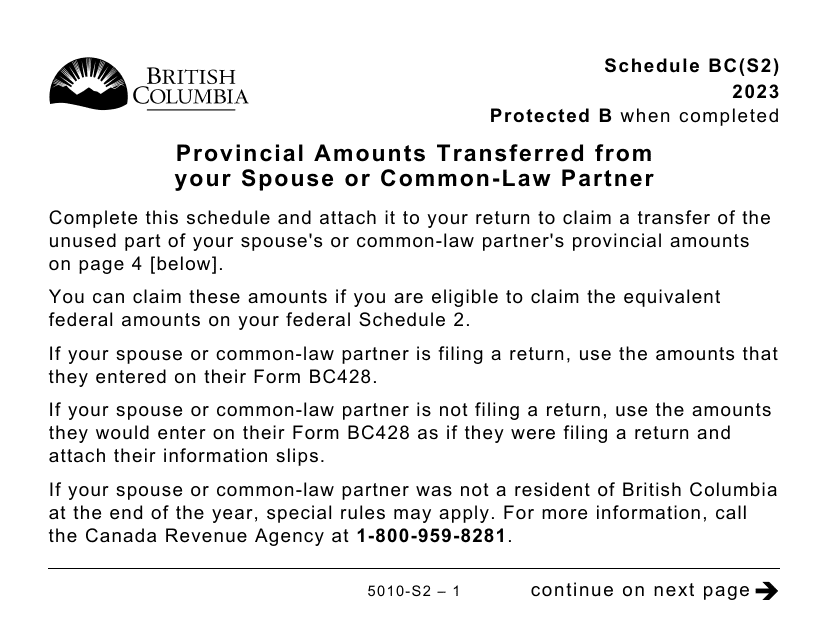

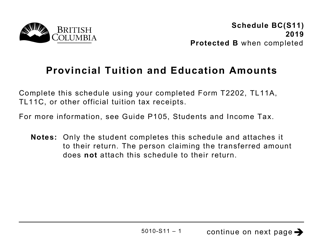

Form 5010-S2 Schedule BC(S2) Provincial Amounts Transferred From Your Spouse or Common-Law Partner - Large Print - Canada

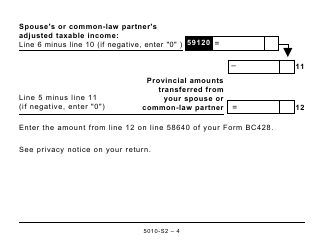

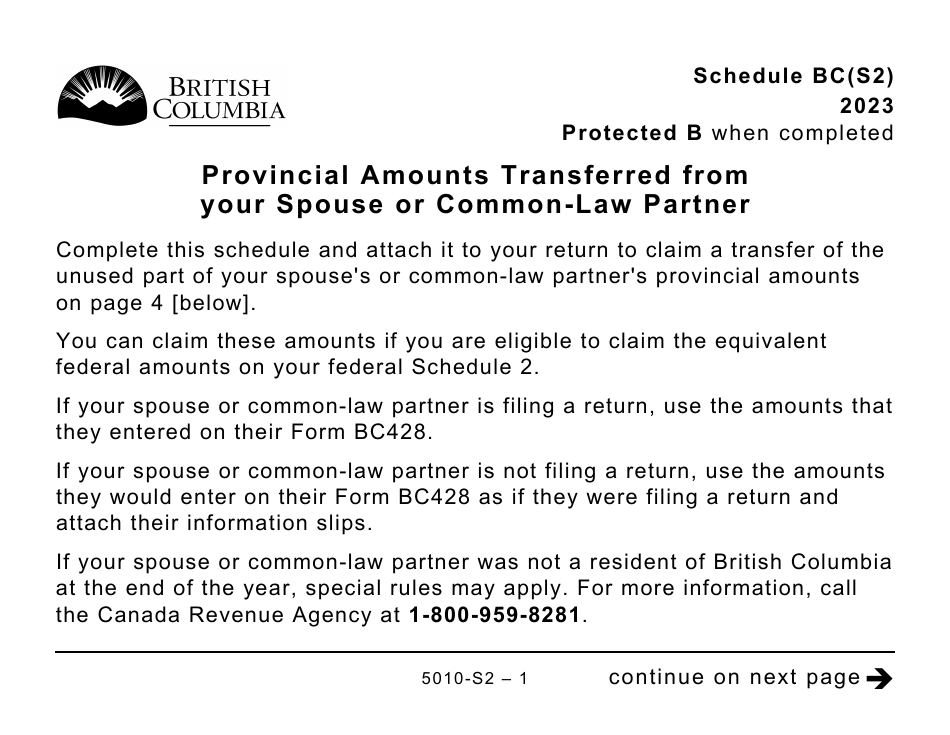

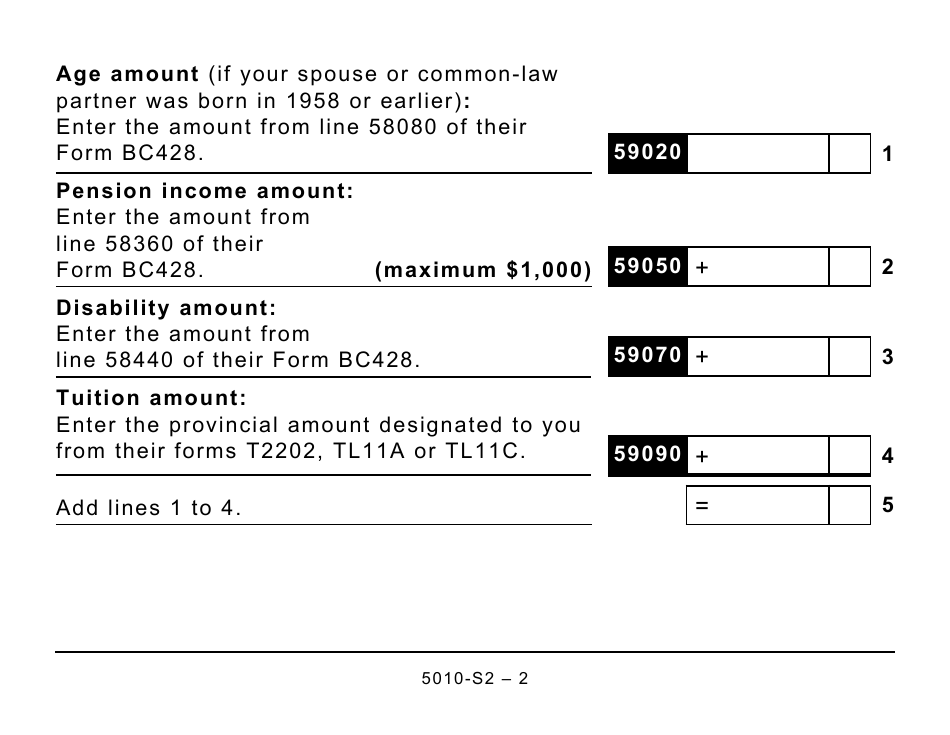

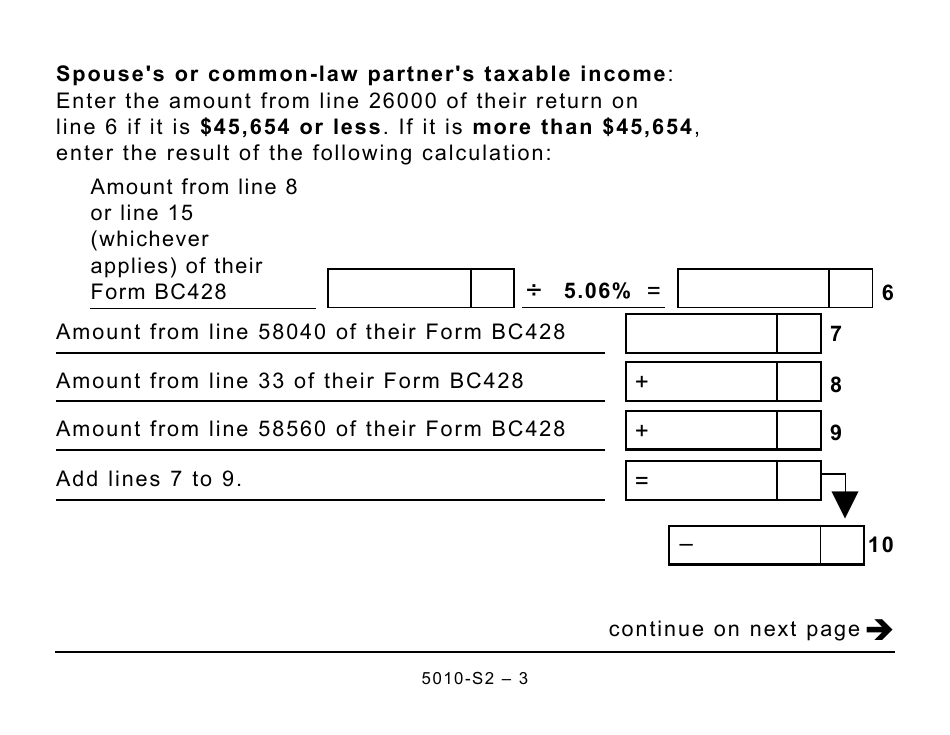

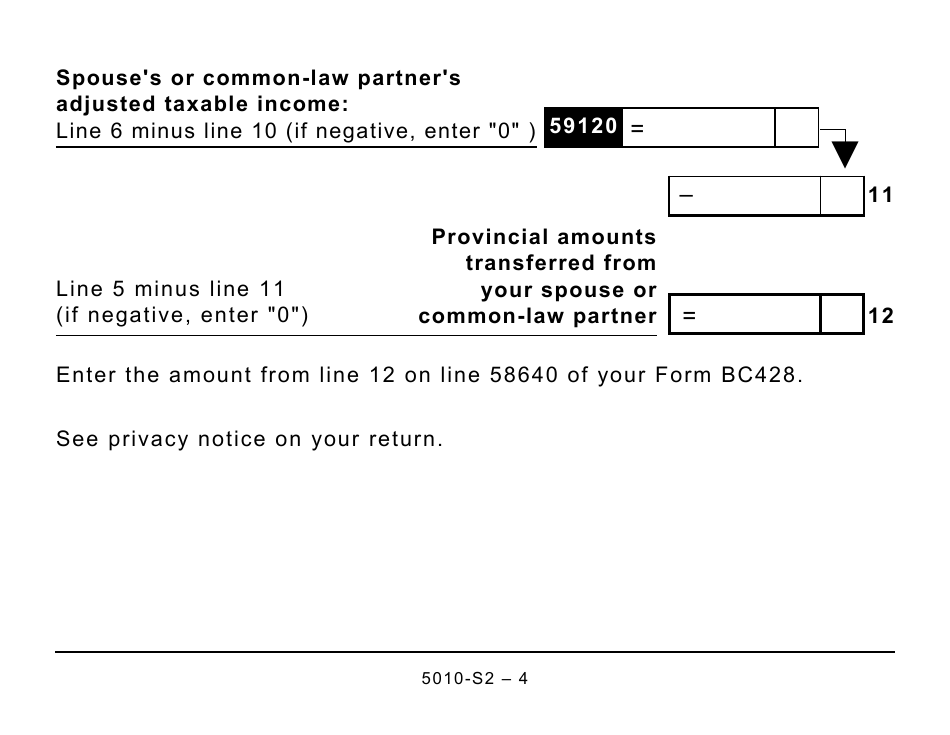

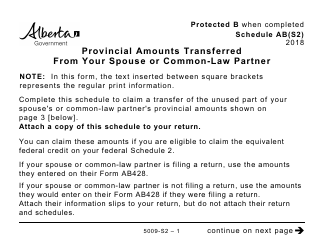

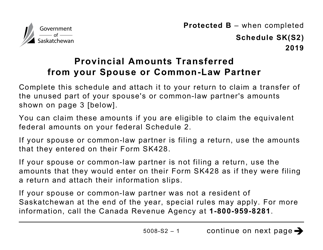

Form 5010-S2 Schedule BC(S2) Provincial Amounts Transferred From Your Spouse or Common-Law Partner (Large Print) is a form used in Canada to report provincial amounts that are transferred from your spouse or common-law partner. It is used for tax purposes.

FAQ

Q: What is Form 5010-S2?A: Form 5010-S2 is a schedule used in Canada for reporting provincial amounts transferred from your spouse or common-law partner.

Q: What is Schedule BC(S2)?A: Schedule BC(S2) is a specific section of Form 5010-S2 that pertains to provincial amounts transferred from your spouse or common-law partner.

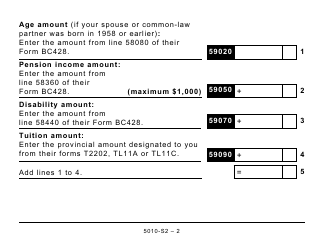

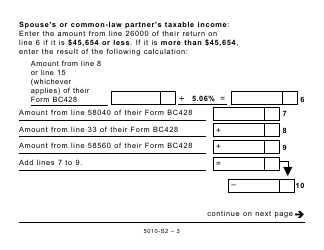

Q: What is a provincial amount?A: A provincial amount refers to an amount that can be transferred from your spouse or common-law partner's provincial tax credits to reduce your own tax liability.

Q: Why would I need to use Schedule BC(S2)?A: You would need to use Schedule BC(S2) if you want to claim any provincial amounts transferred from your spouse or common-law partner.

Q: What is the purpose of Form 5010-S2?A: The purpose of Form 5010-S2 is to accurately report and calculate the provincial amounts transferred from your spouse or common-law partner.

Q: Is Form 5010-S2 only applicable in Canada?A: Yes, Form 5010-S2 is specific to the Canadian tax system and is used for reporting purposes within Canada.

Q: Is there a large print version of Form 5010-S2?A: Yes, there is a large print version available for Form 5010-S2 to accommodate individuals with visual impairments.