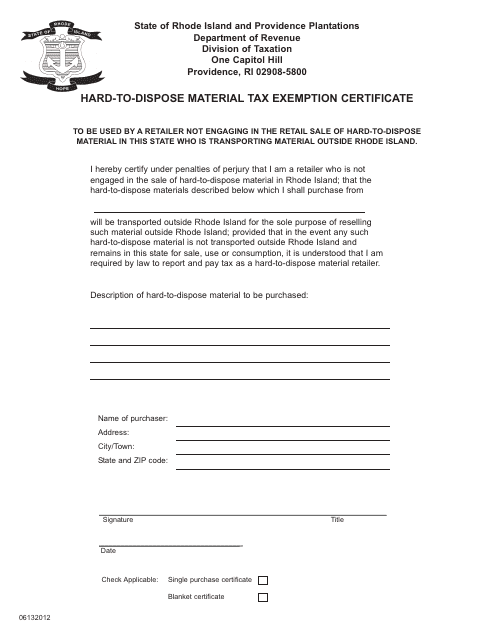

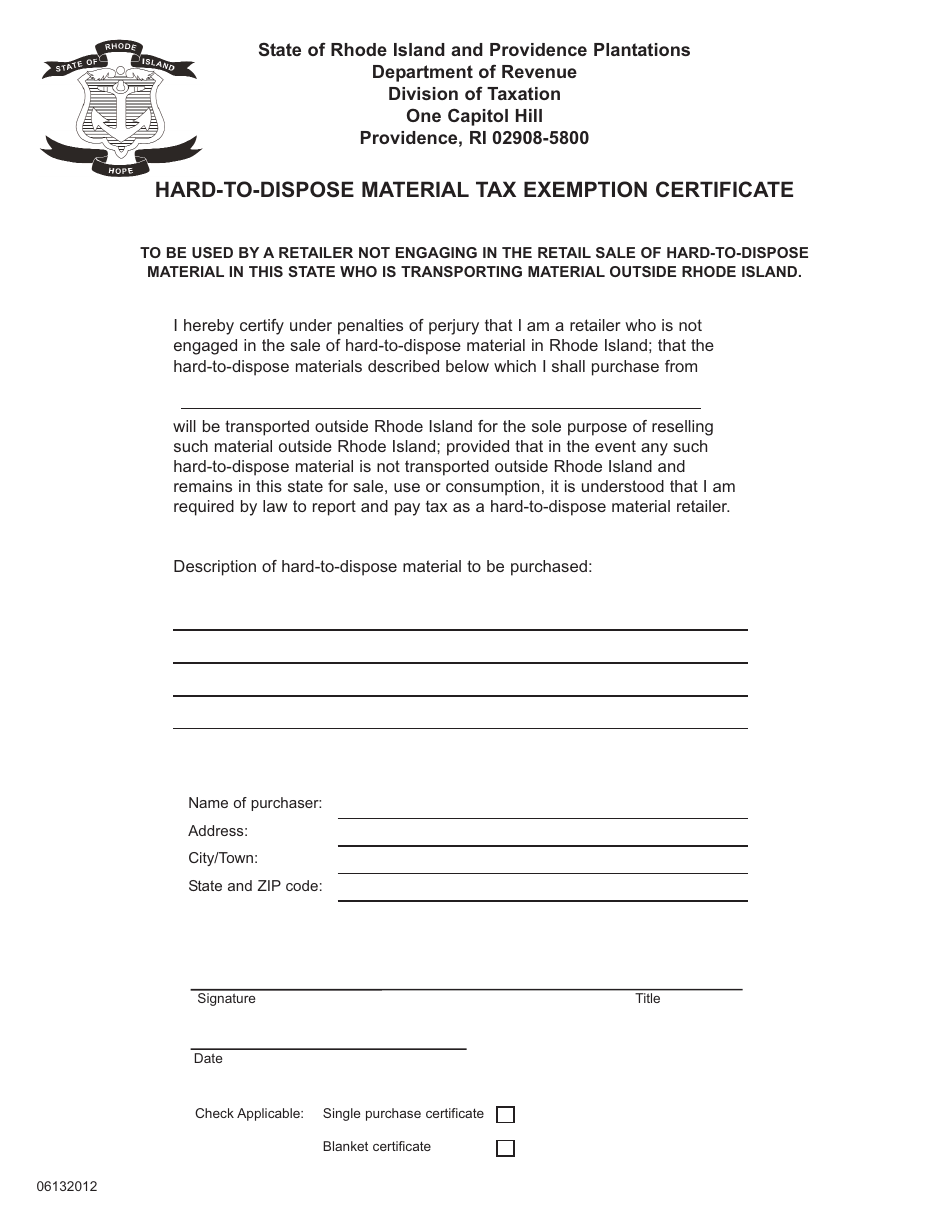

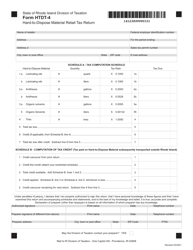

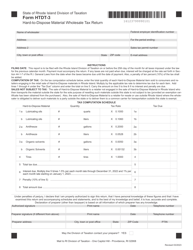

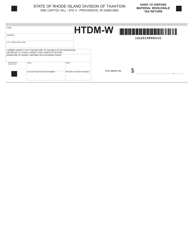

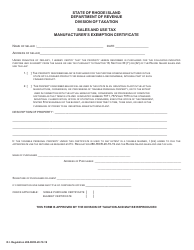

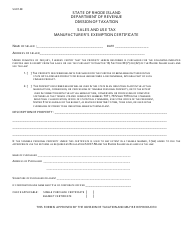

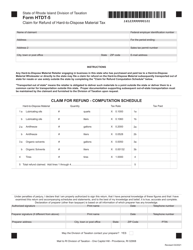

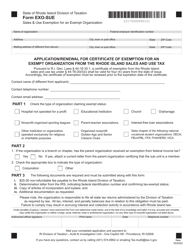

Hard-To-Dispose Material Tax Exemption Certificate - Rhode Island

Hard-To-Dispose Material Tax Exemption Certificate is a legal document that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island.

FAQ

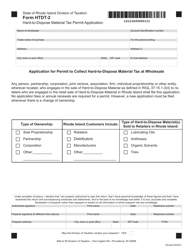

Q: What is the Hard-To-Dispose Material Tax Exemption Certificate?A: The Hard-To-Dispose Material Tax Exemption Certificate is a document that allows certain businesses in Rhode Island to claim an exemption from the sales and use tax on the disposal of certain hard-to-dispose materials.

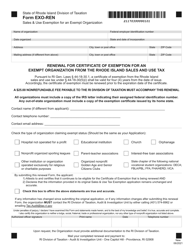

Q: Which businesses are eligible for this tax exemption?A: Businesses engaged in the removal or remediation of certain hard-to-dispose materials, as specified by the Rhode Island Division of Taxation, may be eligible for this tax exemption.

Q: What are hard-to-dispose materials?A: Hard-to-dispose materials are substances that are difficult or costly to dispose of properly, such as asbestos, lead-based paint, and hazardous waste.

Q: Why is there a tax exemption for hard-to-dispose materials?A: The tax exemption is intended to incentivize businesses to properly dispose of hard-to-dispose materials, which helps protect public health and the environment.

Q: How do businesses claim this tax exemption?A: Businesses must complete the Hard-To-Dispose Material Tax Exemption Certificate and provide it to the seller of the disposal service to claim the exemption.

Q: Is there a fee to apply for this tax exemption?A: No, there is no fee to apply for the Hard-To-Dispose Material Tax Exemption Certificate.

Q: How long is this tax exemption valid?A: This tax exemption is valid for a period of one year from the date of issuance, unless stated otherwise by the Rhode Island Division of Taxation.