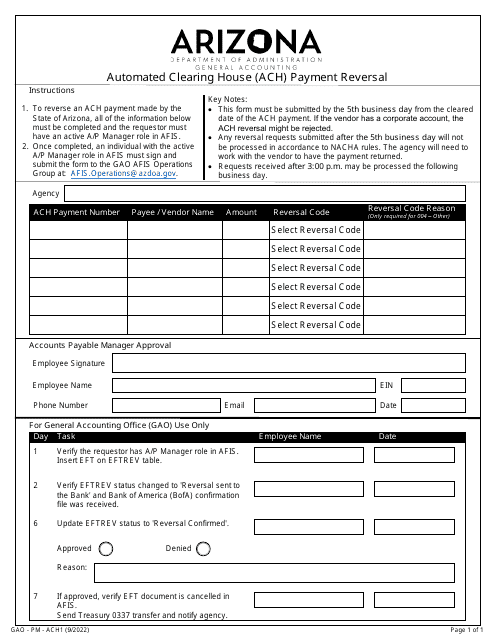

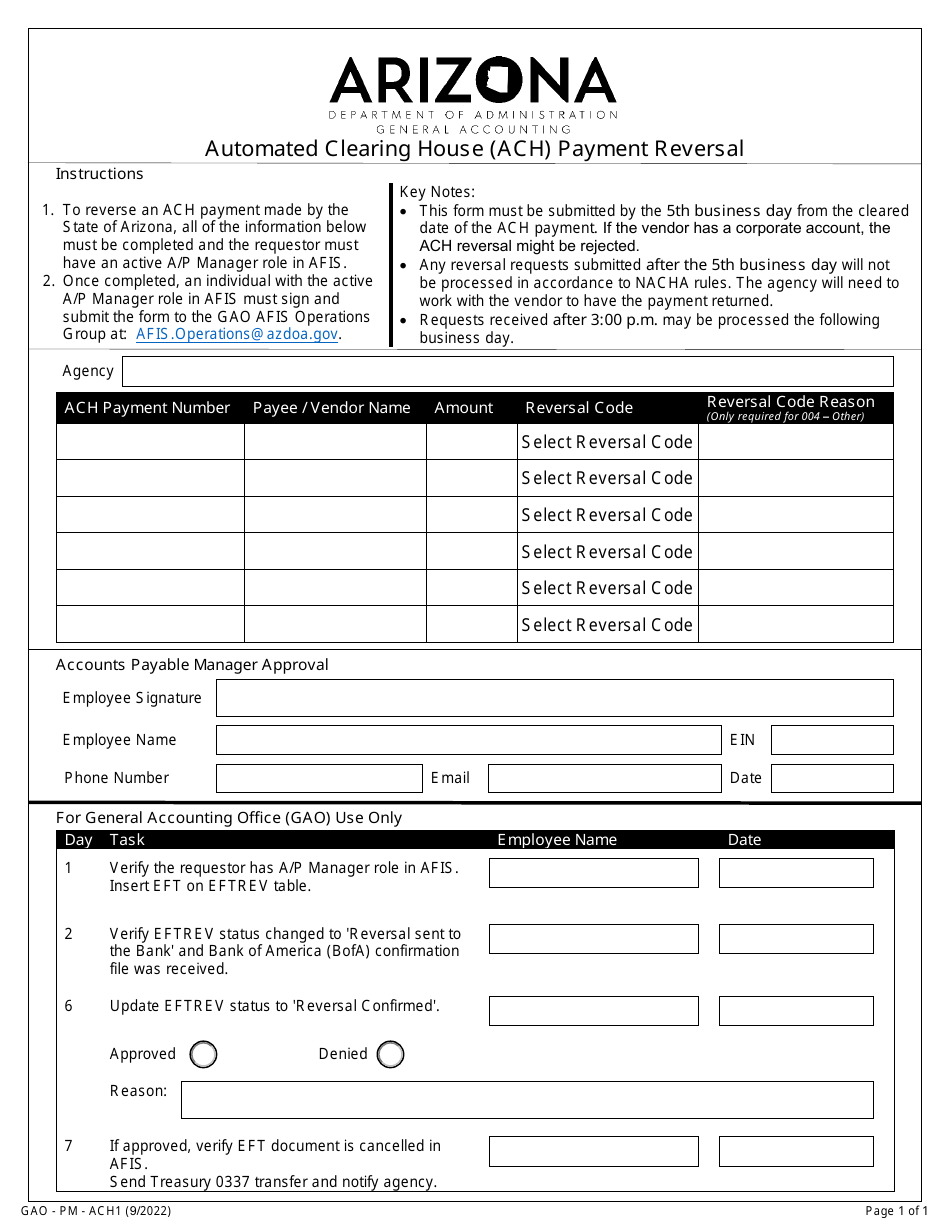

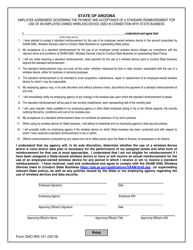

Form GAO-PM-ACH1 Automated Clearing House (ACH) Payment Reversal - Arizona

What Is Form GAO-PM-ACH1?

This is a legal form that was released by the Arizona Department of Administration - General Accounting Office - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the GAO-PM-ACH1 form?A: The GAO-PM-ACH1 form is a form used for Automated Clearing House (ACH) payment reversal in Arizona.

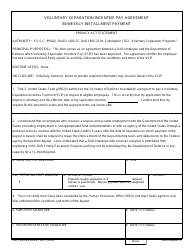

Q: What does Automated Clearing House (ACH) mean?A: Automated Clearing House (ACH) is an electronic payment network used for direct deposits, bill payments, and other types of electronic funds transfers.

Q: What is an ACH payment reversal?A: An ACH payment reversal is the process of undoing or reversing a previously processed ACH payment.

Q: When is the GAO-PM-ACH1 form used?A: The GAO-PM-ACH1 form is used when an ACH payment made in Arizona needs to be reversed.

Q: Who can use the GAO-PM-ACH1 form?A: The GAO-PM-ACH1 form can be used by individuals or organizations who need to reverse an ACH payment in Arizona.

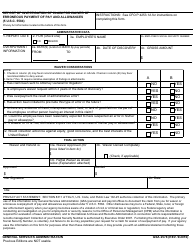

Q: Are there any fees associated with using the GAO-PM-ACH1 form?A: The fees associated with using the GAO-PM-ACH1 form may vary. It is recommended to check the official sources or contact the relevant authorities for fee information.

Q: Can I use the GAO-PM-ACH1 form for payments outside of Arizona?A: No, the GAO-PM-ACH1 form is specifically used for ACH payment reversals in Arizona only.

Q: Is the GAO-PM-ACH1 form mandatory for ACH payment reversals in Arizona?A: The requirement to use the GAO-PM-ACH1 form for ACH payment reversals may vary depending on the specific circumstances. It is advisable to consult the relevant authorities or legal experts for guidance.