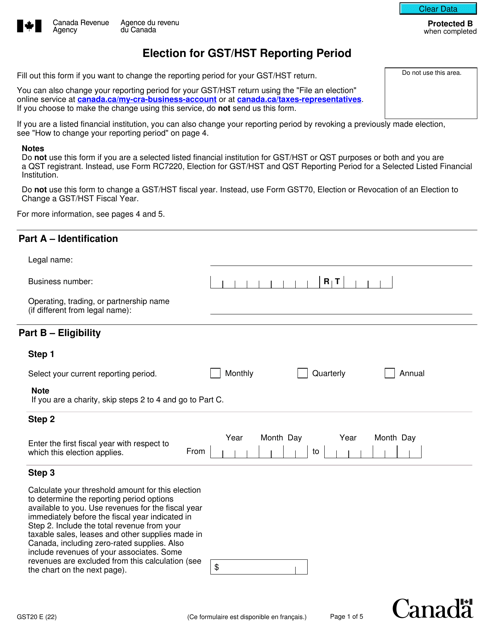

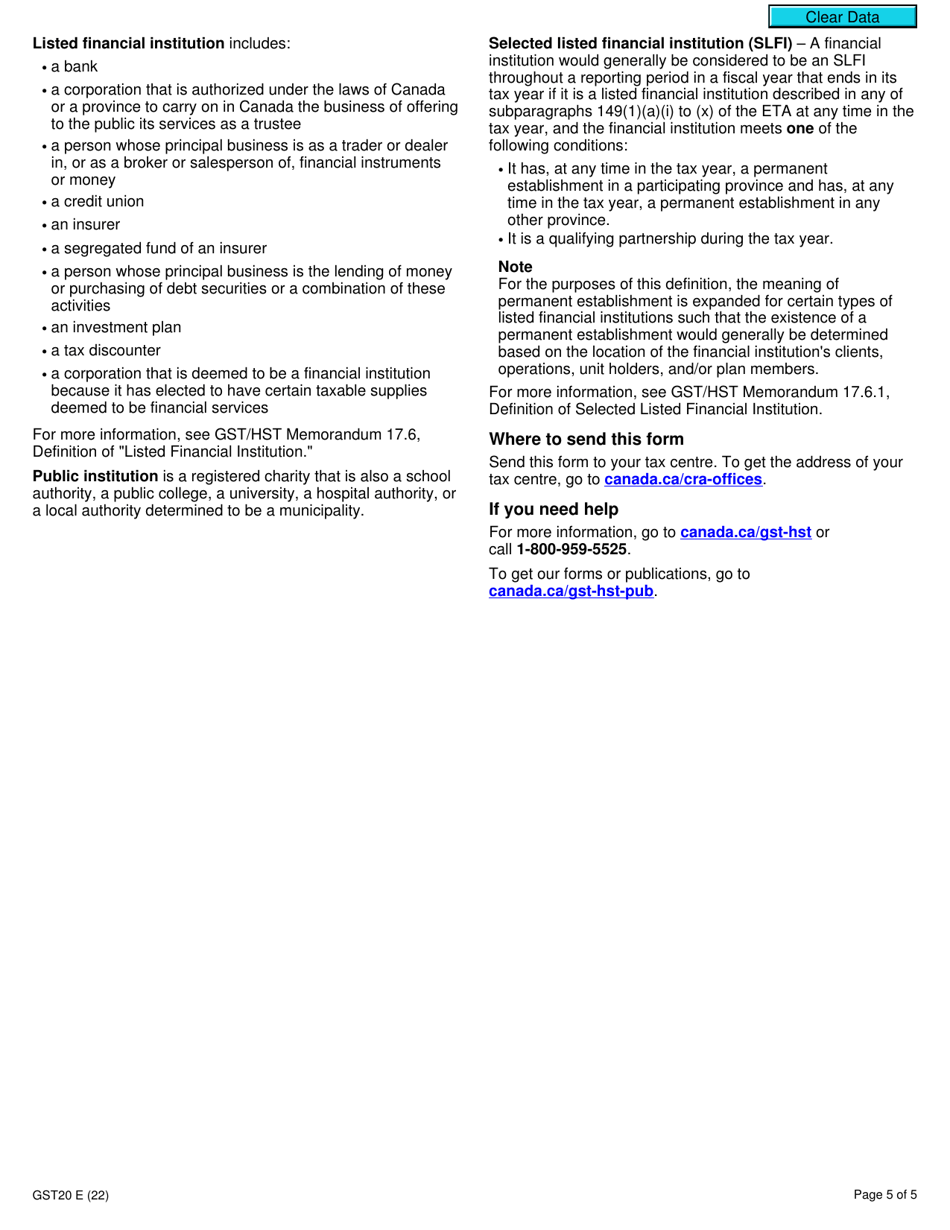

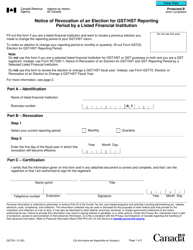

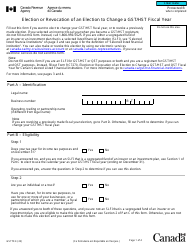

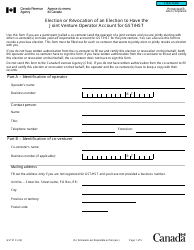

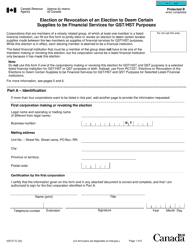

Form GST20 Election for Gst / Hst Reporting Period - Canada

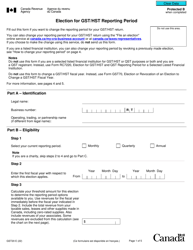

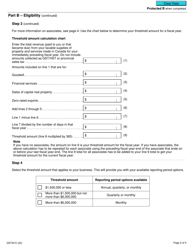

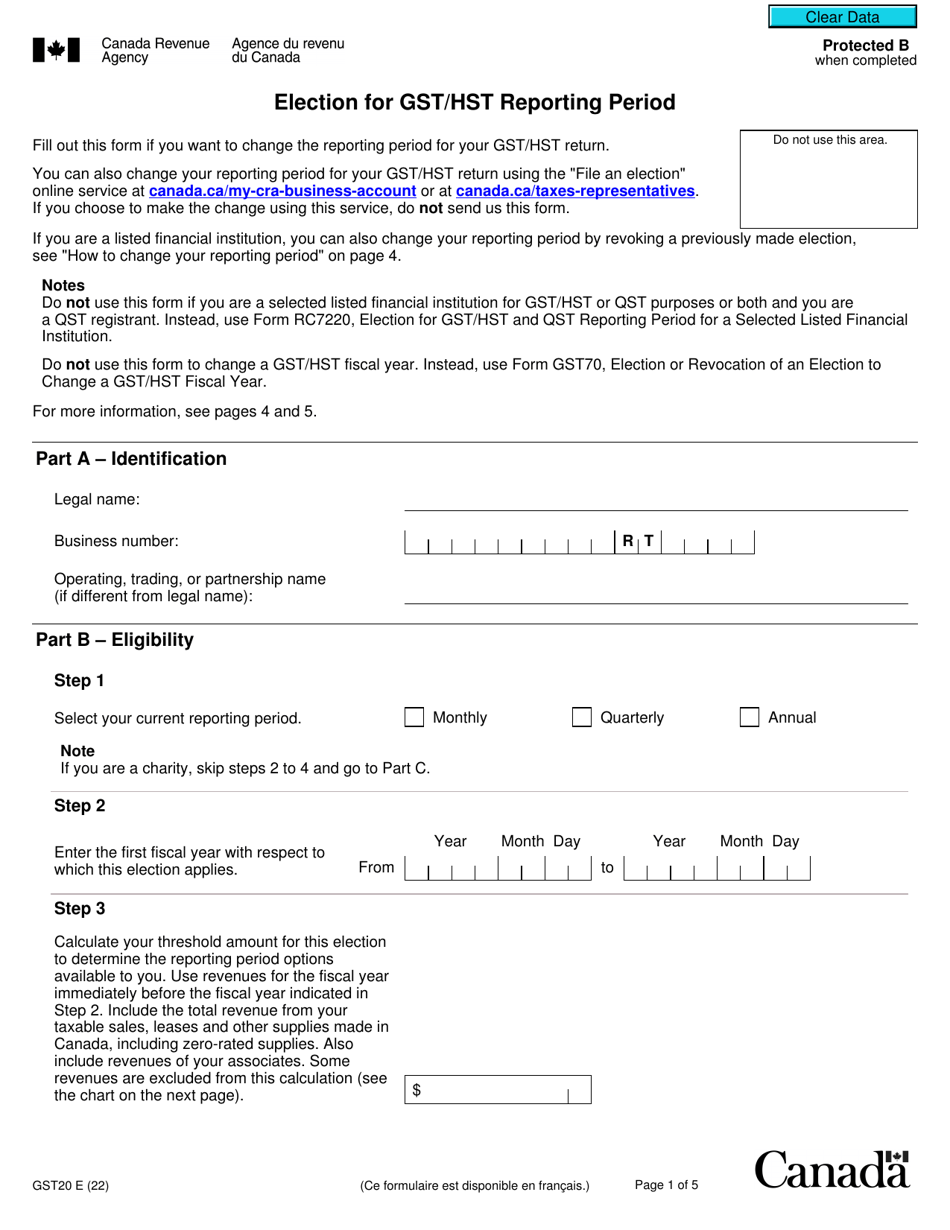

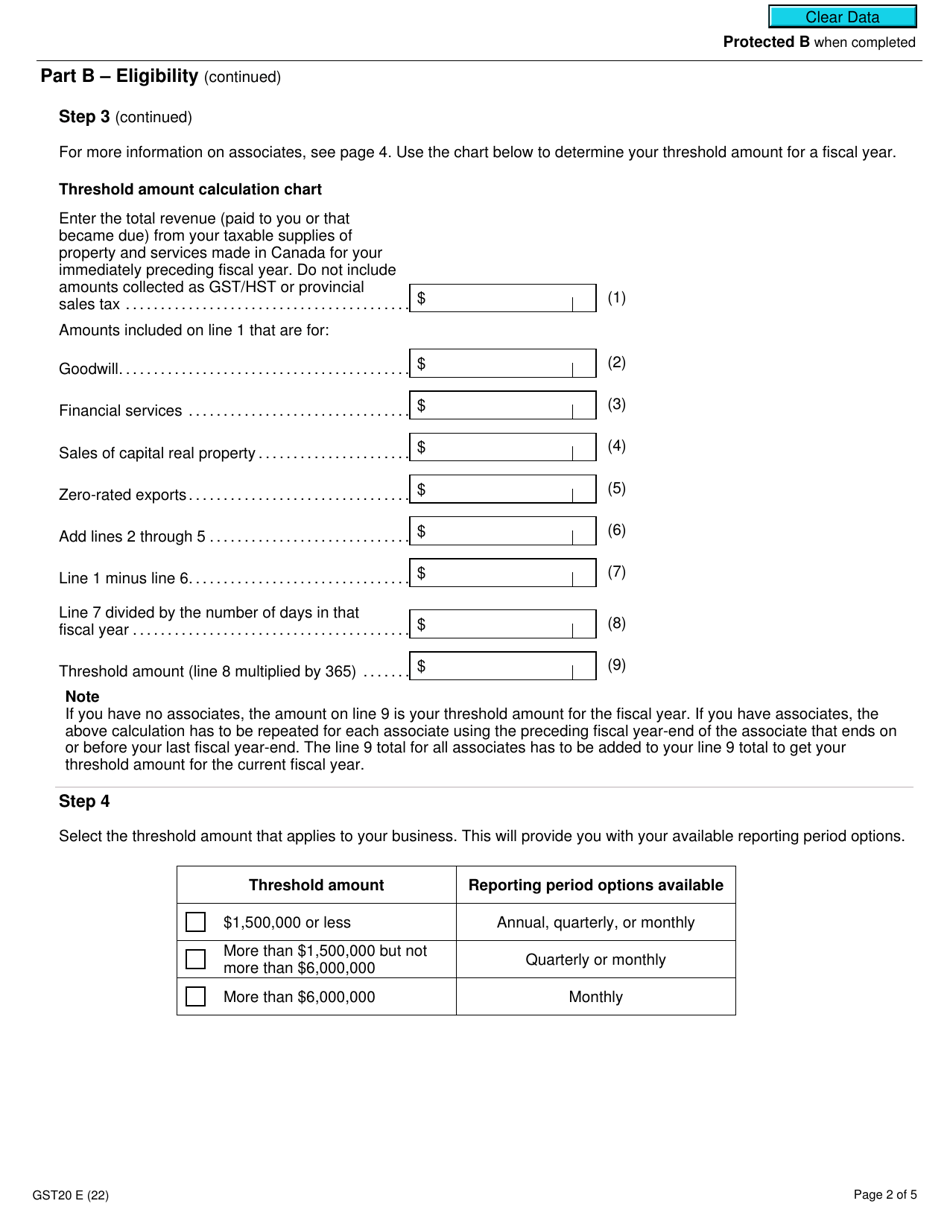

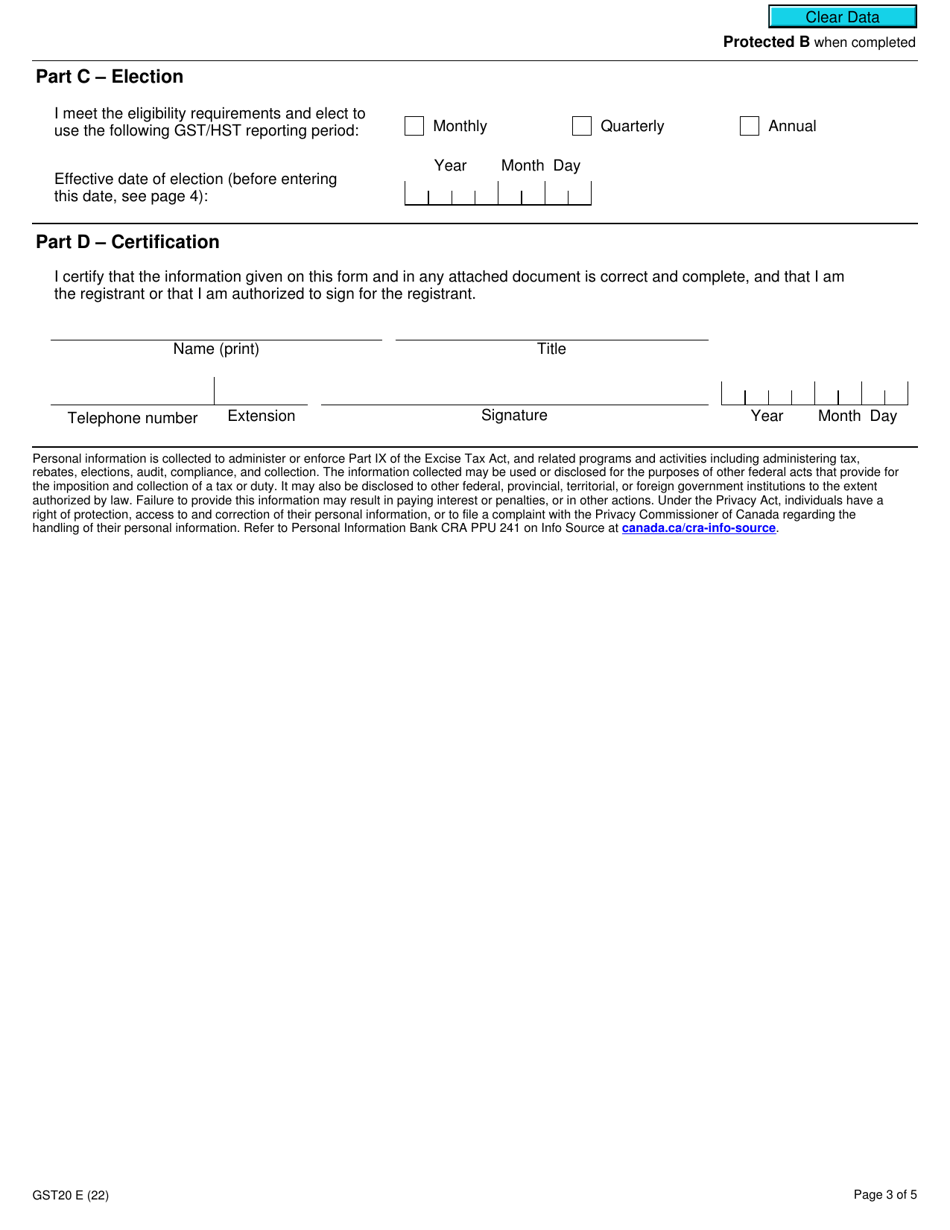

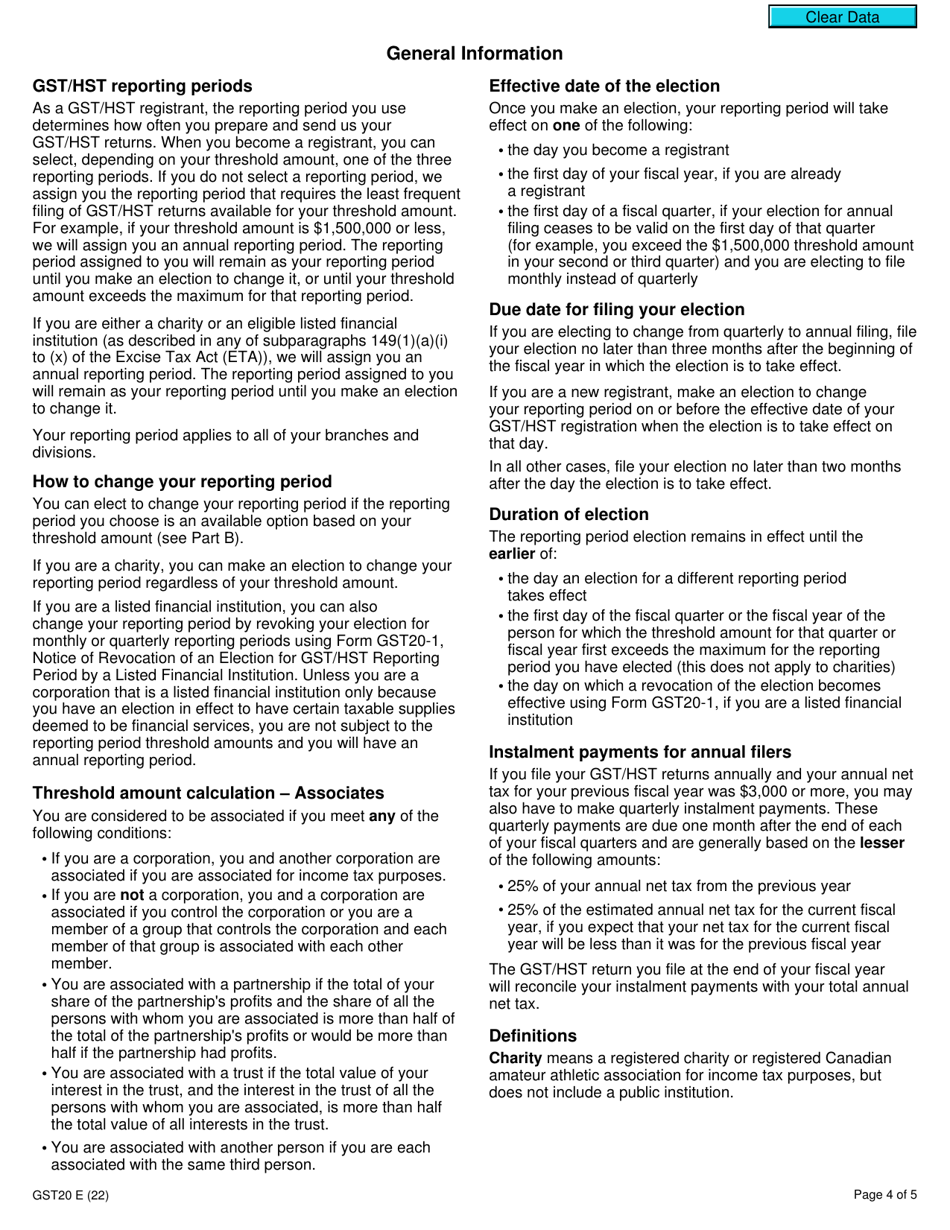

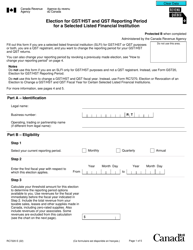

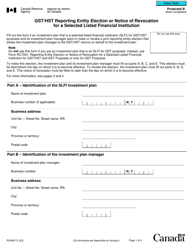

Form GST20 Election for GST/HST Reporting Period in Canada is used by businesses to elect or change their reporting period for the Goods and Services Tax/Harmonized Sales Tax (GST/HST). Businesses can choose to report and remit GST/HST on an annual, quarterly, or monthly basis. This form allows businesses to make the election or change their reporting period.

The Form GST20 Election for GST/HST Reporting Period in Canada is filed by the taxpayer or the authorized representative of the taxpayer.

Form GST20 Election for Gst/Hst Reporting Period - Canada - Frequently Asked Questions (FAQ)

Q: What is Form GST20?

A: Form GST20 is the Election for GST/HST Reporting Period in Canada.

Q: What is the purpose of Form GST20?

A: The purpose of Form GST20 is to elect a specific GST/HST reporting period.

Q: Who needs to fill out Form GST20?

A: Businesses registered for GST/HST in Canada need to fill out Form GST20.

Q: Is there a deadline for submitting Form GST20?

A: Yes, the deadline for submitting Form GST20 is 90 days before the start of the GST/HST reporting period.