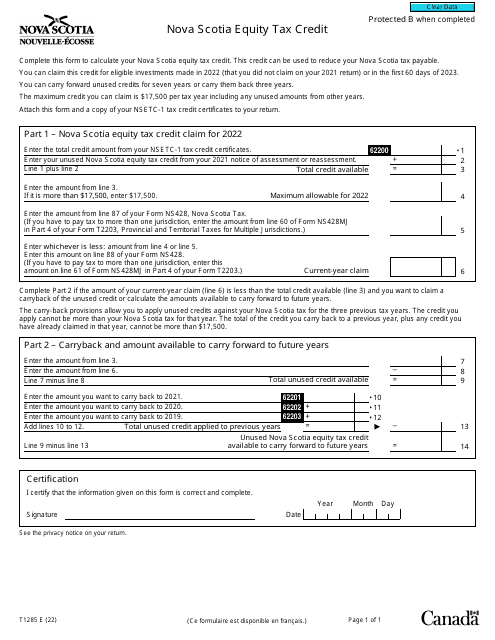

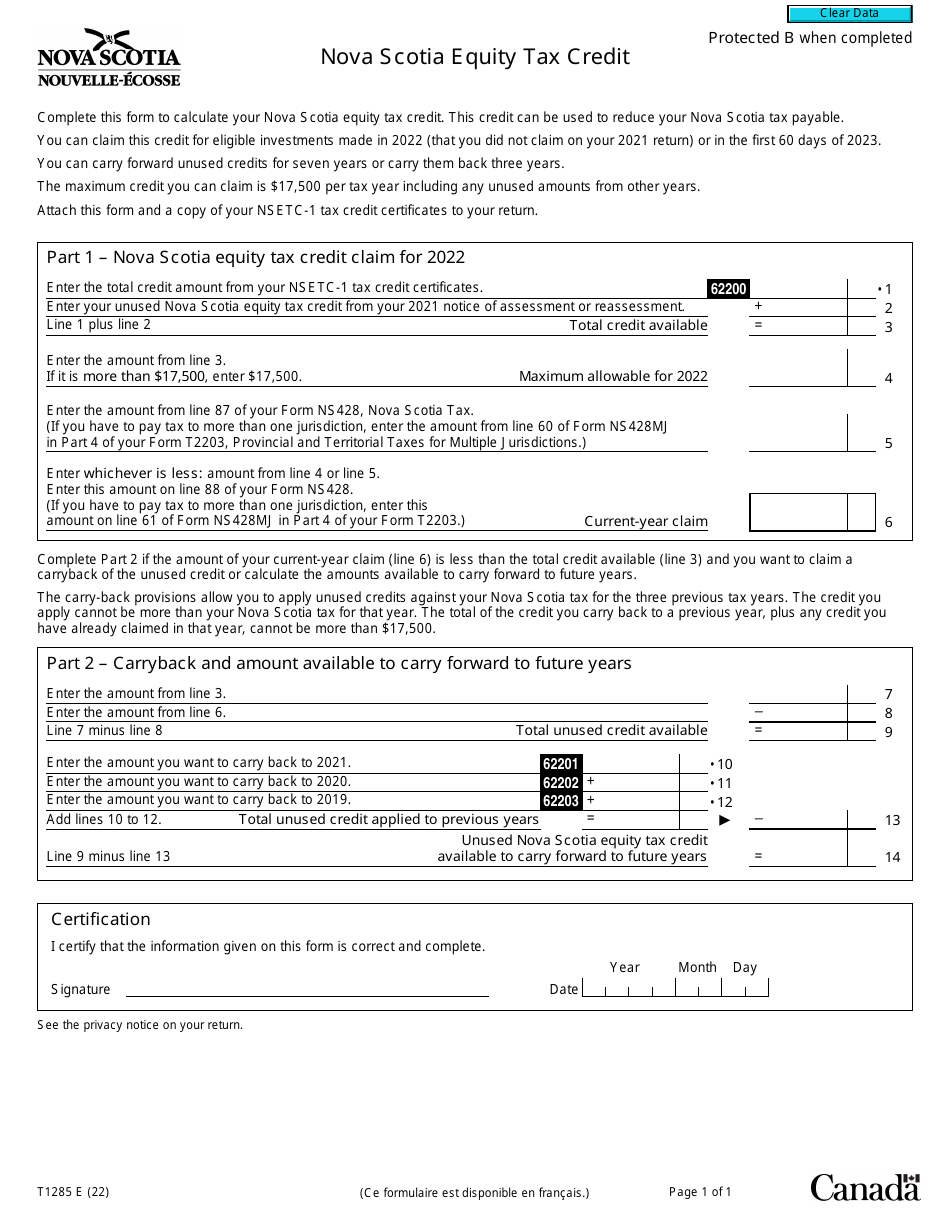

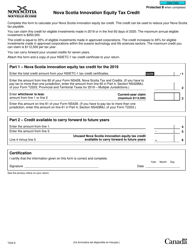

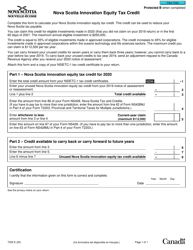

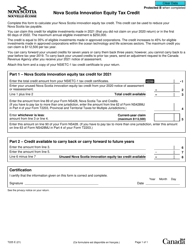

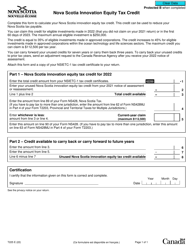

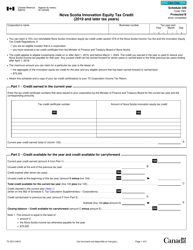

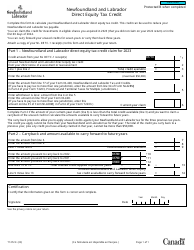

Form T1285 Nova Scotia Equity Tax Credit - Canada

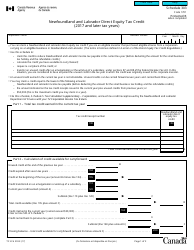

Form T1285 Nova Scotia Equity Tax Credit is a form used in Canada to claim the equity tax credit specifically for residents of Nova Scotia. It provides a credit for investments made in eligible small businesses that are designated by the government of Nova Scotia. This tax credit encourages investment in local businesses and helps to foster economic growth in the province.

The Form T1285 Nova Scotia Equity Tax Credit is filed by individuals or corporations who are eligible for the tax credit in Nova Scotia, Canada.

Form T1285 Nova Scotia Equity Tax Credit - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T1285 Nova Scotia Equity Tax Credit?

A: Form T1285 Nova Scotia Equity Tax Credit is a tax form used by residents of Nova Scotia, Canada to claim the equity tax credit.

Q: Who can claim the Nova Scotia Equity Tax Credit?

A: Residents of Nova Scotia who meet the eligibility criteria can claim the Nova Scotia Equity Tax Credit.

Q: What is the purpose of the Nova Scotia Equity Tax Credit?

A: The purpose of the Nova Scotia Equity Tax Credit is to provide tax relief to individuals who invest in eligible equity investments in Nova Scotia.

Q: What are eligible equity investments for the Nova Scotia Equity Tax Credit?

A: Eligible equity investments for the Nova Scotia Equity Tax Credit include investments in eligible small businesses and community economic development investment funds.

Q: What is the amount of the Nova Scotia Equity Tax Credit?

A: The amount of the Nova Scotia Equity Tax Credit is 35% of the eligible investment, up to a maximum of $10,000 per year.

Q: How do I claim the Nova Scotia Equity Tax Credit?

A: To claim the Nova Scotia Equity Tax Credit, you need to complete Form T1285 and include it with your income tax return.

Q: Are there any special rules or restrictions for the Nova Scotia Equity Tax Credit?

A: Yes, there are certain rules and restrictions, such as a minimum investment amount and a requirement to hold the investment for a certain period of time. It is recommended to consult the official guidelines or seek professional tax advice.

Q: Can I claim the Nova Scotia Equity Tax Credit if I am not a resident of Nova Scotia?

A: No, the Nova Scotia Equity Tax Credit is only available to residents of Nova Scotia.

Q: Is the Nova Scotia Equity Tax Credit refundable?

A: No, the Nova Scotia Equity Tax Credit is non-refundable, meaning it can only be used to reduce your tax payable.