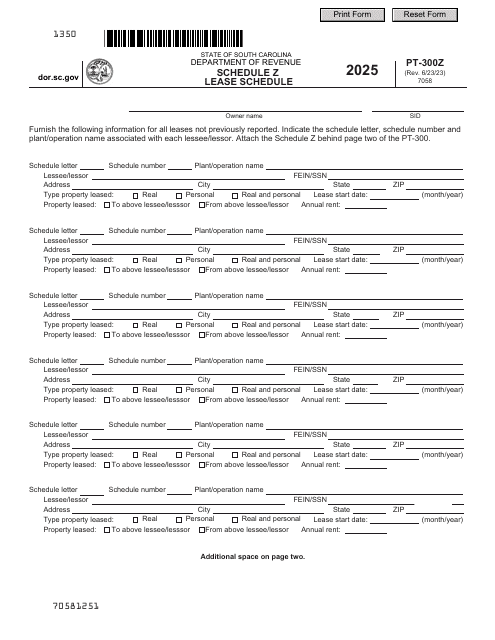

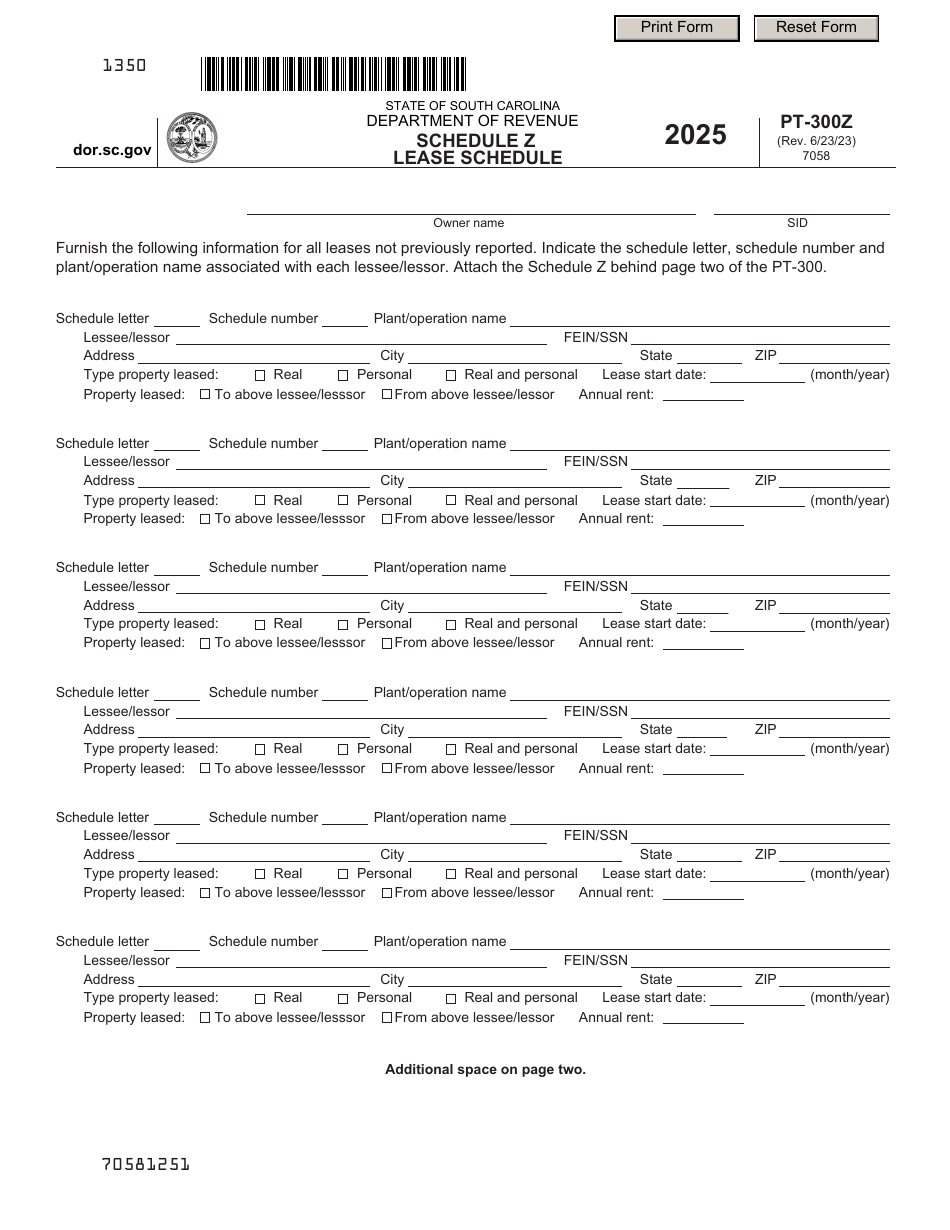

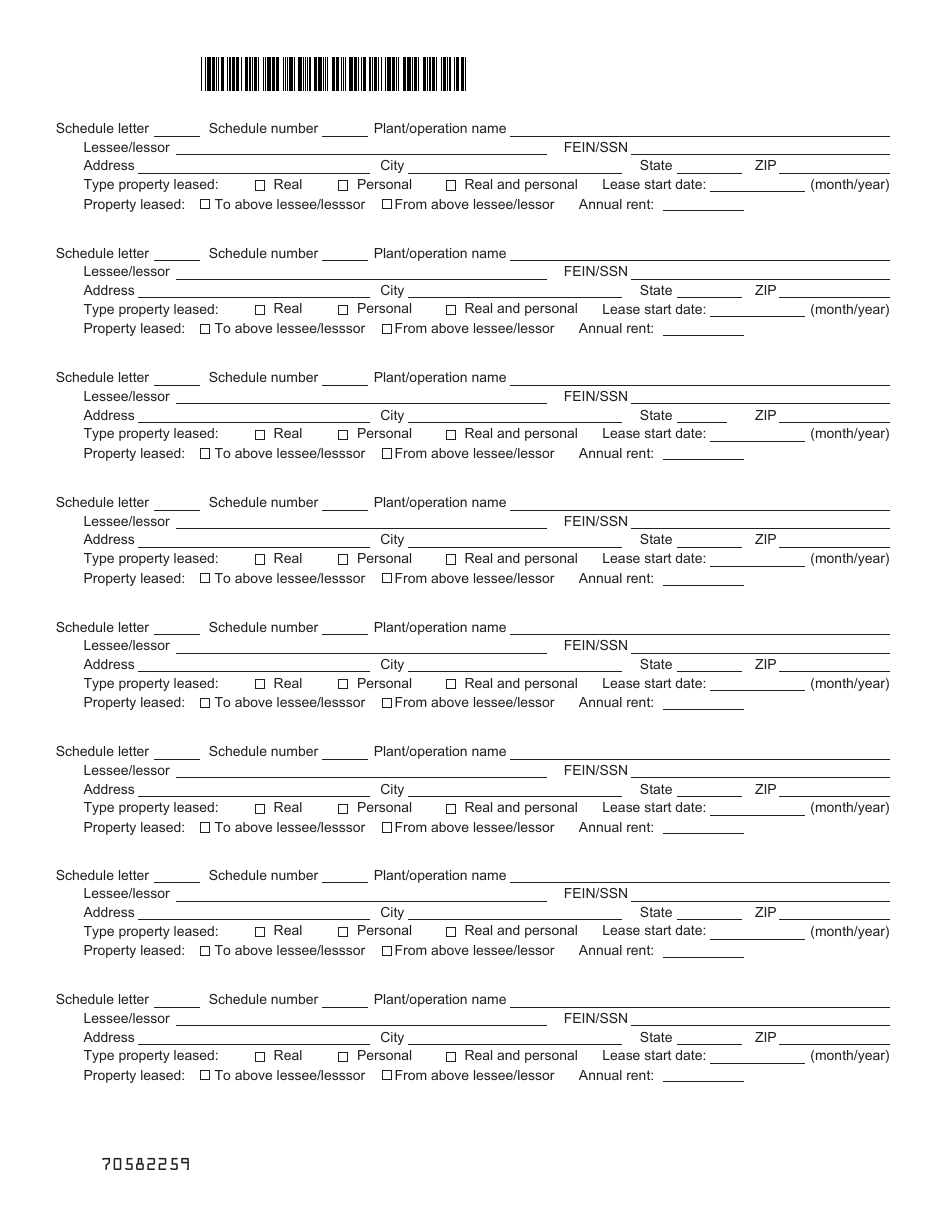

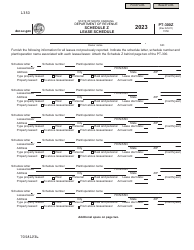

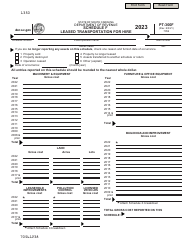

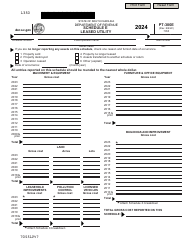

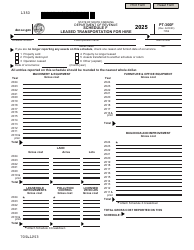

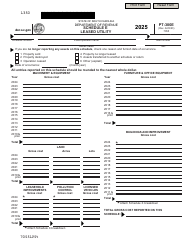

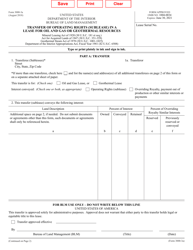

Form PT-300Z Schedule Z Lease Schedule - South Carolina

What Is Form PT-300Z Schedule Z?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PT-300Z Schedule Z?A: Form PT-300Z Schedule Z is a lease schedule specific to South Carolina.

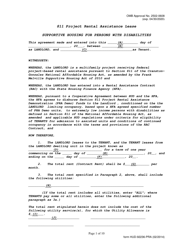

Q: What is the purpose of Form PT-300Z Schedule Z?A: The purpose of Form PT-300Z Schedule Z is to report lease information for tax purposes in South Carolina.

Q: Who needs to file Form PT-300Z Schedule Z?A: Businesses or individuals who own or lease personal property in South Carolina and meet certain criteria may need to file Form PT-300Z Schedule Z.

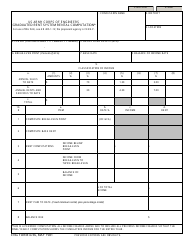

Q: What information is required on Form PT-300Z Schedule Z?A: Form PT-300Z Schedule Z requires details about the leased property, lessee information, lease terms, and lease payment information.

Q: Are there any filing deadlines for Form PT-300Z Schedule Z?A: Yes, Form PT-300Z Schedule Z generally needs to be filed by the due date of the South Carolina personal property tax return, which is typically April 30th.

Q: What happens if I fail to file Form PT-300Z Schedule Z?A: Failing to file Form PT-300Z Schedule Z may result in penalties, interest, or other consequences as determined by the South Carolina Department of Revenue.