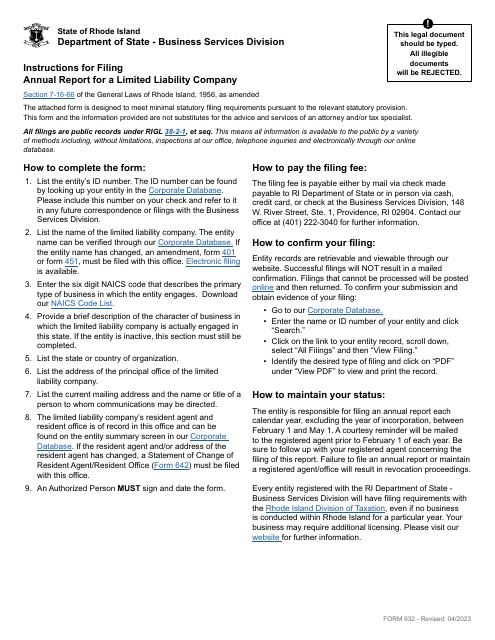

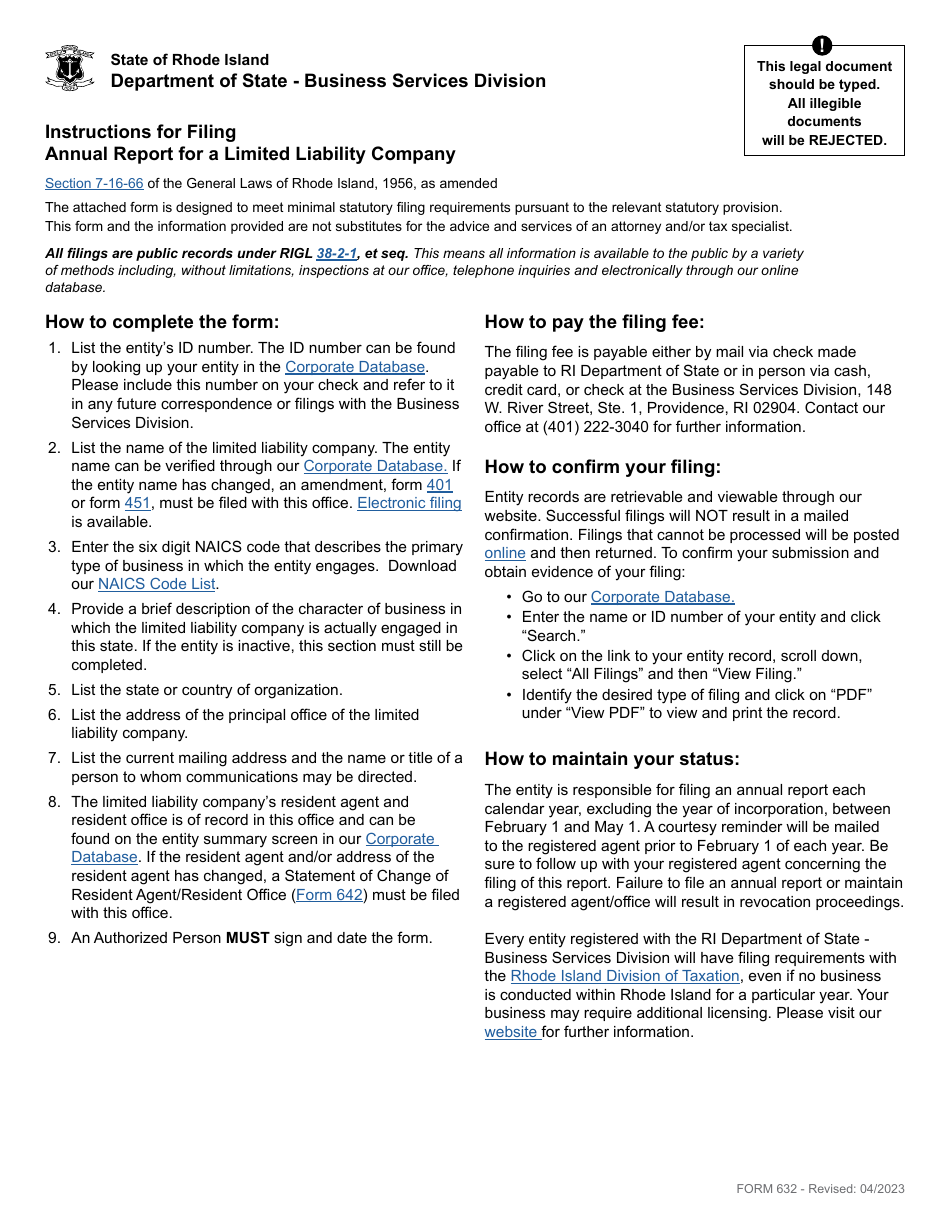

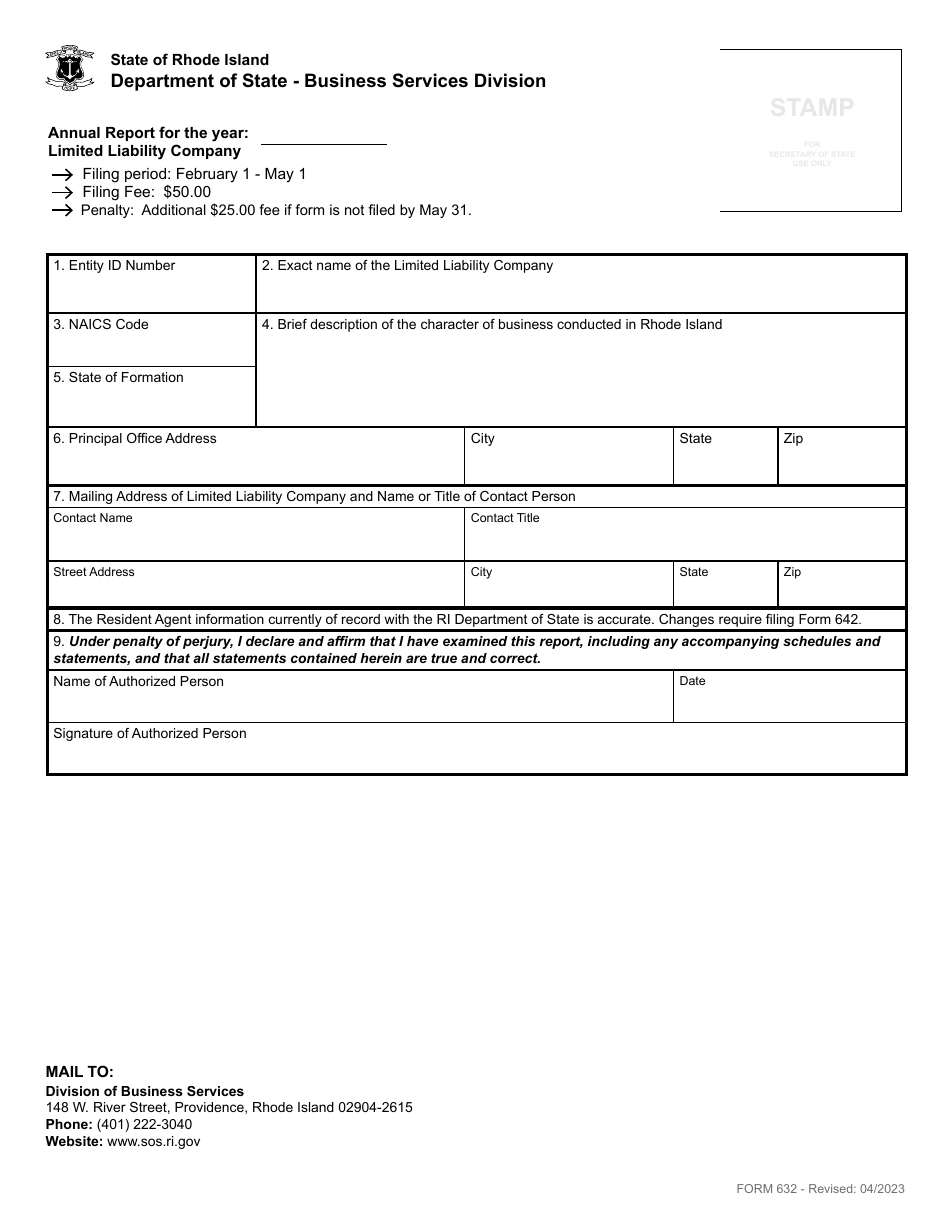

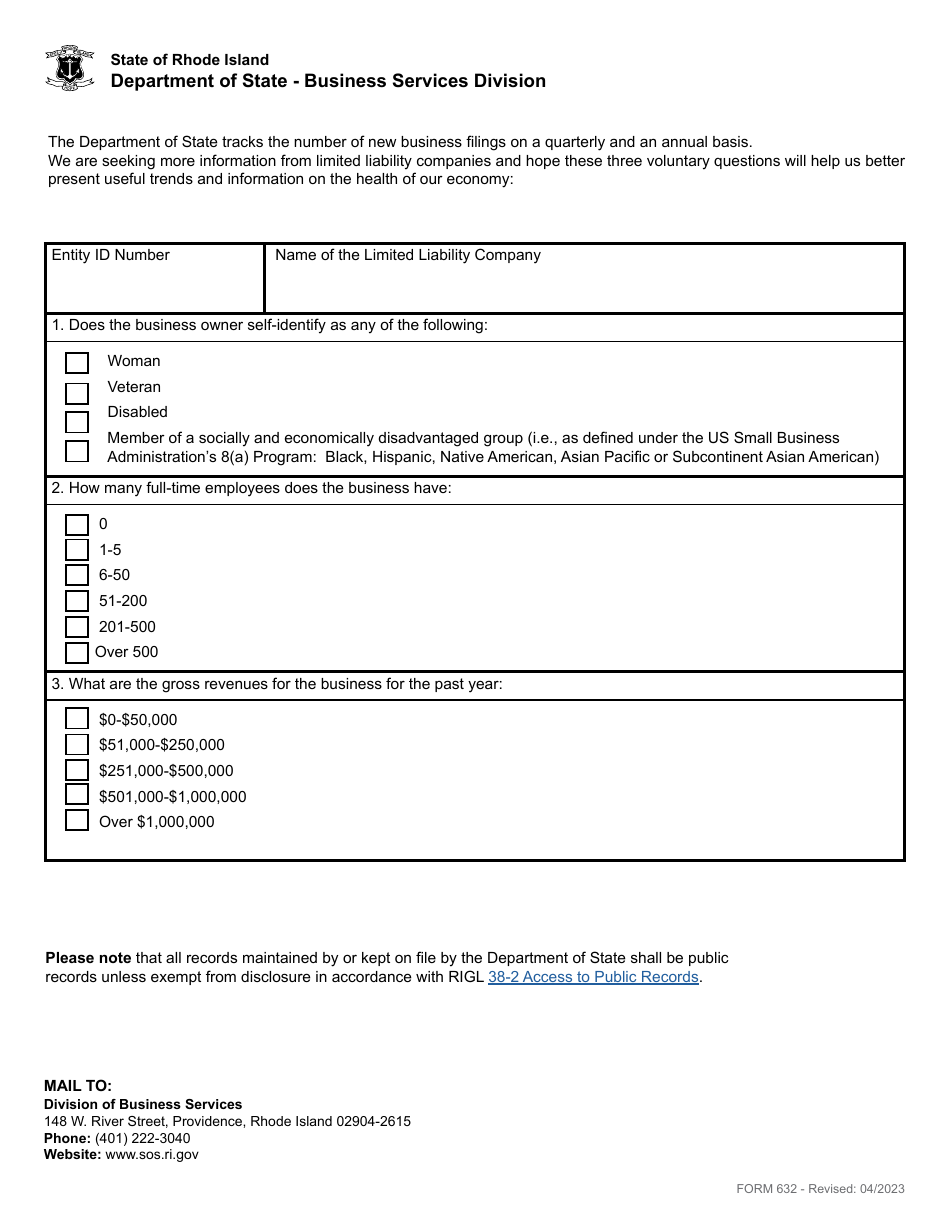

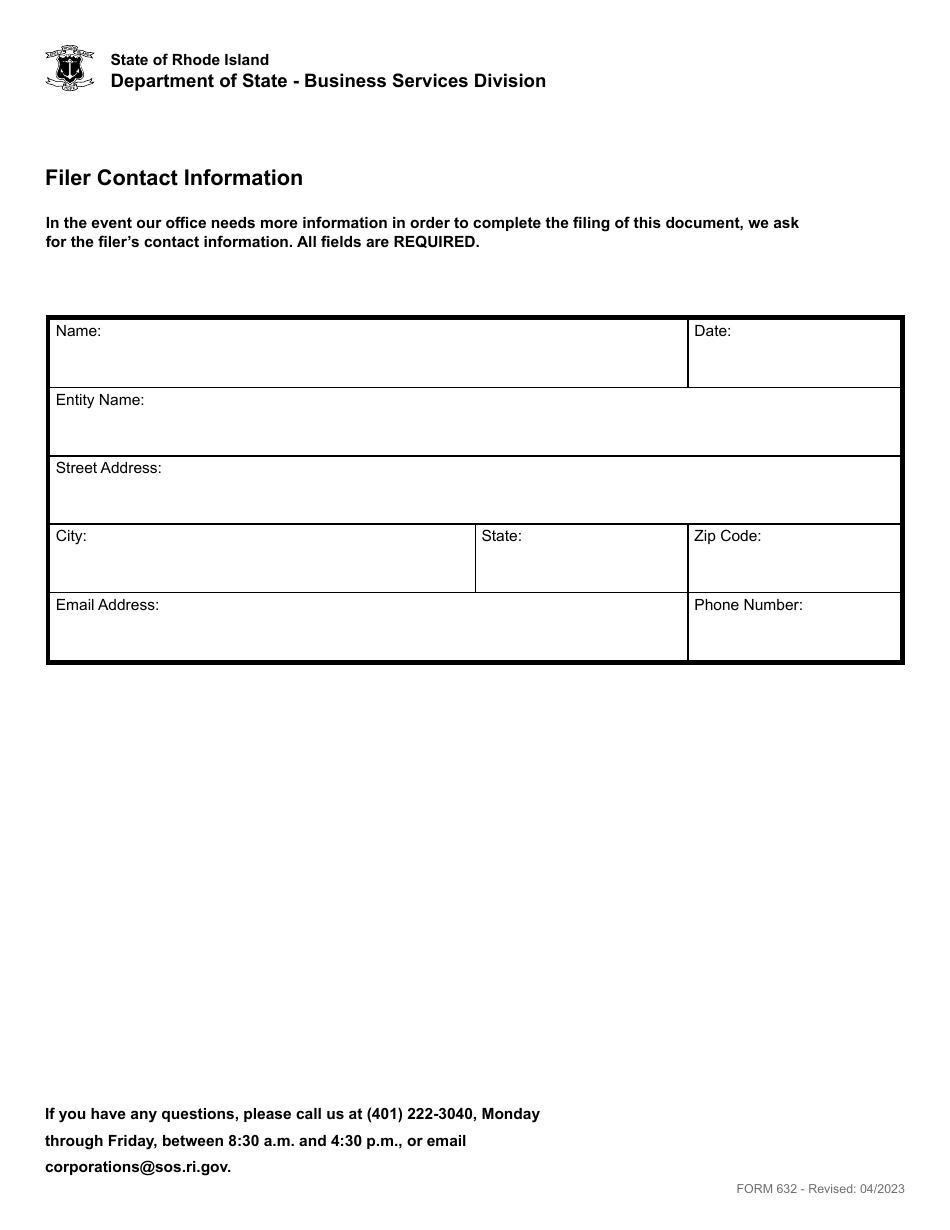

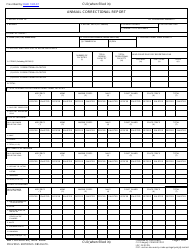

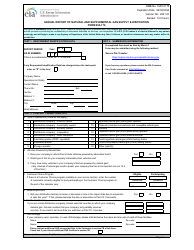

Form 632 Annual Report for a Limited Liability Company - Rhode Island

What Is Form 632?

This is a legal form that was released by the Rhode Island Secretary of State - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

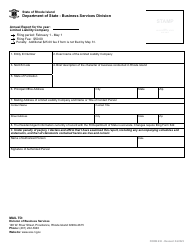

Q: What is Form 632?A: Form 632 is the Annual Report for a Limited Liability Company in Rhode Island.

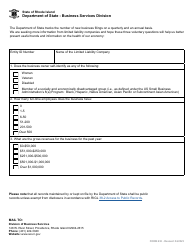

Q: Who needs to file Form 632?A: All Limited Liability Companies (LLCs) registered in Rhode Island are required to file Form 632.

Q: When is the deadline to file Form 632?A: The deadline to file Form 632 is the last day of the anniversary month of the LLC's formation.

Q: What information is required on Form 632?A: Form 632 requires basic information about the LLC, including its name, address, and the names and addresses of its members.

Q: What happens if I don't file Form 632?A: Failure to file Form 632 can result in penalties and the potential dissolution of the LLC.

Q: Can I request an extension to file Form 632?A: No, Rhode Island does not offer extensions for filing Form 632.

Q: Can I file Form 632 if my LLC is inactive?A: Yes, even if your LLC is inactive, you are still required to file Form 632 in Rhode Island.