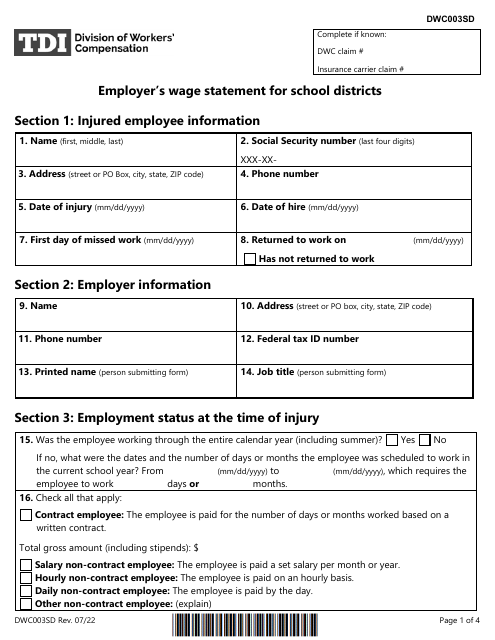

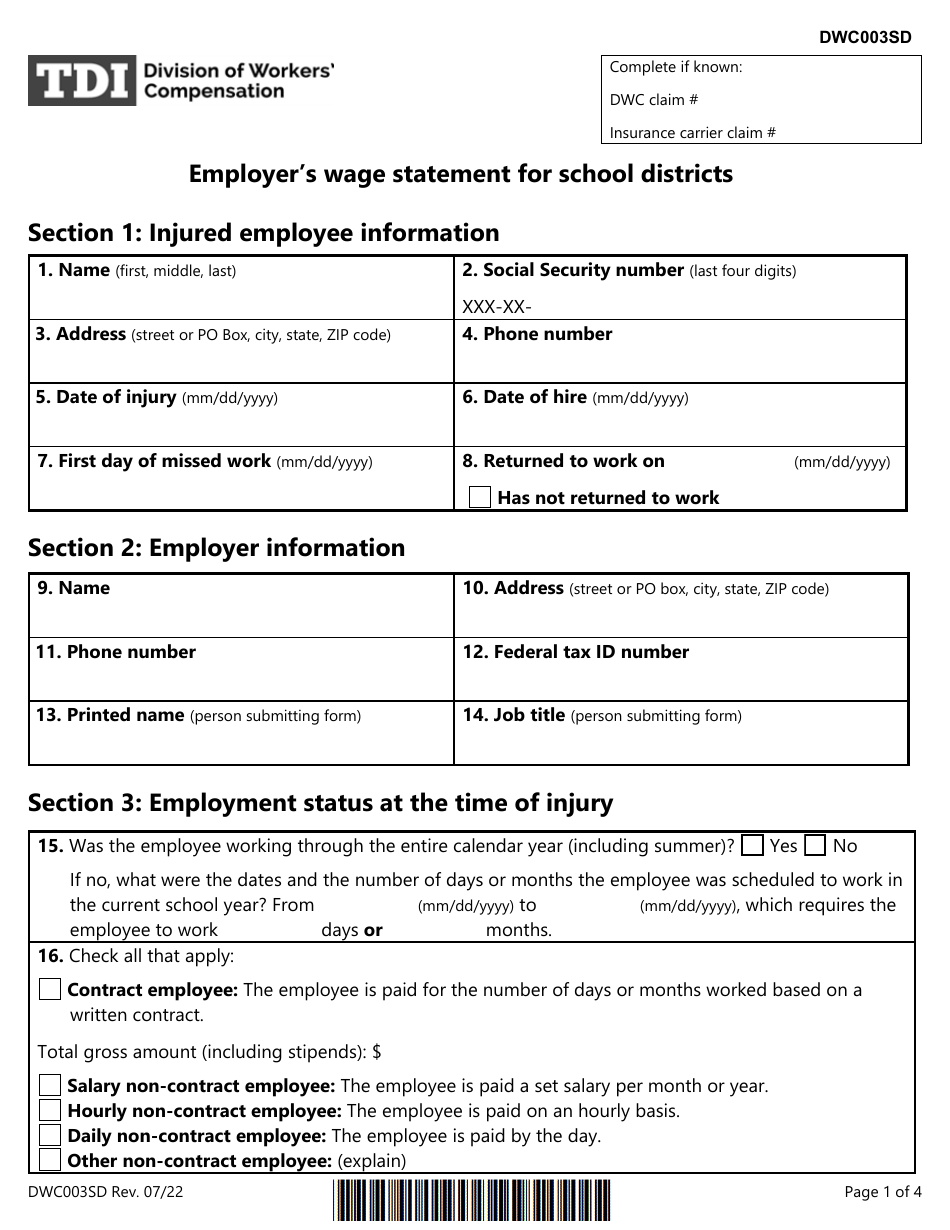

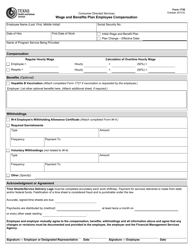

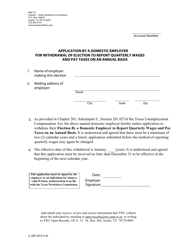

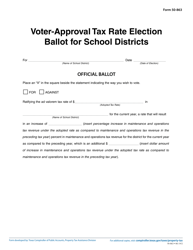

Form DWC003SD Employer's Wage Statement for School Districts - Texas

What Is Form DWC003SD?

This is a legal form that was released by the Texas Department of Insurance - Division of Workers' Compensation - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

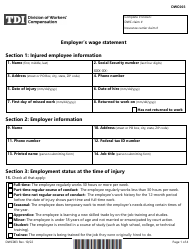

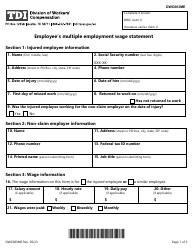

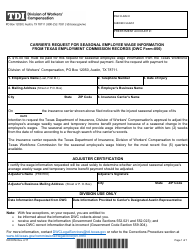

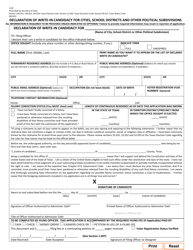

Q: What is Form DWC003SD?A: Form DWC003SD is the Employer's Wage Statement for School Districts in Texas.

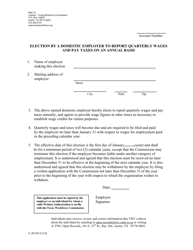

Q: Who is required to file Form DWC003SD?A: School districts in Texas are required to file Form DWC003SD.

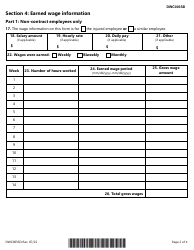

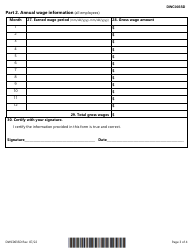

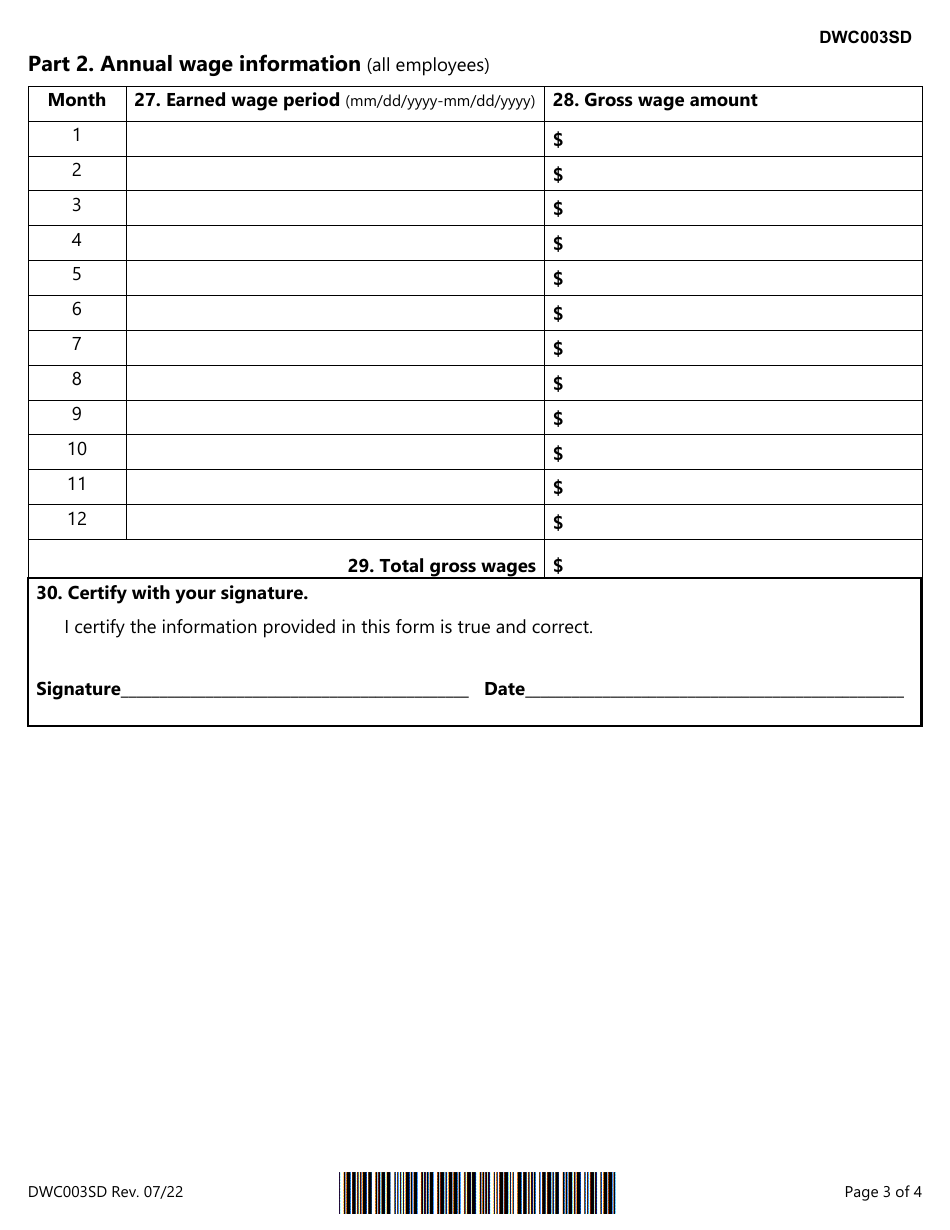

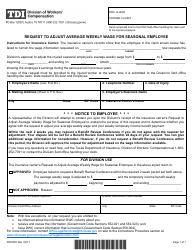

Q: What information is included in Form DWC003SD?A: Form DWC003SD includes wage information for employees in school districts, such as wages earned and taxes withheld.

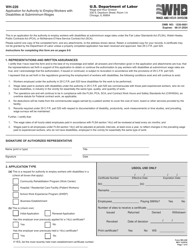

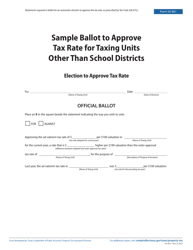

Q: When is Form DWC003SD due?A: Form DWC003SD is due annually by a specified deadline, usually after the end of the tax year.

Q: Is Form DWC003SD used for federal tax purposes?A: No, Form DWC003SD is specific to reporting wages for school districts in Texas and is not used for federal tax purposes.