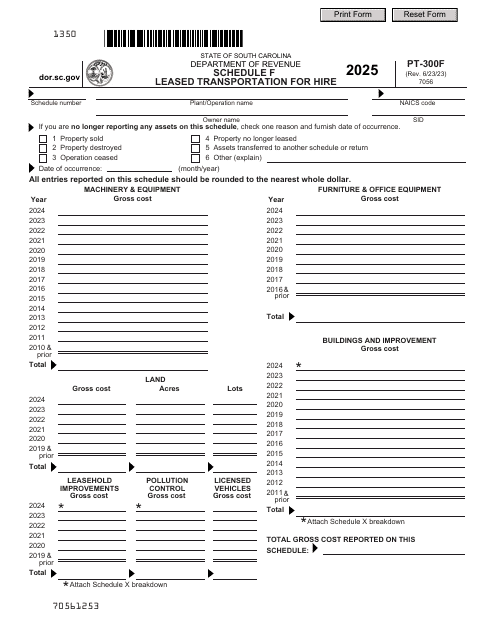

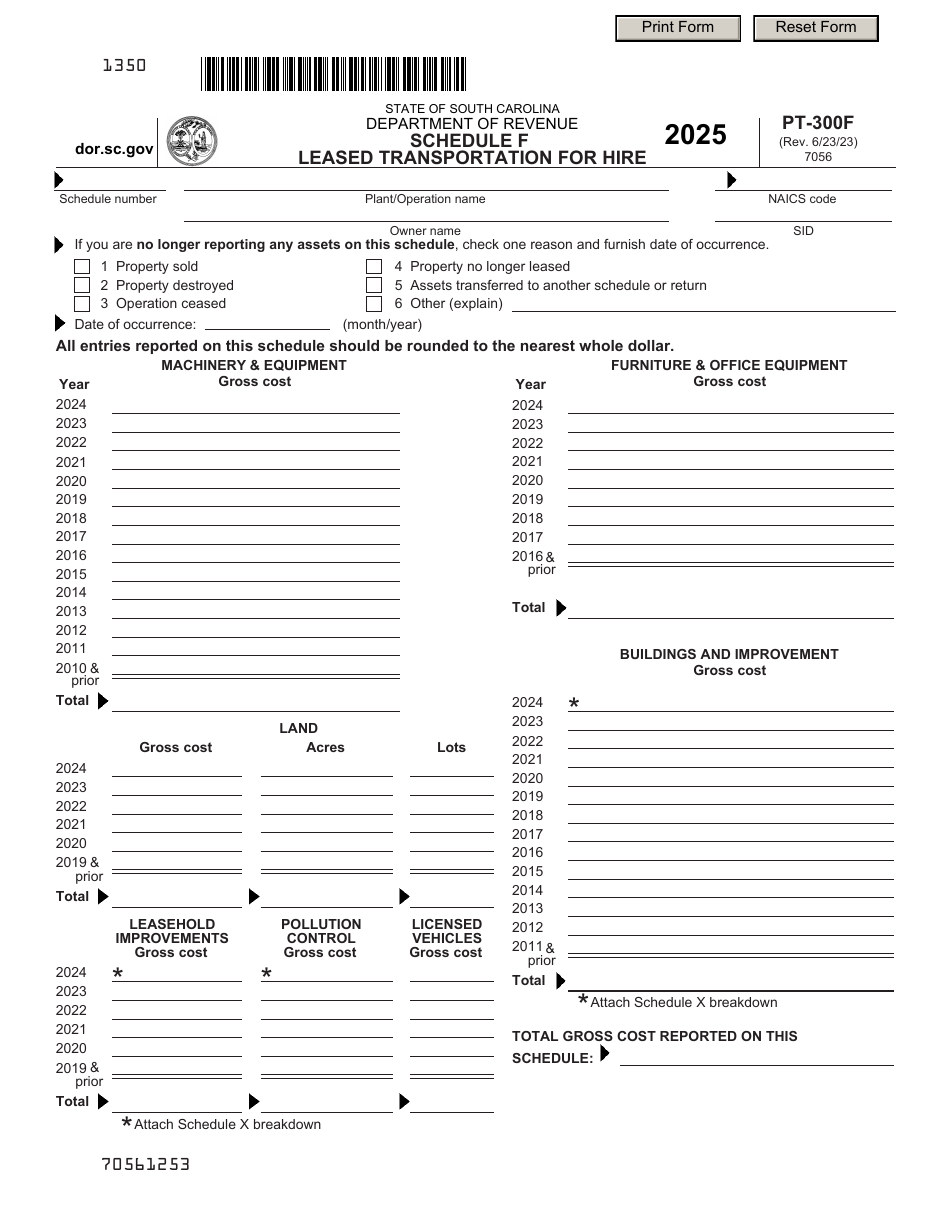

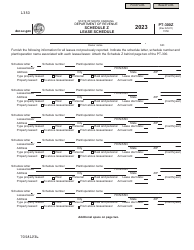

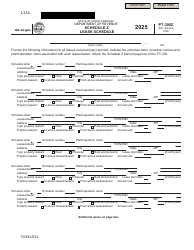

Form PT-300F Schedule F Leased Transportation for Hire - South Carolina

What Is Form PT-300F Schedule F?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PT-300F Schedule F?A: Form PT-300F Schedule F is a form used for reporting leased transportation for hire in South Carolina.

Q: What is the purpose of Form PT-300F Schedule F?A: The purpose of Form PT-300F Schedule F is to report leased transportation for hire in South Carolina.

Q: Who needs to file Form PT-300F Schedule F?A: Any individual or business engaged in leased transportation for hire in South Carolina needs to file Form PT-300F Schedule F.

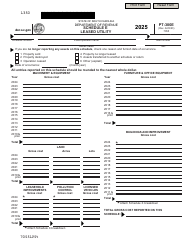

Q: What information do I need to fill out Form PT-300F Schedule F?A: You will need to provide information about the leased vehicles, the lease terms, and the lessee information.

Q: When is the deadline for filing Form PT-300F Schedule F?A: The deadline for filing Form PT-300F Schedule F is the same as the annual incometax deadline for South Carolina, which is generally April 15th.

Q: Are there any penalties for late filing of Form PT-300F Schedule F?A: Yes, there are penalties for late filing, including potential interest charges and penalties for non-compliance.

Q: Is there a fee for filing Form PT-300F Schedule F?A: Yes, there is a fee for filing Form PT-300F Schedule F, which is based on the number of vehicles you are reporting.

Q: Do I need to file Form PT-300F Schedule F every year?A: Yes, if you are engaged in leased transportation for hire in South Carolina, you are required to file Form PT-300F Schedule F annually.