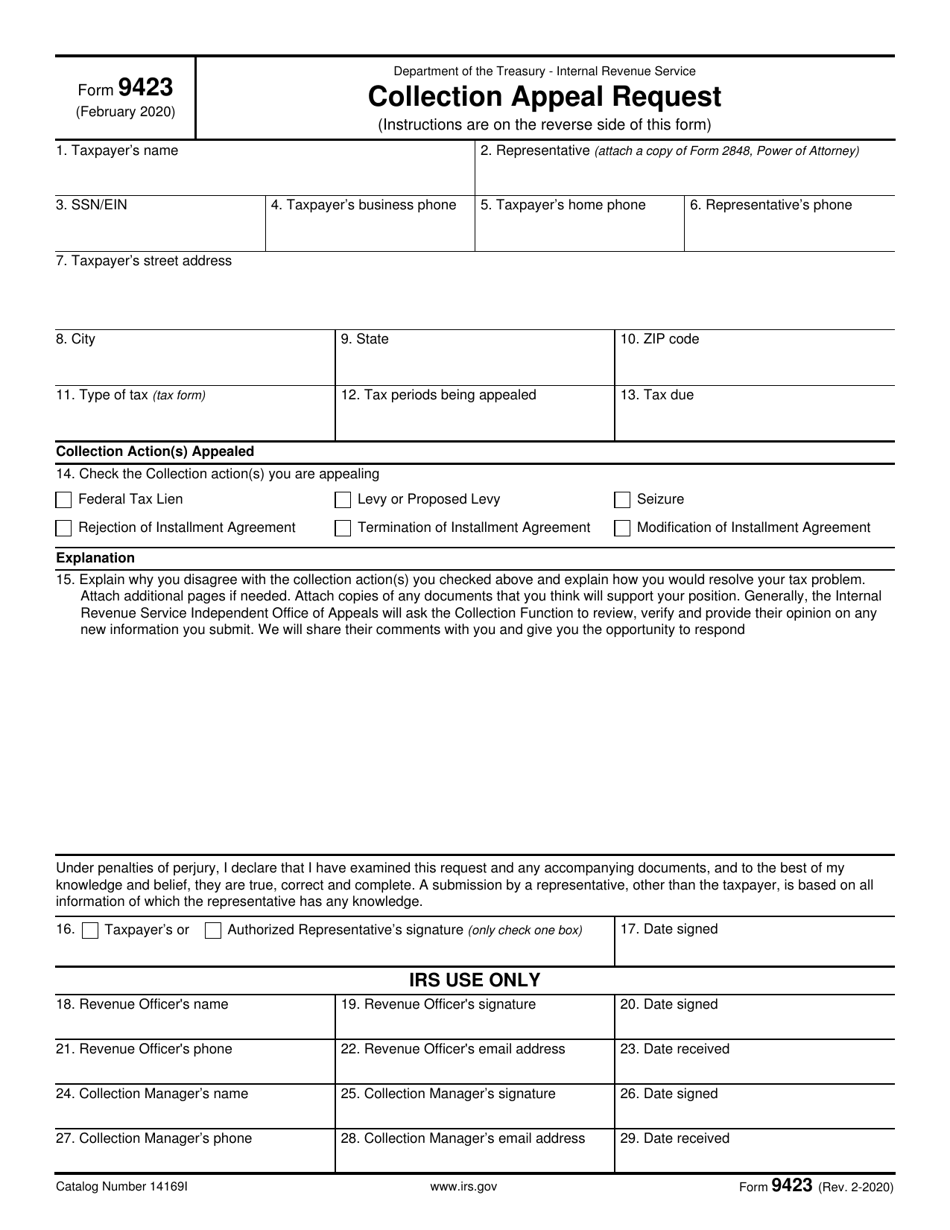

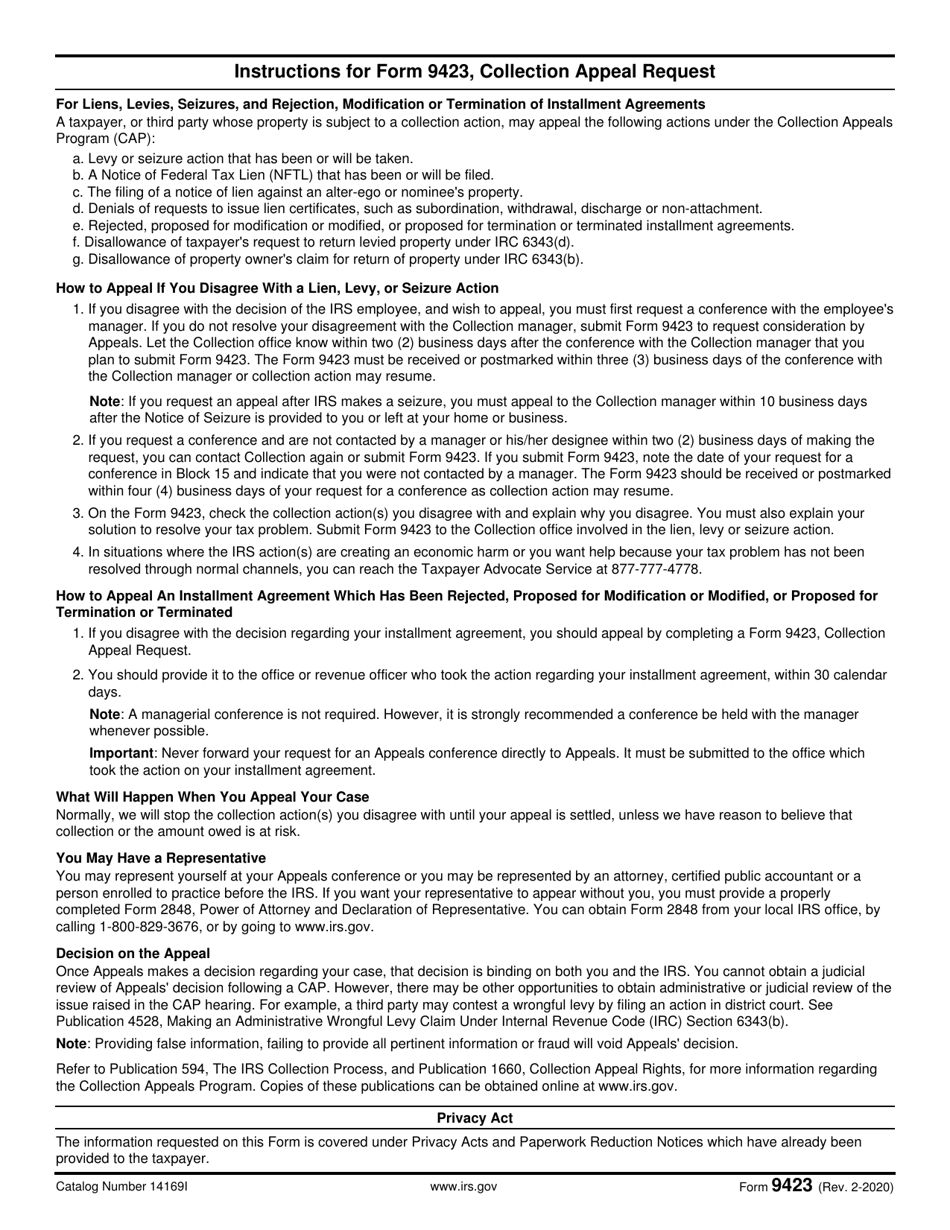

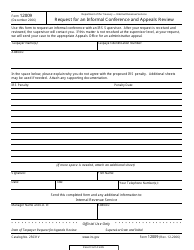

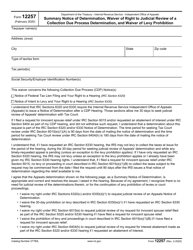

IRS Form 9423 Collection Appeal Request

What Is IRS Form 9423?

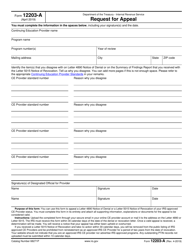

IRS Form 9423, Collection Appeal Request , is a written document prepared by a taxpayer with a tax debt if they want to prevent or stop certain fiscal enforcement actions against them due to their failure to pay tax on time.

Alternate Name:

- IRS Appeal Form 9423.

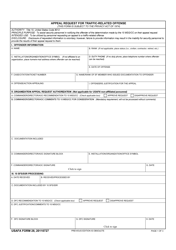

Set up a conference with the manager of the employee that made a decision regarding your taxes and try to address the issue. If this option does not work for you, you are free to file a request for a review of your case.

This request was issued by the Internal Revenue Service (IRS) on February 1, 2020 - previous editions of the form are now obsolete. An IRS Form 9423 fillable version can be found via the link below.

Where to Mail IRS Form 9423?

Whenever you are making an appeal to fiscal organs with the help of IRS Form 9423, you have to communicate with the IRS employee who made the decision in question as well as their manager. You have an opportunity to appeal the decision made by tax organs and ask for a different way to settle your debt - if your payment plan was rejected or authorities seized your assets yet you believe there is another way to deal with the situation, make sure you act quickly. Send the paperwork to the tax office that began the collection action whether they changed or canceled your installment agreement, informed you about a potential lien against your property, or initiated a seizure.

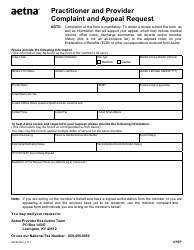

In order to file an appeal, you will have to identify yourself by your full name and social security number. Indicate two telephone numbers fiscal authorities can use to reach out to you as well as your street address with the zip code. Specify the number of the tax form that outlines the tax you owe, list the tax periods you are preparing an appeal for, and enter the amount of tax you are required to pay at the moment. Put a tick in the box to confirm the action you disagree with - it may be a levy, lien, seizure, or objection that relates to the installment agreement you have negotiated.

The request has to contain an elaborate explanation of the appeal - clarify why you disagree with the decision made in regard to your tax issue and propose a resolution to the matter at hand. You are allowed to enclose supplementary documentation that further proves your point. Certify the request by adding your signature and the actual date of signing. Alternatively, the papers can be signed by an authorized representative of the taxpayer. In this case, they are obliged to write down their full name and telephone number on top of the request and attach a copy of IRS Form 2848, Power of Attorney Power of Attorney and Declaration of Representative, to confirm their authority to act on your behalf.