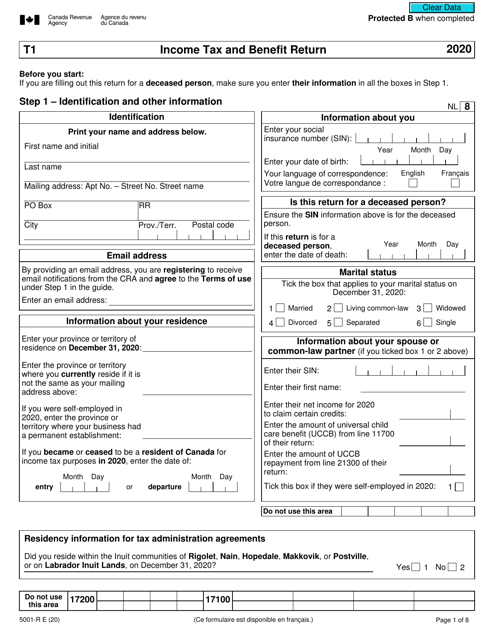

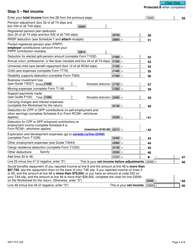

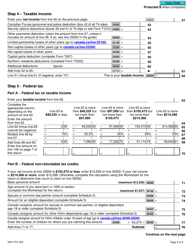

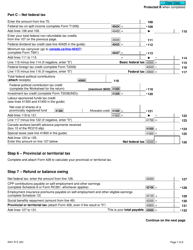

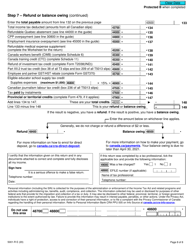

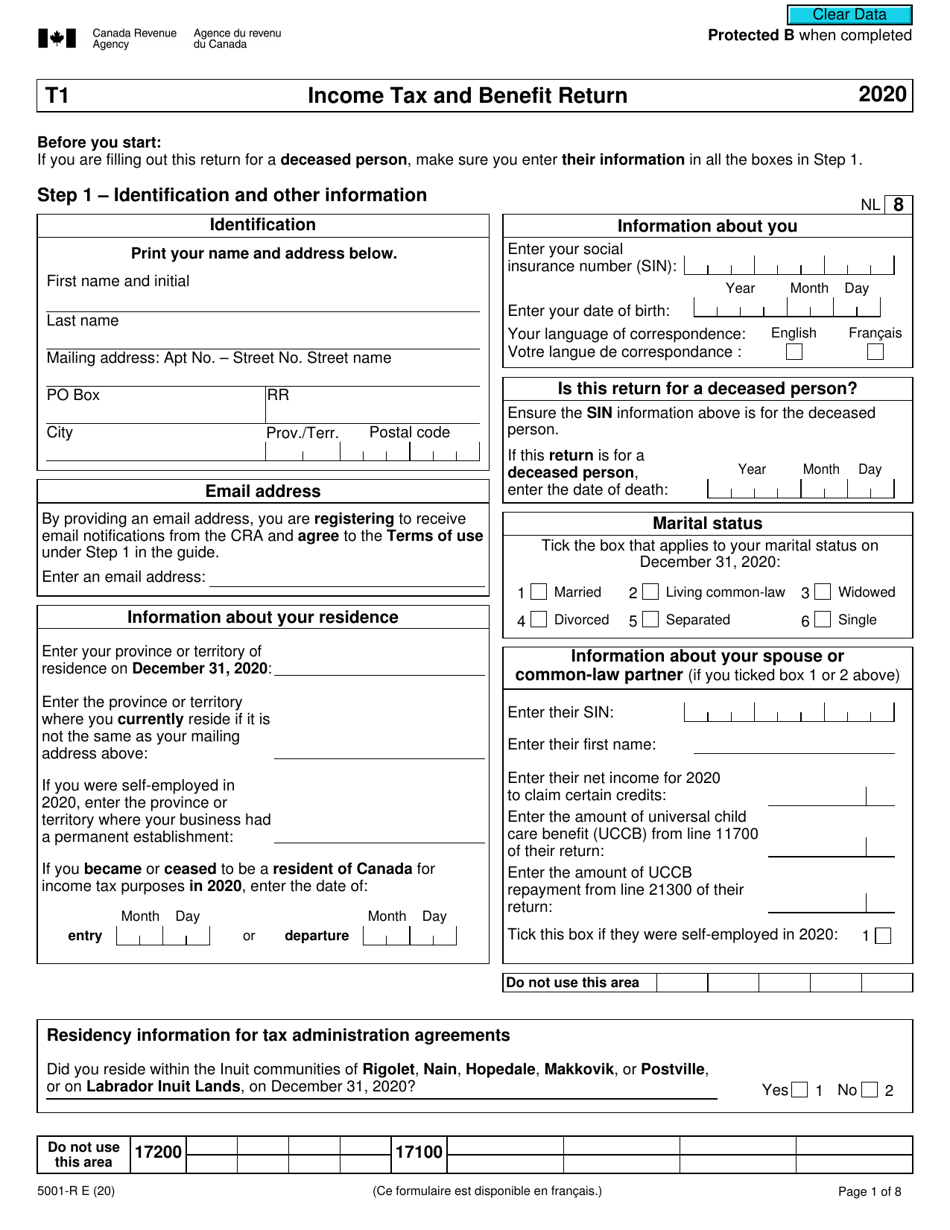

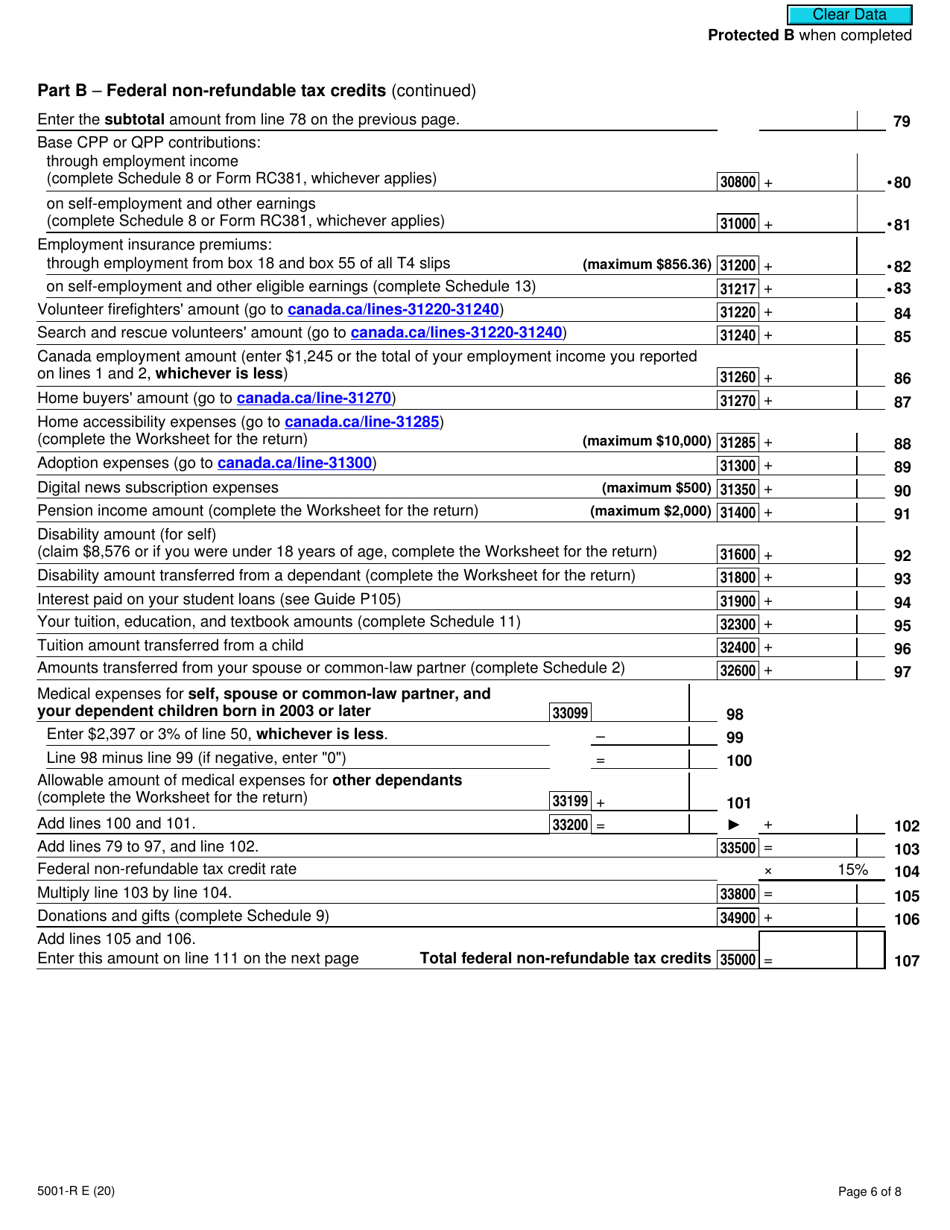

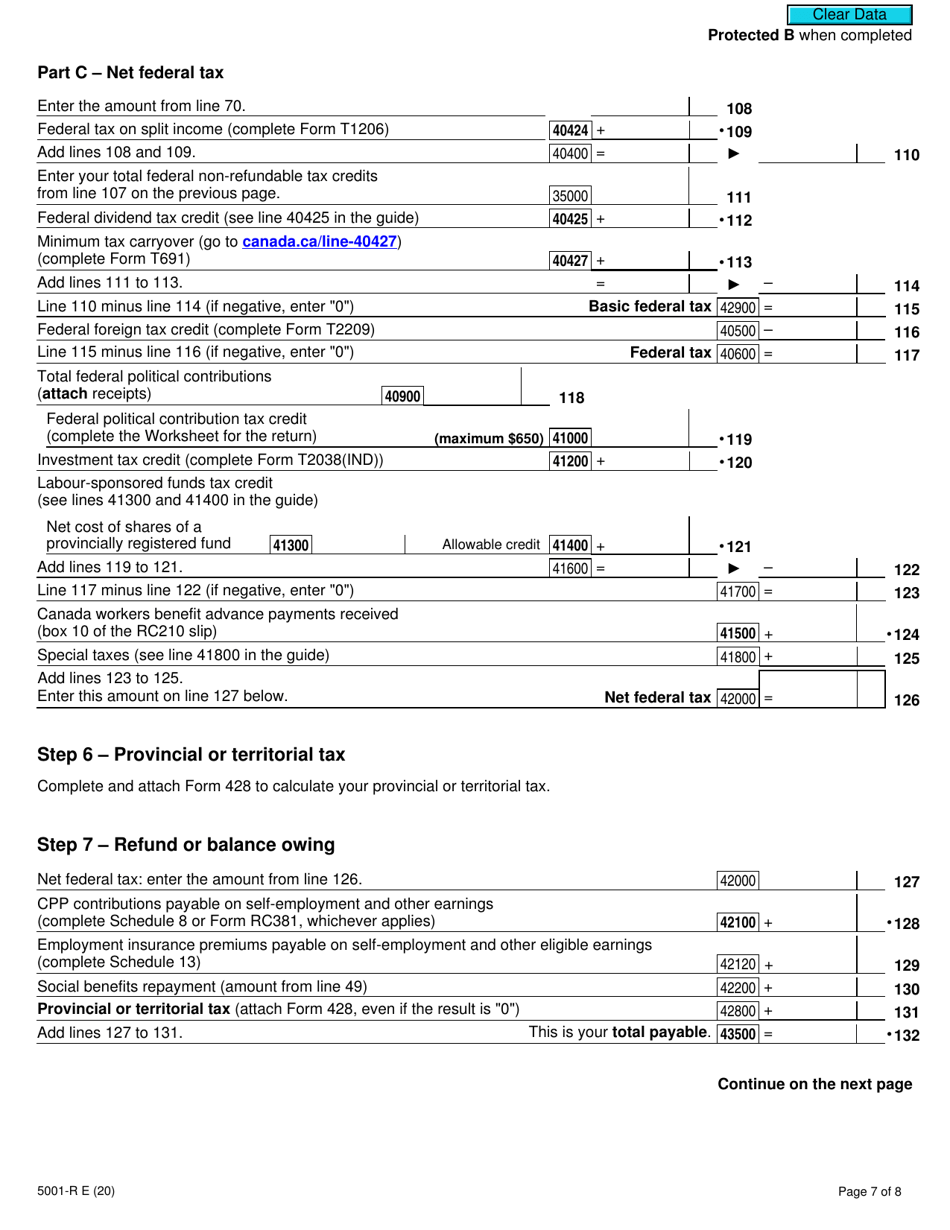

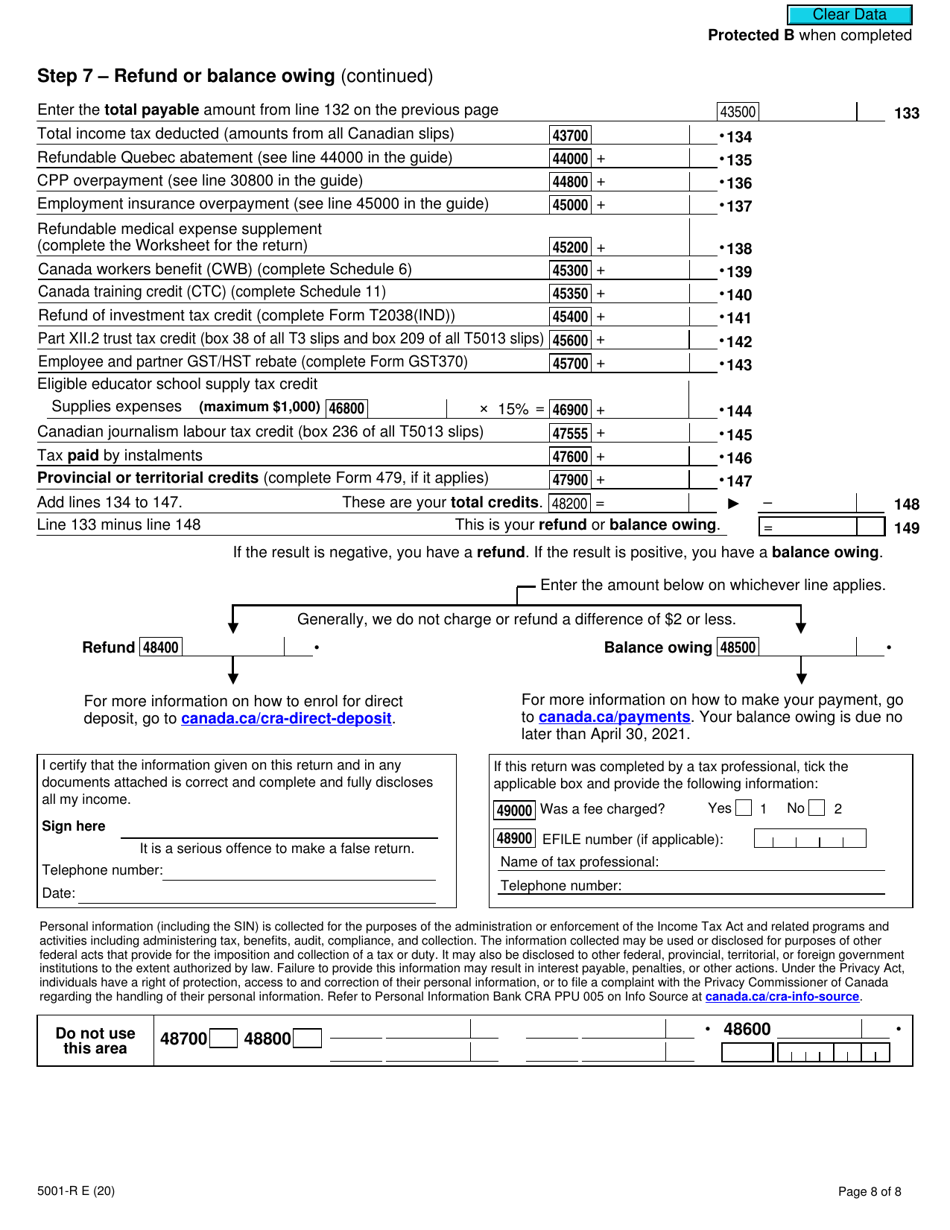

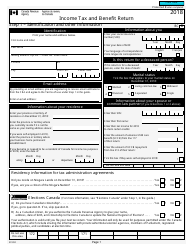

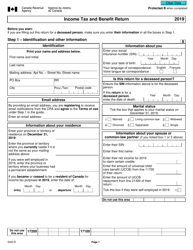

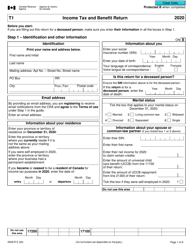

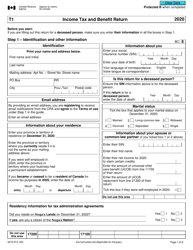

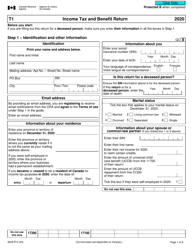

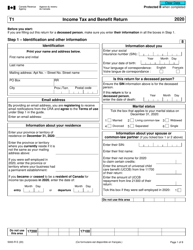

Form 5001-R Income Tax and Benefit Return - Canada

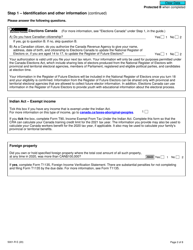

Form 5001-R Income Tax and Benefit Return is used by Canadian residents to report their income, claim deductions and credits, and calculate their taxes owed or refund due to file their annual income tax return.

Individuals who are residents of Canada and need to report their income and claim various tax benefits file the Form 5001-R Income Tax and Benefit Return.

Form 5001-R Income Tax and Benefit Return - Canada - Frequently Asked Questions (FAQ)

Q: What is Form 5001-R?

A: Form 5001-R is the income tax and benefit return form for Canadian residents.

Q: Who needs to file Form 5001-R?

A: Canadian residents who have income and want to claim tax benefits need to file Form 5001-R.

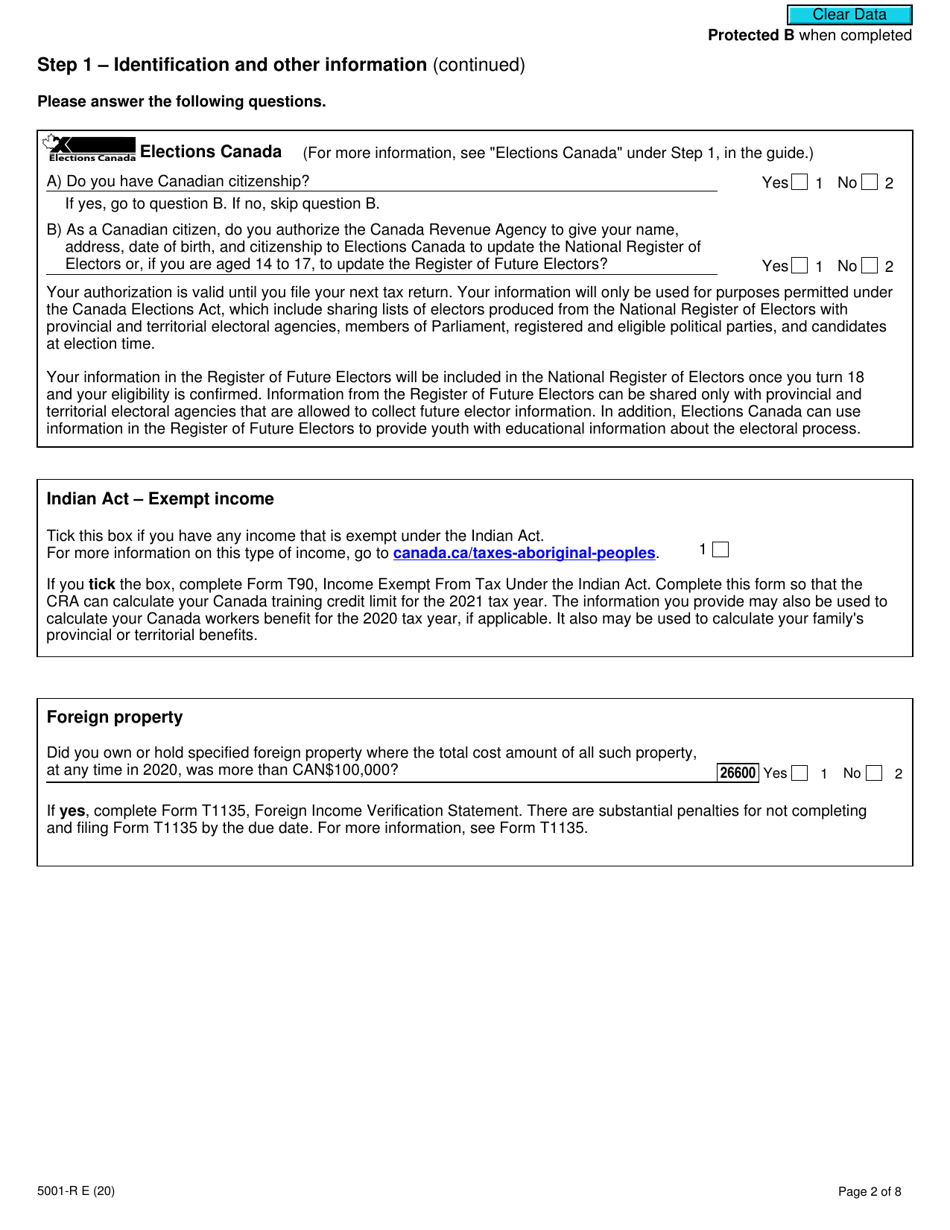

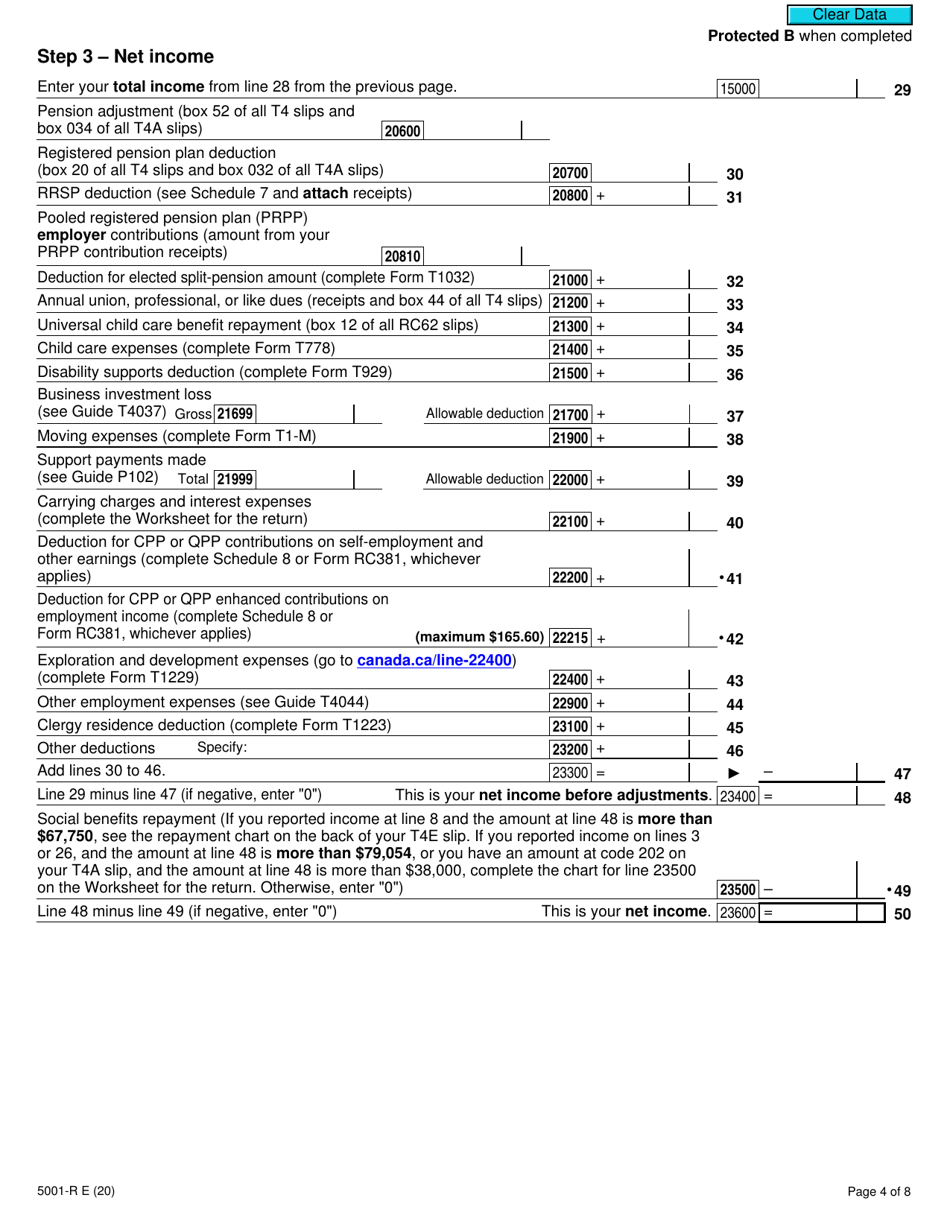

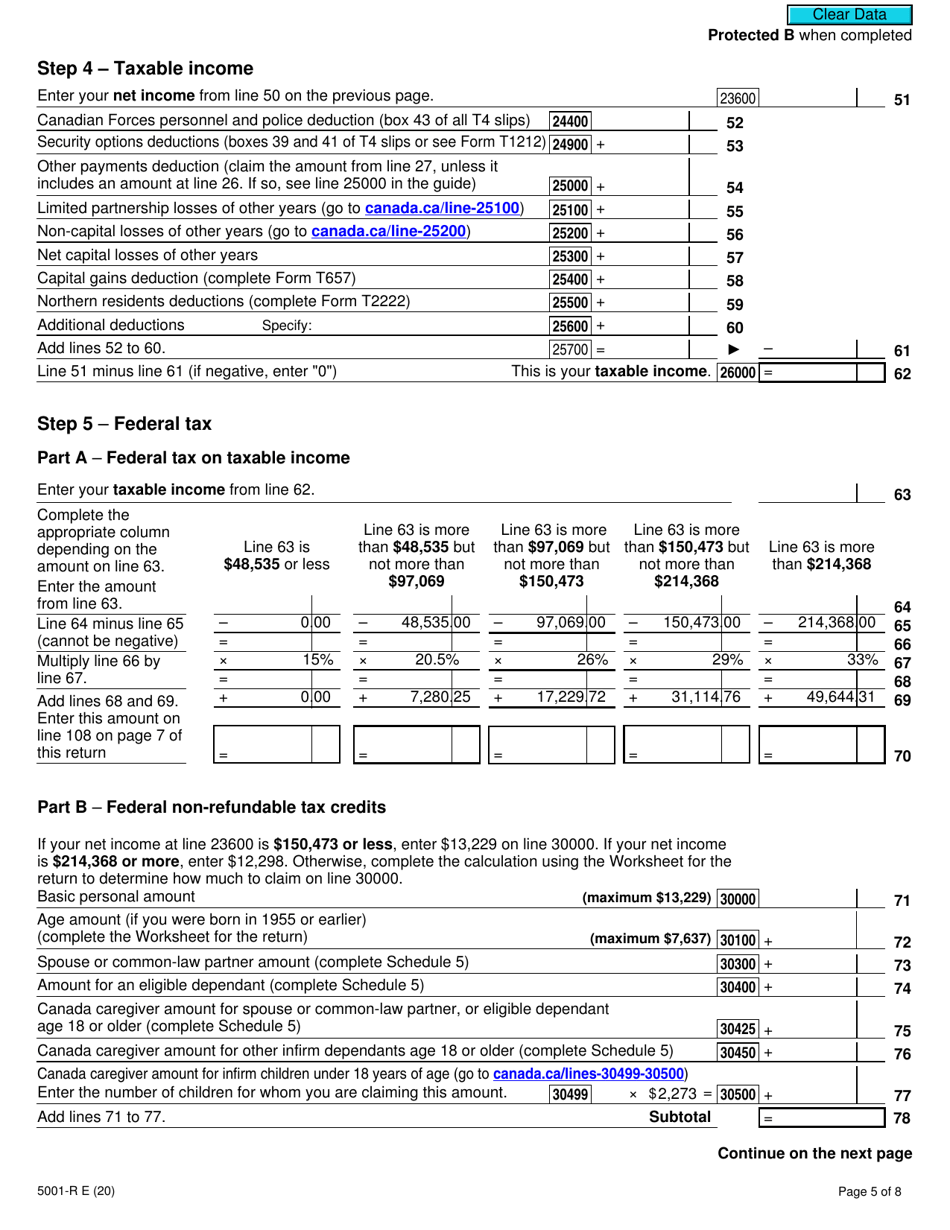

Q: What information is required on Form 5001-R?

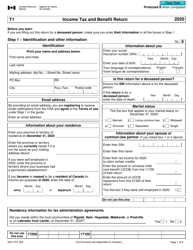

A: Form 5001-R requires information about your income, deductions, credits, and personal information.

Q: When is the deadline to file Form 5001-R?

A: The deadline to file Form 5001-R is April 30th of each year.

Q: Can I file Form 5001-R electronically?

A: Yes, you can file Form 5001-R electronically using the CRA's NETFILE service or through approved software.

Q: What should I do if I can't file Form 5001-R by the deadline?

A: If you can't file Form 5001-R by the deadline, you should contact the CRA and explain your situation.

Q: What happens after I file Form 5001-R?

A: After you file Form 5001-R, the CRA will assess your return and send you a Notice of Assessment.

Q: Are there any penalties for late filing or incorrect information on Form 5001-R?

A: Yes, there may be penalties for late filing or incorrect information on Form 5001-R, so it's important to file accurately and on time.

Q: Is there a separate form for provincial taxes in Canada?

A: Yes, each province in Canada has its own separate form for reporting and paying provincial taxes.