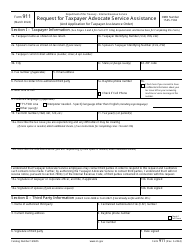

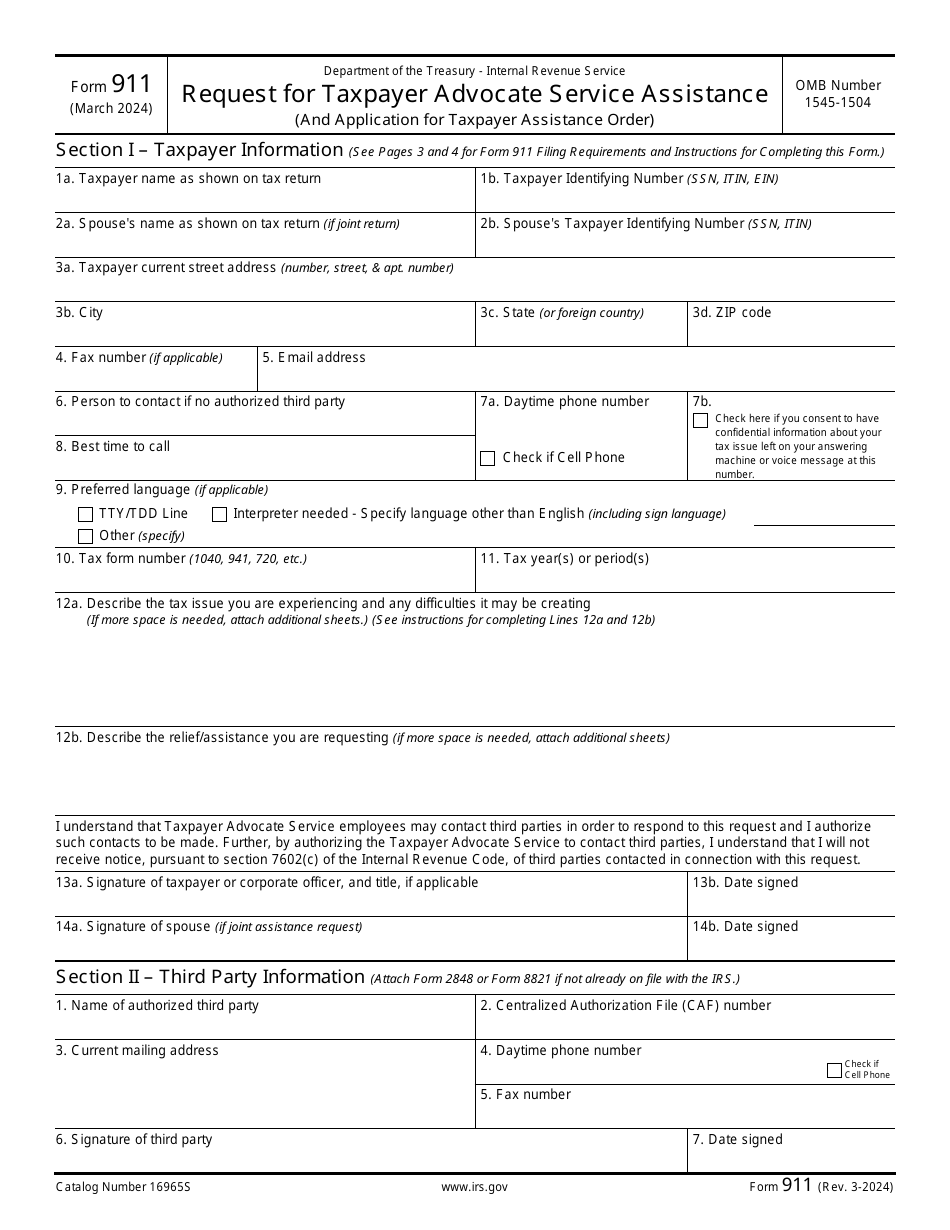

IRS Form 911 Request for Taxpayer Advocate Service Assistance (And Application for Taxpayer Assistance Order)

What Is IRS Form 911?

IRS Form 911, Request for Taxpayer Advocate Service Assistance (And Application for Taxpayer Assistance Order) , is a fiscal instrument used by taxpayers that have already exhausted all other options when dealing with a tax issue.

Alternate Names:

- Taxpayer Advocate Form;

- Taxpayer Advocate Form 911.

If you are in trouble with tax authorities and the matter at hand has made your life difficult, your business may face an adverse action in the near future, or you got no response from authorities in relation to your problem, you can prepare this request to tackle the issue.

This statement was issued by the Internal Revenue Service (IRS) on March 1, 2024 , making older editions of the form obsolete. You can download an IRS Form 911 fillable version through the link below.

A Spanish version of IRS Form 911 is available for spanish-speaking filers.

What Is IRS Form 911 Used For?

Complete Taxpayer Advocate Form 911 if you are in need of urgent help from the IRS. It is possible you are unable to deal with your tax problem or handle the difficulties in the name of your company yet there has been no certainty in remedies you have already applied for or the recipient of your applications and request has ignored your efforts to resolve the matter - in this case, the surest way to ask for help is to use Form 911.

Whether the procedures you may have to go through are too complicated or liens and seizures worsened your financial situation, reach out to the IRS directly by filing this form and qualify for assistance that will allow you to handle the problem. Stay in touch with tax authorities and make sure you submit this request with supplementary documentation that further proves your need for assistance - the better you explain the reason behind your issue, the quicker you will get the help you require.

Form 911 Instructions

Follow these IRS Form 911 instructions to ask for assistance with the tax issues you cannot manage on your own:

-

Write down your personal details - the name that matches the one you include on your income statement and a taxpayer identification number . If you are married and filing jointly, the instrument has to contain the name and taxpayer identification number of your spouse as well.

-

Add your contact details - the street address, fax number, email address, and telephone number . Specify whether the phone number you have listed is your cell phone number or not and clarify when the IRS can contact you. You are also allowed to indicate the name of another individual that can be contacted on your behalf if you do not have a formal representative. State what language you want to use when communicating with tax authorities.

-

Record the number of the tax form you have issues with and point out the tax period covered in the document or the tax year when the problem arose . Use blank space to provide information about the tax issue you have had and the consequences you have had to deal with. You may add extra sheets of paper if you need to offer more details. Additionally, tell the IRS what kind of assistance you want to get.

-

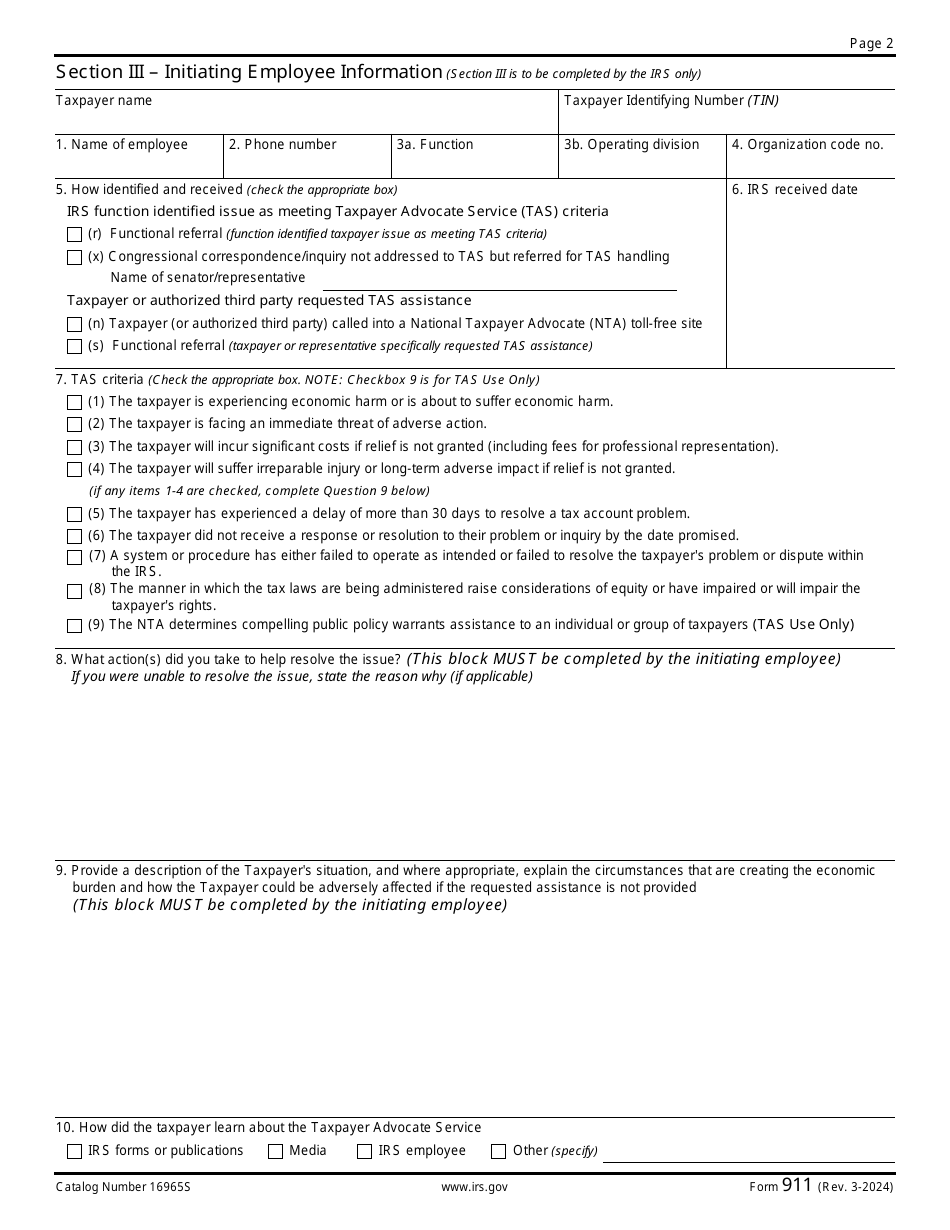

Certify the document - you must authorize tax organs to respond to you in different ways, sign the paperwork, and write down the actual date . Obtain the signature of your spouse if necessary. In case the form is filed on behalf of the corporation, it has to be verified by a corporate officer who also records their title. If you have hired a tax professional to help you with the filing of the request, they must identify themselves in writing and add their contact information. Do not complete the third part of the form - the second page of the instrument must be filled out by the IRS employee that will manage your case.

Where to File Form 911?

There are three ways to submit IRS Form 911:

-

It is recommended to file the document via fax - there is at least one taxpayer advocate office in every state. Look for the fax number on the taxpayer advocate service website - www.taxpayeradvocate.irs.gov/contact-us/submit-a-request-for-assistance/

-

If it is more convenient for you to send the paperwork the traditional way, you may file the request by using the mail . Once again, reach out to the local office of the service that renders services to taxpayers in need or call 1-877-777-4778 to learn the nearest office to your current location.

-

Note that taxpayers that reside abroad at the present moment are obliged to send the form to the Taxpayer Advocate Service, Internal Revenue Service, PO Box 11996, San Juan, Puerto Rico 00922; in case you prefer to submit the papers by fax, the number is 1-304-707-9793.