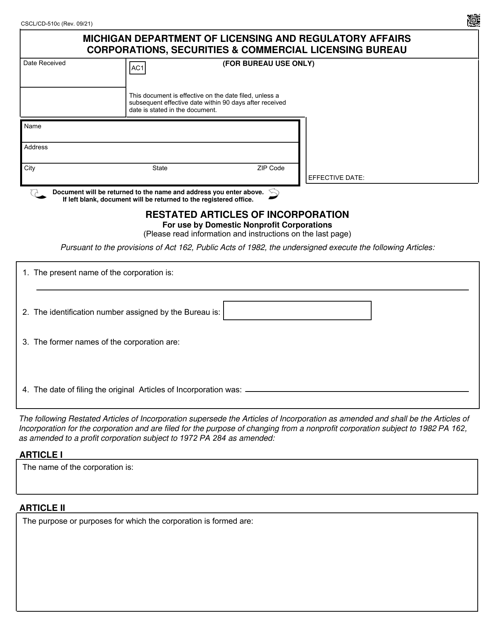

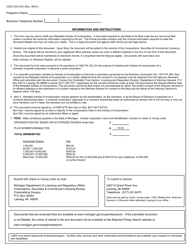

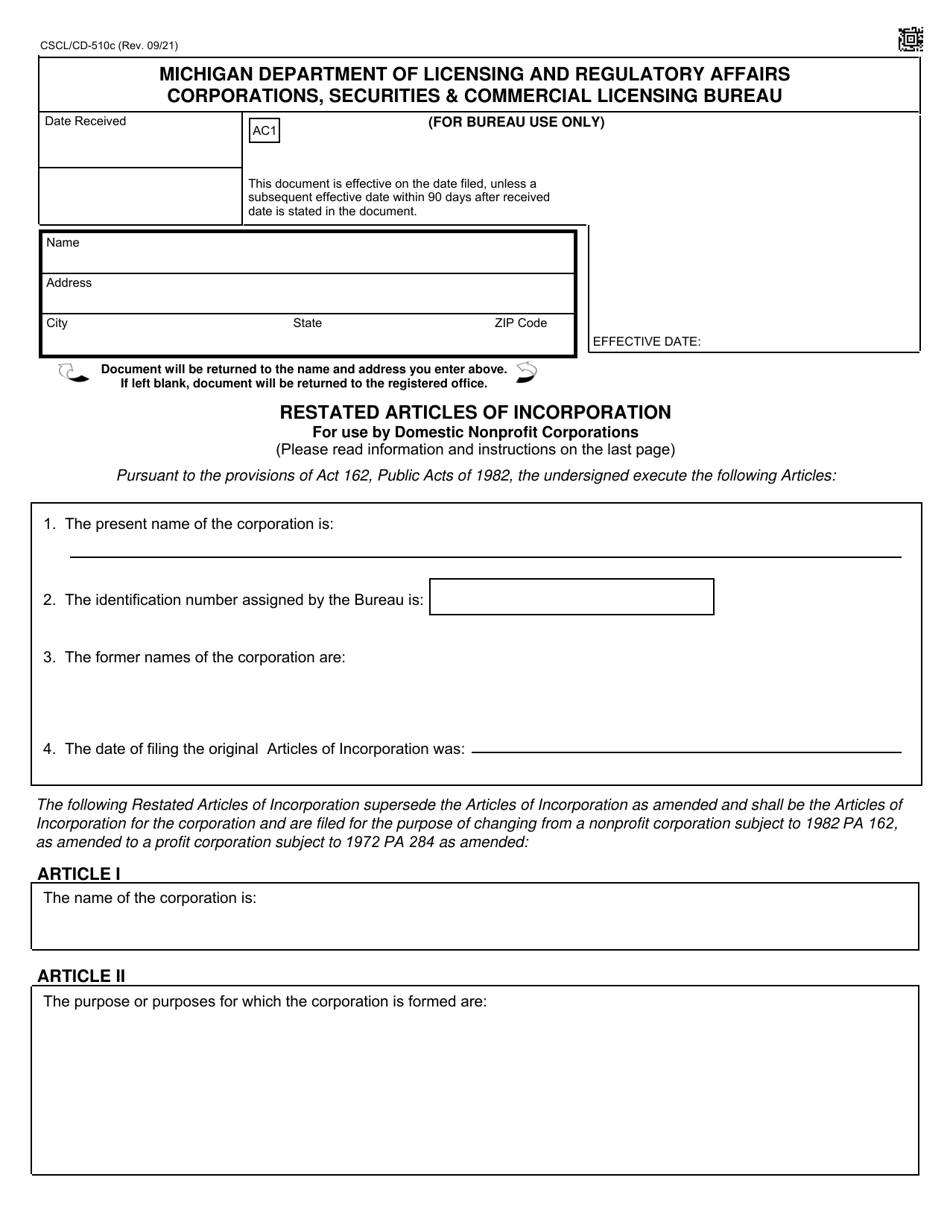

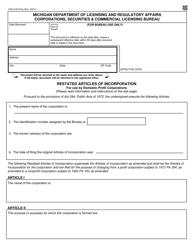

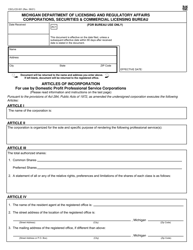

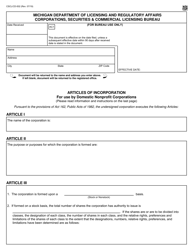

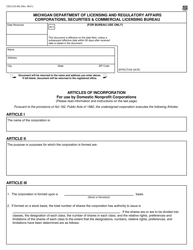

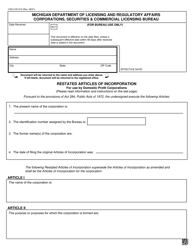

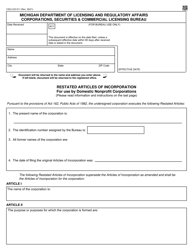

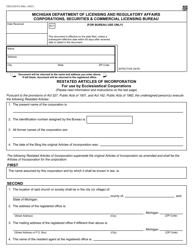

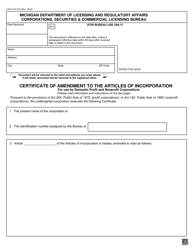

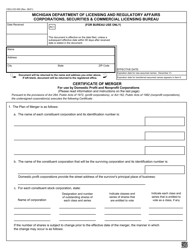

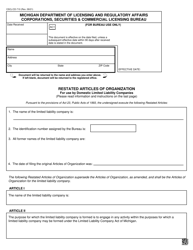

Form CSCL / CD-510C Restated Articles of Incorporation for Use by Domestic Nonprofit Corporations - Michigan

What Is Form CSCL/CD-510C?

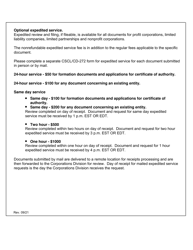

This is a legal form that was released by the Michigan Secretary of State - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the form CSCL/CD-510C?A: The form CSCL/CD-510C is the Restated Articles of Incorporation for Use by Domestic Nonprofit Corporations in Michigan.

Q: Who can use the form CSCL/CD-510C?A: The form CSCL/CD-510C can be used by Domestic Nonprofit Corporations in Michigan.

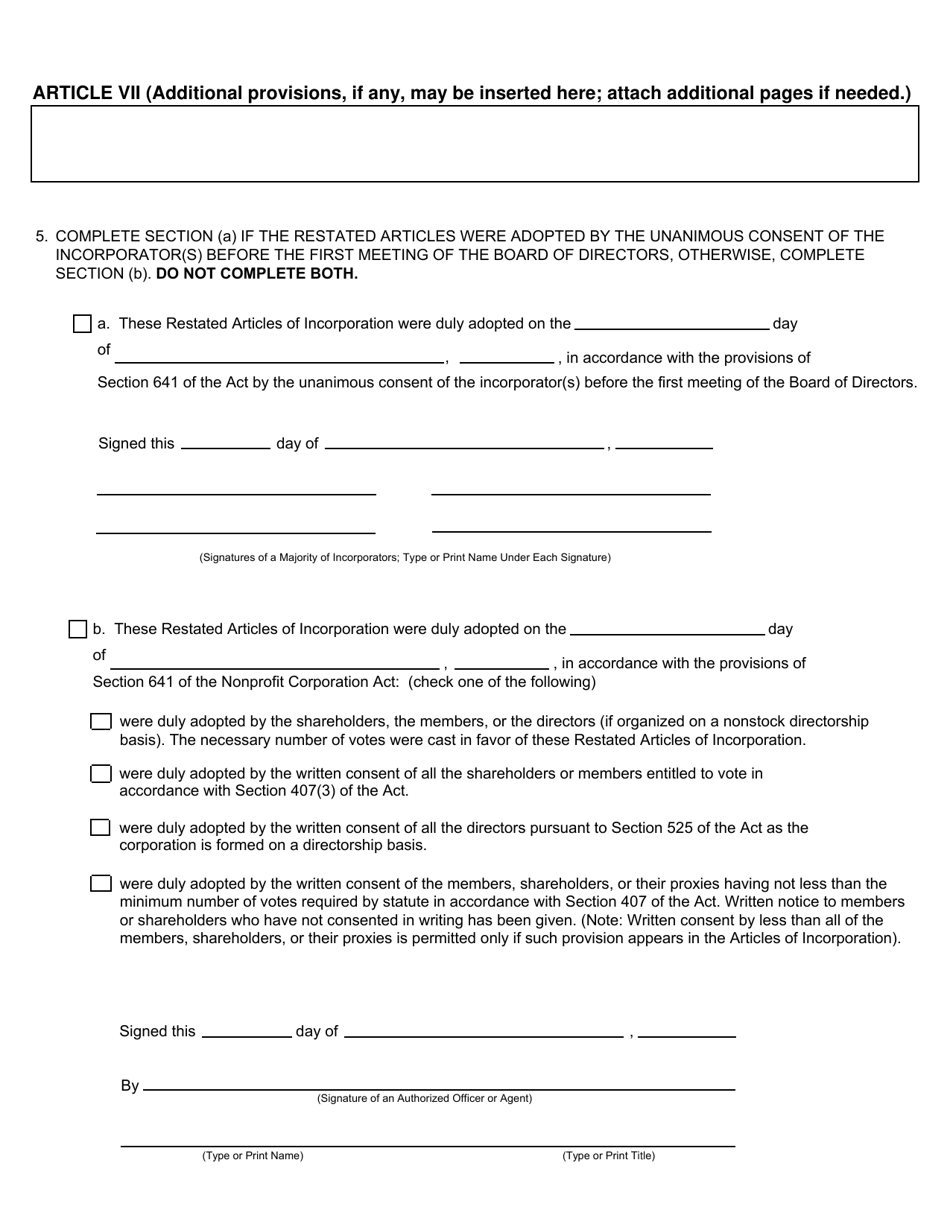

Q: What is the purpose of the form CSCL/CD-510C?A: The purpose of the form CSCL/CD-510C is to restate the Articles of Incorporation for a Domestic Nonprofit Corporation.

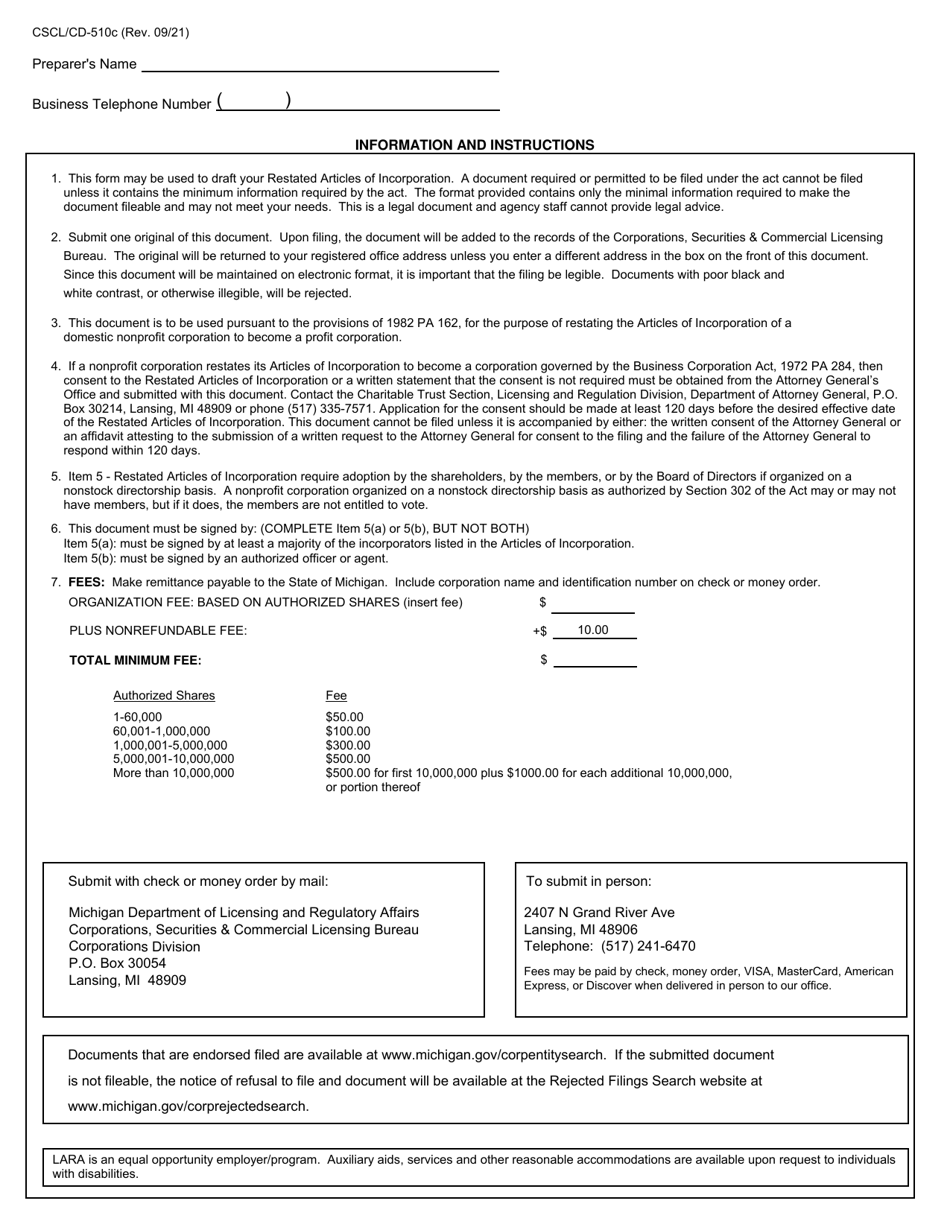

Q: Do I need to file the form CSCL/CD-510C with any government agency?A: Yes, you need to file the form CSCL/CD-510C with the Michigan Department of Licensing and Regulatory Affairs (LARA).

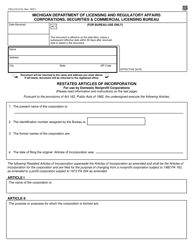

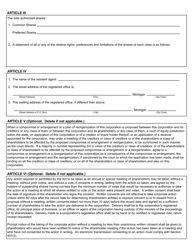

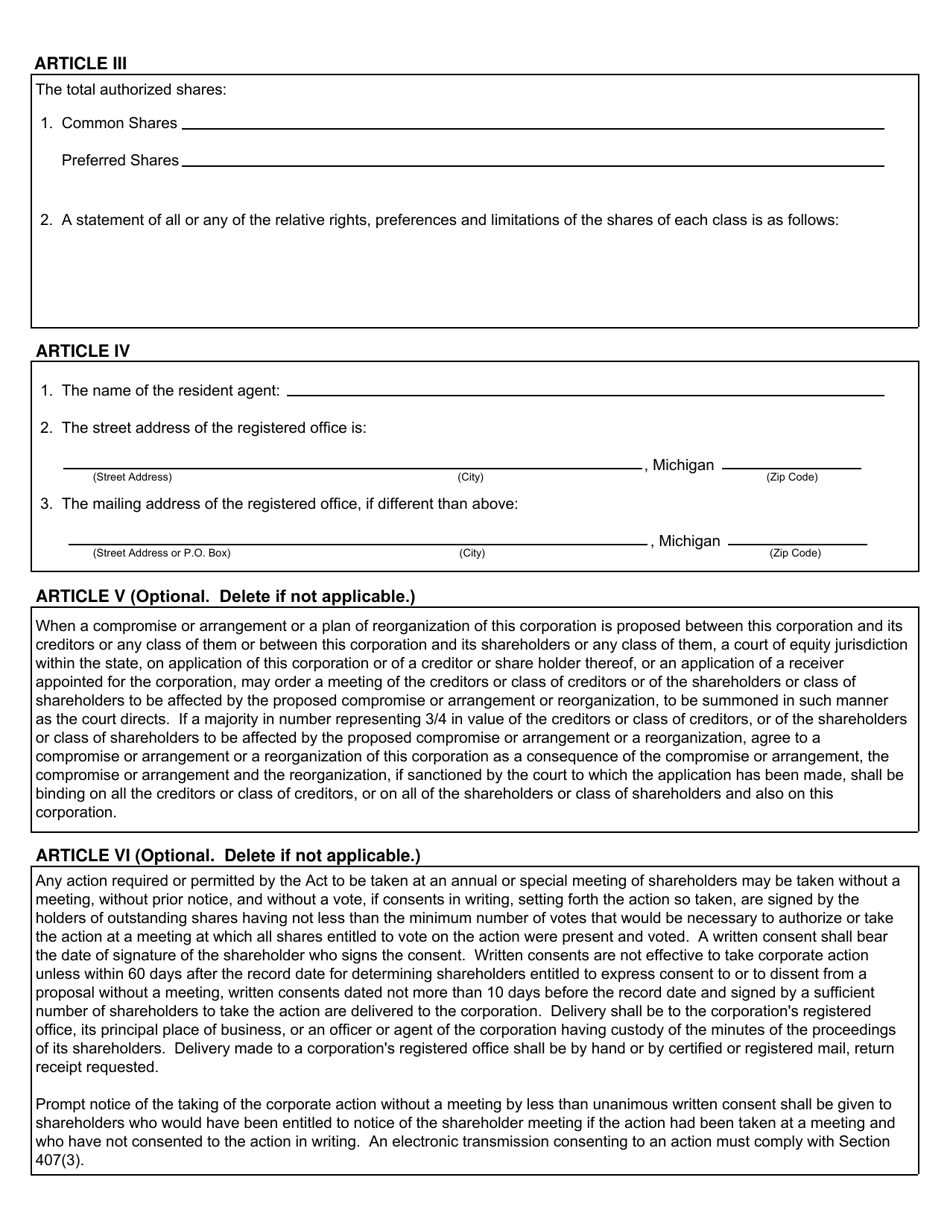

Q: Can I make changes to the Articles of Incorporation while restating them using form CSCL/CD-510C?A: Yes, you can make changes or amendments to the Articles of Incorporation while restating them using form CSCL/CD-510C.

Q: Can I use the form CSCL/CD-510C for other types of corporations?A: No, the form CSCL/CD-510C is specifically designed for use by Domestic Nonprofit Corporations in Michigan.

Q: Do I need to provide any supporting documents with the form CSCL/CD-510C?A: No, you generally don't need to provide any supporting documents with the form CSCL/CD-510C. However, it is always recommended to review the official instructions or consult with an attorney for specific requirements.

Q: Can I draft my own restated Articles of Incorporation instead of using form CSCL/CD-510C?A: Yes, you can draft your own restated Articles of Incorporation instead of using form CSCL/CD-510C. However, it is advisable to consult with an attorney to ensure compliance with Michigan laws and regulations.