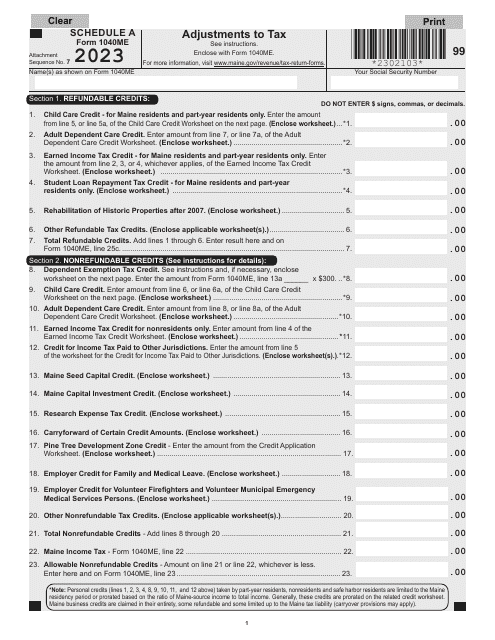

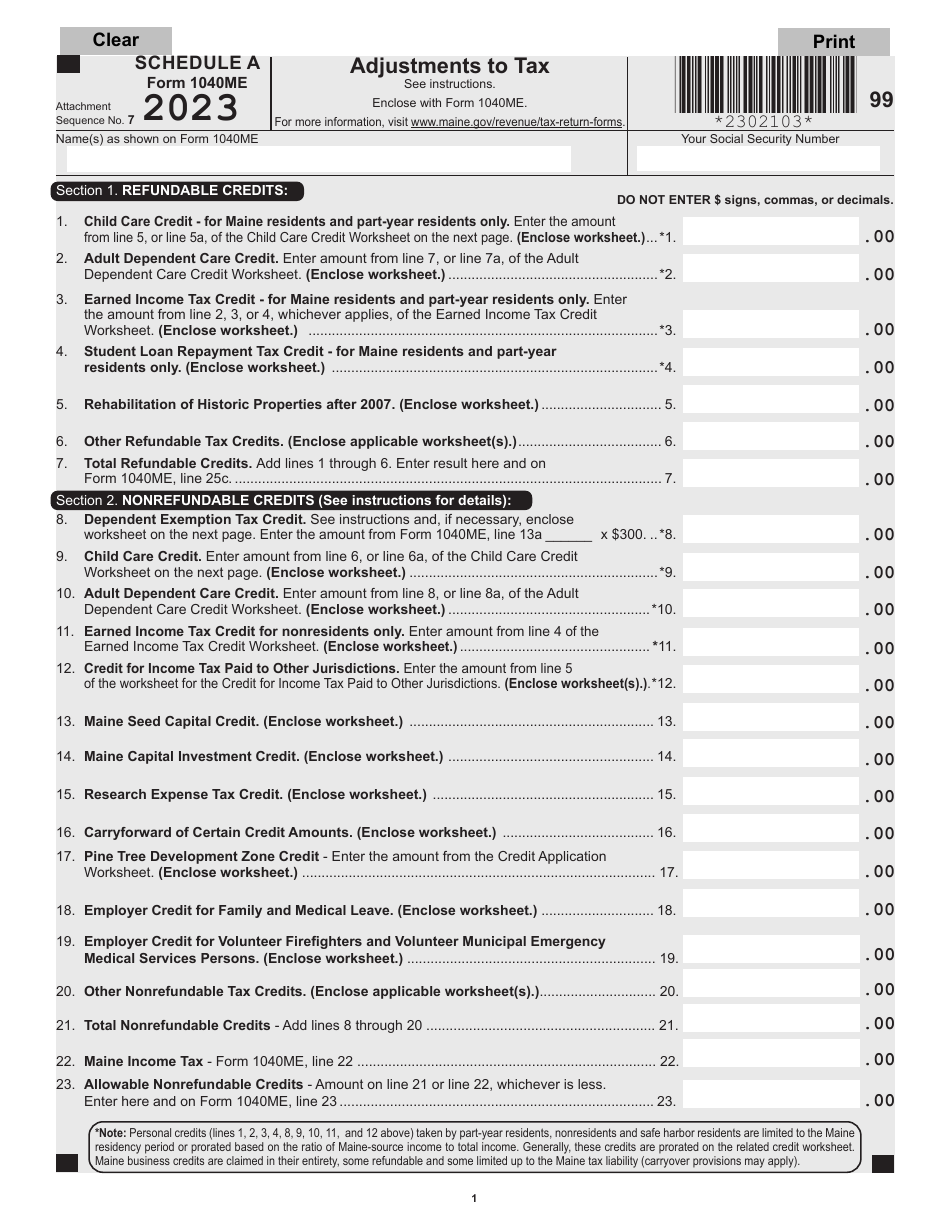

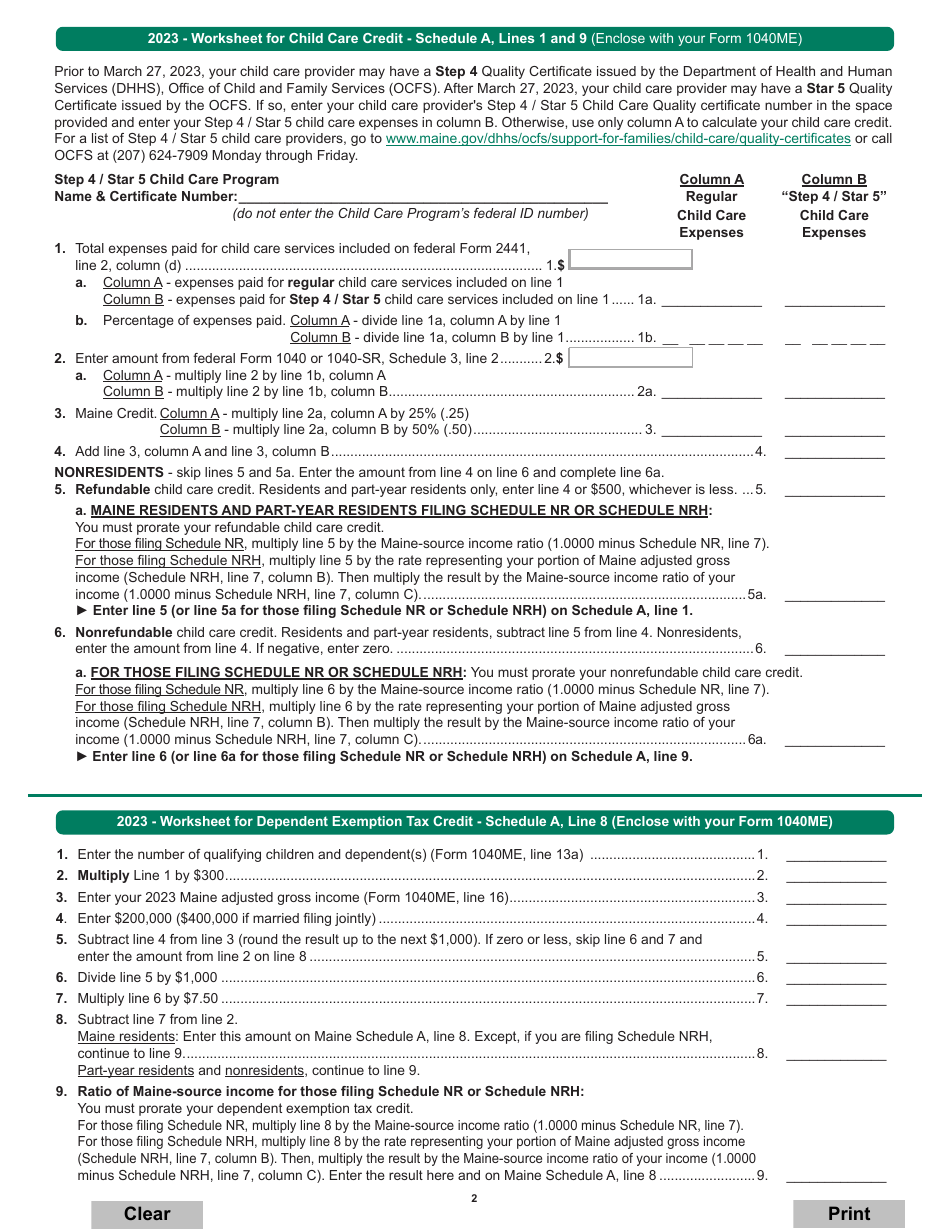

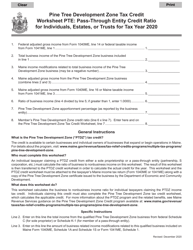

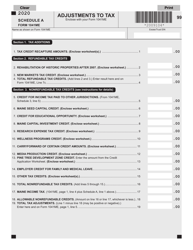

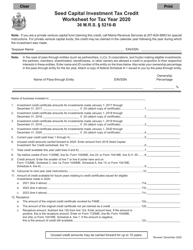

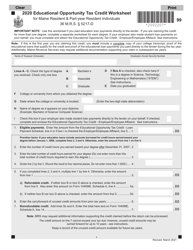

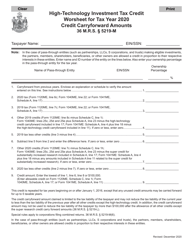

Form 1040ME Schedule A Adjustments to Tax / Child Care Credit Worksheet - Maine

What Is Form 1040ME Schedule A?

This is a legal form that was released by the Maine Revenue Services - a government authority operating within Maine.The document is a supplement to Form 1040ME, Maine Individual Income Tax. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1040ME Schedule A?A: Form 1040ME Schedule A is a tax form used in the state of Maine to report adjustments to tax.

Q: What kind of adjustments can be reported on Schedule A?A: Schedule A allows you to report various adjustments to your taxable income, such as deductions for student loan interest, educator expenses, and certain IRA contributions.

Q: Do I need to file Form 1040ME Schedule A?A: You need to file Schedule A if you have any adjustments to your Maine state tax. However, not everyone will have adjustments, so it depends on your specific situation.

Q: When is the deadline to file Form 1040ME Schedule A?A: The deadline to file Form 1040ME Schedule A is the same as the deadline to file your Maine state tax return, usually April 15th.

Q: Can I e-file Form 1040ME Schedule A?A: Yes, you can e-file your Form 1040ME Schedule A through approved tax software or by using a professional tax preparer.

Q: Is there a separate Schedule A for federal taxes?A: Yes, there is a separate Schedule A for federal taxes. Form 1040ME Schedule A is specifically for adjustments to your Maine state tax.

Q: What other forms should I include with Form 1040ME Schedule A?A: You may need to include supporting documentation for the adjustments you're reporting on Schedule A, such as receipts or other proof of expenses.

Q: Can I claim the same adjustments on both federal Schedule A and Form 1040ME Schedule A?A: No, the adjustments you report on federal Schedule A should not be claimed again on Form 1040ME Schedule A.