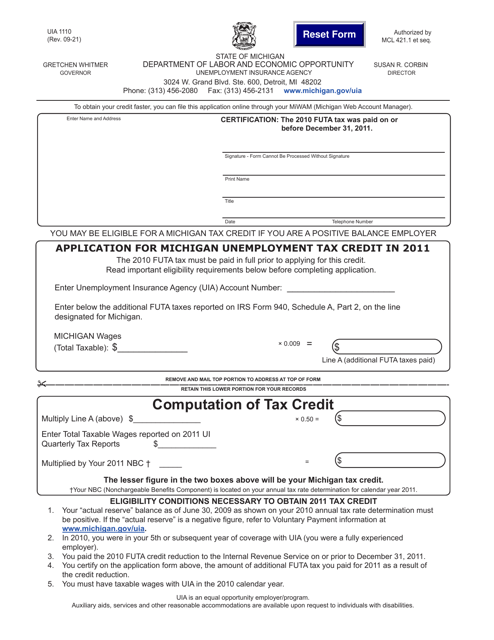

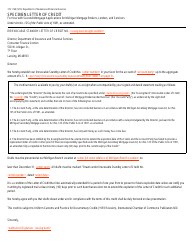

Form UIA1110 Application for Michigan Unemployment Tax Credit - Michigan

What Is Form UIA1110?

This is a legal form that was released by the Michigan Department of Labor and Economic Opportunity - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

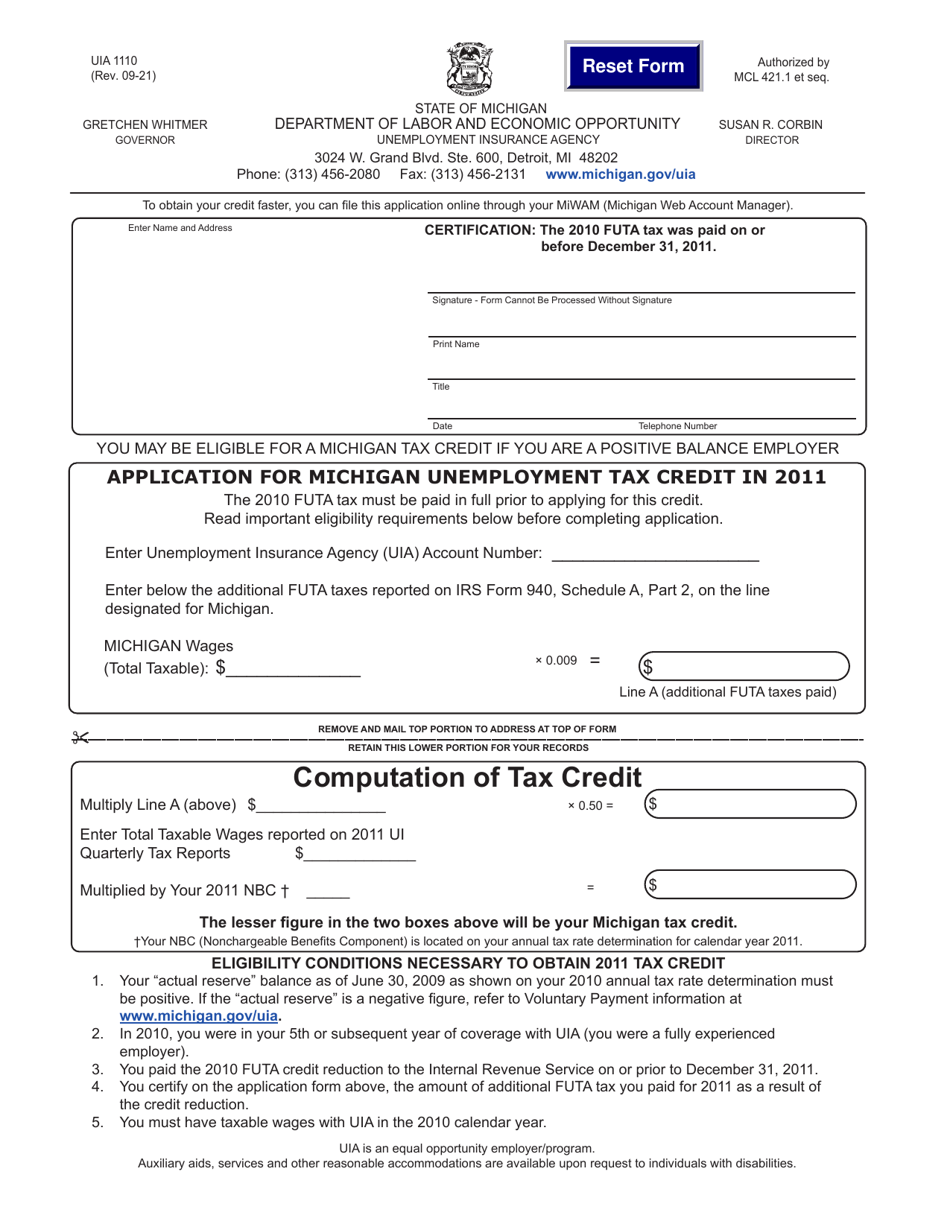

Q: What is UIA1110?A: UIA1110 is an application form for the Michigan Unemployment Tax Credit in 2011.

Q: Who should use this form?A: This form should be used by businesses or individuals who are seeking a tax credit for unemployment taxes paid in Michigan in 2011.

Q: What is the Michigan Unemployment Tax Credit?A: The Michigan Unemployment Tax Credit is a tax credit that businesses or individuals can claim for unemployment taxes paid in Michigan.

Q: What year does this form apply to?A: This form applies to the tax year 2011.

Q: Are there any eligibility requirements for the Michigan Unemployment Tax Credit?A: Yes, there are eligibility requirements for the Michigan Unemployment Tax Credit. Please refer to the instructions provided with the UIA1110 form for more information.

Q: Can I claim the Michigan Unemployment Tax Credit for taxes paid in a different year?A: No, the Michigan Unemployment Tax Credit is specifically for taxes paid in the tax year 2011.