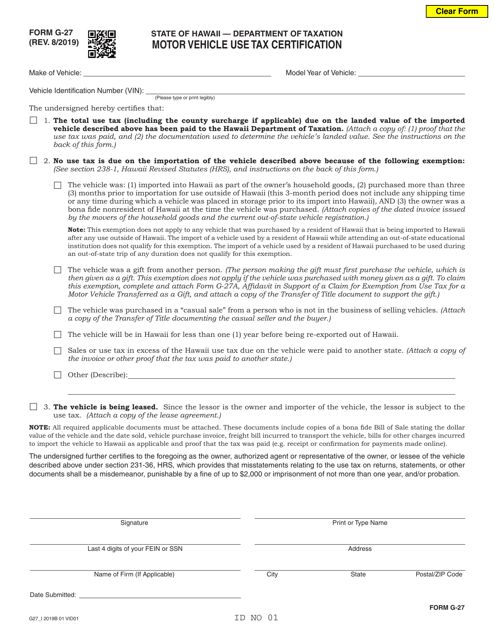

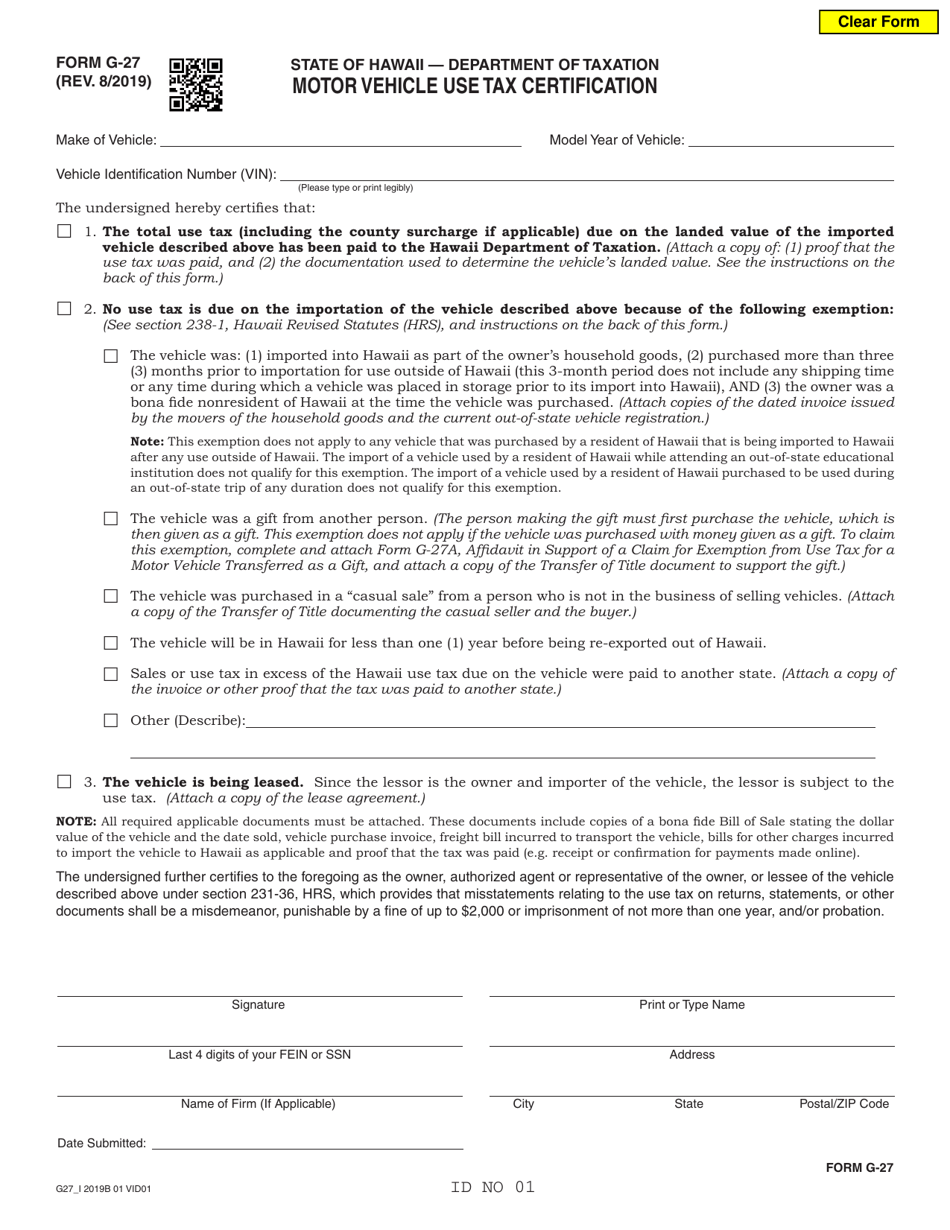

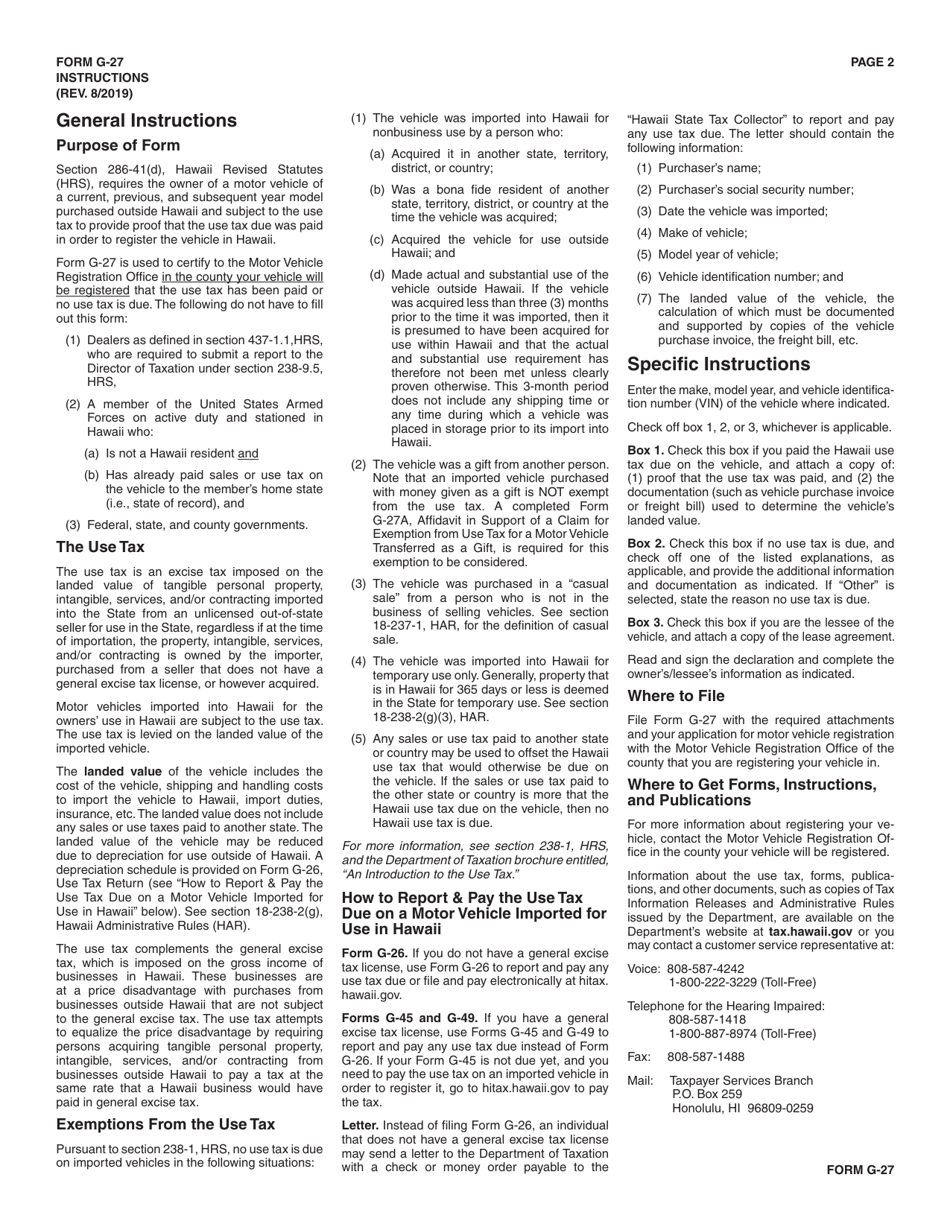

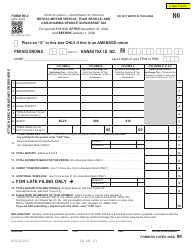

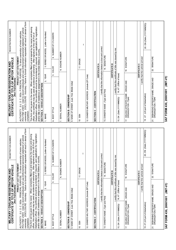

Form G-27 Motor Vehicle Use Tax Certification - Hawaii

What Is Form G-27?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

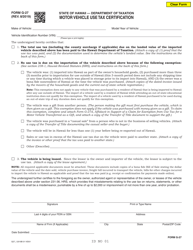

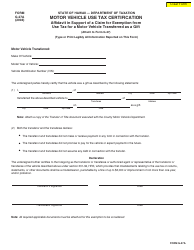

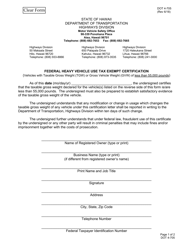

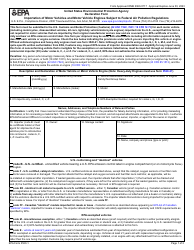

Q: What is Form G-27 Motor VehicleUse Tax Certification?A: Form G-27 Motor Vehicle Use Tax Certification is a document used in Hawaii to certify that a motor vehicle is exempt from the motor vehicle use tax.

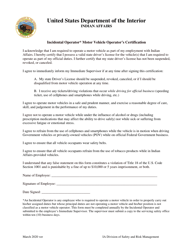

Q: Who needs to fill out Form G-27?A: Individuals or businesses who want to certify that a motor vehicle is exempt from the motor vehicle use tax in Hawaii need to fill out Form G-27.

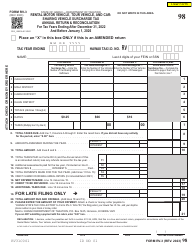

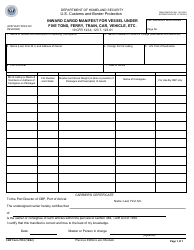

Q: What is the purpose of the motor vehicle use tax in Hawaii?A: The motor vehicle use tax in Hawaii is used to provide revenue for the state's Highway Trust Fund, which is dedicated to maintaining and improving the state's highways.

Q: What are the exemptions from the motor vehicle use tax in Hawaii?A: Some of the exemptions from the motor vehicle use tax in Hawaii include vehicles owned by the federal government, vehicles owned by a nonprofit organization, and vehicles brought into Hawaii for temporary use.