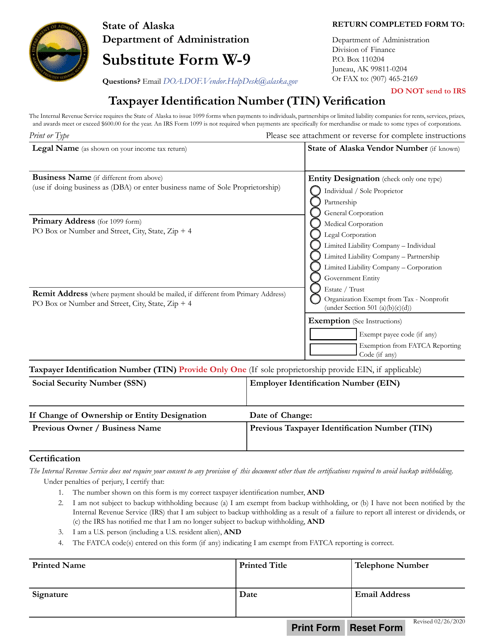

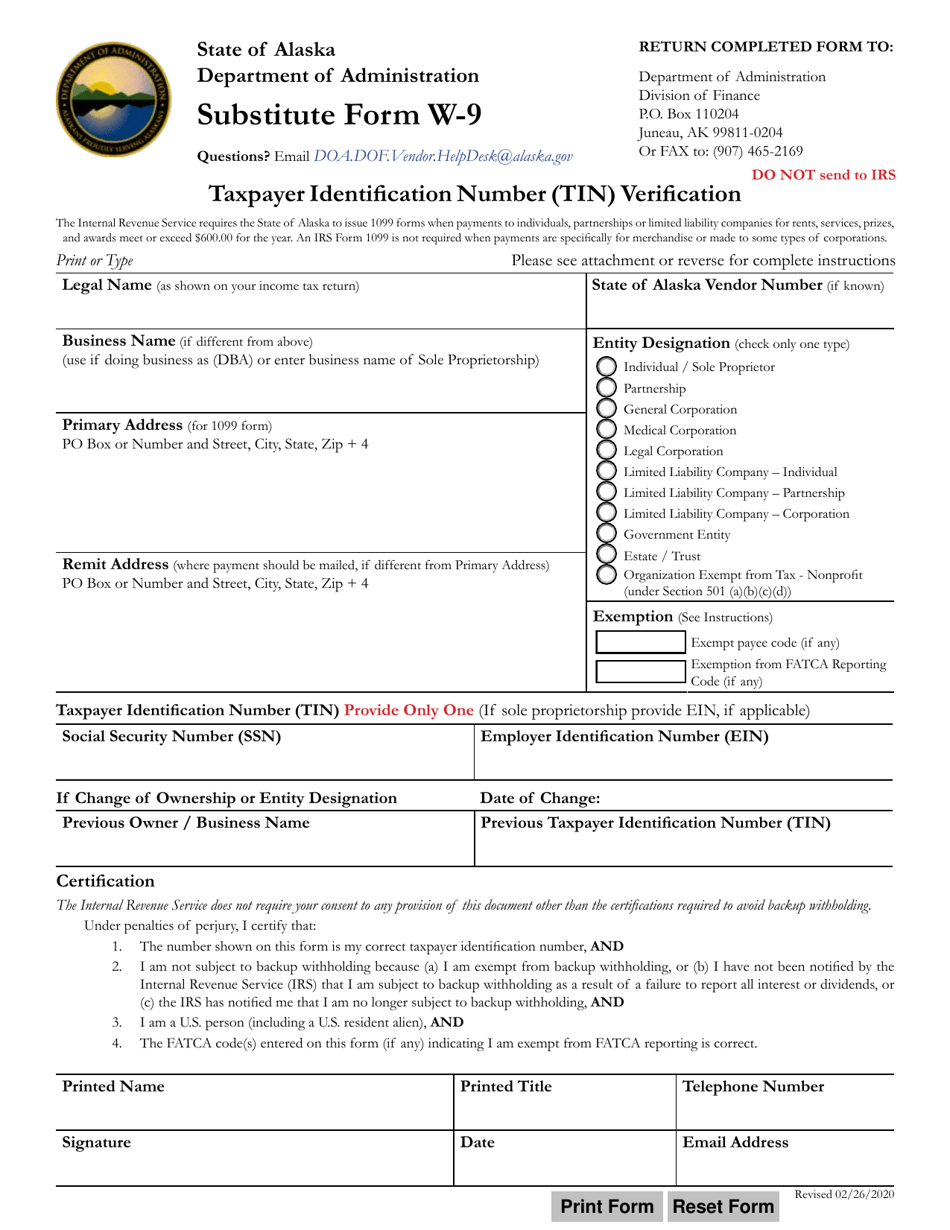

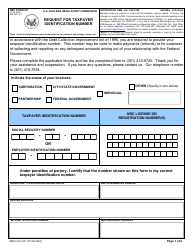

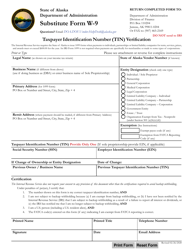

Form W-9 Taxpayer Identification Number (Tin) Verification - Alaska

What Is Form W-9?

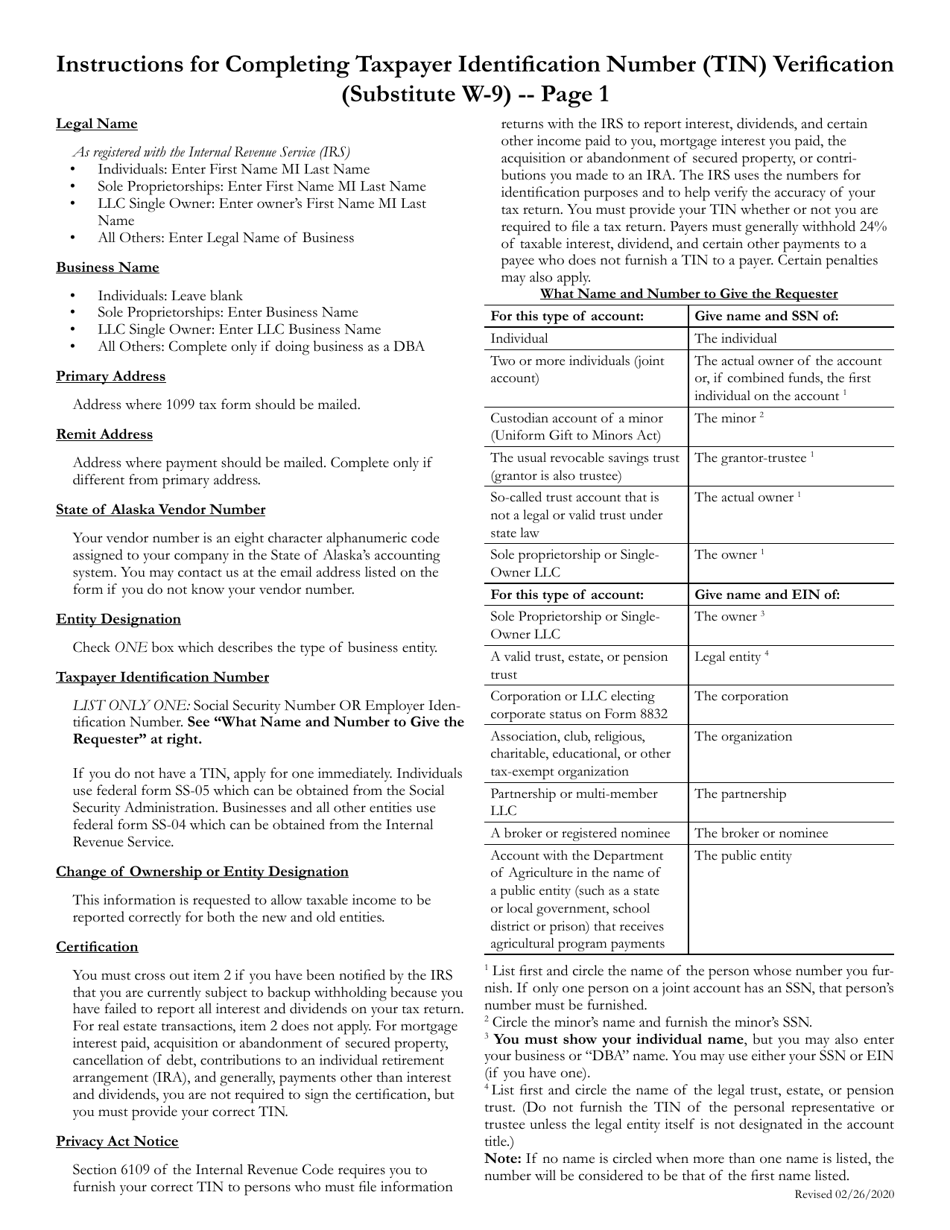

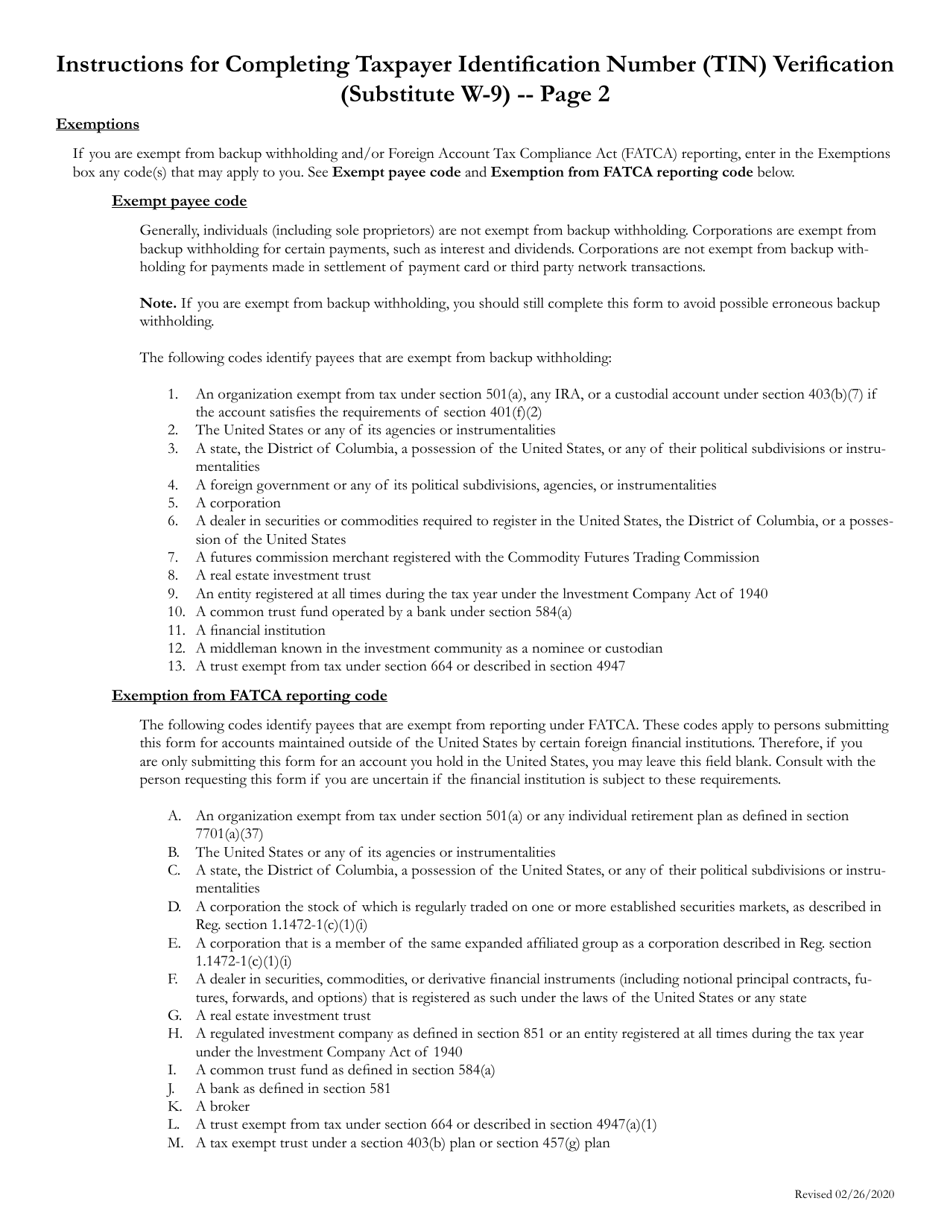

This is a legal form that was released by the Alaska Department of Administration - a government authority operating within Alaska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

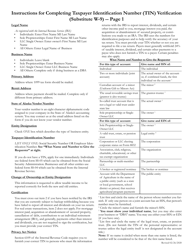

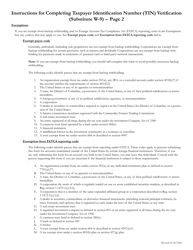

Q: What is Form W-9?A: Form W-9 is a tax form used to request the taxpayer identification number (TIN) of an individual or business.

Q: Why is Form W-9 used?A: Form W-9 is used by businesses to collect the TIN of a vendor or independent contractor for tax reporting purposes.

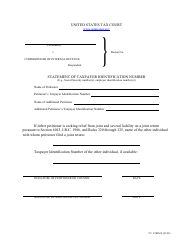

Q: What is a taxpayer identification number (TIN)?A: A taxpayer identification number (TIN) is a unique identifier assigned to individuals or businesses by the Internal Revenue Service (IRS) for tax purposes.

Q: Who should fill out Form W-9?A: Anyone who is required to provide their TIN to a business for tax reporting purposes should fill out Form W-9.

Q: Is Form W-9 specific to Alaska?A: No, Form W-9 is a federal tax form and is used across all states, including Alaska.