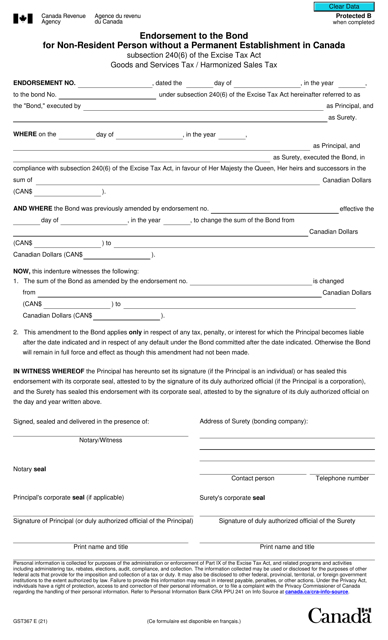

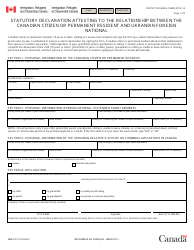

Form GST367 Endorsement to the Bond for Non-resident Person Without a Permanent Establishment in Canada - Canada

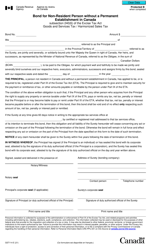

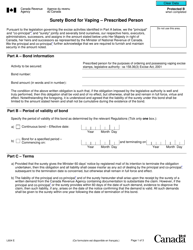

Form GST367 Endorsement to the Bond for Non-resident Person Without a Permanent Establishment in Canada is used in Canada for non-resident individuals or businesses who do not have a permanent establishment in Canada, but are required to post a bond for certain goods and services. It is an endorsement form that provides additional information and confirmation regarding the bond.

The non-resident person without a permanent establishment in Canada files the Form GST367 Endorsement to the Bond.

Form GST367 Endorsement to the Bond for Non-resident Person Without a Permanent Establishment in Canada - Canada - Frequently Asked Questions (FAQ)

Q: What is GST367 form?

A: GST367 form is the endorsement to the bond for a non-resident person without a permanent establishment in Canada.

Q: Who needs to fill out the GST367 form?

A: The form is required to be filled out by non-resident persons without a permanent establishment in Canada who want to participate in the Canadian goods and services tax/harmonized sales tax (GST/HST) system.

Q: What is the purpose of the GST367 form?

A: The purpose of the form is to provide a bond to the Canada Revenue Agency (CRA) as security for the GST/HST obligations of a non-resident person without a permanent establishment in Canada.

Q: Are there any fees associated with submitting the GST367 form?

A: Yes, there is a fee that needs to be paid when submitting the form. The fee amount is determined by the amount of security required for the bond.

Q: What happens after I submit the GST367 form?

A: Once the form is submitted, the CRA will review it and, if everything is in order, will issue a bond number. This bond number can then be used on other GST/HST-related forms and documents.

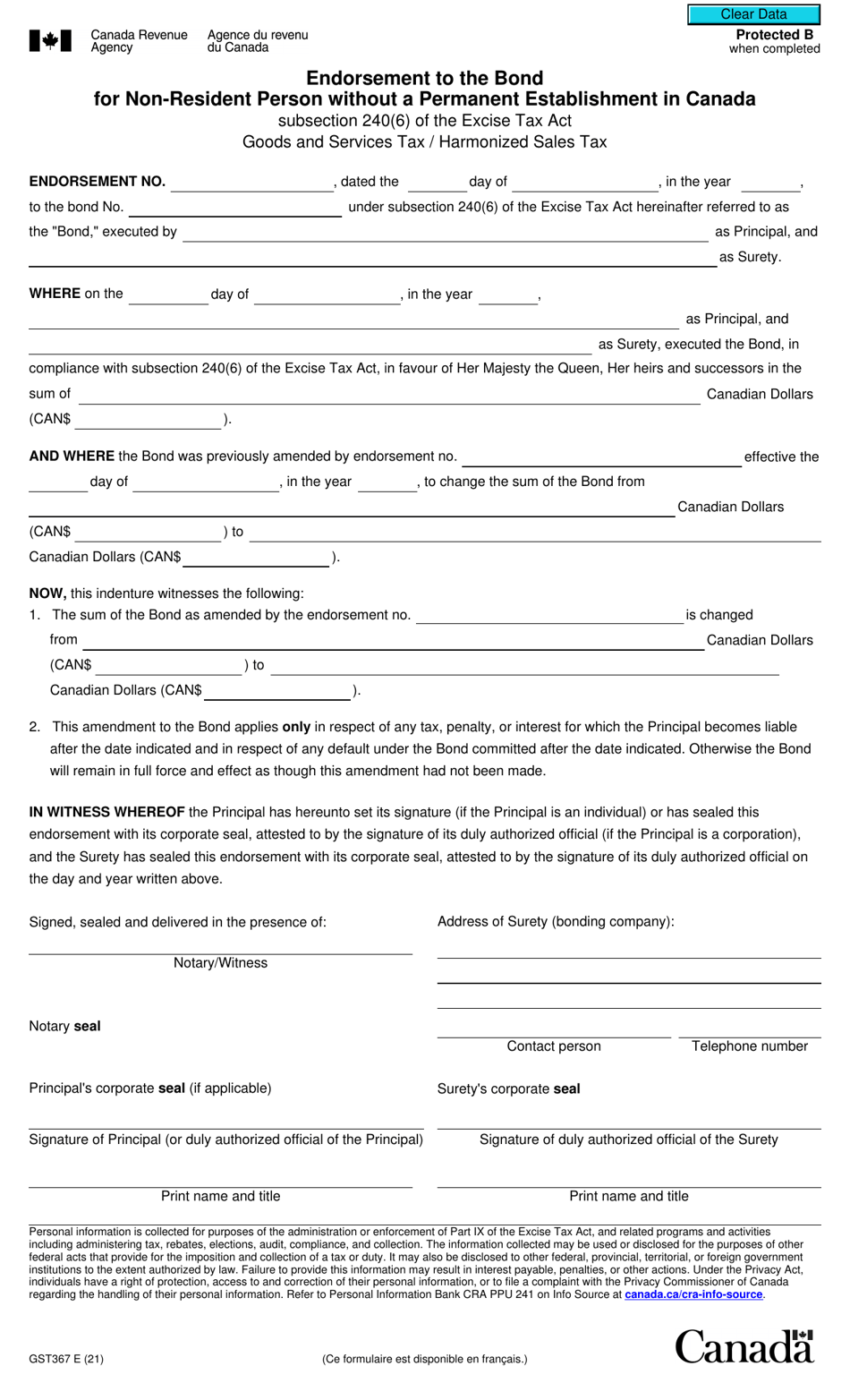

Q: Can the bond be cancelled or amended?

A: Yes, the bond can be cancelled or amended. You will need to contact the CRA to request any changes or cancellation of the bond.