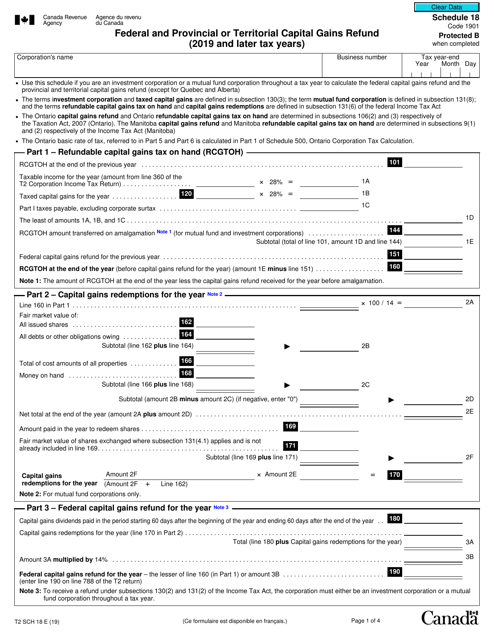

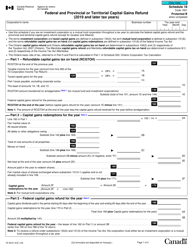

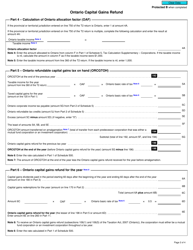

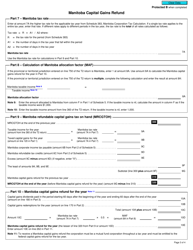

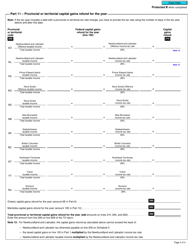

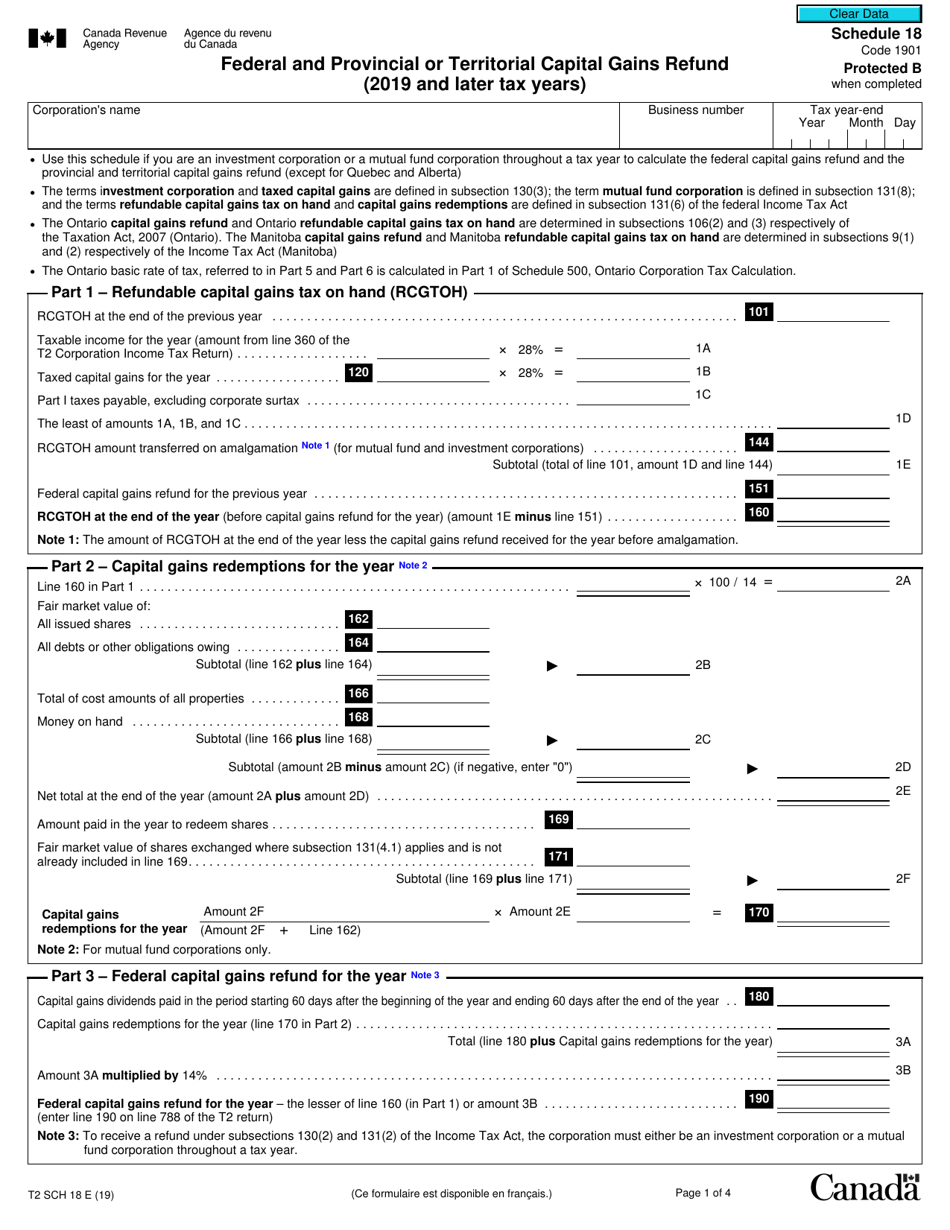

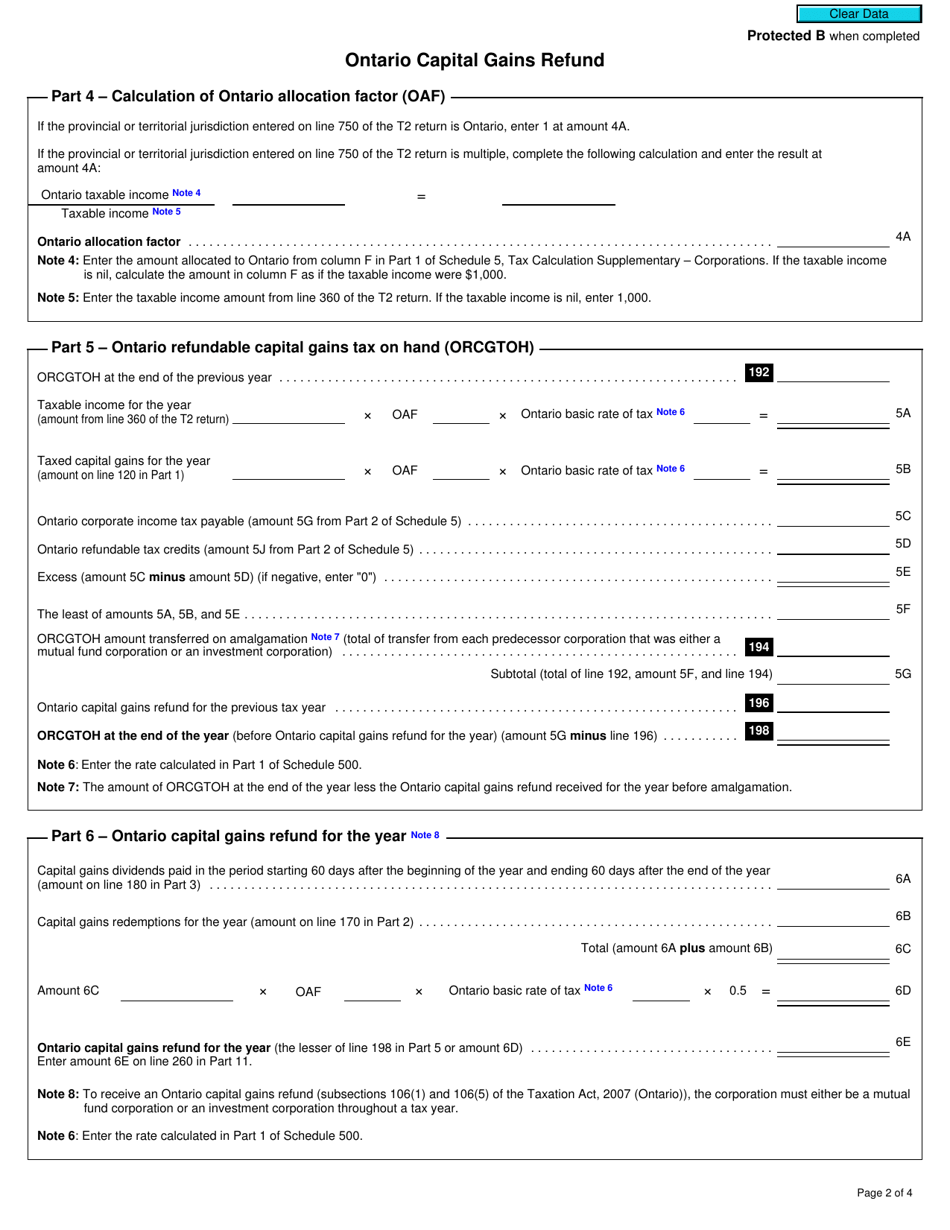

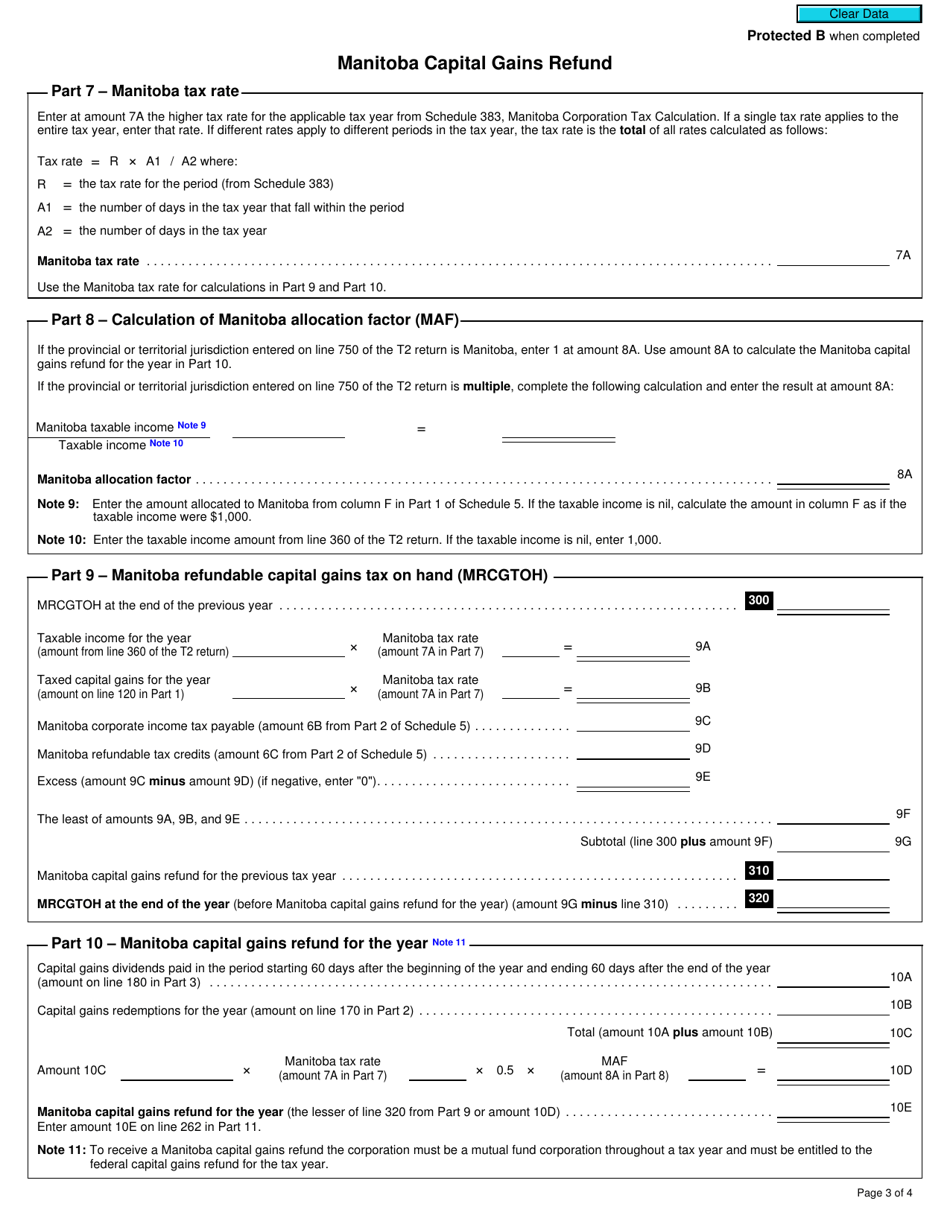

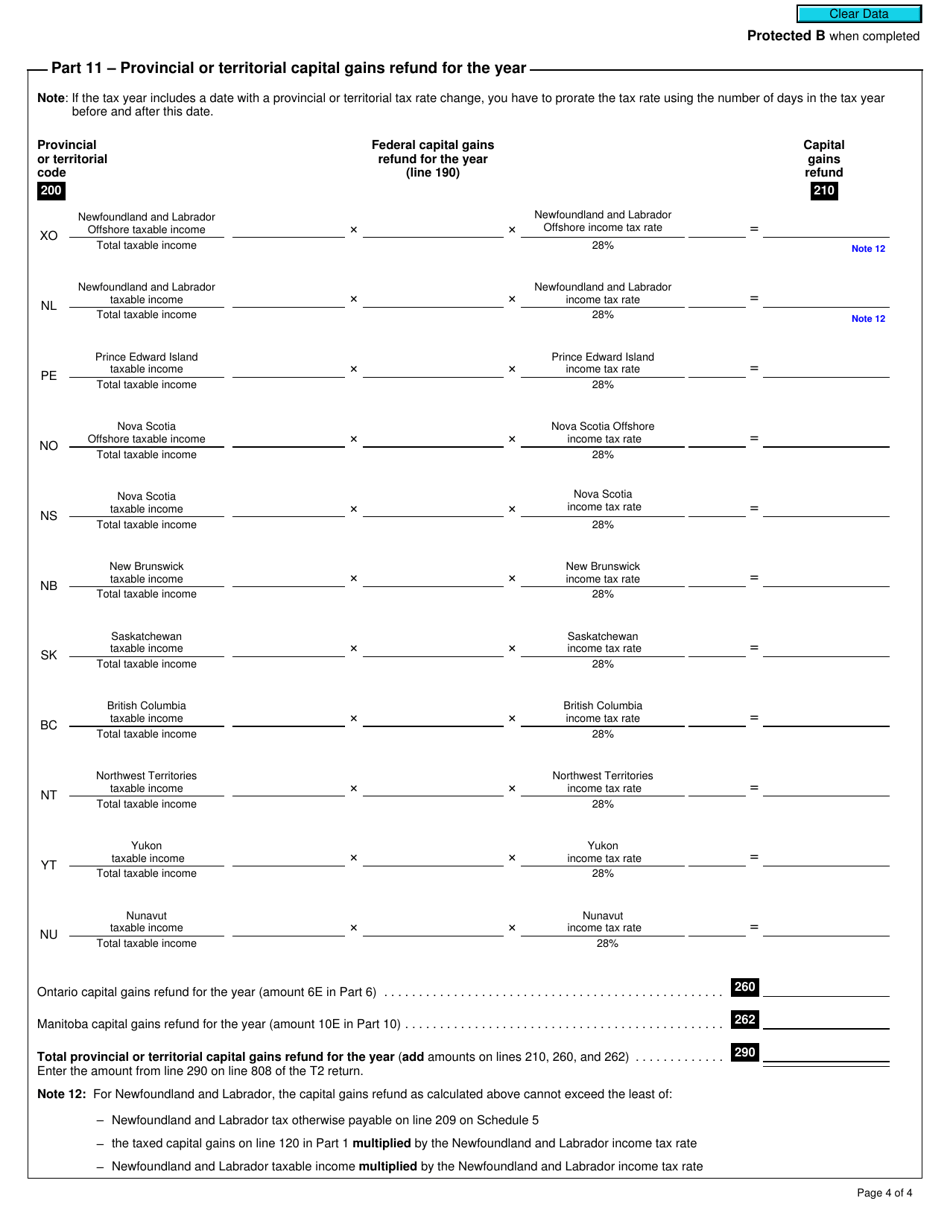

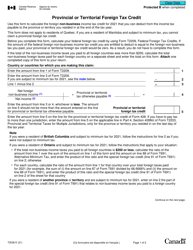

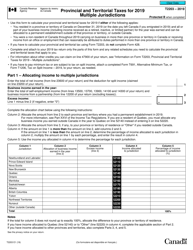

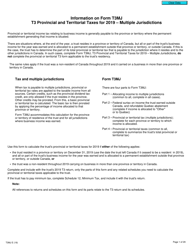

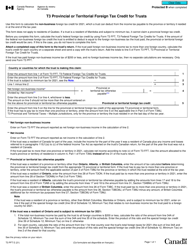

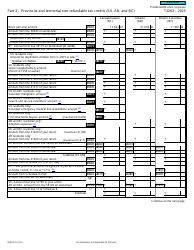

Form T2 Schedule 18 Federal and Provincial or Territorial Capital Gains Refund (2019 and Later Tax Years) - Canada

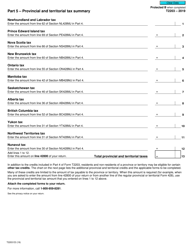

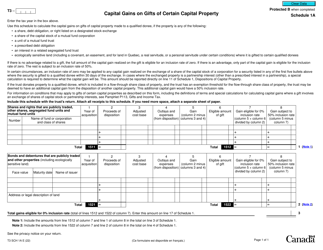

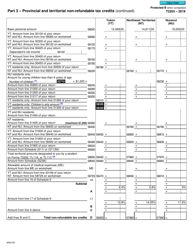

Form T2 Schedule 18 in Canada is used to claim a federal and provincial or territorial capital gains refund for the tax years 2019 and later. This form is used by corporations to calculate and apply for a refund of the federal and provincial or territorial taxes paid on capital gains.

The Form T2 Schedule 18 Federal and Provincial or Territorial Capital Gains Refund is filed by corporations in Canada.

Form T2 Schedule 18 Federal and Provincial or Territorial Capital Gains Refund (2019 and Later Tax Years) - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T2 Schedule 18?

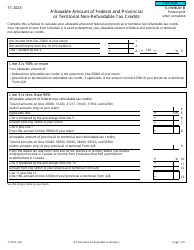

A: Form T2 Schedule 18 is a tax form in Canada used to calculate the federal and provincial or territorial capital gains refund for tax years 2019 and later.

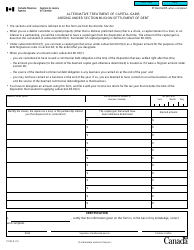

Q: What is a capital gains refund?

A: A capital gains refund is a refund given to taxpayers who have realized capital gains and paid taxes on those gains.

Q: Who needs to file Form T2 Schedule 18?

A: Corporations in Canada who need to calculate their federal and provincial or territorial capital gains refund for tax years 2019 and later need to file Form T2 Schedule 18.

Q: How do I fill out Form T2 Schedule 18?

A: To fill out Form T2 Schedule 18, you need to provide information about your corporation, its capital gains, and calculate the refund amount using the provided formulas.

Q: When is the deadline to file Form T2 Schedule 18?

A: The deadline to file Form T2 Schedule 18 is generally within six months after the end of the corporation's tax year.

Q: Is Form T2 Schedule 18 applicable for personal income tax?

A: No, Form T2 Schedule 18 is applicable only for corporate income tax in Canada.

Q: What are the consequences of not filing Form T2 Schedule 18?

A: Failure to file Form T2 Schedule 18 or providing false information may result in penalties and interest charges.

Q: Can I e-file Form T2 Schedule 18?

A: As of now, e-filing is not available for Form T2 Schedule 18. You need to mail a printed copy to the CRA.