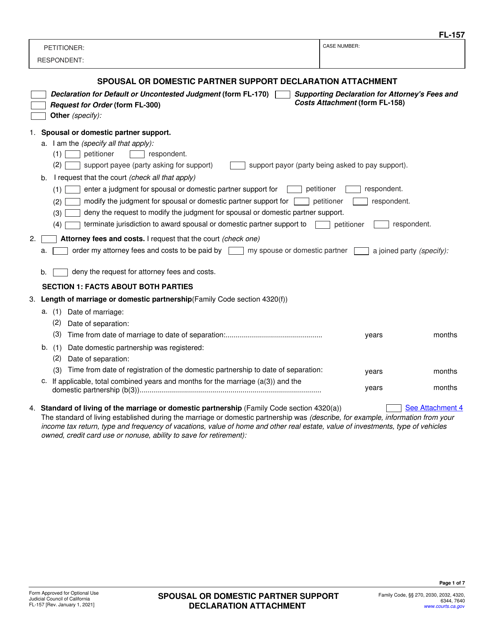

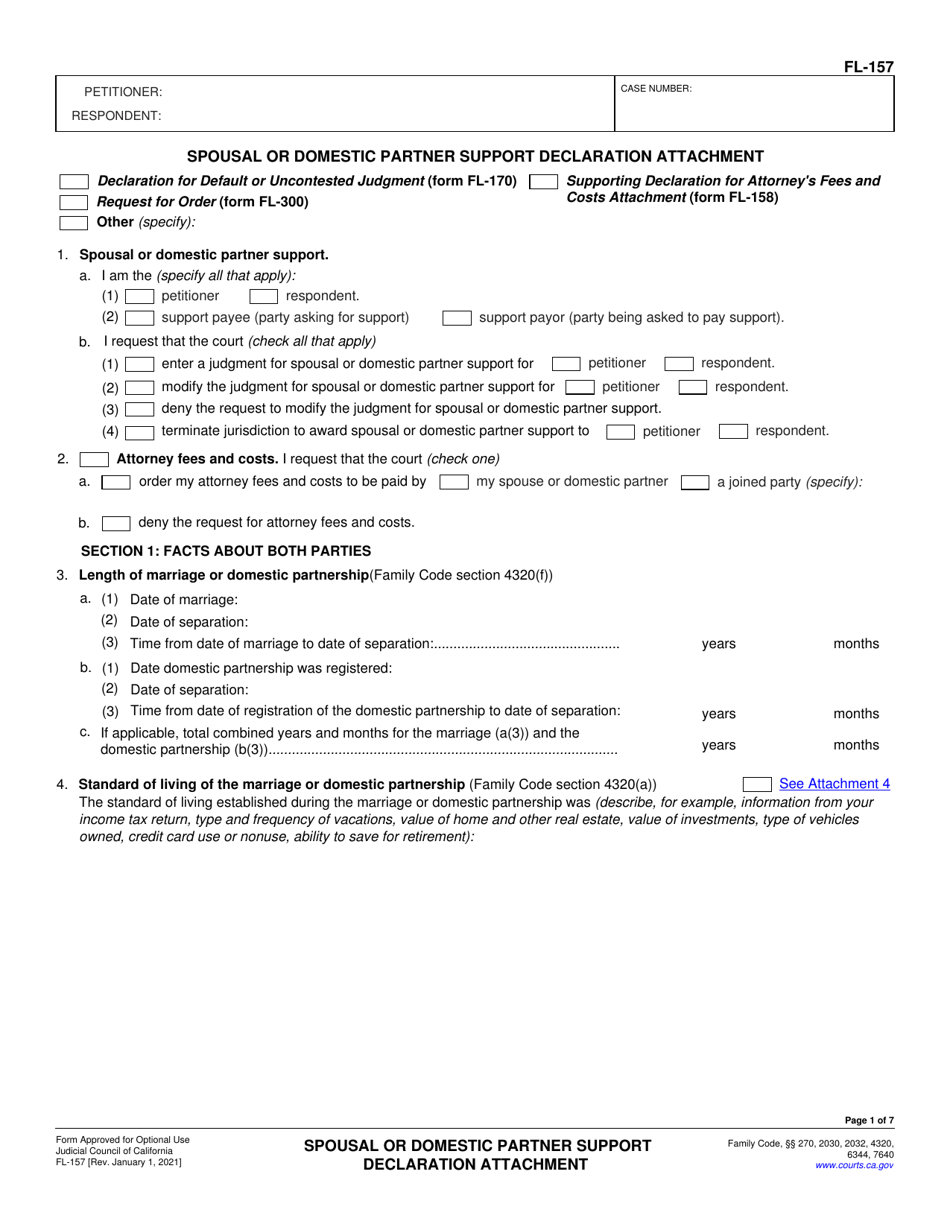

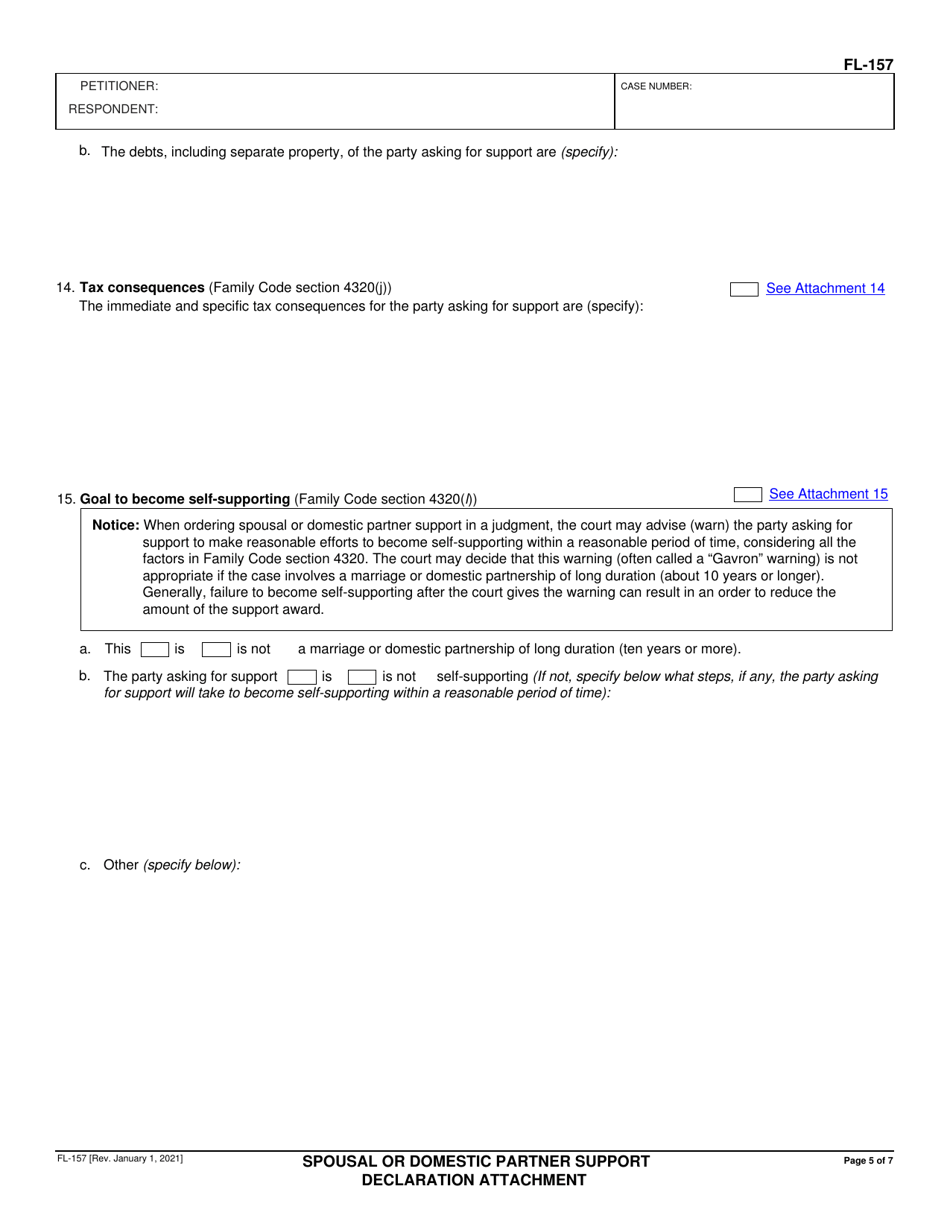

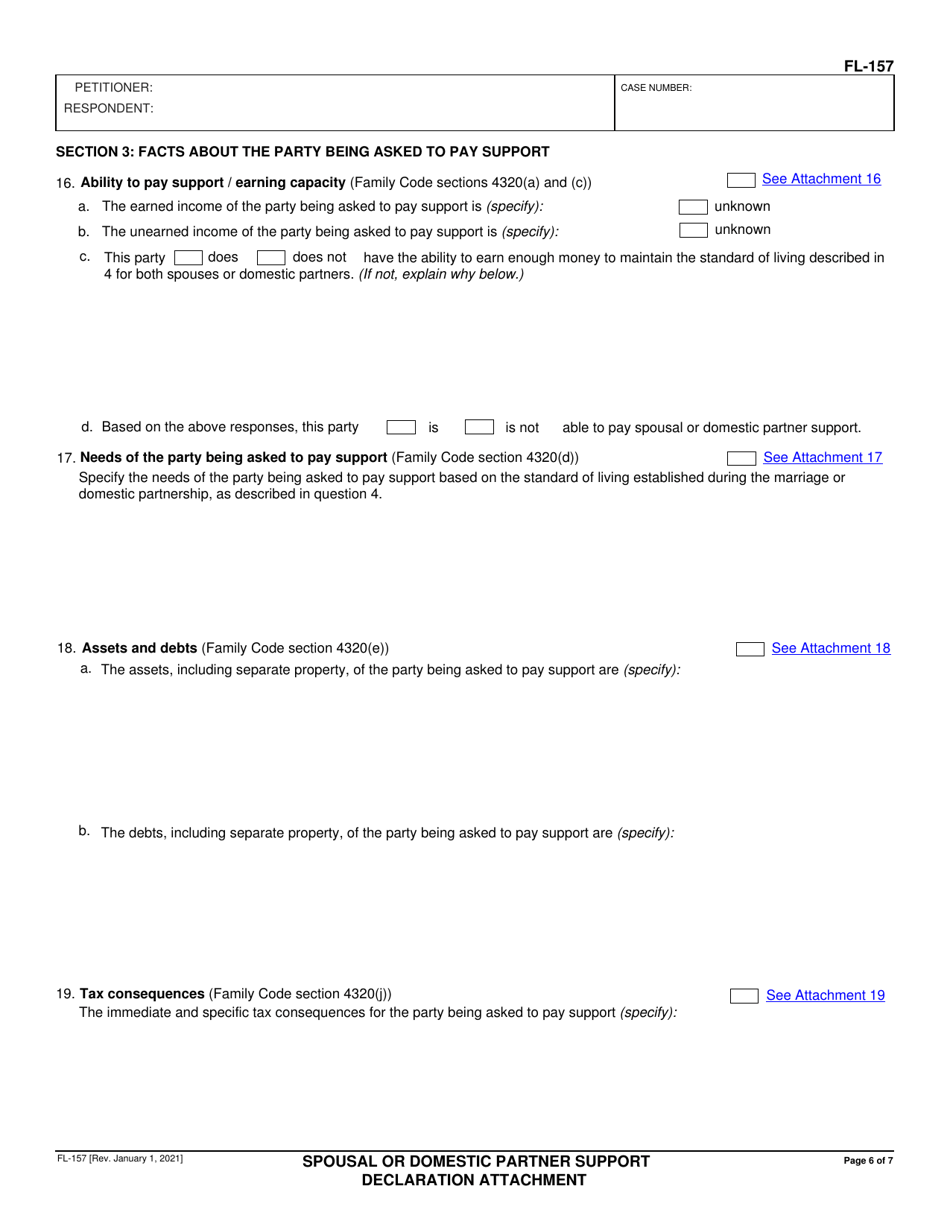

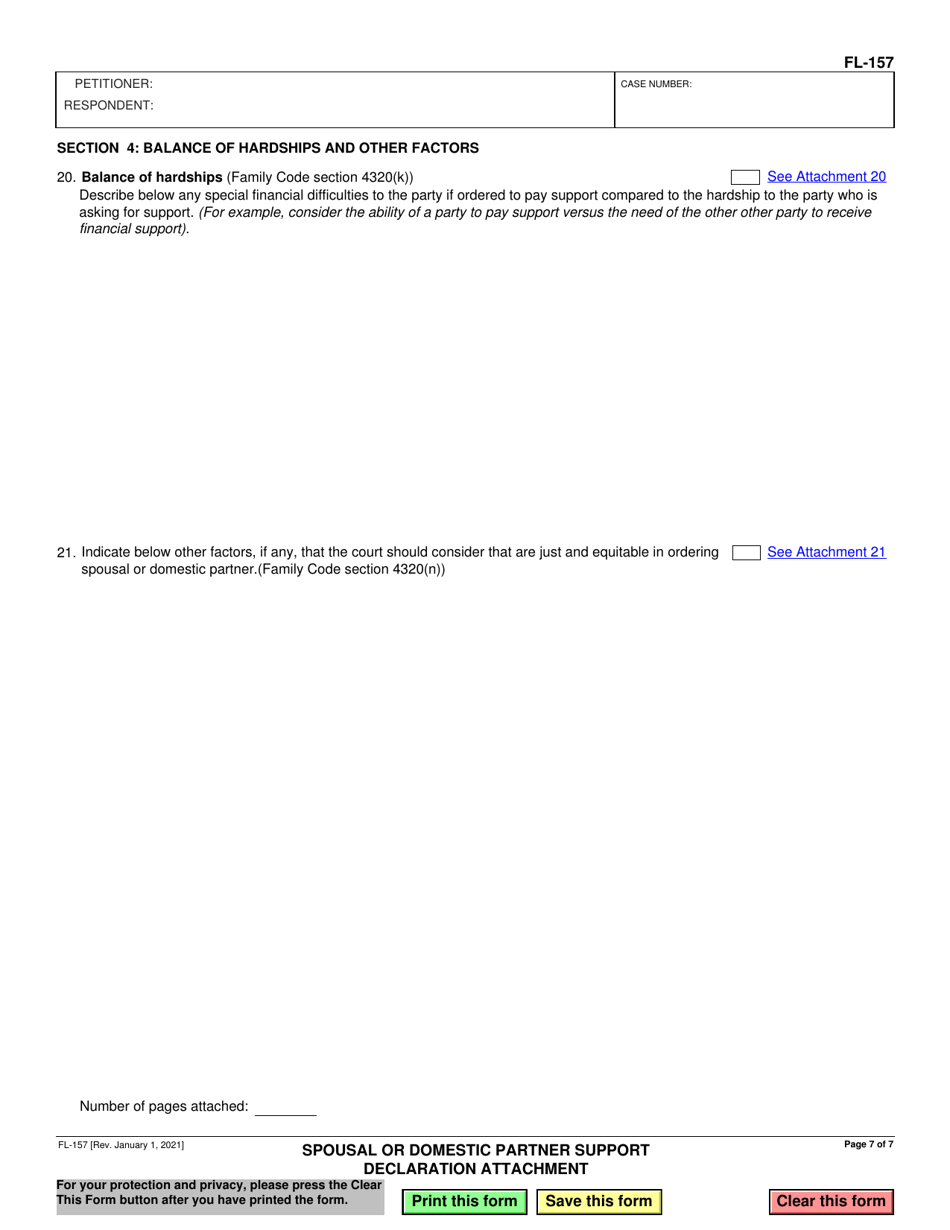

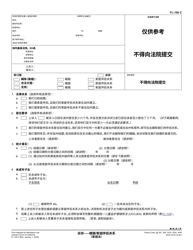

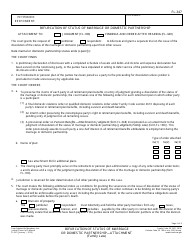

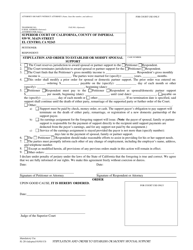

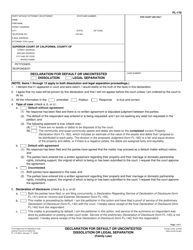

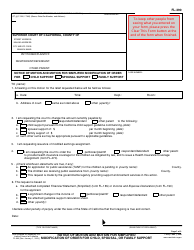

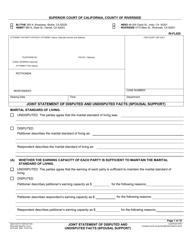

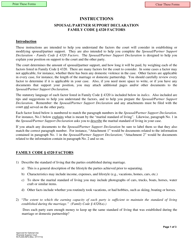

Form FL-157 Spousal or Domestic Partner Support Declaration Attachment - California

What Is Form FL-157?

This is a legal form that was released by the California Judicial Branch - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

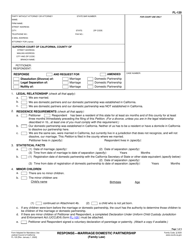

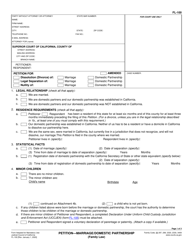

Q: What is Form FL-157?A: Form FL-157 is the Spousal or Domestic Partner Support Declaration Attachment in California.

Q: What is the purpose of Form FL-157?A: The purpose of Form FL-157 is to provide additional information and details regarding spousal or domestic partner support.

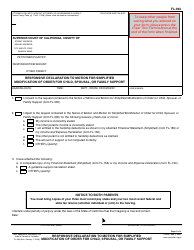

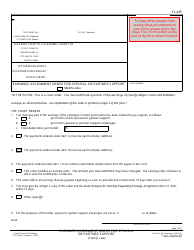

Q: Who needs to file Form FL-157?A: Form FL-157 needs to be filed by parties who are seeking spousal or domestic partner support in California.

Q: Is Form FL-157 required for all spousal or domestic partner support cases in California?A: No, Form FL-157 is not required for all cases. It is only required when additional information is needed.

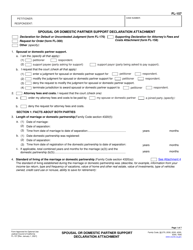

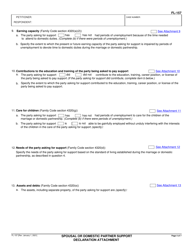

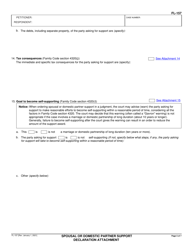

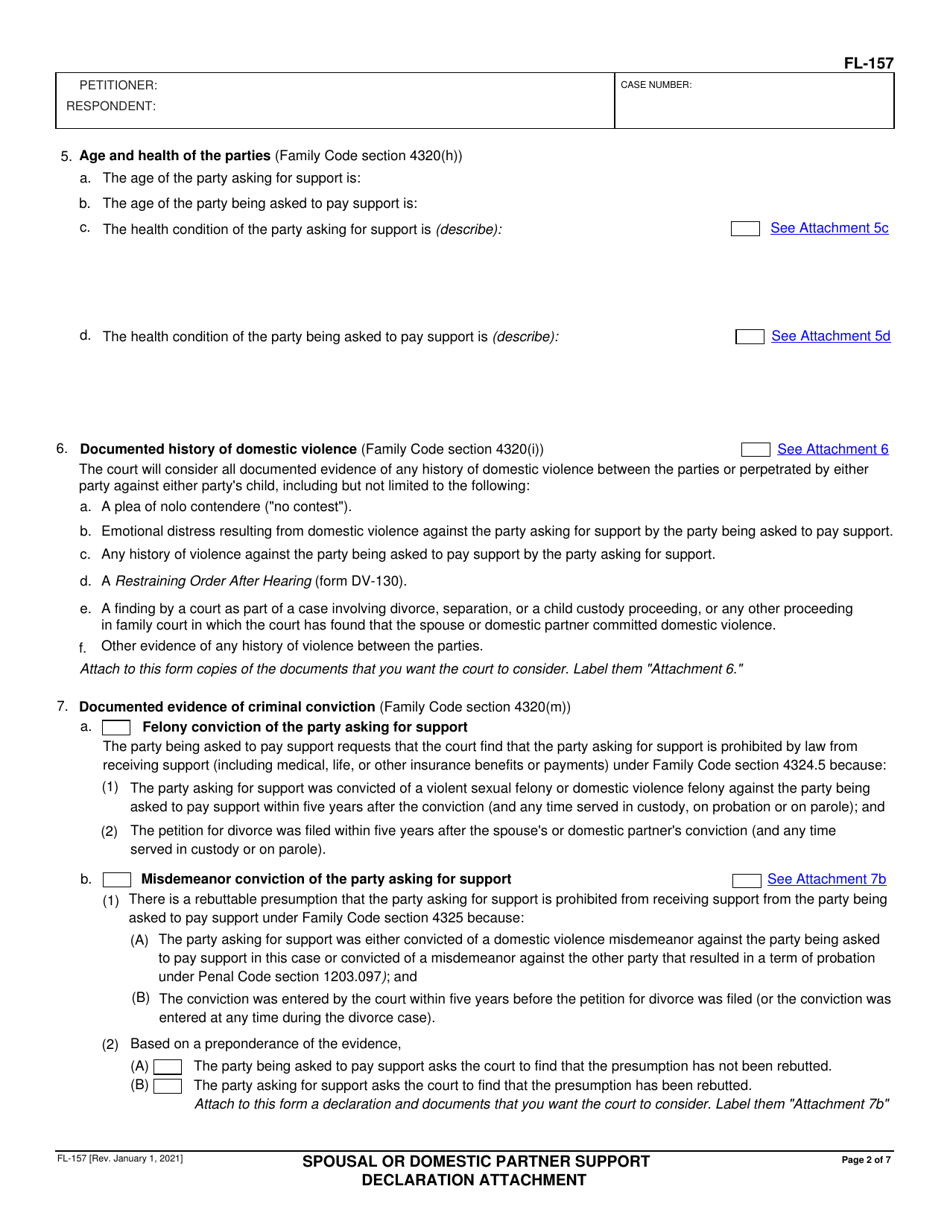

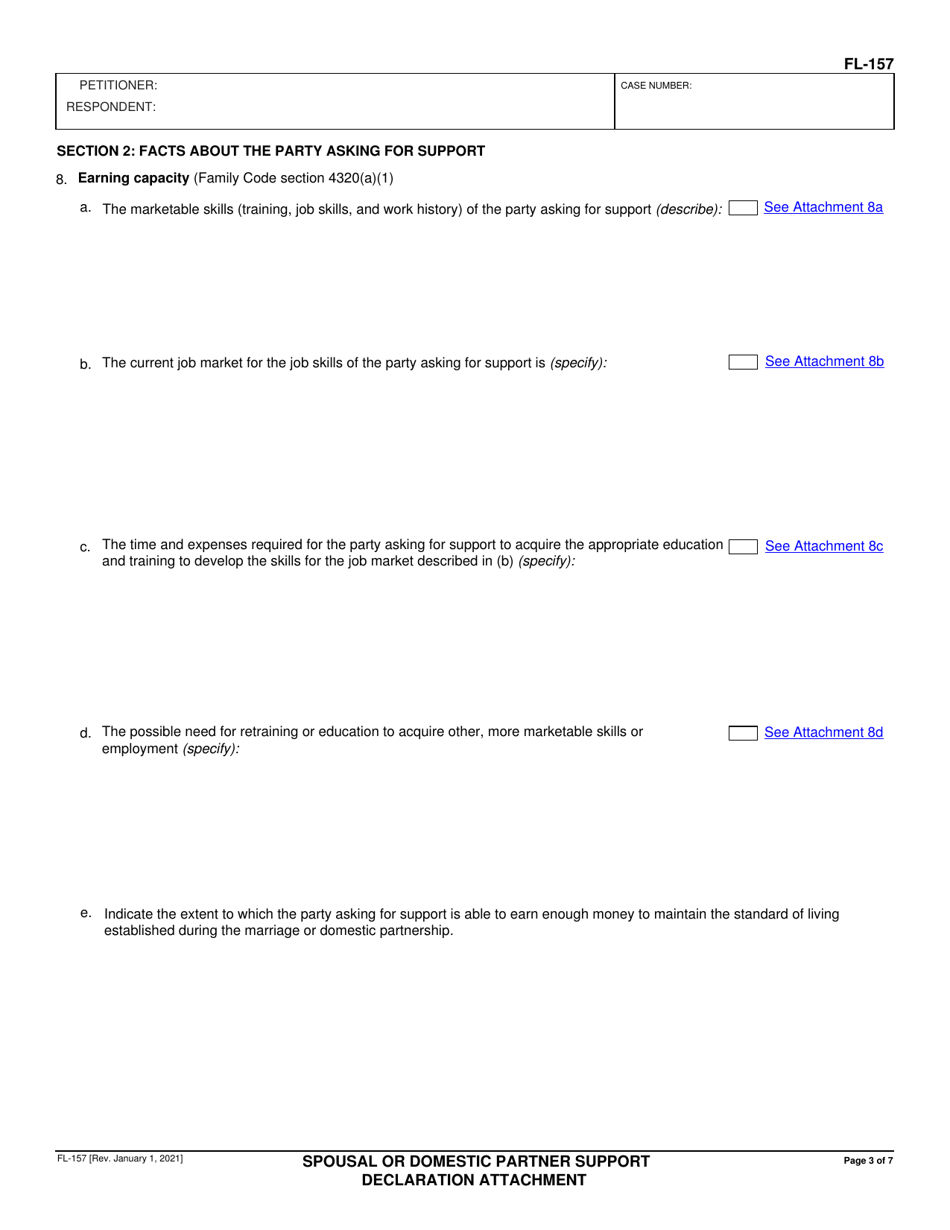

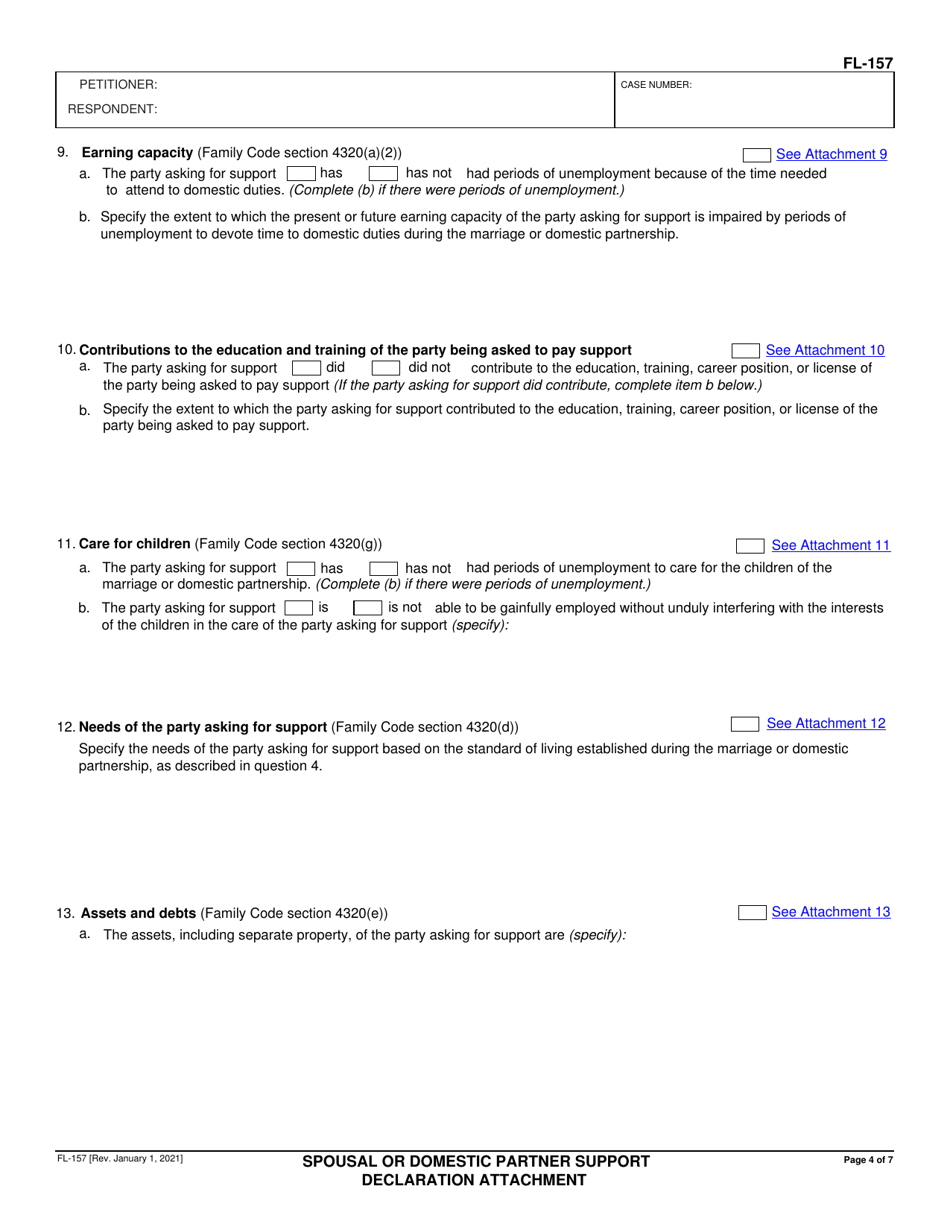

Q: What information should be included in Form FL-157?A: Form FL-157 should include detailed information about the income, expenses, assets, and debts of the parties seeking support.

Q: Do I need to provide supporting documents with Form FL-157?A: Yes, you may need to provide supporting documents such as pay stubs, bank statements, and tax returns to substantiate the information provided in Form FL-157.

Q: Who should I contact if I have questions about Form FL-157?A: If you have questions about Form FL-157, you should contact the clerk's office at the courthouse where your case is being heard.

Q: Is there a deadline for filing Form FL-157?A: The deadline for filing Form FL-157 varies depending on the court and the specific case. You should consult with an attorney or the court clerk for the specific deadline in your case.