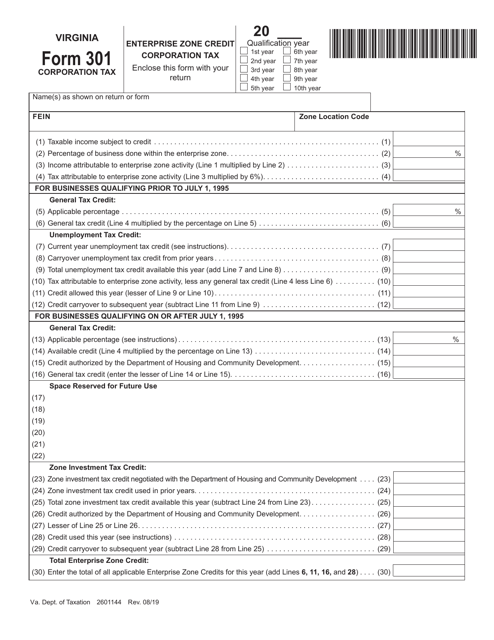

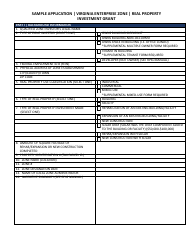

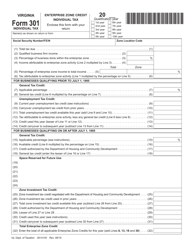

Form 301 Enterprise Zone Credit Corporation Tax - Virginia

What Is Form 301?

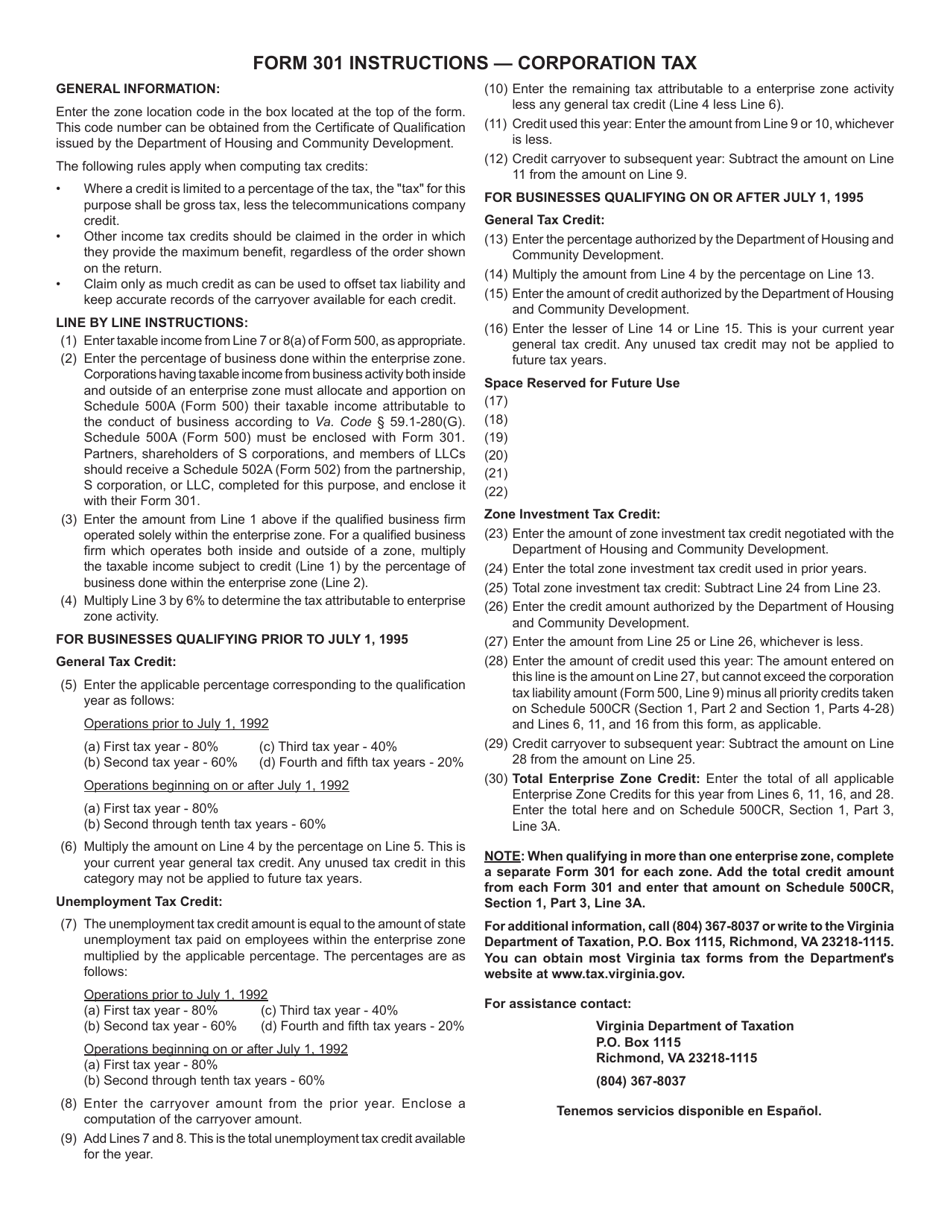

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

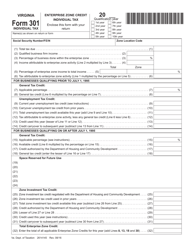

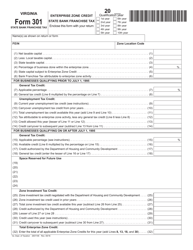

Q: What is Form 301 Enterprise Zone Credit Corporation Tax?A: Form 301 is a tax form used in the state of Virginia to claim the Enterprise Zone Credit for Corporation Tax.

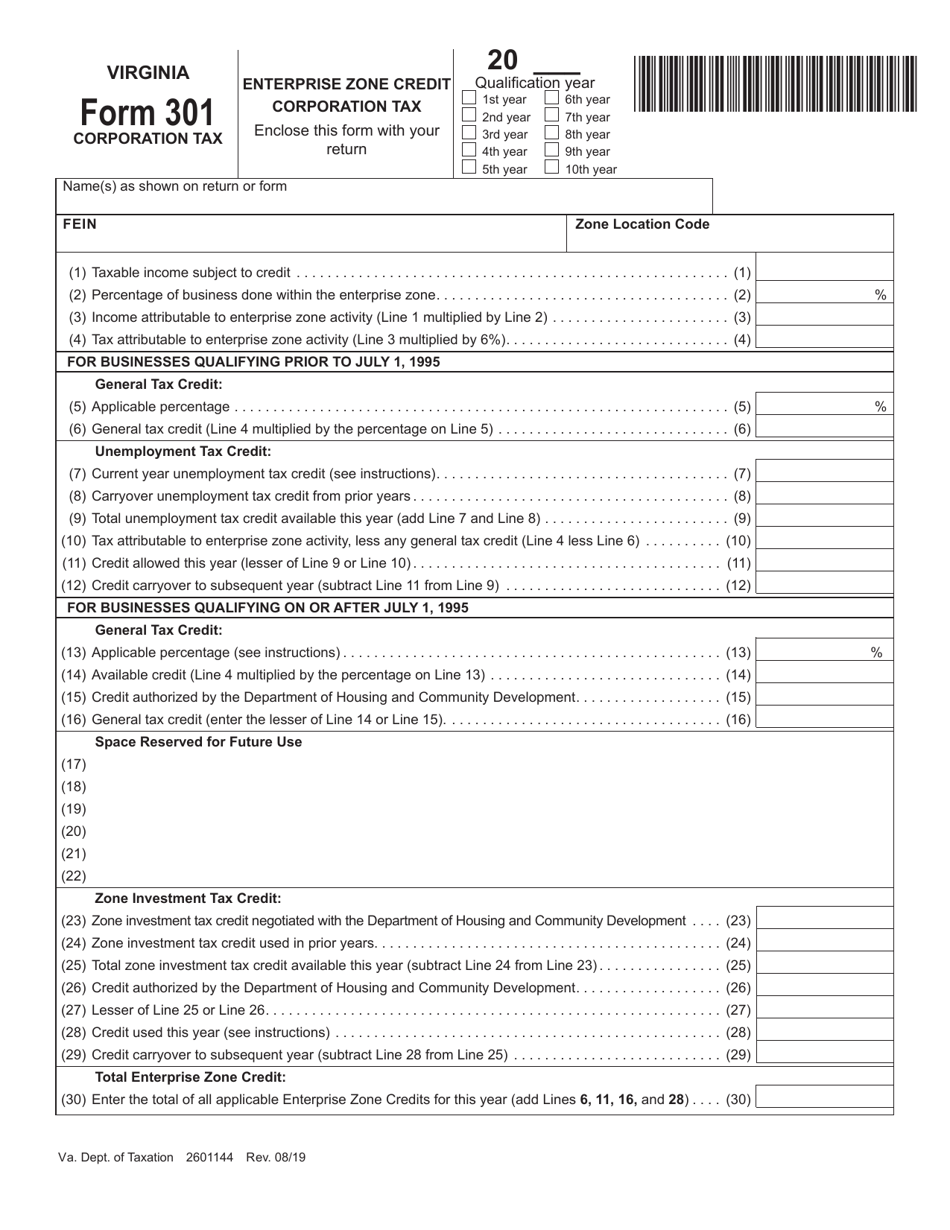

Q: What is the Enterprise Zone Credit?A: The Enterprise Zone Credit is a tax credit available to corporations in designated enterprise zones in Virginia.

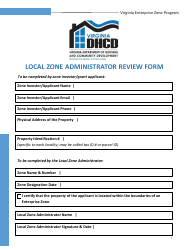

Q: Who is eligible to claim the Enterprise Zone Credit?A: Corporations that are located and doing business within an enterprise zone in Virginia are eligible to claim this credit.

Q: What expenses can be claimed for the Enterprise Zone Credit?A: Eligible expenses include job creation, machinery and equipment purchases, and real property improvements within the designated enterprise zone.

Q: How much is the Enterprise Zone Credit worth?A: The credit amount varies based on the eligible expenses incurred and the location of the enterprise zone.

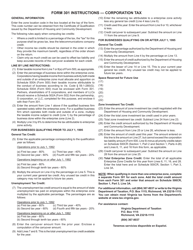

Q: How tofill out Form 301?A: Form 301 requires the corporation to provide details about the eligible expenses, job creation, and other relevant information. It is recommended to consult with a tax professional or review the instructions provided with the form.