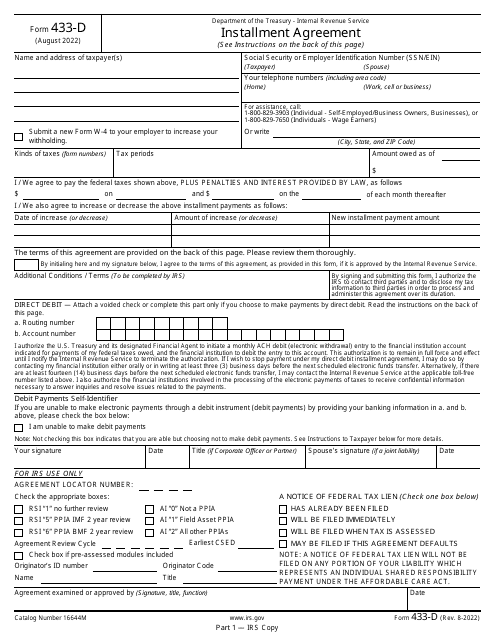

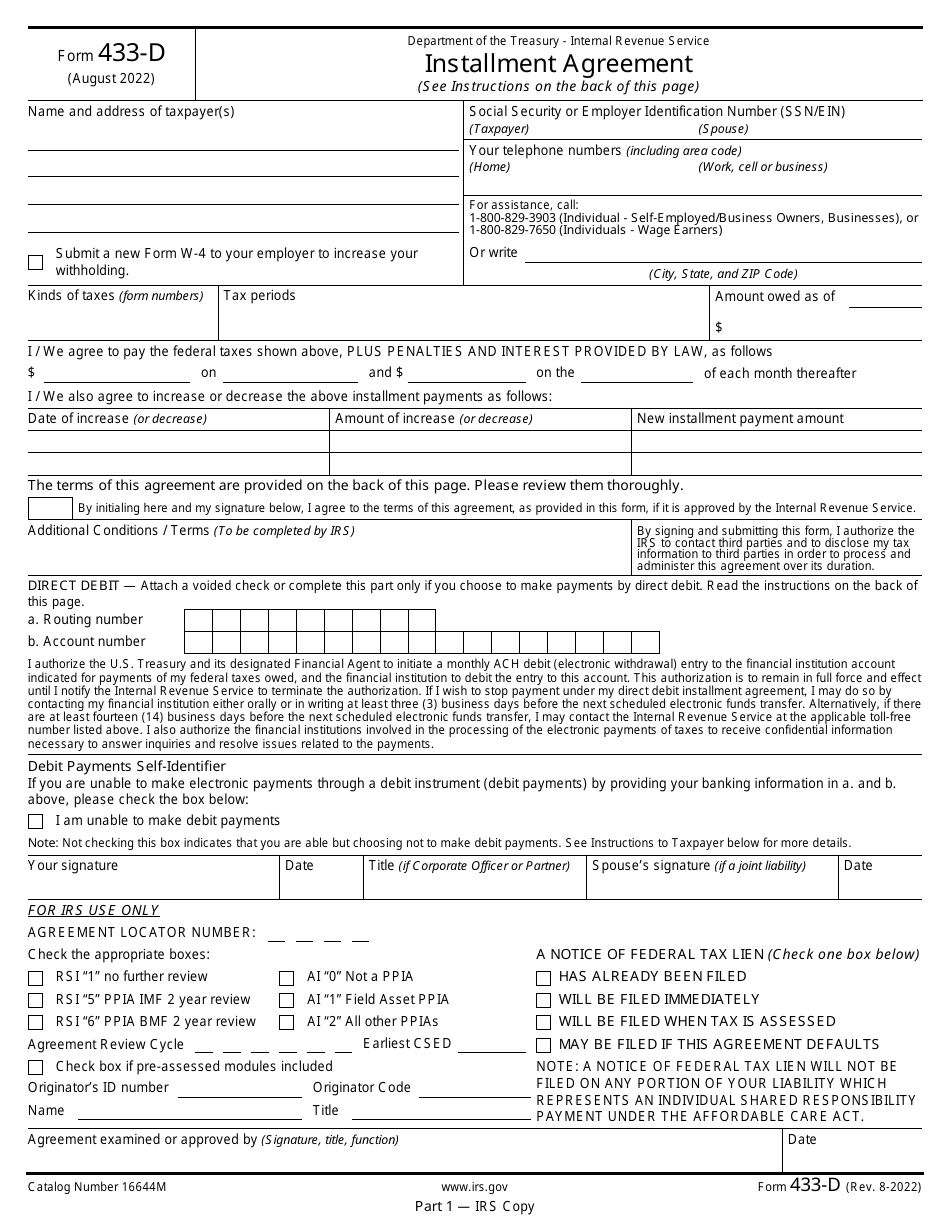

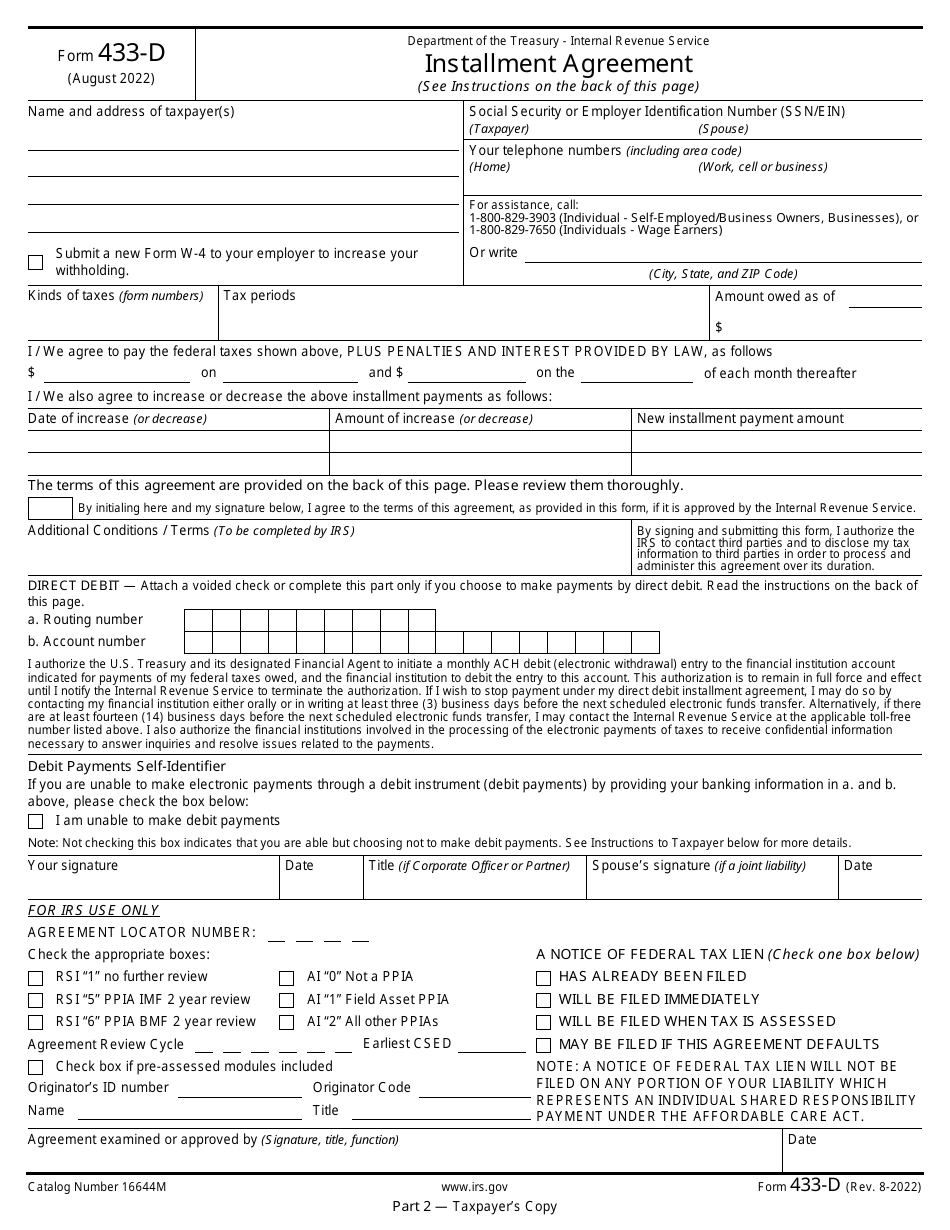

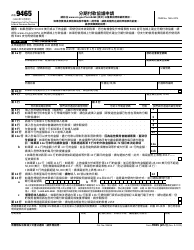

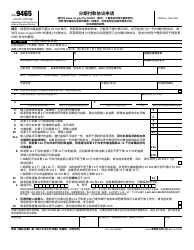

IRS Form 433-D Installment Agreement

What Is IRS Form 433-D?

IRS Form 433-D, Installment Agreement , is a fiscal instrument used by a taxpayer to express their intention to pay off their tax debt via a direct debit payment.

Alternate Names:

- IRS Installment Agreement;

- Tax Form 433-D.

If you have an outstanding tax liability and you filed a request with tax authorities in order to establish a monthly installment plan so that you are able to deal with your tax responsibilitiesstep by step, you will get a copy of this agreement in the mail - sign the papers and file them with the tax organs to inform them about your willingness to adhere to the terms and conditions of the arrangement you have made.

This document was issued by the Internal Revenue Service (IRS) on August 1, 2022 - older editions of this form are now outdated. An IRS Form 433-D fillable version is available for download below.

A Spanish version of IRS Form 433-D is available for spanish-speaking filers.

What Is Form 433-D Used For?

Tax Form 433-D is prepared by the taxpayer upon receiving it from the IRS - tell the sender you agree to the provisions of the financial arrangement they have offered. This tool will specify how much you owe and how much you are required to pay on a regular basis as well as identify you and your spouse as people responsible for scheduled payments. The funds will be deducted from the bank account you list in the form until the debt is paid off in full, including possible penalties and interest the taxpayer must handle.

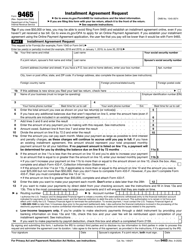

Note that you cannot file this document on your own initiative - you have to wait until fiscal authorities approve your application for this agreement. To get the IRS to agree to installment payments, you must submit IRS Form 9465, Installment Agreement Request, and wait until the papers are reviewed and you obtain a formal letter and a blank agreement to complete.

How to Fill Out Form 433-D?

Follow these Form 433-D instructions to let the IRS know you agree to the terms and conditions of the proposed payment plan:

-

Write down the full name, correspondence address, and telephone numbers of the taxpayer . The form has to contain the social security number of the taxpayer and their spouse in case the person in question is married. In case you are filing a new copy of the IRS Form W-4, Employee's Withholding Certificate, with your employer, check the appropriate box.

-

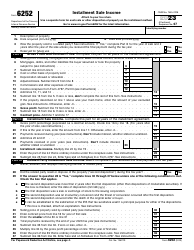

List the types of taxes you owe (indicate the form numbers), record the tax periods covered by those documents, and specify the amount of tax you currently owe . Confirm your agreement to pay the taxes in addition to interest and penalties established by tax laws. The document is supposed to elaborate on the payment schedule - list the amount of money you will pay and state the date of every month when you will be obliged to make your payments.

-

If you agreed with the proposal to decrease or increase installment payments, this information has to be outlined in writing as well . List the dates the increase or decrease took place and write down the adjusted amount.

-

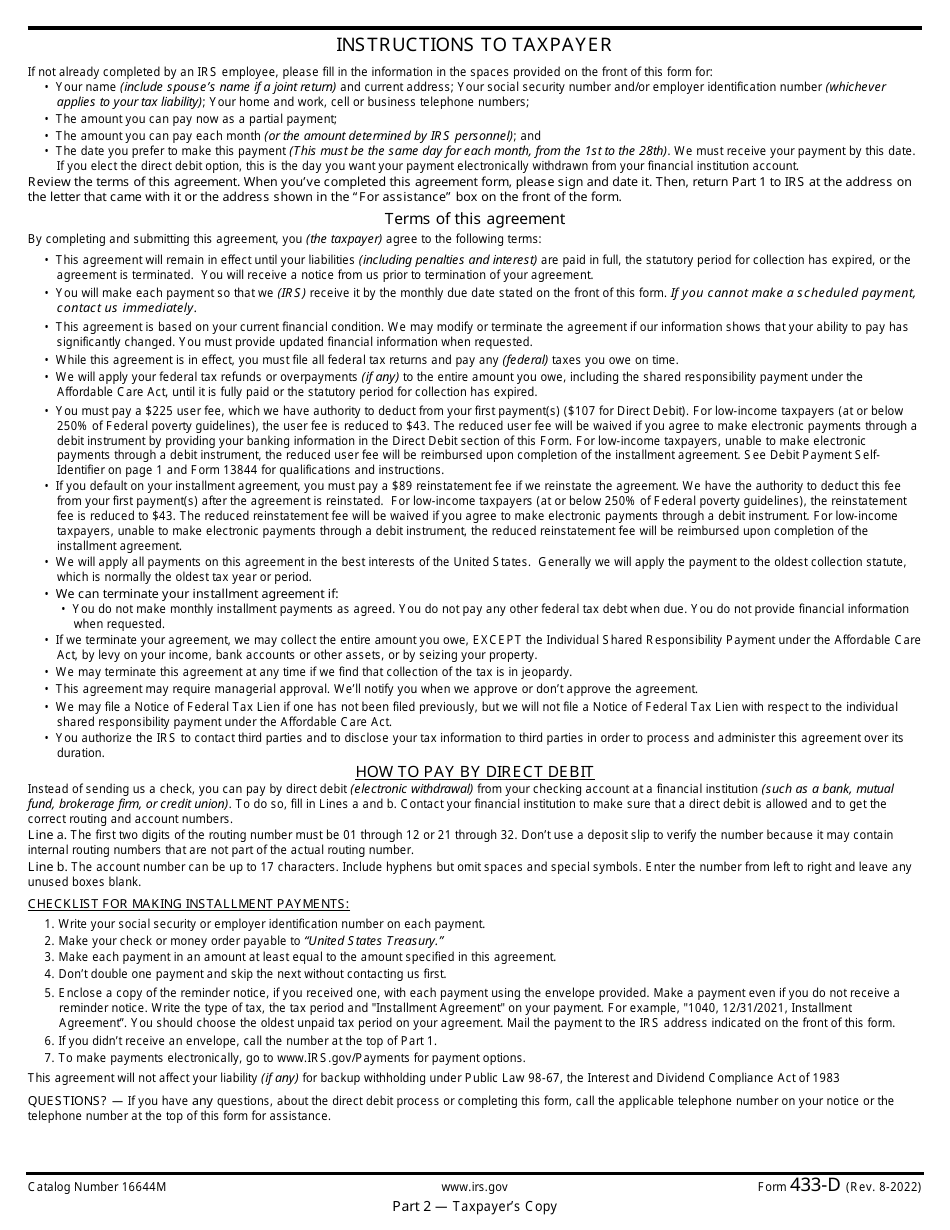

Certify the paperwork by adding your initials, signing the form, recording the date, and writing down your title if you are filing as a partner or corporate officer . The form has to be certified by your spouse in case you are dealing with a joint liability. If your preferred method of payment is direct debit, you have to indicate the routing number that identifies your financial entity alongside the number of your account. Alternatively, you must attach a voided check to the agreement upon submission. Check the box if you cannot make debit payments.

-

Leave the field designed for additional terms and conditions blank - it will be completed by the IRS employee later if necessary . Do the same for the section at the bottom of the page - it will further elaborate on the arrangement you have made. Fill out two copies of the agreement - one has to be submitted to tax organs while the other remains in your records.

Where Do I Mail My Installment Agreement to the IRS?

There is no uniform Form 433-D mailing address all taxpayers are expected to use when sending the copy of the document back to the IRS - in order to submit this instrument, you have to follow the guidelines you were provided with in the letter that accompanied the paperwork you received. In case the letter does not contain specific Form 433-D instructions, you will find the right address in the agreement itself - look at the box marked with the words "For assistance". Additionally, you will be given telephone numbers you may use to ask further questions about the financial arrangement whether you are a self-employed individual, business owner, or wage earner.