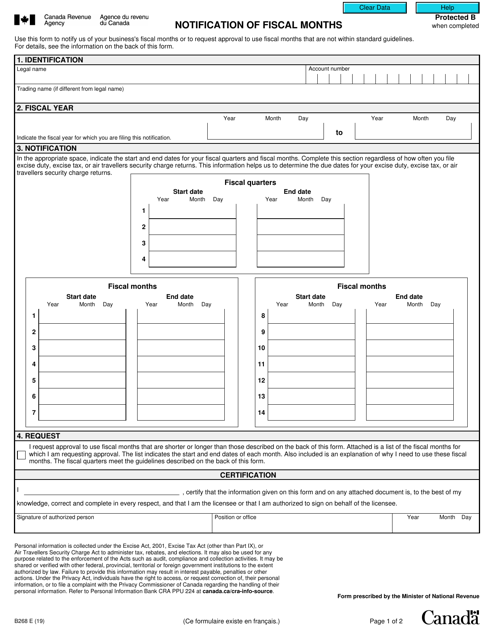

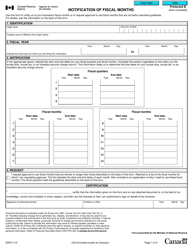

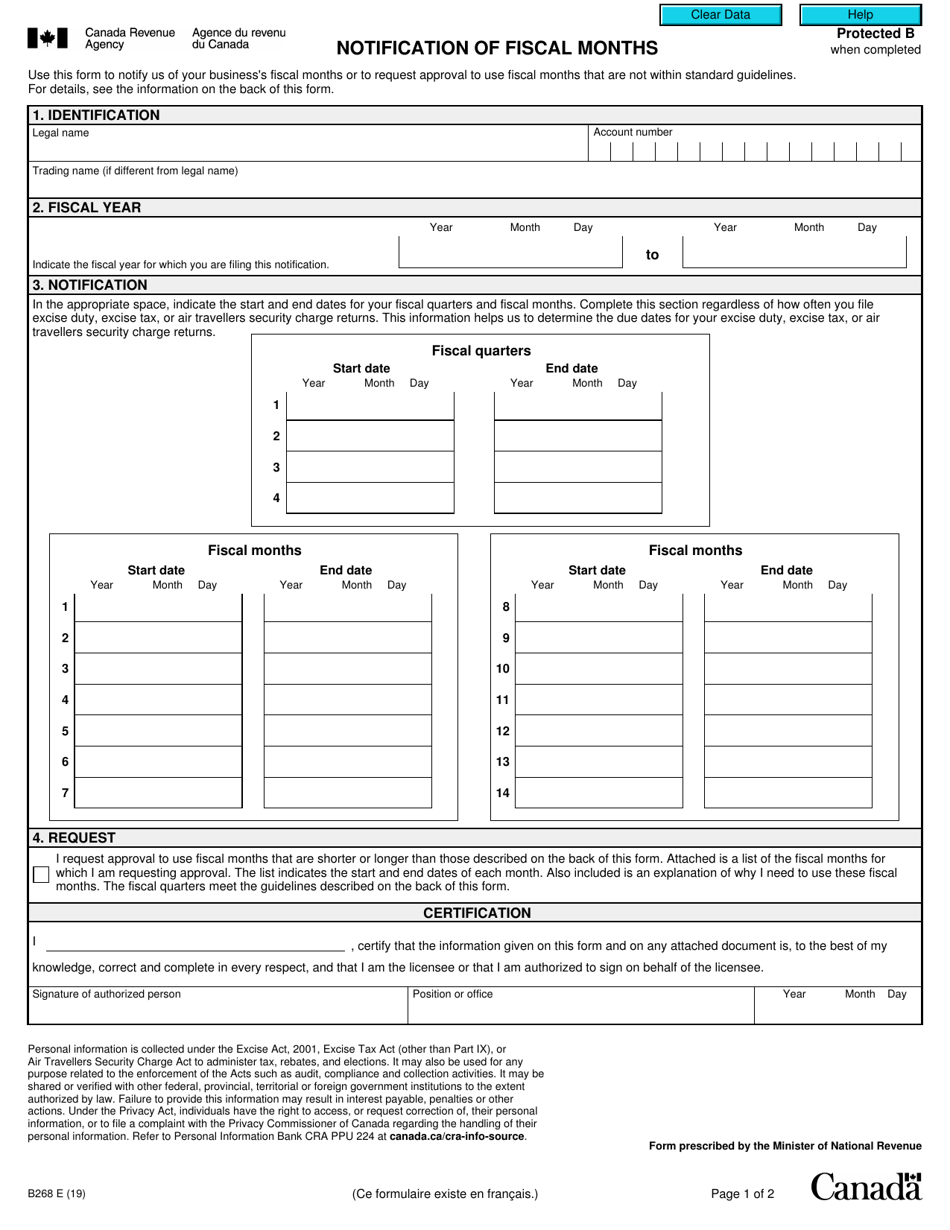

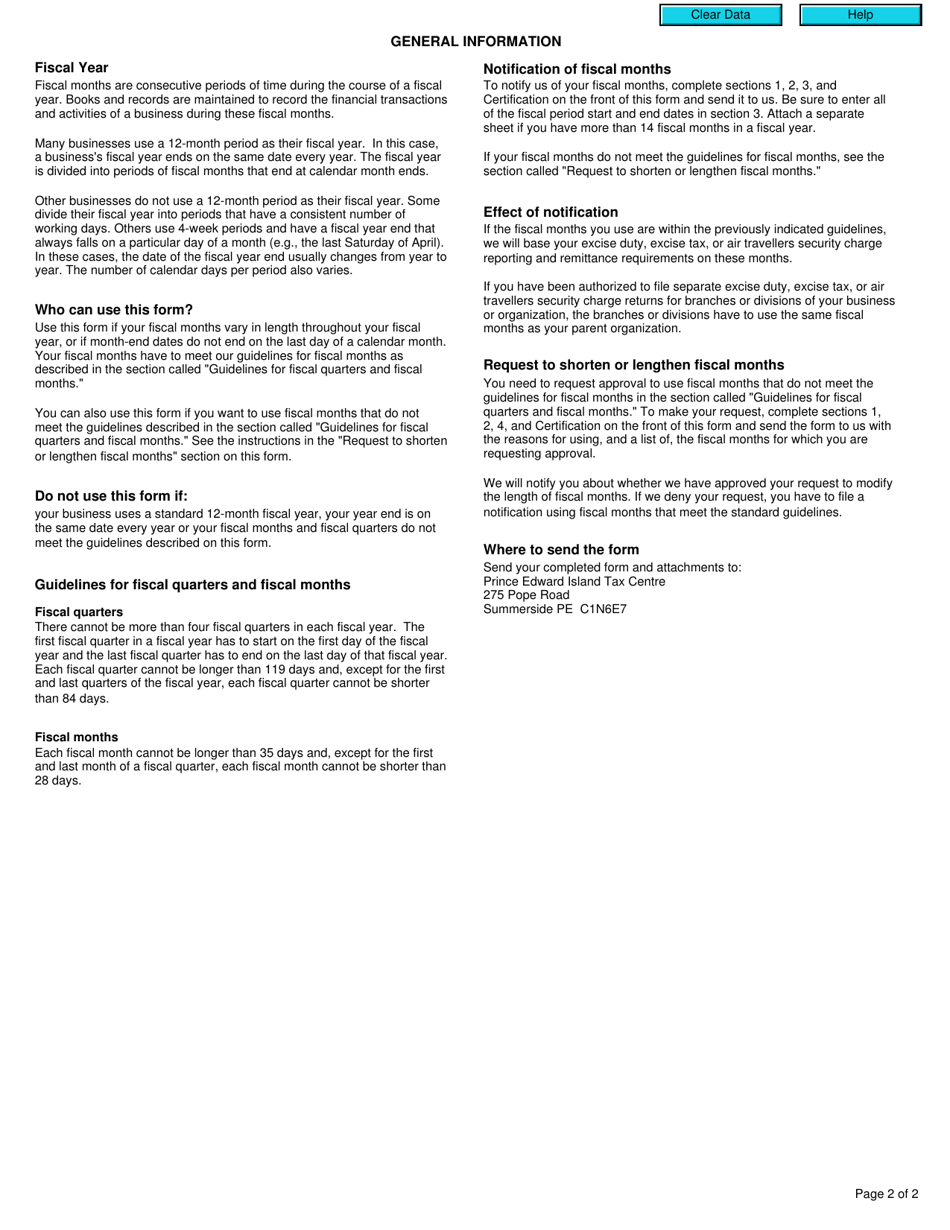

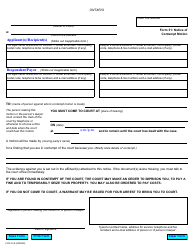

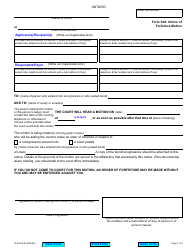

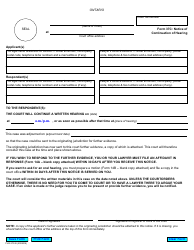

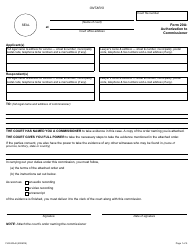

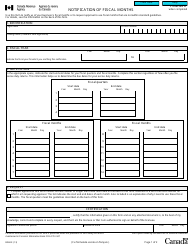

Form B268 Notification of Fiscal Months - Canada

Form B268 - Notification of Fiscal Months is used in Canada to notify the Canada Revenue Agency (CRA) about a change in the fiscal year-end of a corporation. It is typically filed when a corporation wants to change its fiscal year-end date. This form helps the CRA keep track of corporations' financial reporting periods for tax purposes.

Form B268 Notification of Fiscal Months - Canada - Frequently Asked Questions (FAQ)

Q: What is Form B268?

A: Form B268 is a notification form used in Canada to report the fiscal months of a business.

Q: Why is Form B268 required?

A: Form B268 is required to inform the Canada Revenue Agency (CRA) about the fiscal months of a business.

Q: Who needs to fill out Form B268?

A: Businesses in Canada that have a fiscal year that does not align with the calendar year need to fill out Form B268.

Q: What happens if I don't file Form B268?

A: Failing to file Form B268 can result in penalties or fines imposed by the CRA.

Q: Is Form B268 only for businesses?

A: Yes, Form B268 is specifically for businesses in Canada that have a fiscal year different than the calendar year.

Q: Are there any fees for filing Form B268?

A: No, there are no fees for filing Form B268. It is a free form provided by the CRA.

Q: Can I request an extension to file Form B268?

A: No, there is no provision for requesting an extension to file Form B268. It must be filed within the specified deadline.