VA Form 21P-4706B VA Fiduciary's Account

What Is VA Form 21P-4706B?

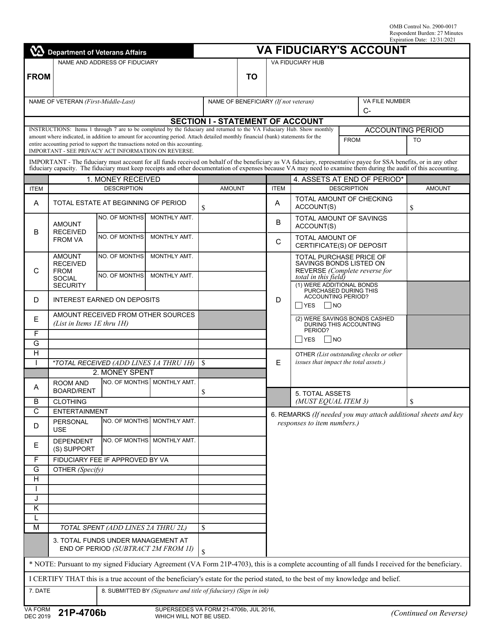

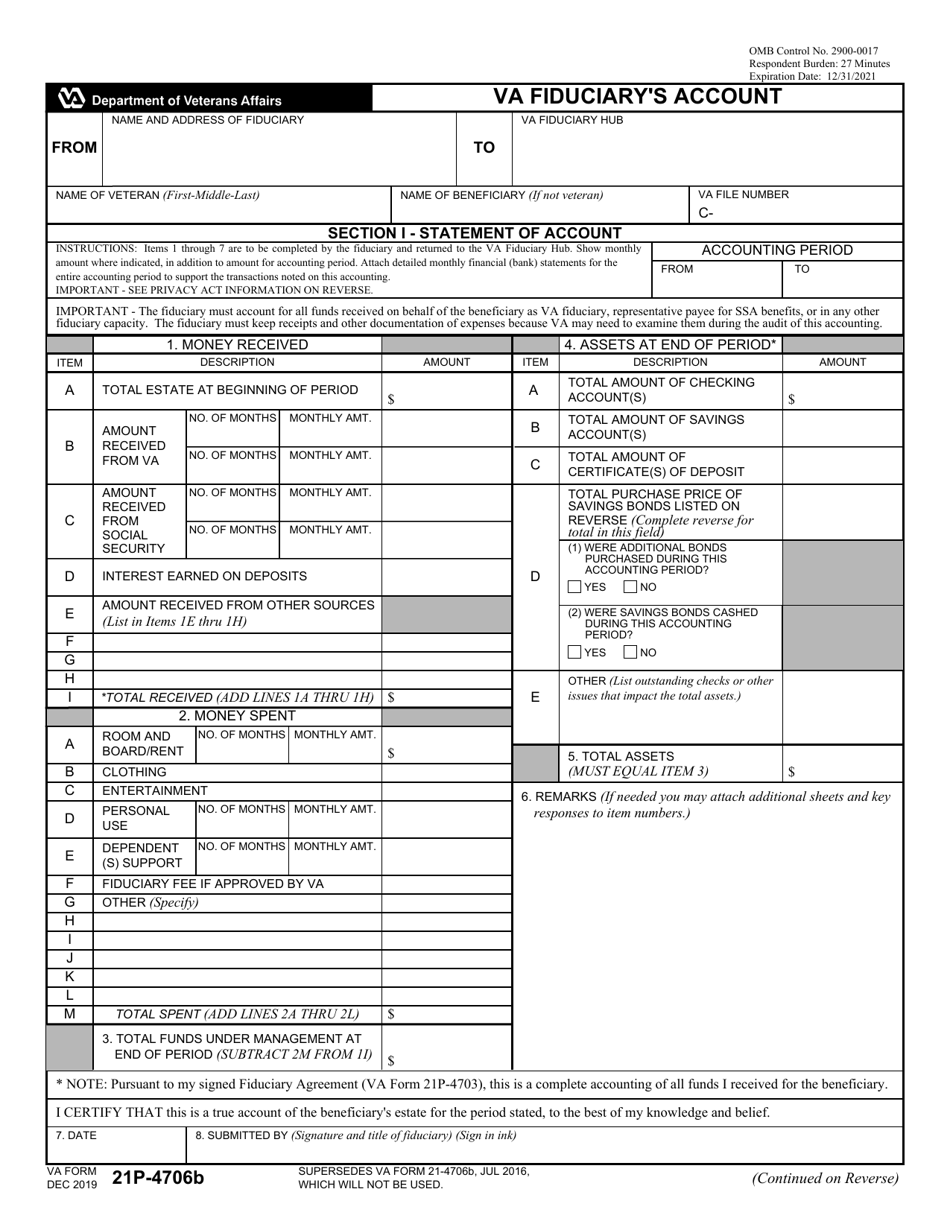

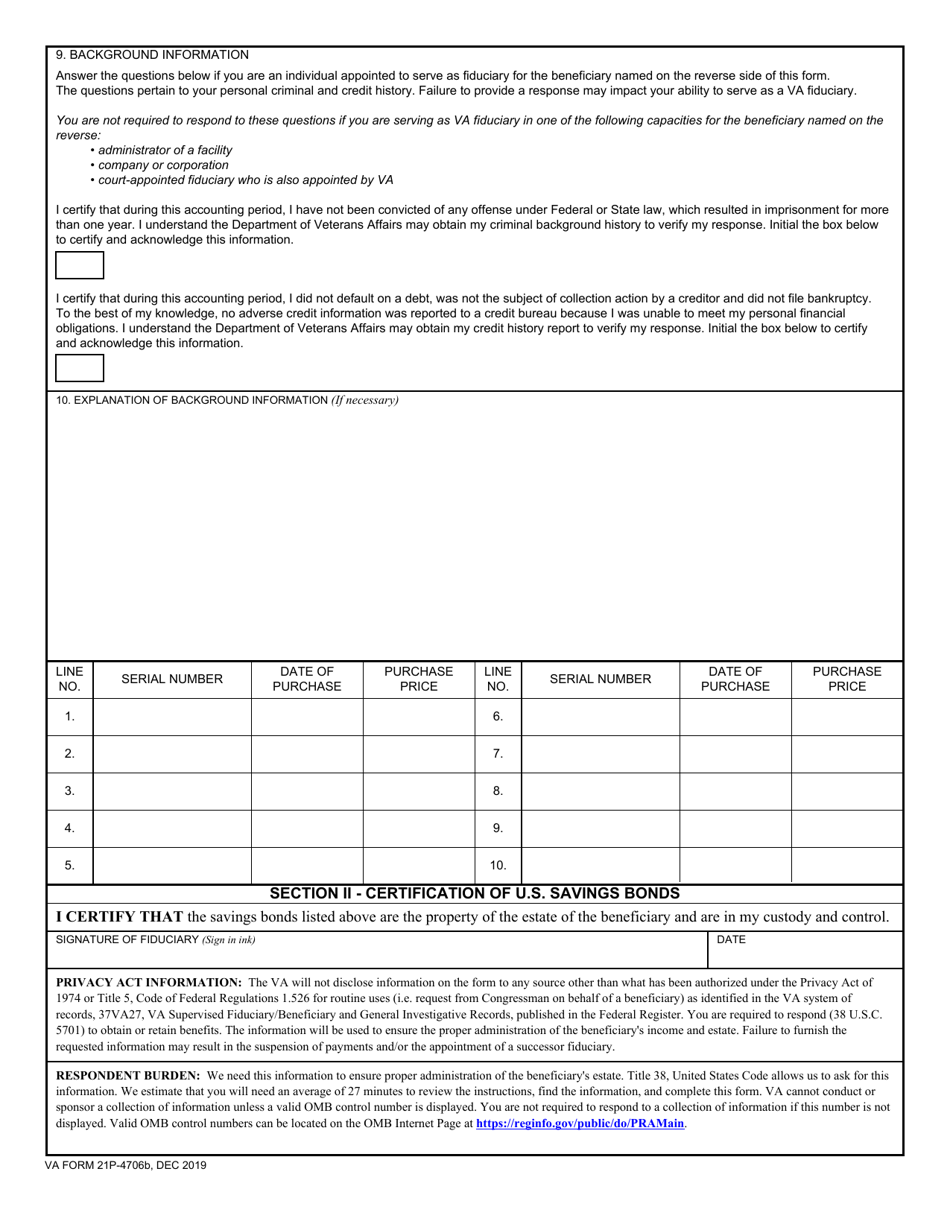

VA Form 21P-4706B, Federal Fiduciary's Account , is a document used to report the complete accounting of the beneficiary's estate for the period stated by the Department of Veterans Affairs (VA) . An accounting should contain the opening account balance, funds the individual (fiduciary) handles for the beneficiary, a full list of expenses paid from these funds, and the closing account balance. All this data is required to ensure the beneficiary's account is managed properly.

The latest version of the form was released on December 1, 2019 , and supersedes the now obsolete VA Form 21-4706B. An up-to-date fillable version of the form is available for digital filing and download through the link below or can be found on the VA website.

VA Form 21P-4706B has several related forms:

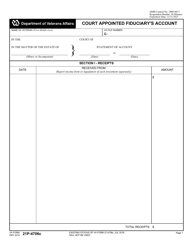

- VA Form 21P-4706C, Court Appointed Fiduciary's Account;

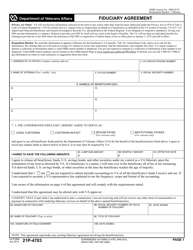

- VA Form 21P-4703, Fiduciary Agreement;

- VA Form 21-0509, Notice of Fiduciary Commission ;

- VA Form 21P-4718A, Certificate of Balance on Deposit and Authorization to Disclose Financial Records;

- VA Form 21-592, Request for Appointment of a Fiduciary, Custodian or Guardian .

VA Form 21P-4706B Instructions

The instructions for VA Form 21P-4706B are provided in Section I of the document. You are obligated to account for all funds obtained on the beneficiary's behalf, including VA funds, military retirement pay, and Social Security Administration (SSA) funds. All the receipts and other documentation of expenses must be kept, since they may be requested during the audit of the submitted account. You should not indicate in the report any funds you do not manage on the behalf of the beneficiary.

If personal assistance is required, you can call toll-free at 1-888-407-0144 or contact the Fiduciary Hub of jurisdiction for help.

How to Fill out VA Form 21P-4706B?

VA Form 21P-4706B should be completed as follows:

-

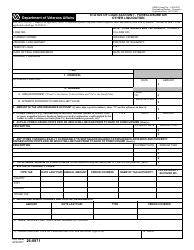

Enter your name and full address in "From." Enter the address of the Fiduciary Hub in "To". The Fiduciary Hub address can be found in the letter informing about the accounting.

-

Enter the full name of the veteran in "Name of Veteran." If the beneficiary - the person entitled to receive funds - is someone other than the veteran, provide their name in "Name of Beneficiary."

-

Enter the claim number or SSN in "File Number". It can be found in the top right corner of the letters received from the VA.

-

"Money Received" includes Items A through I.

- If it's the first accounting, Item A should contain "$0". Otherwise, the ending balance from the previous accounting must be indicated;

- The number of months and the monthly amount of funds you managed during the accounting period on the behalf of the beneficiary must be provided in the corresponding boxes of Item B. Besides, this part should include any retroactive funds received during this period. If the amount varied more than twice, it is allowed to use Items E through H to provide full information;

- If the SSA recognizes you as the representative payee on the beneficiary's behalf, the corresponding amount of the SSA funds is required to be entered in Item C;

- Item D is for the amount of interest received for funds deposited in a bank;

- All funds received from other sources must be indicated in Items E through H;

- The total amount received is provided in Item I;

-

"Money Spent" includes Items A through M.

- Indicate the amounts paid for room and board, clothing, entertainment of the beneficiary, for support of beneficiary's dependents, and other expenses in Items A through L;

- The total amount of the funds spent must be entered in Item M.

-

Subtract the amount in Item M ("Money Spent") from the amount in Item I ("Money Received") and enter the amount in Box 3 "Total Estate at End of Period."

-

Enter the assets at the end of the accounting period in Section IV.

-

The sum provided in Box 5 ("Total Assets") should concur with the sum indicated in Box 3.

-

Box 6 is for any additional information and remarks.

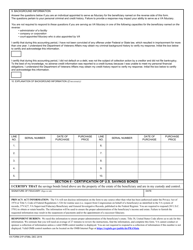

Sign the document after completion. The reverse part of the form is optional and should be filled out only if you are appointed to serve as a fiduciary for the beneficiary named in the account.

How Can I Submit VA Form 21P-4706B?

VA Form 21P-4706B can be submitted in person or via mail to the Fiduciary Hub. The address of the Fiduciary Hub is the address indicated in the Box "To" on the top of the document.