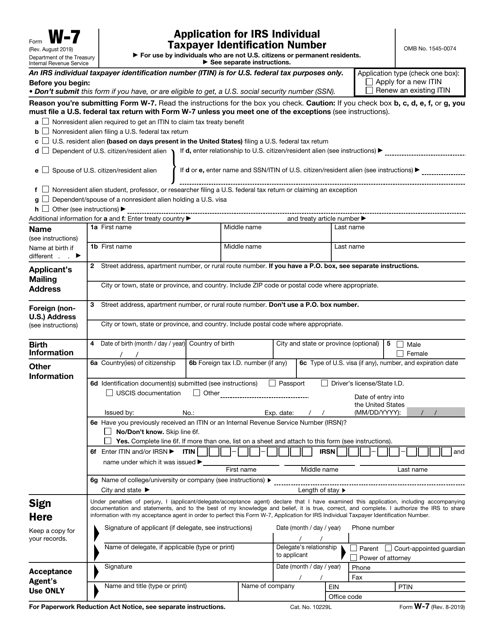

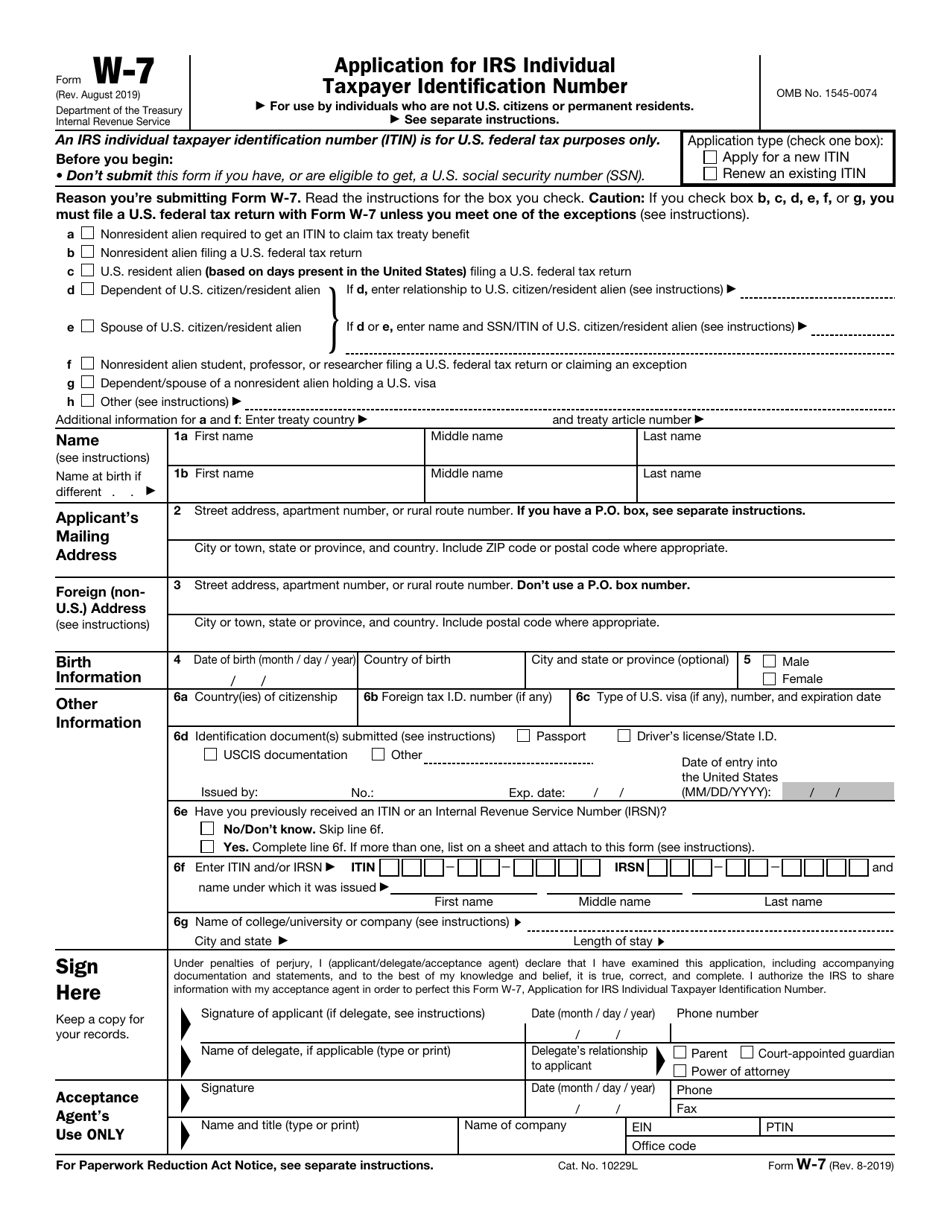

IRS Form W-7 Application for IRS Individual Taxpayer Identification Number

What Is IRS Form W-7?

IRS Form W-7, Application for IRS Individual Taxpayer Identification Number , is a formal statement filled out by individuals that want to obtain an identification number that will confirm their identity to fiscal organizations and let them communicate with the government as taxpayers. Additionally, it may be completed to renew a number they received before.

Alternate Names:

- IRS ITIN Application;

- ITIN Number Application;

- ITIN Application;

- Individual Tax Identification Number Application;

- Tax Form W-7.

This application was issued by the Internal Revenue Service (IRS) on August 1, 2019 , rendering older editions of the form outdated. An IRS Form W-7 fillable version is available for download below.

The Spanish version can be found here.

Check out the W-7 Series of forms to see more IRS documents in this series.

What Is Form W-7 Used For?

Prepare and submit a W-7 Tax Form to obtain an individual taxpayer identification number. This statement is indispensable for people that cannot get a social security number yet have an obligation to properly identify themselves when filing various tax documents. For example, if you are a permanent resident of the country without a social security number, this is how you can receive a unique combination of numbers you will use to submit an income statement or request a tax refund.

Foreigners usually need this number when filing a United States Federal Tax Return, looking to buy a house in the United States, and in other similar situations.

Form W-7 Instructions

Follow these Form W-7 Instructions to apply for an ITIN:

-

Check the box to state the reason behind the filing - you either get an ITIN for the first time or want to renew the ITIN you were assigned in the past.

-

Read a list of filer categories and put a tick in the box that applies to you . It is likely that several boxes describe your present status - you must choose just one category that suits you better than the rest. There are additional W-7 Form instructions for certain filers - for instance, they may have to identify their spouse or the person who includes them on their income statement as a dependent. Applicants eligible for an exception in accordance with an income tax treaty the United States signed with a foreign country have to name that country and add the number of the treaty article.

-

Disclose information about yourself - write down your full name and the name you had when you were born if it was different from the current one you use, list your correspondence address in the United States and the address you have abroad, record your date and place of birth, and specify your gender.

-

Provide more details about your documentation and status - state how you confirmed your identity, when you arrived in the United States, and what the ITIN you were issued before was. If you had an ITIN, enter the name under which it was assigned to you. Nonresident alien researchers, professors, and students must identify their academic institution and confirm how long their stay is going to be.

-

Certify the papers by signing them, adding the actual date, and listing your telephone number. Parents and guardians are permitted to sign the form for minor applicants . If you file the documentation with the help of an acceptance agent, they will record their own details at the bottom of the page as well.

Where to Mail ITIN Application?

There are several ways to submit an ITIN Application:

-

File the document with the Internal Revenue Service, ITIN Operation, P.O. Box 149342, Austin, TX 78714-9342 if you prefer to send the paperwork via a post office.

-

Individuals that want to pay for a private delivery service have to mail the form to the I nternal Revenue Service, ITIN Operation, Mail Stop 6090-AUSC, 3651 S. Interregional, Hwy 35, Austin, TX 78741-0000 .

-

Go to a local IRS center established to assist taxpayers - employees of this entity will check your submission package while you are there in person . This may be the most convenient filing method for people that need to retain original documents instead of parting with them for a time.

-

Reach out to an acceptance agent who is authorized by tax organs to facilitate the process of application - you can find them both in the United States and abroad .

Do not forget Tax Form W-7 is not the only instrument you are supposed to send to the IRS - there are additional tools that will allow fiscal authorities to confirm your identity and foreign status, from a driver's license to healthcare records. Both originals and copies certified by relevant agencies and institutions will be accepted.

How to Check ITIN Application Status?

Do not worry if you are not contacted by the IRS right away upon sending the ITIN Number Application and supplementary documentation - usually, seven weeks are required for the government to review the information you have submitted. Sometimes the period of waiting is longer - for instance, if you file the paperwork at the start of the calendar year or send it from a foreign country, it is possible you will have to wait up to four months for a response.

However, in case the application is processed longer than that, you have an opportunity to check its status - call 800-829-1040 and learn more about the document in question. If you are currently abroad, the telephone number you should use is 267-941-1000.

IRS W-7 Related Forms

IRS Form W-7 has three related forms:

- Form W-7 (SP). This document is the Spanish version of IRS W-7 you use to apply for an ITIN;

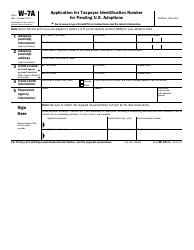

- Form W-7 (COA). It is a form filled out and submitted by the ITIN Certifying Acceptance Agents to confirm they have reviewed all documentation that proves the ITIN applicant's identity and foreign status;

- Form W-7A. Fill out this form to request an adoption taxpayer identification number for a child living in your home and pending legal adoption.