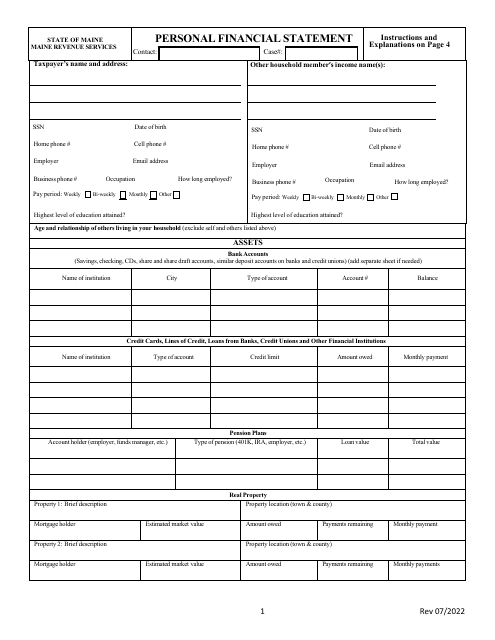

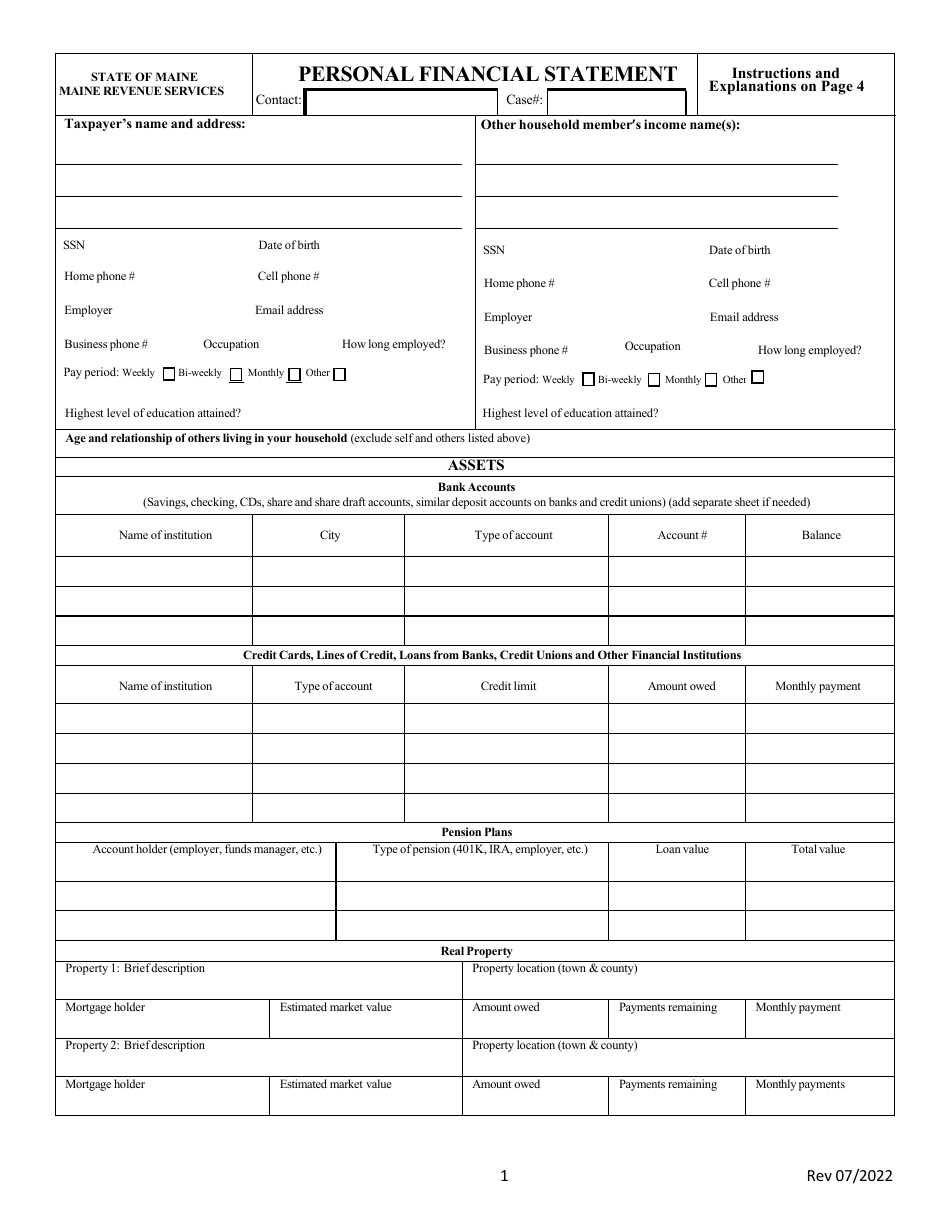

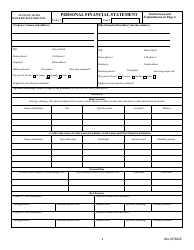

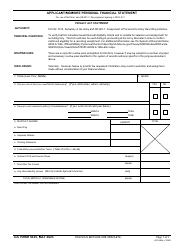

Personal Financial Statement - Maine

Personal Financial Statement is a legal document that was released by the Maine Revenue Services - a government authority operating within Maine.

FAQ

Q: What is a personal financial statement?

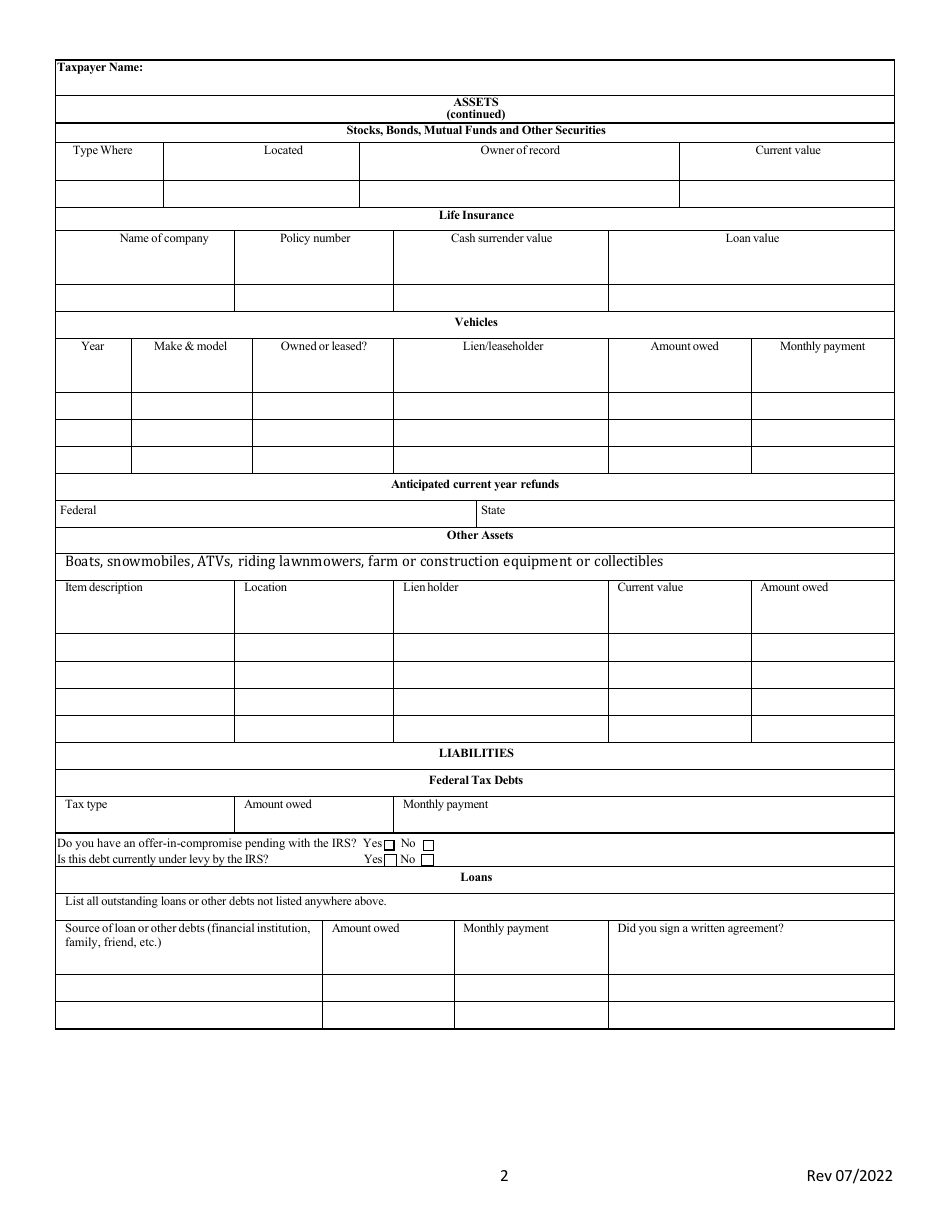

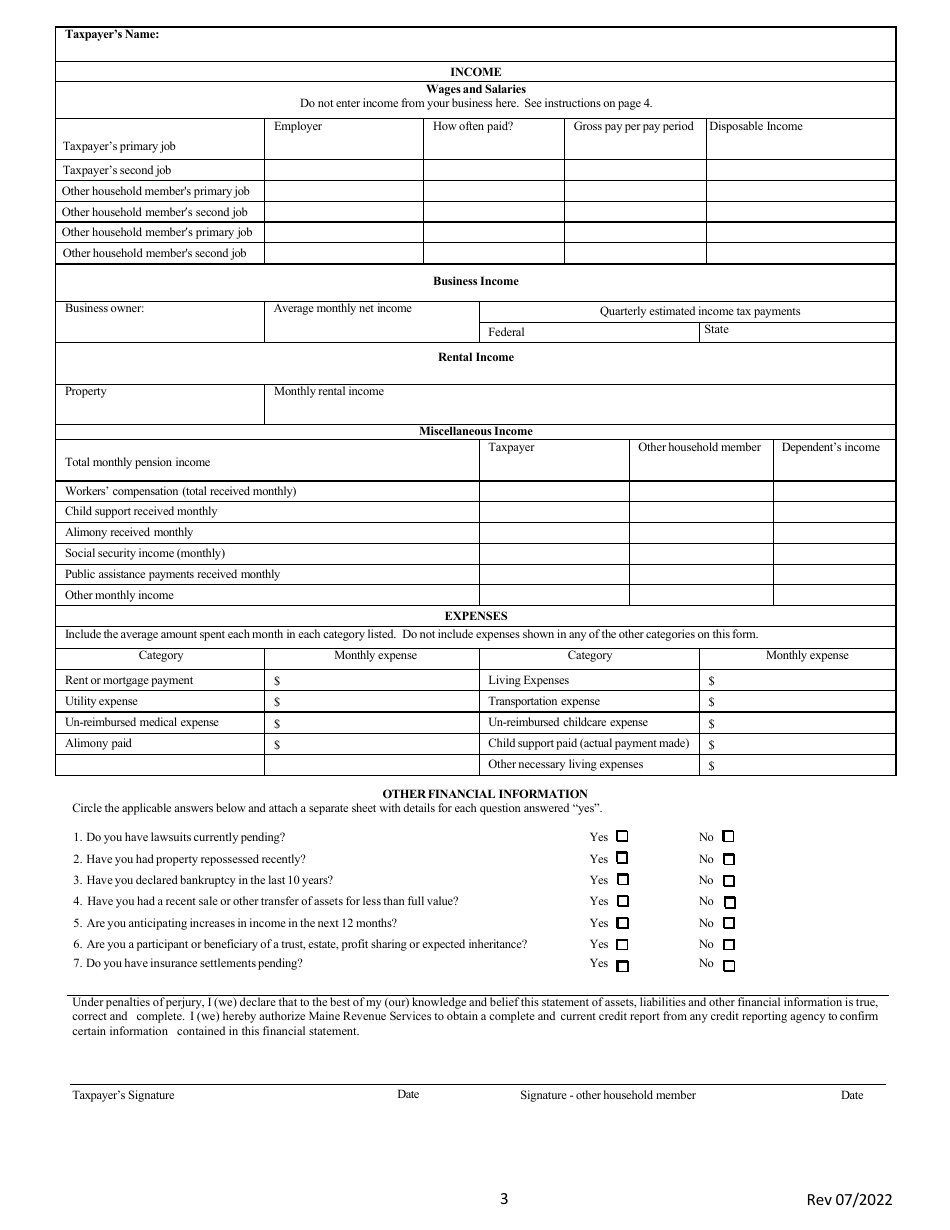

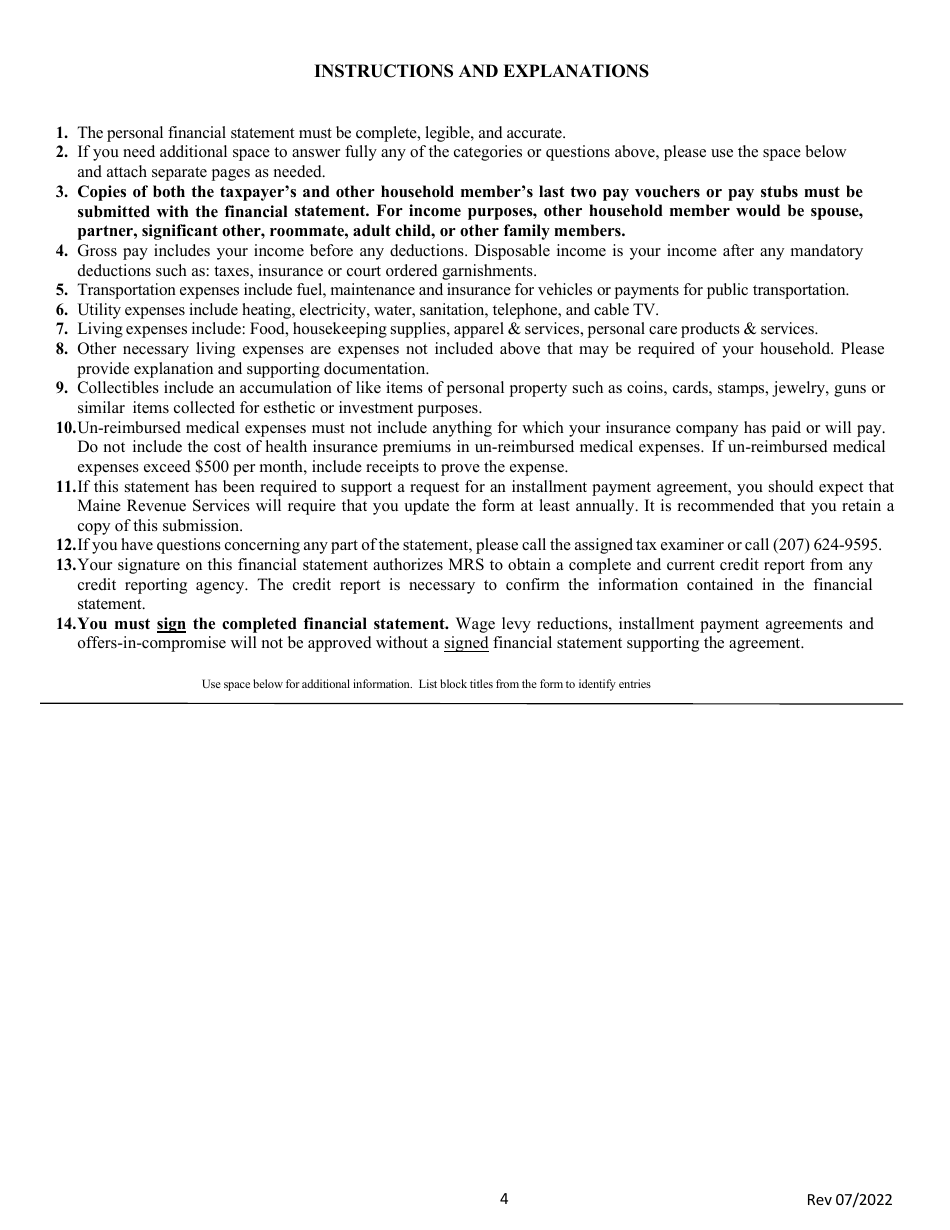

A: A personal financial statement is a document that provides an overview of an individual's financial situation, including their assets, liabilities, income, and expenses.

Q: Why is a personal financial statement important?

A: A personal financial statement is important because it allows individuals to assess their financial health, plan for the future, and make informed decisions about their money.

Q: What should be included in a personal financial statement?

A: A personal financial statement should include information about assets (such as cash, investments, and real estate), liabilities (such as debts and loans), income, and expenses.

Q: How can I create a personal financial statement?

A: You can create a personal financial statement by gathering information about your assets, liabilities, income, and expenses, and organizing it in a clear and accurate format.

Q: Are personal financial statements confidential?

A: Yes, personal financial statements are confidential documents that should only be shared with trusted individuals, such as financial advisors or lenders, when necessary.

Q: Why do lenders require a personal financial statement?

A: Lenders often require a personal financial statement to assess an individual's creditworthiness and ability to repay a loan.

Q: Can a personal financial statement be updated regularly?

A: Yes, it is recommended to update your personal financial statement regularly, especially when there are significant changes in your financial situation.