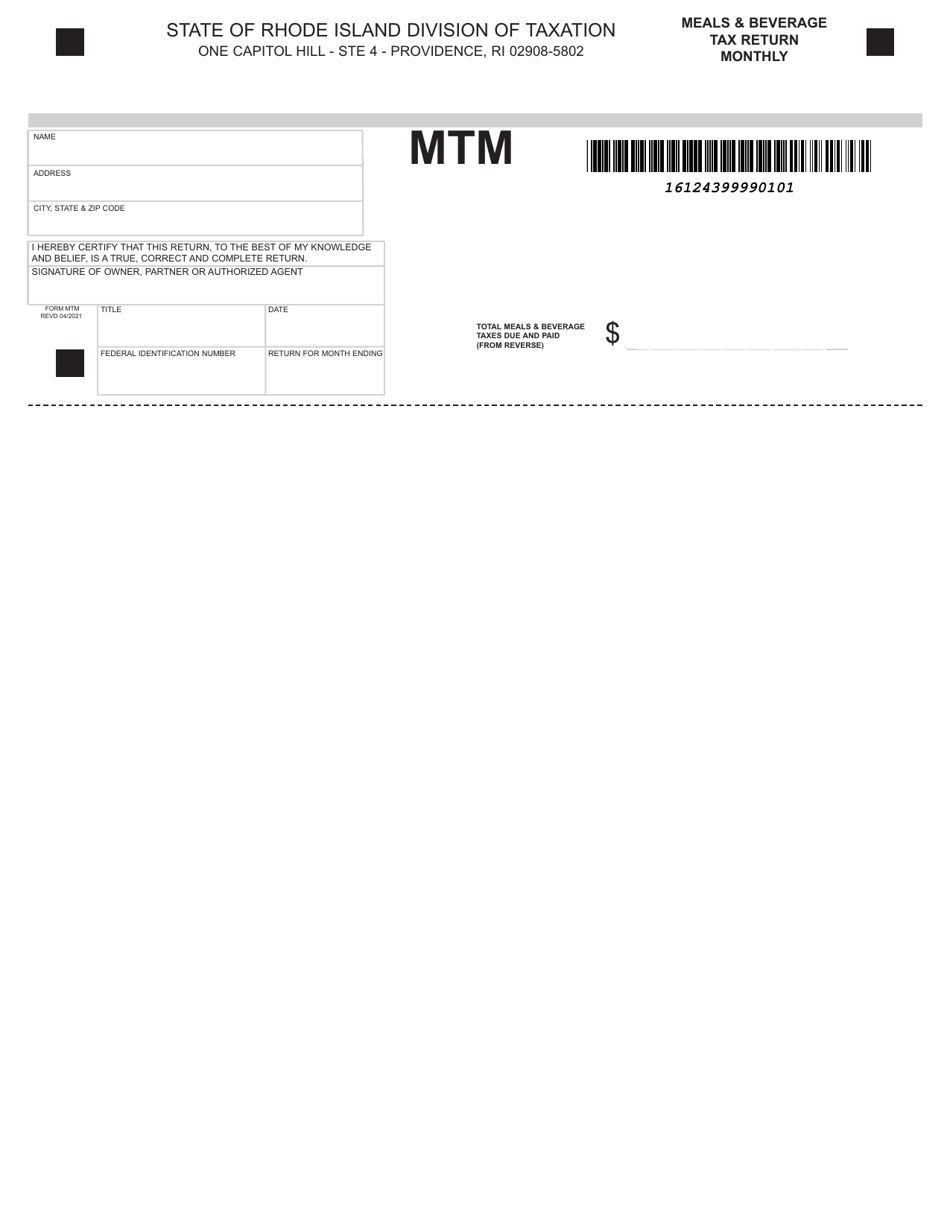

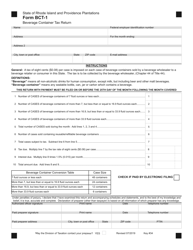

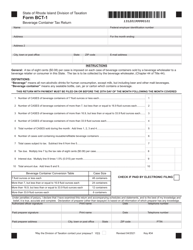

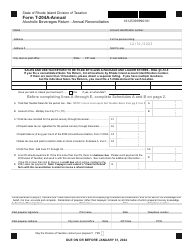

Form MTM Meals & Beverage Tax Return Monthly - Rhode Island

What Is Form MTM?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

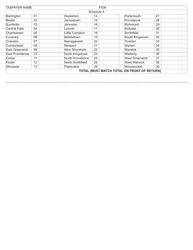

Q: What is the MTM Meals & Beverage Tax Return Monthly?A: MTM Meals & Beverage Tax Return Monthly is a tax return form that needs to be filed in Rhode Island on a monthly basis for businesses that sell meals and beverages.

Q: Who needs to file the MTM Meals & Beverage Tax Return Monthly?A: Businesses in Rhode Island that sell meals and beverages are required to file the MTM Meals & Beverage Tax Return Monthly.

Q: What is the purpose of the MTM Meals & Beverage Tax Return Monthly?A: The purpose of this tax return form is to report and pay the taxes collected from the sales of meals and beverages in Rhode Island.

Q: When is the due date for filing the MTM Meals & Beverage Tax Return Monthly?A: The due date for filing this tax return form is on or before the 20th day of the following month.

Q: What happens if I fail to file the MTM Meals & Beverage Tax Return Monthly?A: Failure to file the MTM Meals & Beverage Tax Return Monthly may result in penalties and interest charges imposed by the Rhode Island Division of Taxation.