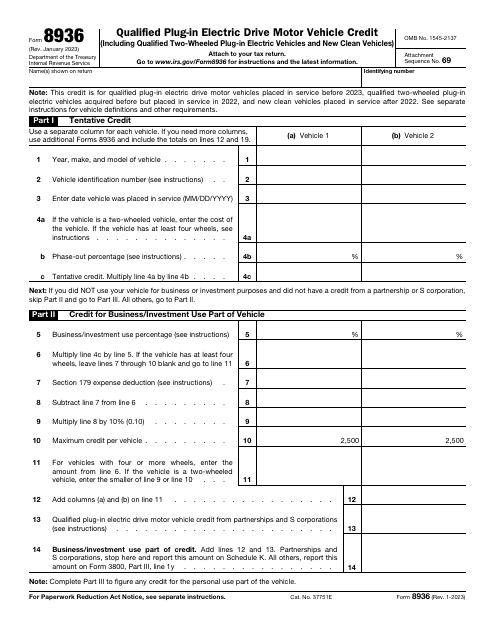

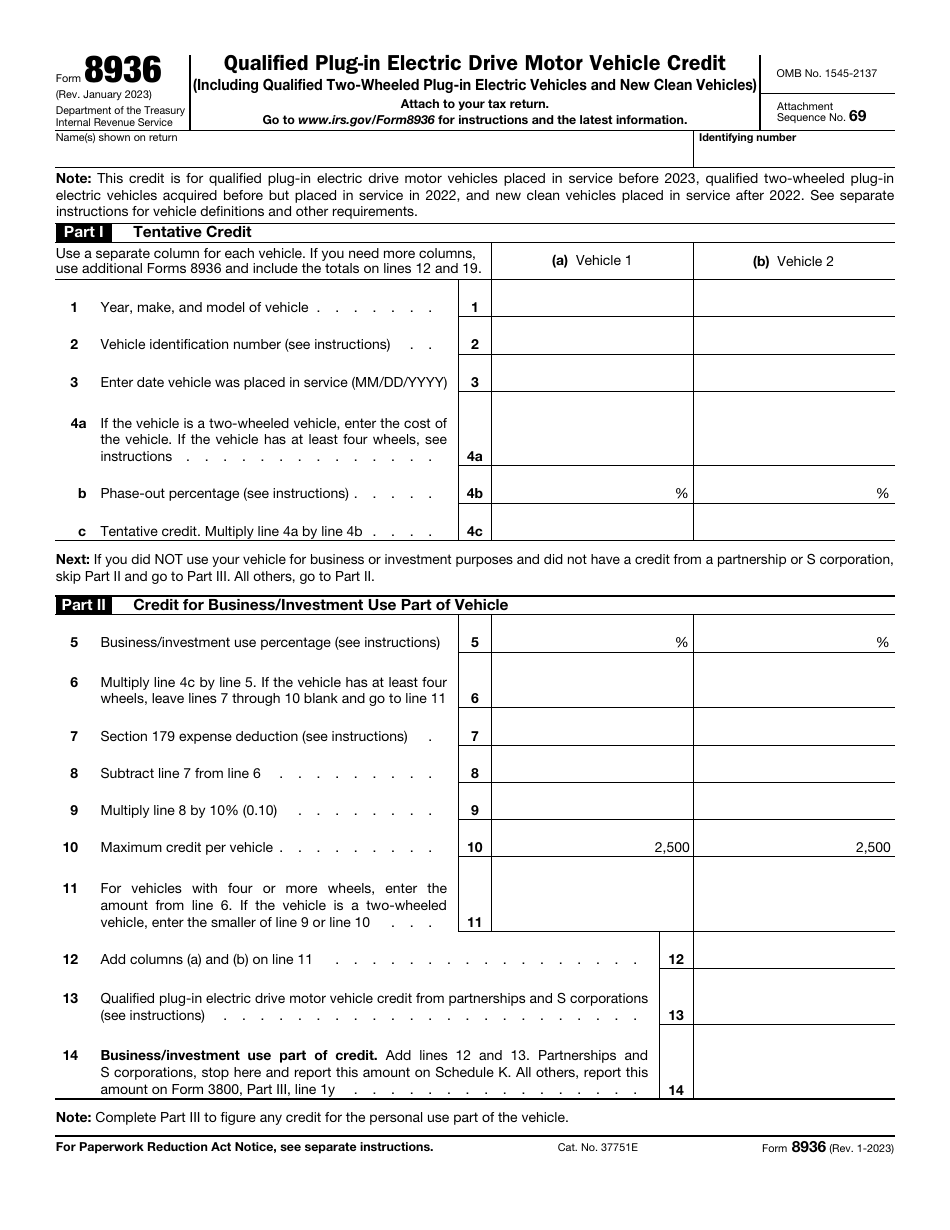

IRS Form 8936 Qualified Plug-In Electric Drive Motor Vehicle Credit

What Is IRS Form 8936?

IRS Form 8936, Qualified Plug-In Electric Drive Motor Vehicle Credit , is a formal instrument used by taxpayers that purchased electric vehicles in order to claim a tax credit when filing their tax returns.

Alternate Name:

- Tax Form 8936.

Individuals and businesses alike are allowed to file this form as long as the vehicle in question was purchased for their own use and is mainly driven in the United States. The laws allow each taxpayer to claim this credit only one time for every vehicle that meets the requirements established by the fiscal authorities - make sure you file the paperwork in the year the purchase took place and you started using the vehicle for personal needs or professional obligations.

This document was issued by the Internal Revenue Service (IRS ) on January 1, 2023 - older editions of the form are now obsolete. An IRS Form 8936 fillable version can be downloaded through the link below.

Form 8936 Instructions

The IRS Form 8936 Instructions are as follows:

-

Make sure your vehicle qualifies for this tax credit - it is supposed to have an external source of charging, weigh less than 14.000 pounds, and be manufactured by a company that sold 200.000 electric vehicles or less on the territory of the country . The vehicle has to be new when you buy it; however, if you got a used one from a dealer with a valid license and its cost was $25.000 or less, you have an opportunity to fill out this form. People and entities that purchase vehicles to resell them in the future or those who feature as dependents on other taxpayers' tax returns cannot qualify for the tax credit; you also may not submit this document if you own an electric bicycle.

-

Include your own name and the identifying number of the vehicle . Write down the description of the vehicle - the date it was placed in service, its make, model, and year, the cost of the vehicle (in case it has two wheels), and the phase-out percentage (the number will depend on the manufacturer). Calculate the tentative credit - multiply the percentage you got by the price of the vehicle.

-

If you are using the vehicle in the course of the business, it must be properly reflected in the form - you need to determine how many miles were driven with the purpose of generating income for your company . Use the formulas in the document to figure out what part of the credit is related to business operations and investment.

-

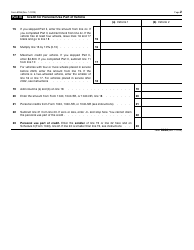

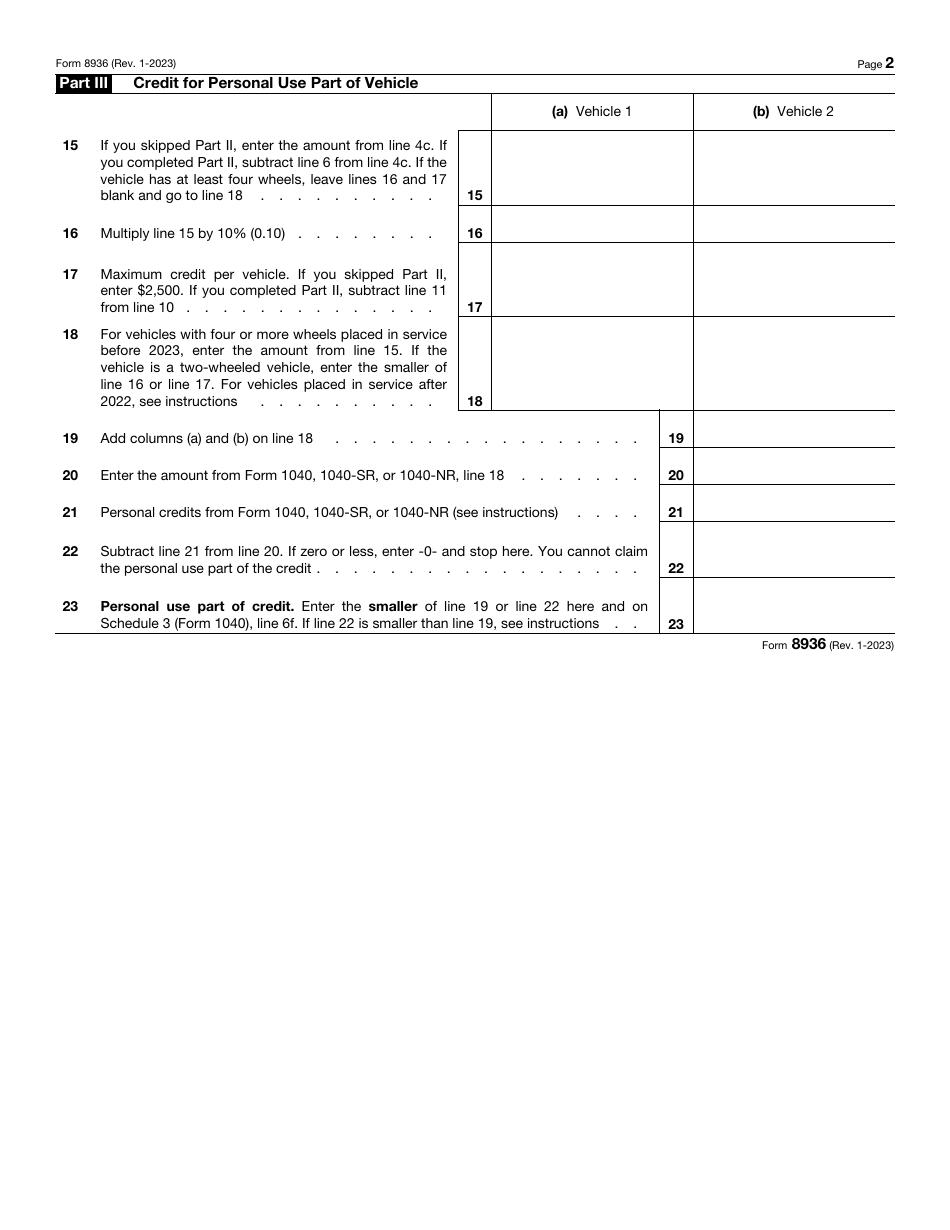

Only complete the next section of the 8936 Tax Form if you used the vehicle for private purposes - otherwise, you may skip this part . Indicate the maximum credit per vehicle, replicate the numbers you put in your main tax return, find out whether you can claim the personal use portion of the credit judging by the numbers you got, and enter the number that shows how much you are able to claim in the opposite case.