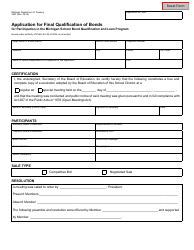

Form FIS2137 Bond - Mortgage Loan Originator - Company - Michigan

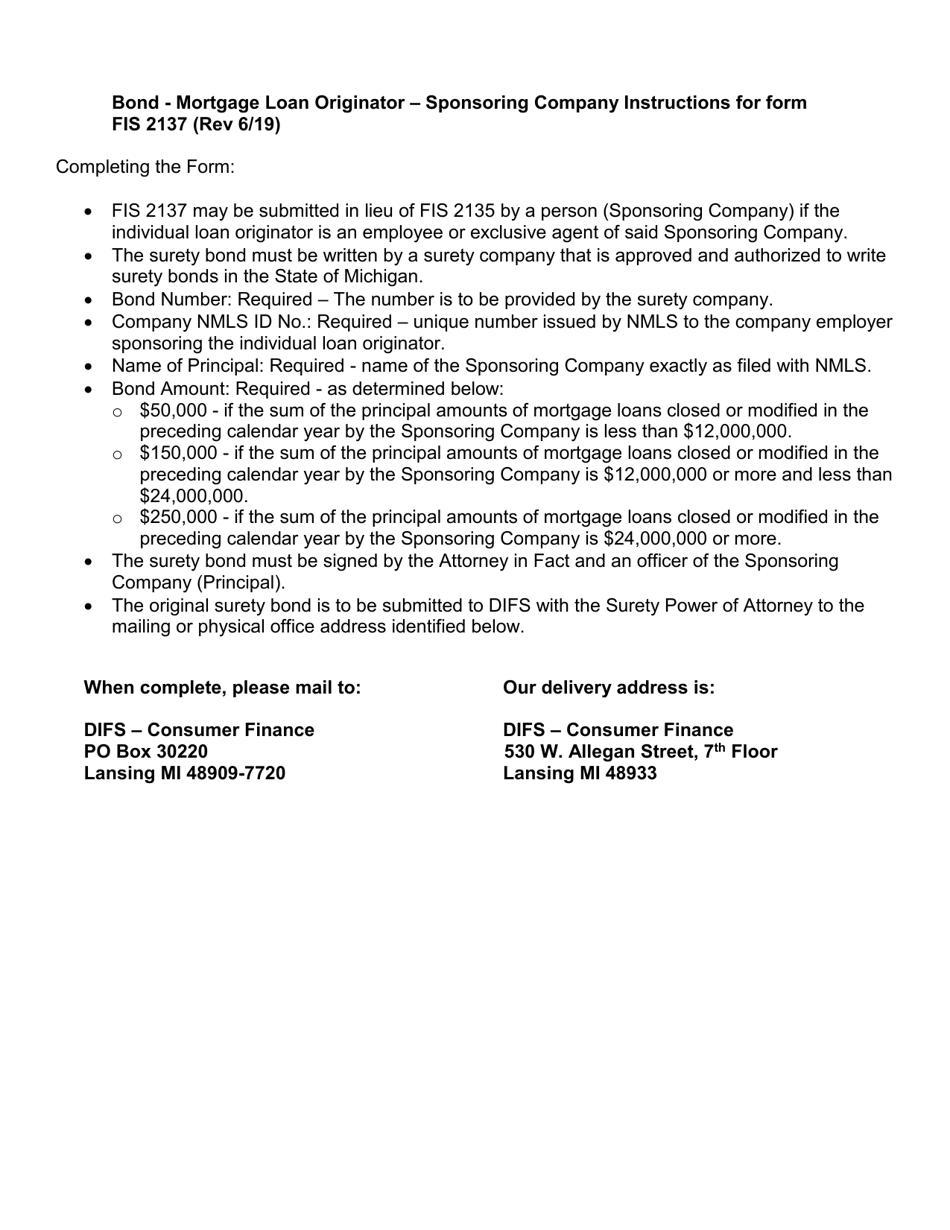

What Is Form FIS2137?

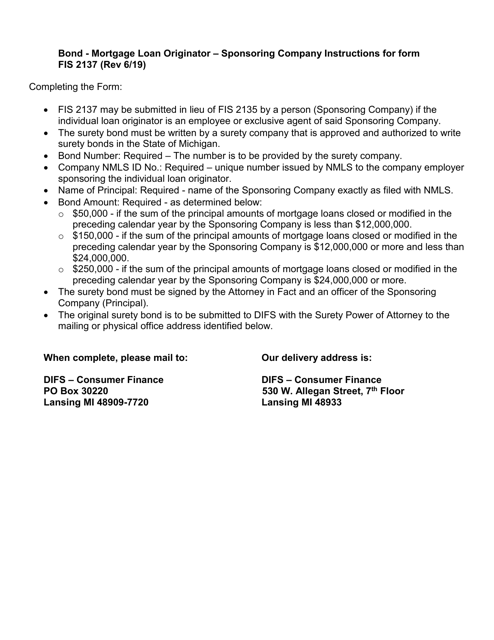

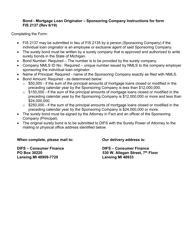

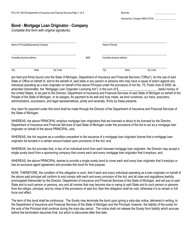

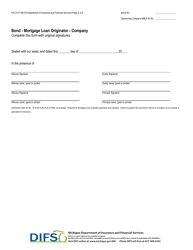

This is a legal form that was released by the Michigan Department of Licensing and Regulatory Affairs - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

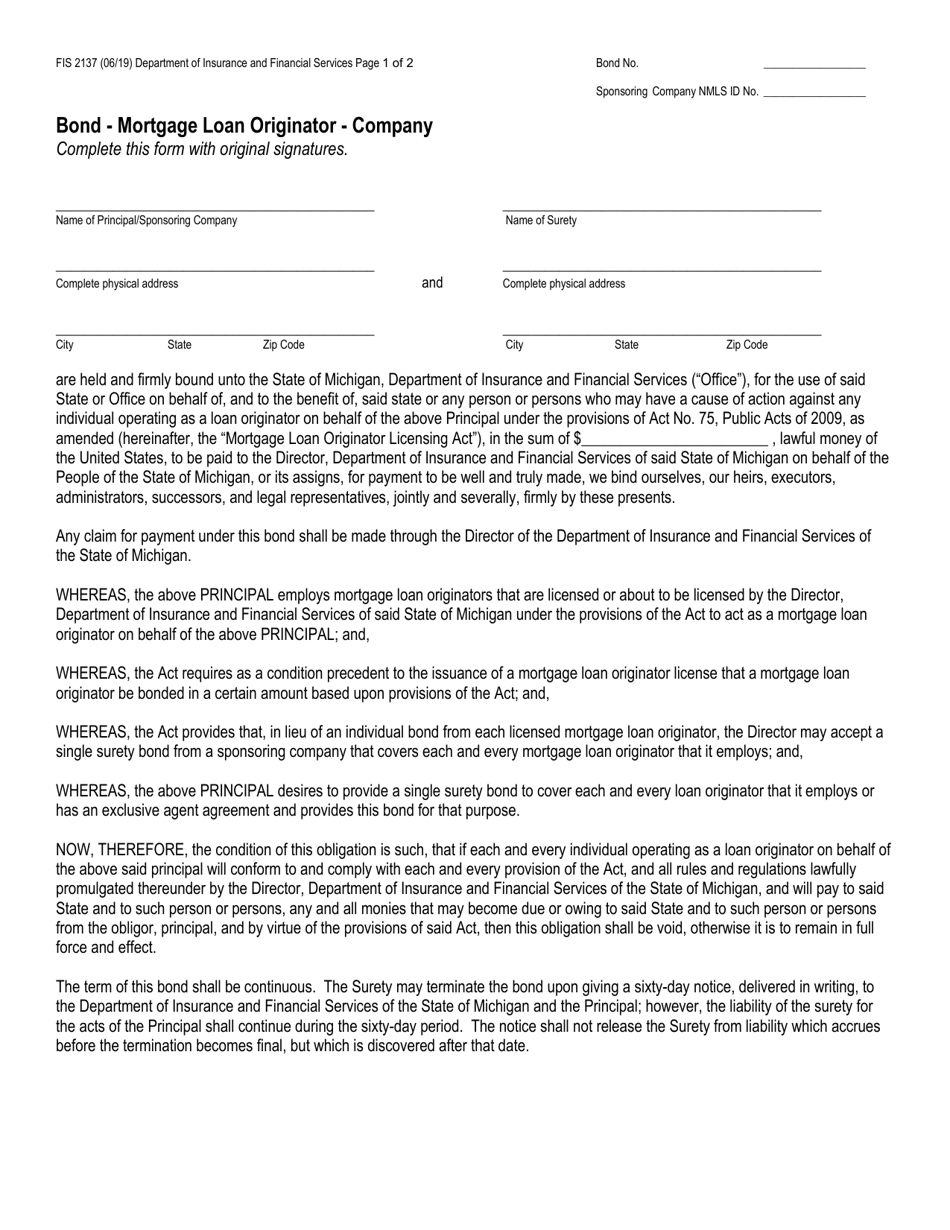

Q: What is a FIS2137 Bond?A: The FIS2137 Bond is a type of surety bond required for Mortgage Loan Originators (MLOs) who work for a company in Michigan.

Q: What is a Mortgage Loan Originator?A: A Mortgage Loan Originator is an individual who assists borrowers in obtaining loans for purchasing or refinancing real estate properties.

Q: What is the purpose of the FIS2137 Bond?A: The purpose of the FIS2137 Bond is to provide financial protection to consumers who may suffer financial losses as a result of the MLO's actions.

Q: Who requires the FIS2137 Bond?A: The FIS2137 Bond is required by the State of Michigan for Mortgage Loan Originators working for companies.

Q: How much coverage does the FIS2137 Bond provide?A: The coverage amount of the FIS2137 Bond required in Michigan is $25,000.

Q: How much does the FIS2137 Bond cost?A: The cost of the FIS2137 Bond can vary depending on the MLO's creditworthiness, but it typically ranges from $100 to $500 per year.

Q: Do all Mortgage Loan Originators need a bond?A: Yes, Mortgage Loan Originators working for companies in Michigan are required to have a bond, such as the FIS2137 Bond.

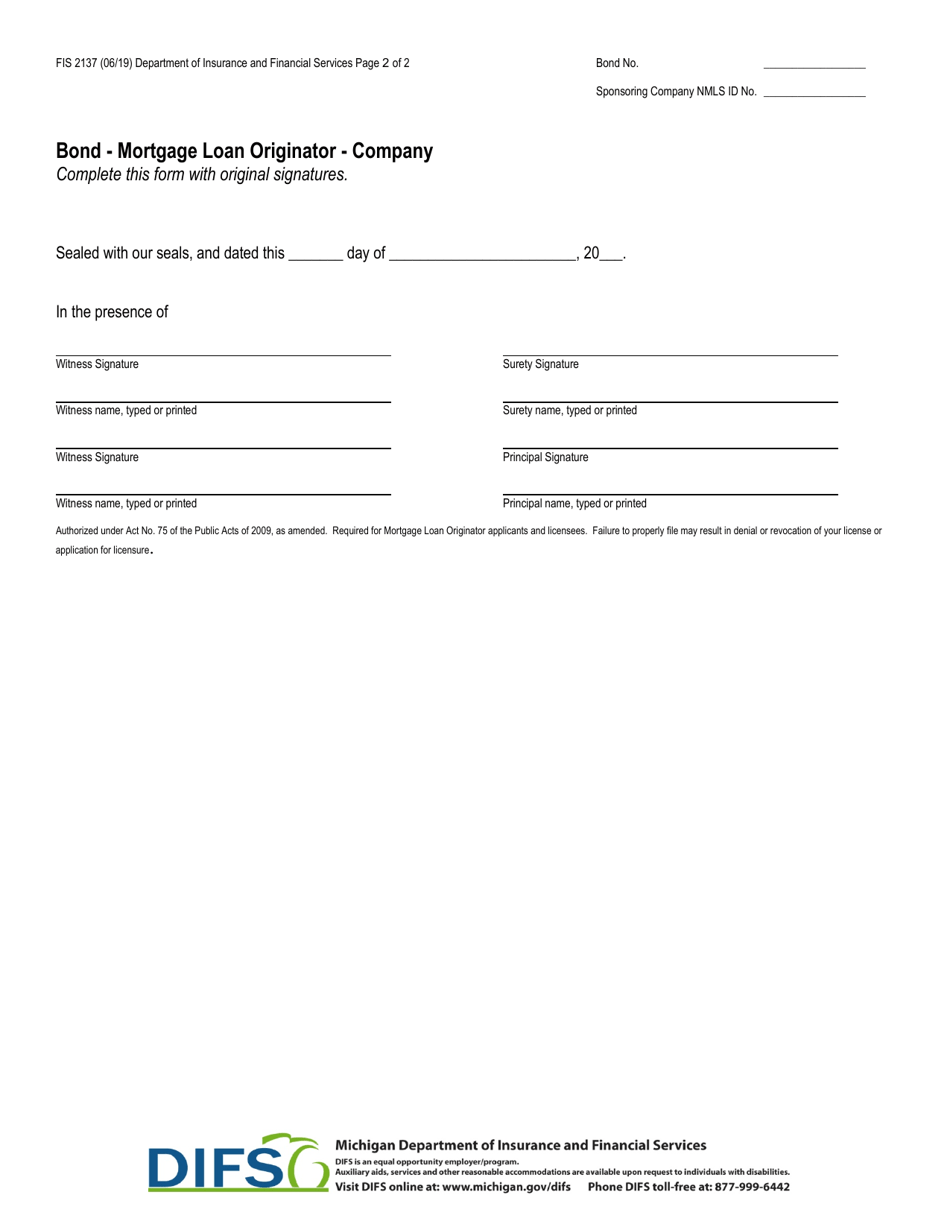

Q: How long is the FIS2137 Bond valid for?A: The FIS2137 Bond is typically valid for one year and needs to be renewed annually.

Q: What happens if a Mortgage Loan Originator does not have a bond?A: Failure to have the required FIS2137 Bond can result in penalties, fines, or the suspension/revocation of the MLO's license.