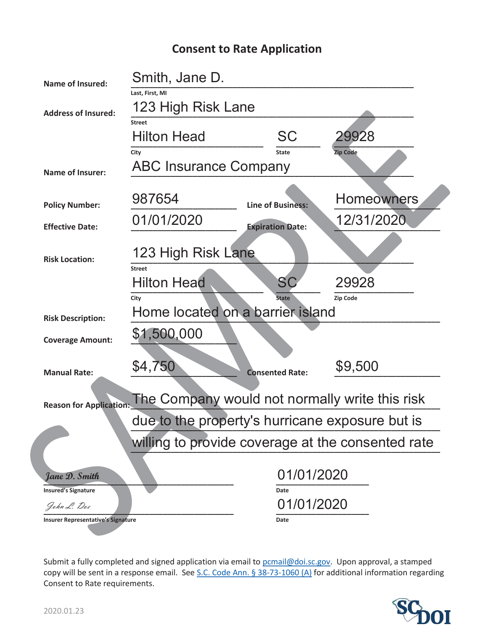

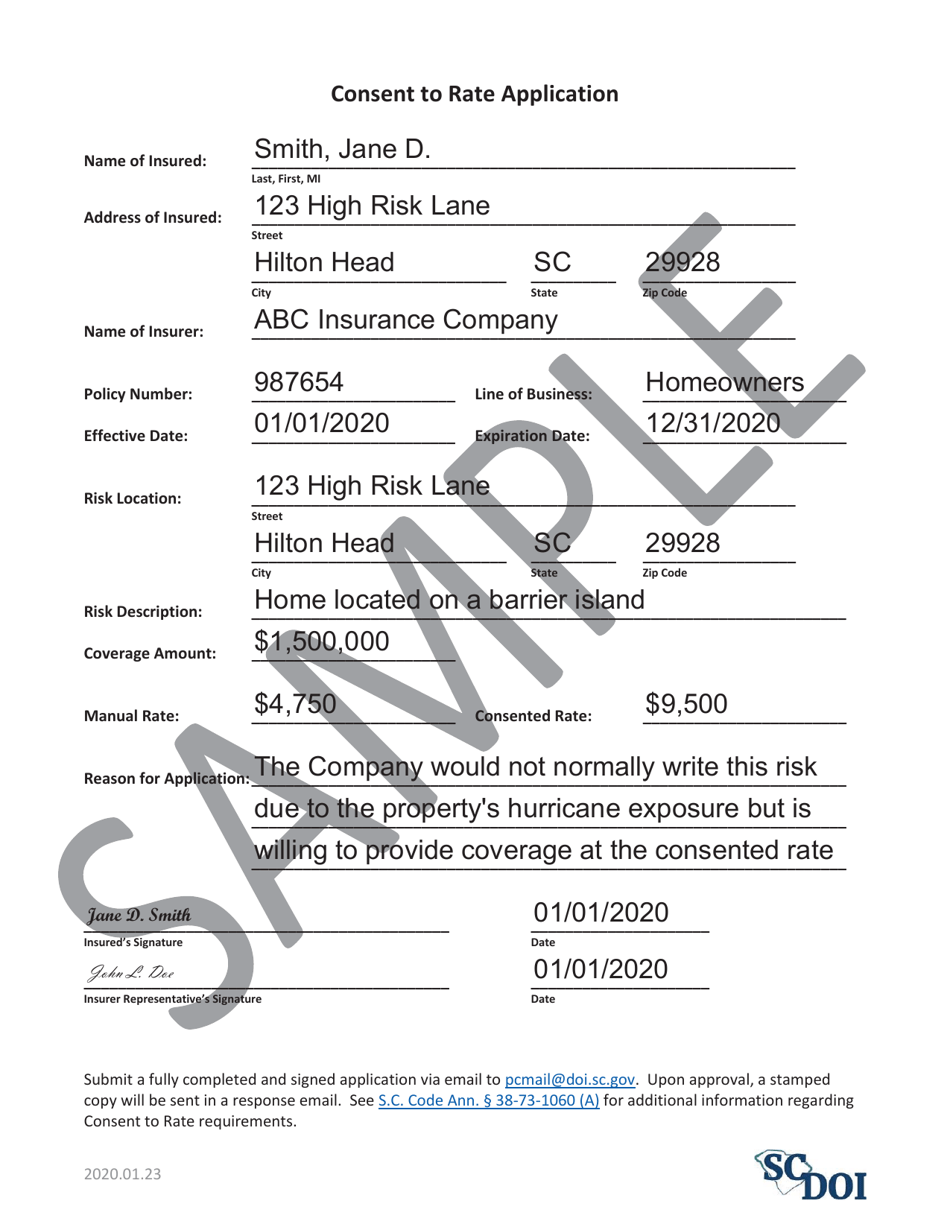

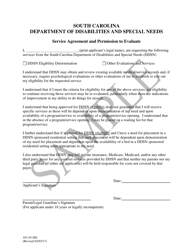

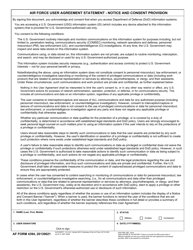

Sample Consent to Rate Application - South Carolina

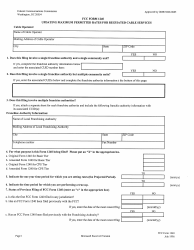

Consent to Rate Application is a legal document that was released by the South Carolina Department of Insurance - a government authority operating within South Carolina.

FAQ

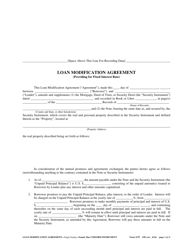

Q: What is a Sample Consent to Rate Application?A: A Sample Consent to Rate Application is a document that allows an insurer to request permission from the insured to charge rates that are higher than the rates approved by the state insurance department.

Q: What is the purpose of a Consent to Rate Application?A: The purpose of a Consent to Rate Application is to allow insurers to charge higher rates in cases where the insurance department has not approved their requested rates.

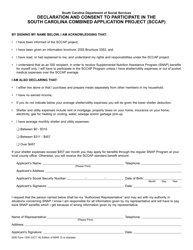

Q: Who needs to fill out a Consent to Rate Application?A: The insurer needs to fill out a Consent to Rate Application and obtain the insured's consent.

Q: Is a Consent to Rate Application required in South Carolina?A: Yes, a Consent to Rate Application is required in South Carolina for certain types of insurance policies.

Q: What types of insurance policies require a Consent to Rate Application in South Carolina?A: Certain property and casualty insurance policies, such as commercial policies and high-risk property insurance policies, may require a Consent to Rate Application in South Carolina.

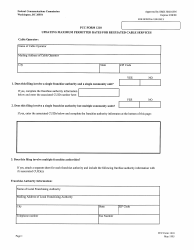

Q: How long does it take for the insurance department to review a Consent to Rate Application?A: The time it takes for the insurance department to review a Consent to Rate Application can vary, but it is typically within a few weeks.

Q: Can an insured refuse to sign a Consent to Rate Application?A: Yes, an insured has the right to refuse to sign a Consent to Rate Application. However, the insurer may then choose not to provide coverage or may offer coverage at a lower limit or with higher rates.

Q: Is a Consent to Rate Application permanent?A: No, a Consent to Rate Application is typically valid for a specific period of time and may need to be renewed or updated.