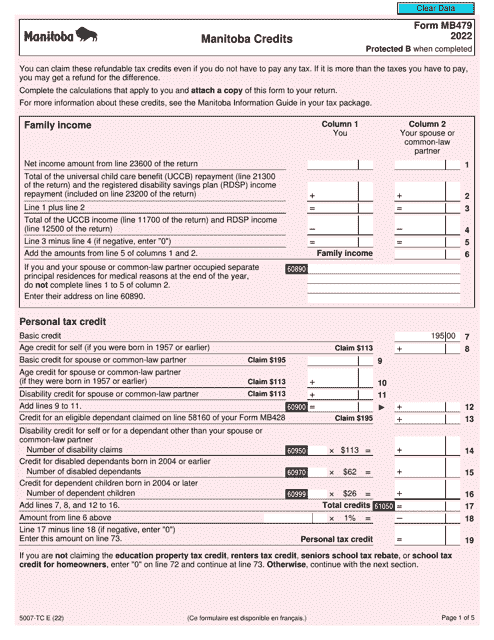

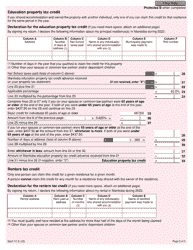

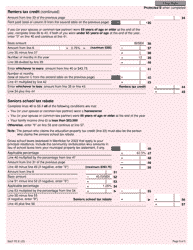

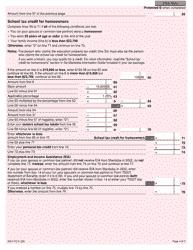

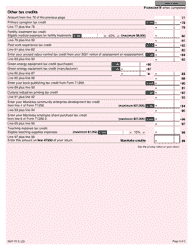

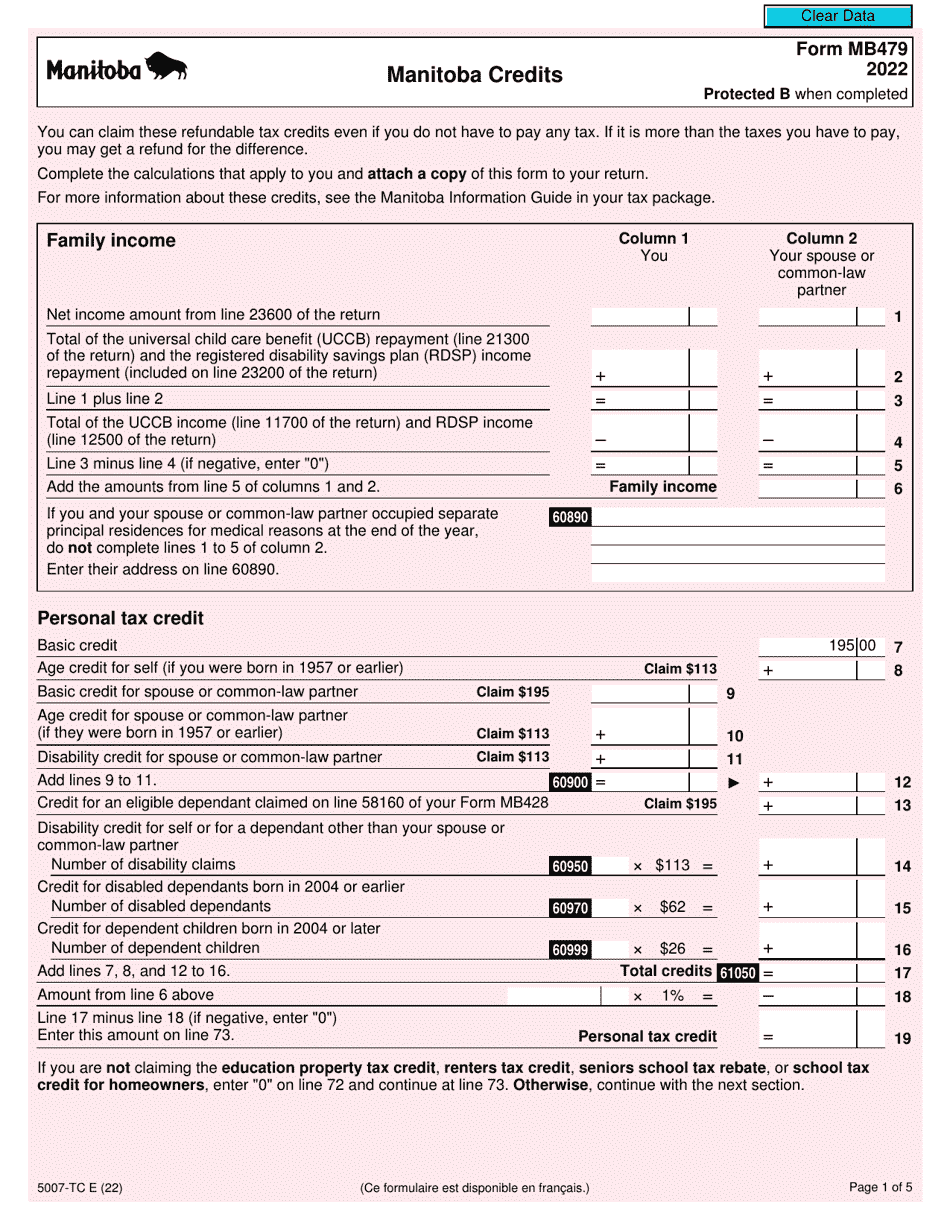

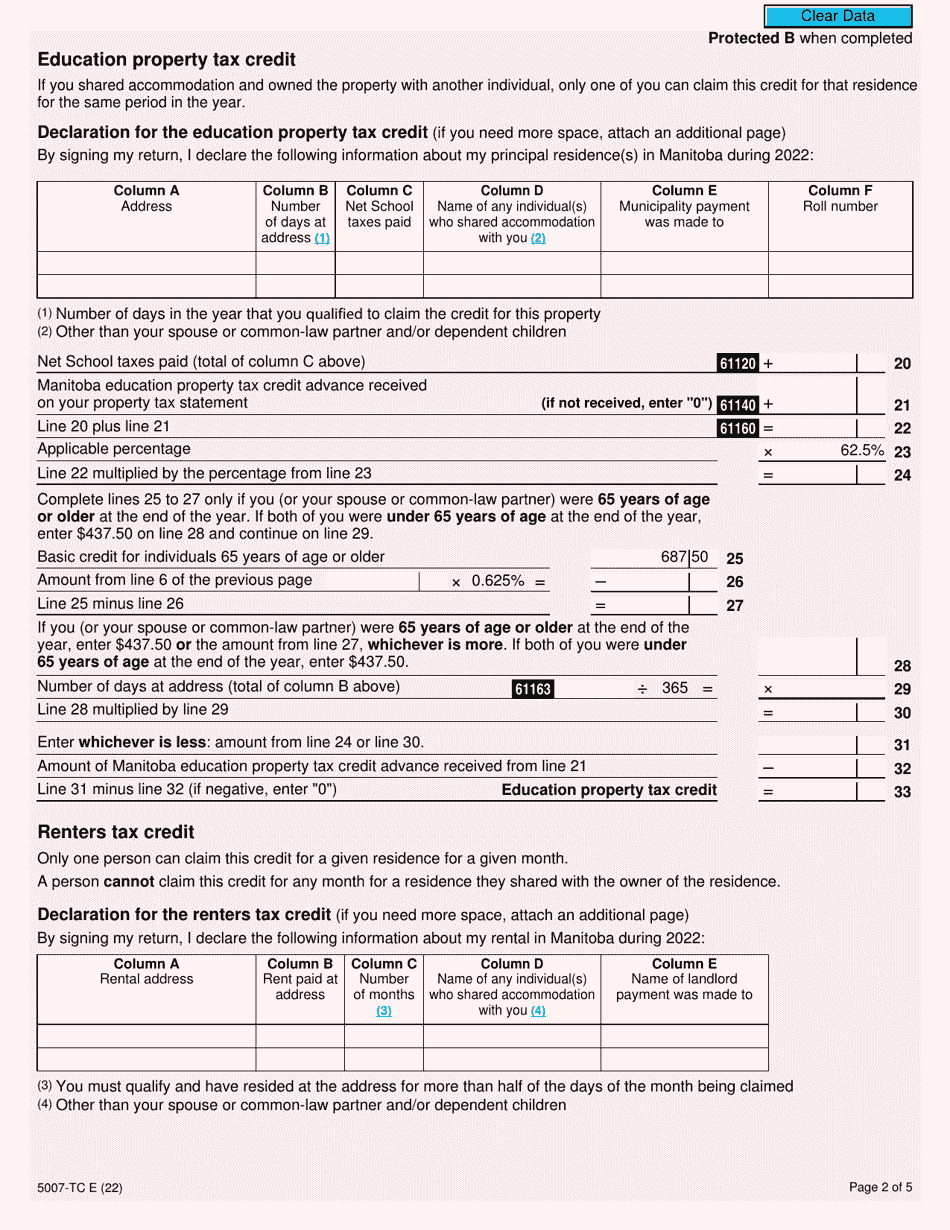

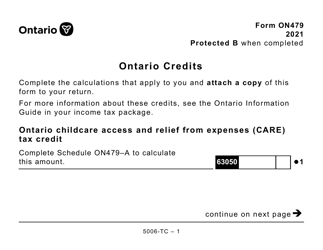

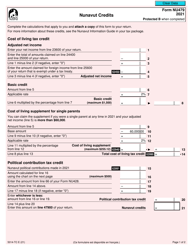

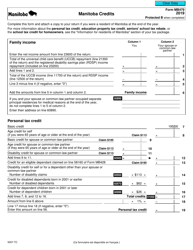

Form 5007-TC (MB479) Manitoba Credits - Canada

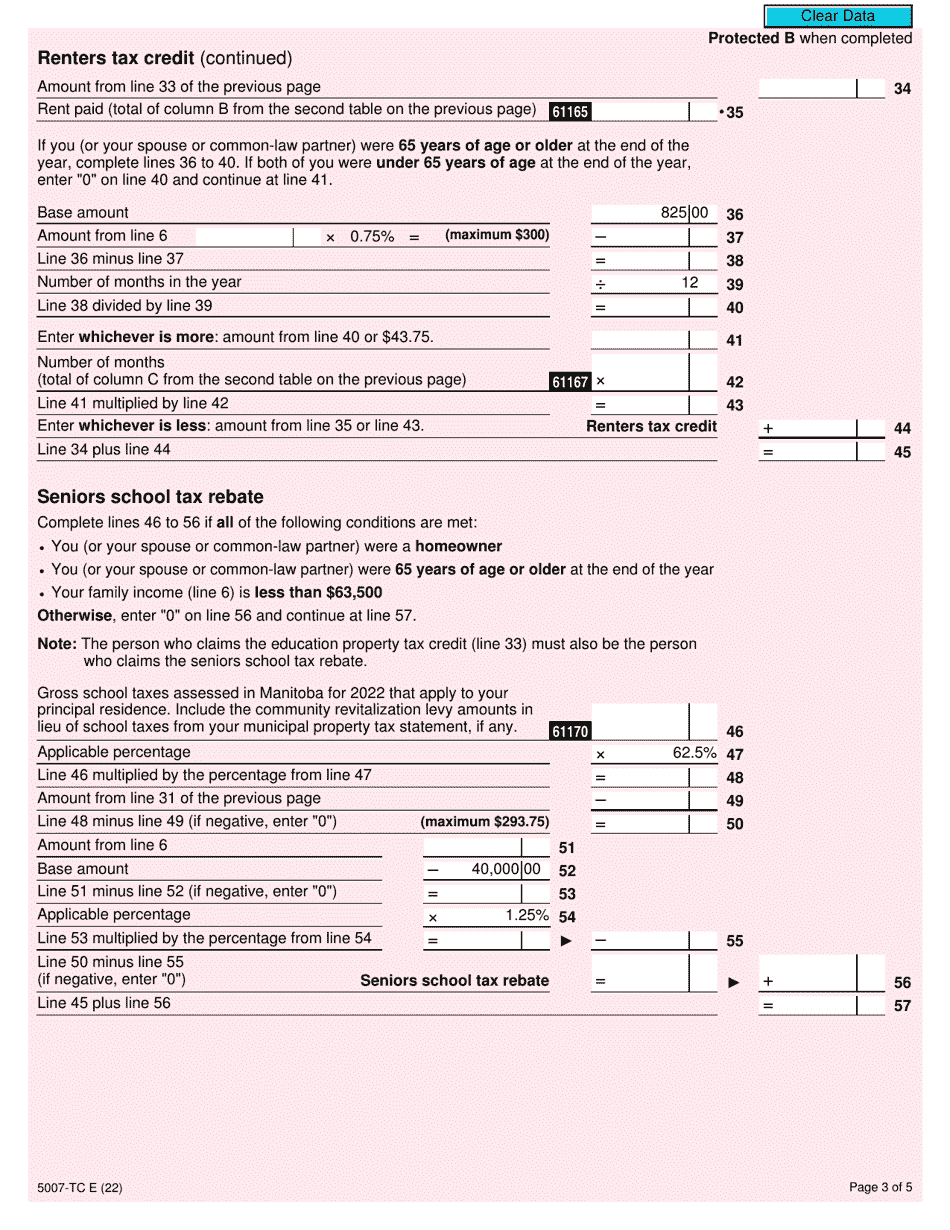

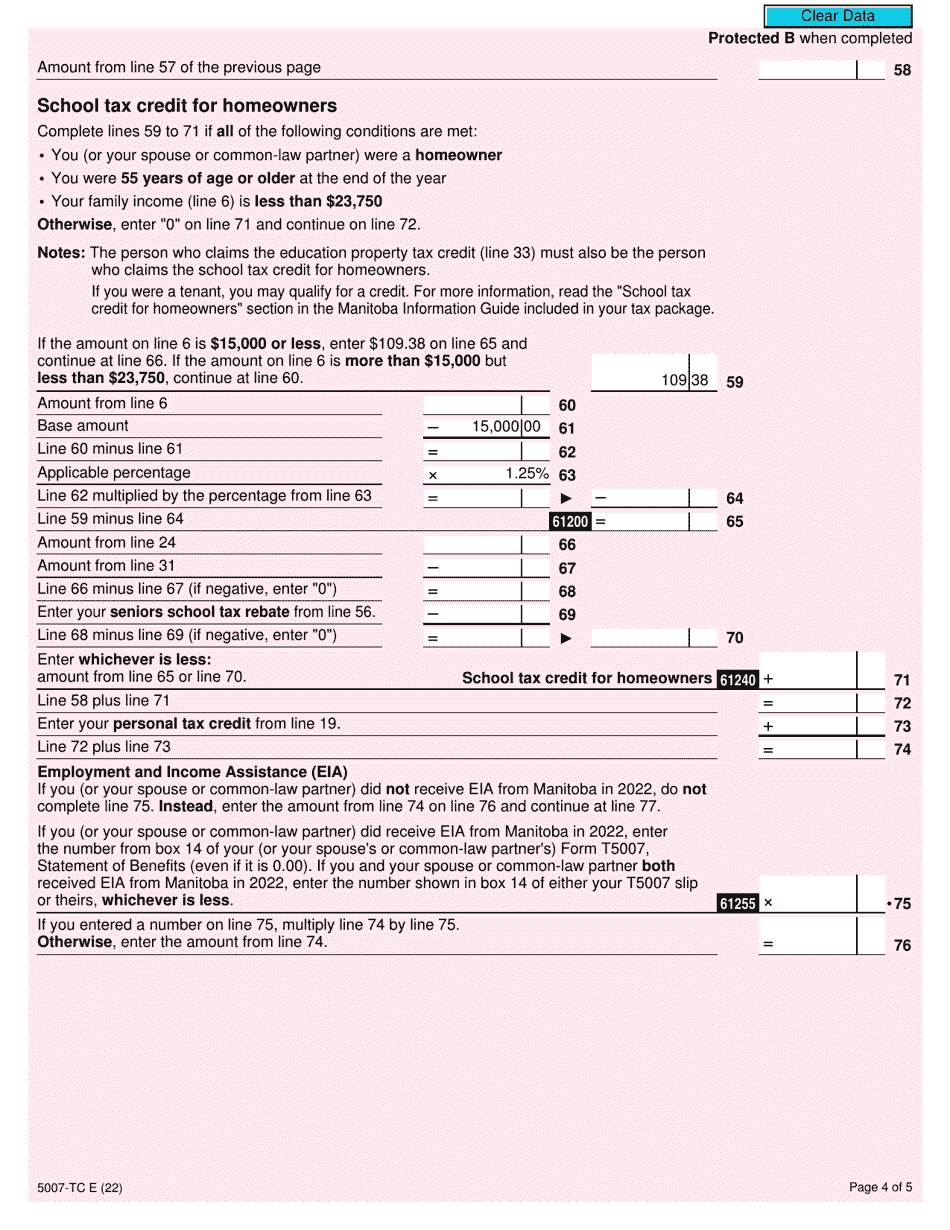

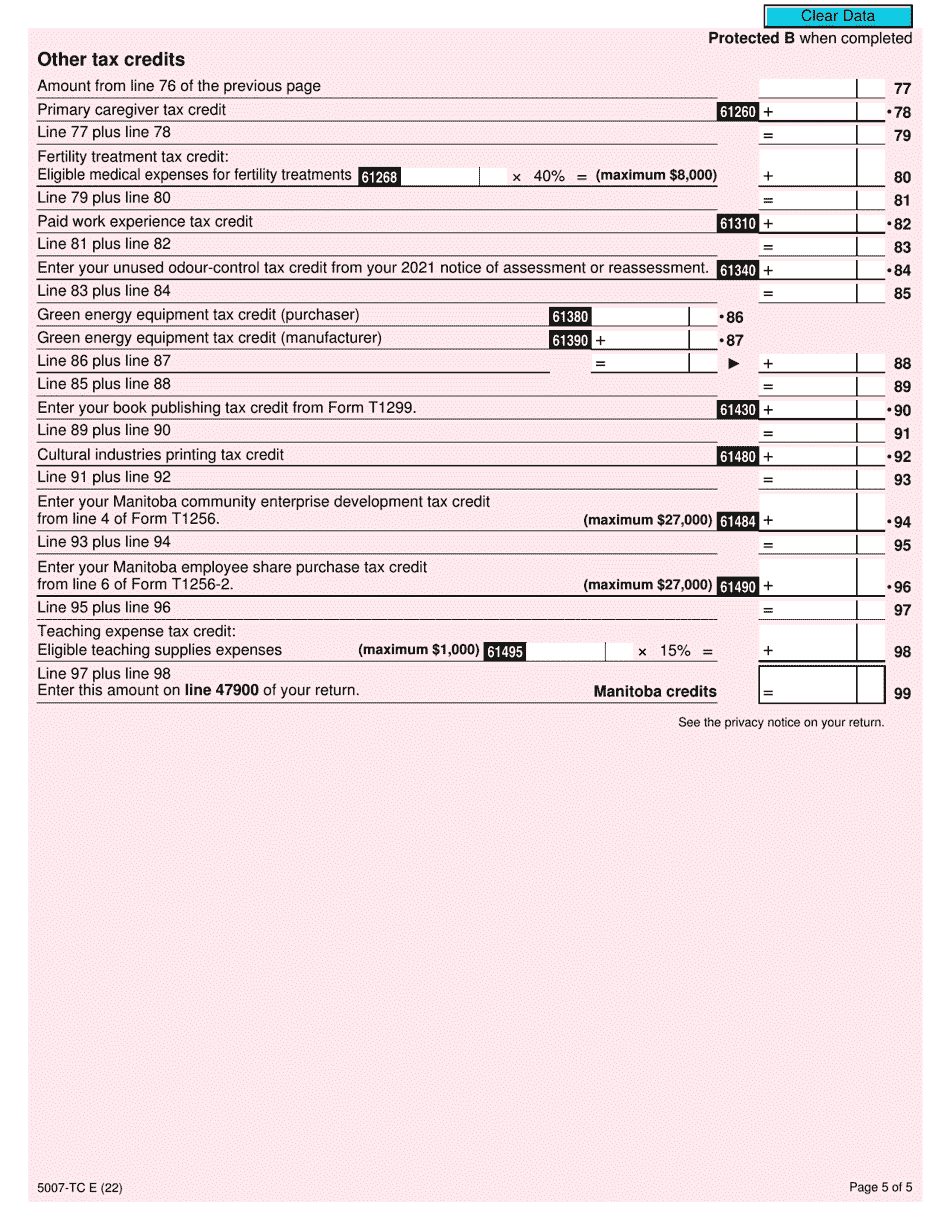

Form 5007-TC (MB479) is used to claim Manitoba tax credits on your Canadian tax return. It allows residents of Manitoba to claim various tax credits and deductions specific to the province.

Form 5007-TC (MB479) Manitoba Credits - Canada - Frequently Asked Questions (FAQ)

Q: What is Form 5007-TC?

A: Form 5007-TC is a tax form used in Manitoba, Canada.

Q: What is MB479?

A: MB479 is another name for Form 5007-TC.

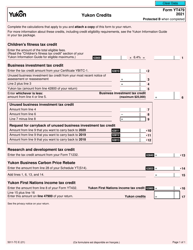

Q: What are Manitoba Credits?

A: Manitoba Credits are tax credits available to residents of Manitoba.

Q: Who needs to file Form 5007-TC?

A: Residents of Manitoba who want to claim Manitoba Credits need to file Form 5007-TC.

Q: What information do I need to complete Form 5007-TC?

A: You will need your personal information, as well as details about the Manitoba Credits you are claiming.

Q: When is the deadline to file Form 5007-TC?

A: The deadline to file Form 5007-TC is usually April 30th of the following year.

Q: Can I e-file Form 5007-TC?

A: Yes, you can e-file Form 5007-TC if you are using approved tax software that supports electronic filing.

Q: What should I do if I need help with Form 5007-TC?

A: If you need help with Form 5007-TC, you can contact the Manitoba Tax Assistance Office or consult a tax professional.