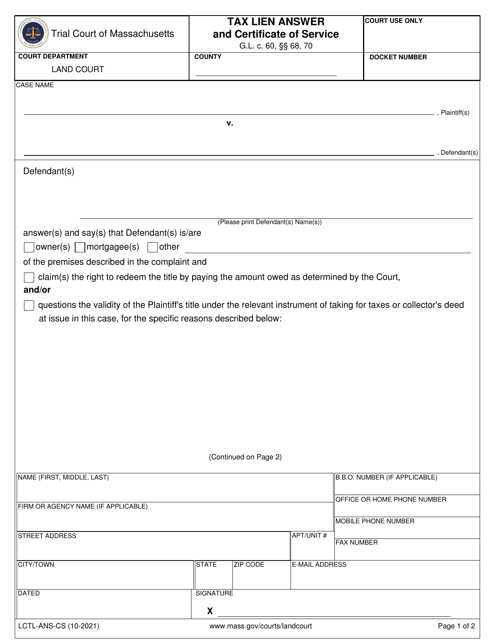

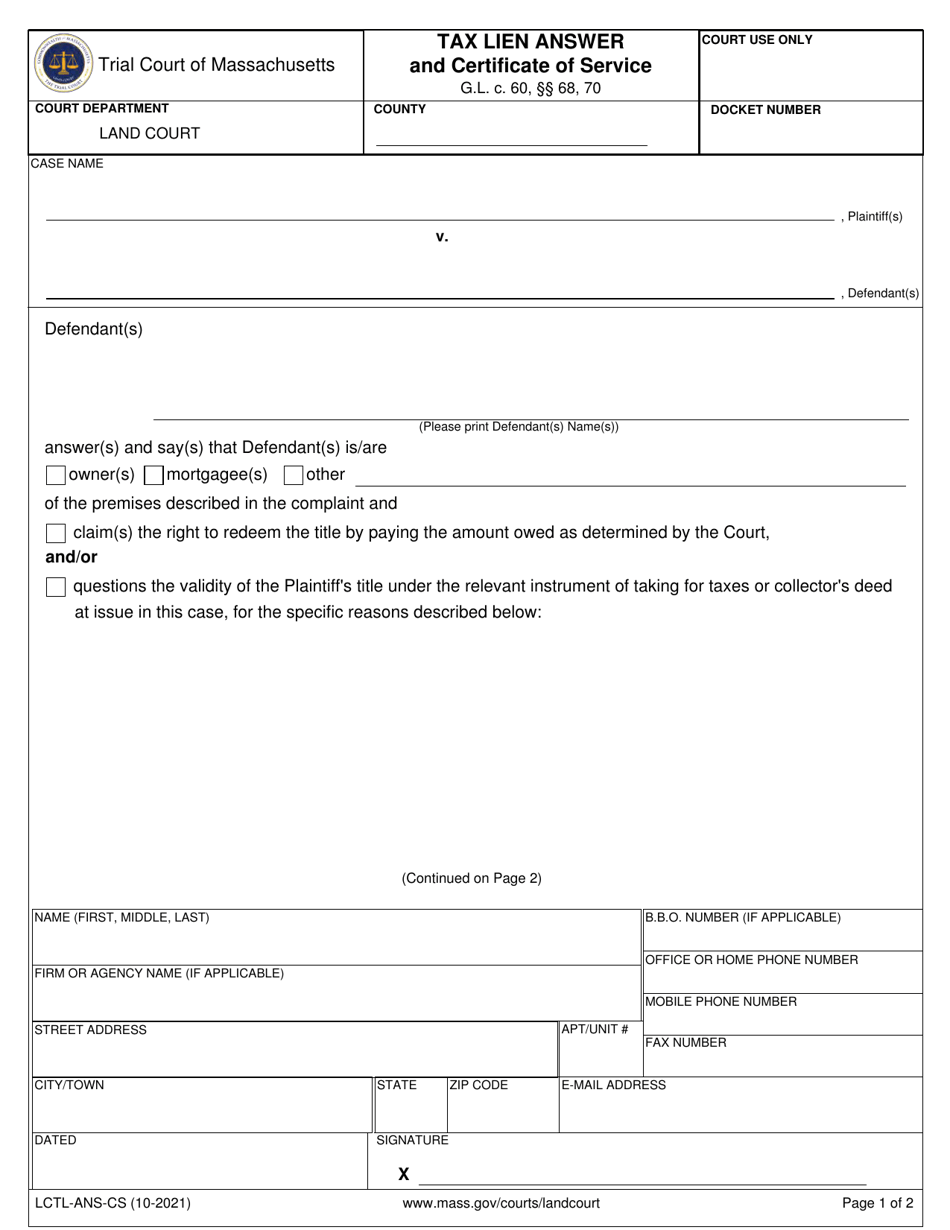

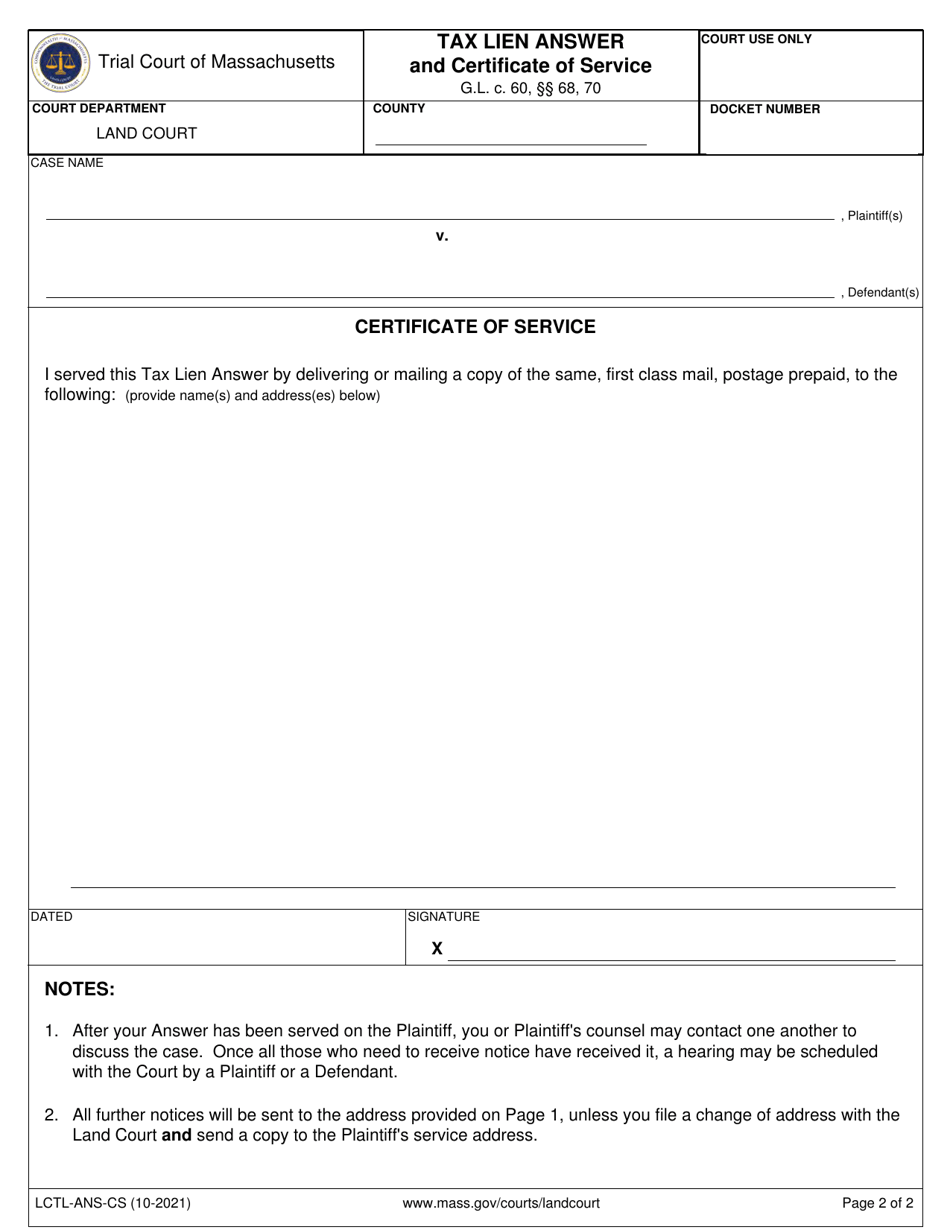

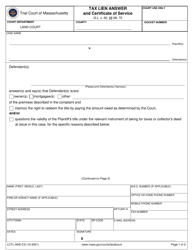

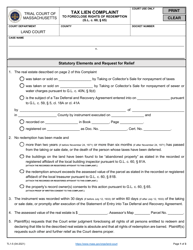

Form LCTL-ANS-CS Tax Lien Answer and Certificate of Service - Massachusetts

What Is Form LCTL-ANS-CS?

This is a legal form that was released by the Trial Court of Massachusetts - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is LCTL-ANS-CS?A: LCTL-ANS-CS stands for Tax Lien Answer and Certificate of Service.

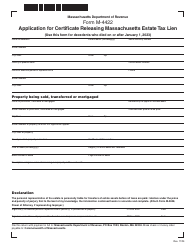

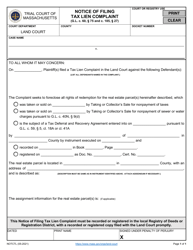

Q: What is the purpose of LCTL-ANS-CS?A: The purpose of LCTL-ANS-CS is to respond to a tax lien and provide proof of service.

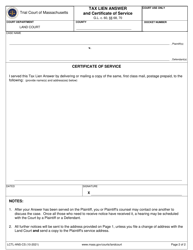

Q: What information is included in LCTL-ANS-CS?A: LCTL-ANS-CS includes information about the tax lien, the respondent's statement and contact information, and a certificate of service.

Q: How do I fill out LCTL-ANS-CS?A: You need to provide details about the tax lien, your response to the lien, and information about the delivery of the document.

Q: Is there a fee associated with LCTL-ANS-CS?A: Yes, there is a fee that needs to be paid when submitting the LCTL-ANS-CS form.

Q: What happens after I submit LCTL-ANS-CS?A: After you submit LCTL-ANS-CS, the tax authorities will review your response and take appropriate action.

Q: What should I do if I disagree with the tax lien?A: If you disagree with the tax lien, you should provide a detailed explanation in the LCTL-ANS-CS form and seek legal advice if necessary.

Q: Can I get assistance in filling out LCTL-ANS-CS?A: Yes, you can seek assistance from tax professionals or legal advisors to help you fill out the LCTL-ANS-CS form.