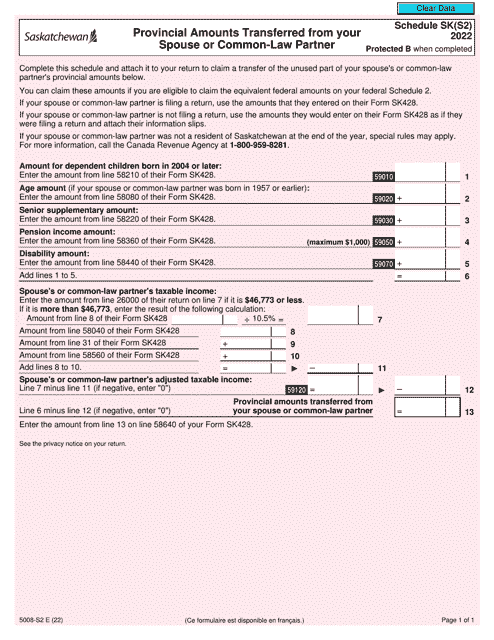

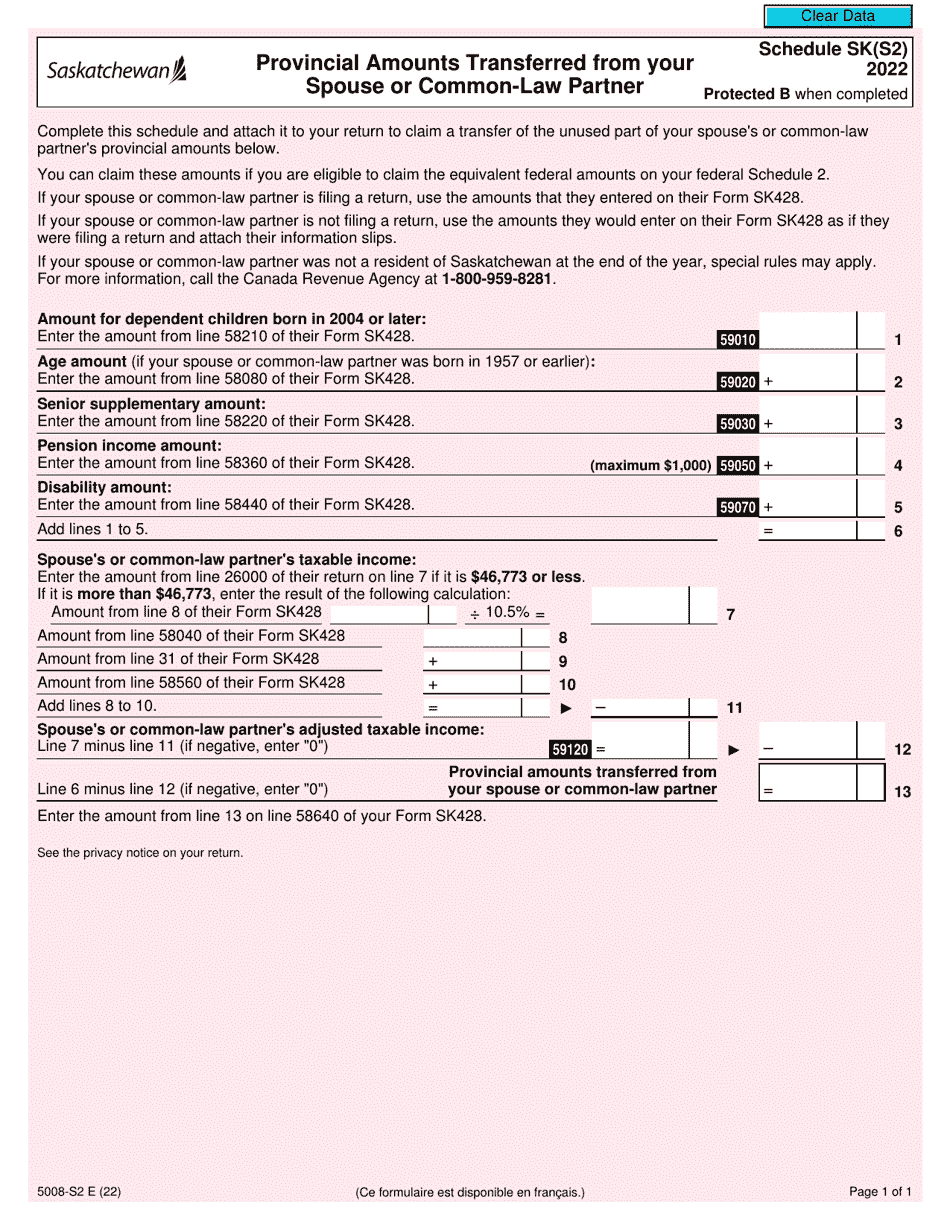

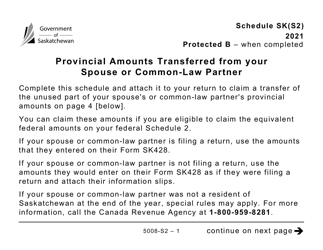

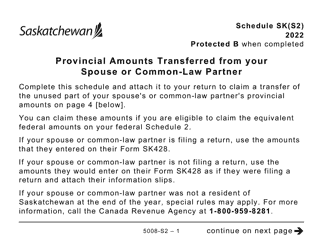

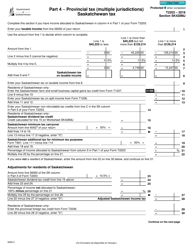

Form 5008-S2 Schedule SK(S2) Provincial Amounts Transferred From Your Spouse or Common-Law Partner - Canada

Form 5008-S2 Schedule SK(S2) is used in Canada to report the amounts transferred from your spouse or common-law partner for the purpose of calculating your provincial tax credits or deductions in the province of Saskatchewan.

Form 5008-S2 Schedule SK(S2) Provincial Amounts Transferred From Your Spouse or Common-Law Partner - Canada - Frequently Asked Questions (FAQ)

Q: What is Form 5008-S2?

A: Form 5008-S2 is a schedule used in Canada for reporting provincial amounts transferred from your spouse or common-law partner.

Q: What is Schedule SK(S2)?

A: Schedule SK(S2) is a specific form within Form 5008-S2 that is used to report provincial amounts transferred from your spouse or common-law partner.

Q: What are provincial amounts?

A: Provincial amounts refer to certain tax credits or deductions that can be transferred from your spouse or common-law partner to reduce your taxes owed.

Q: Why would I need to use Form 5008-S2?

A: You would need to use Form 5008-S2 if your spouse or common-law partner has provincial amounts that they are transferring to you for tax purposes.