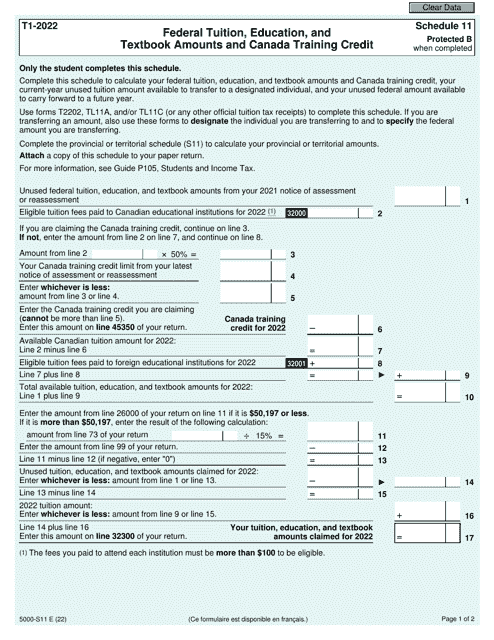

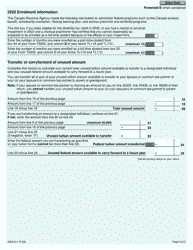

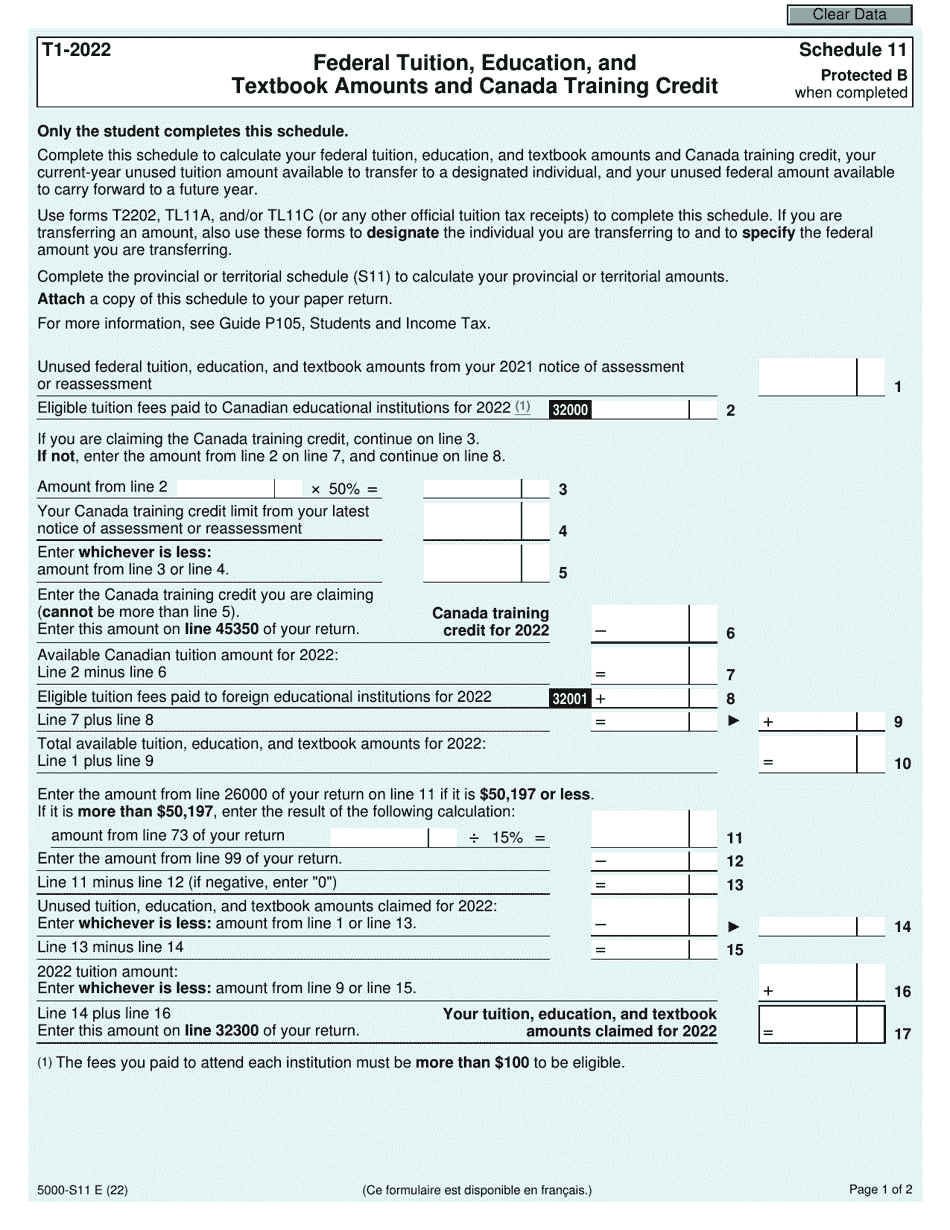

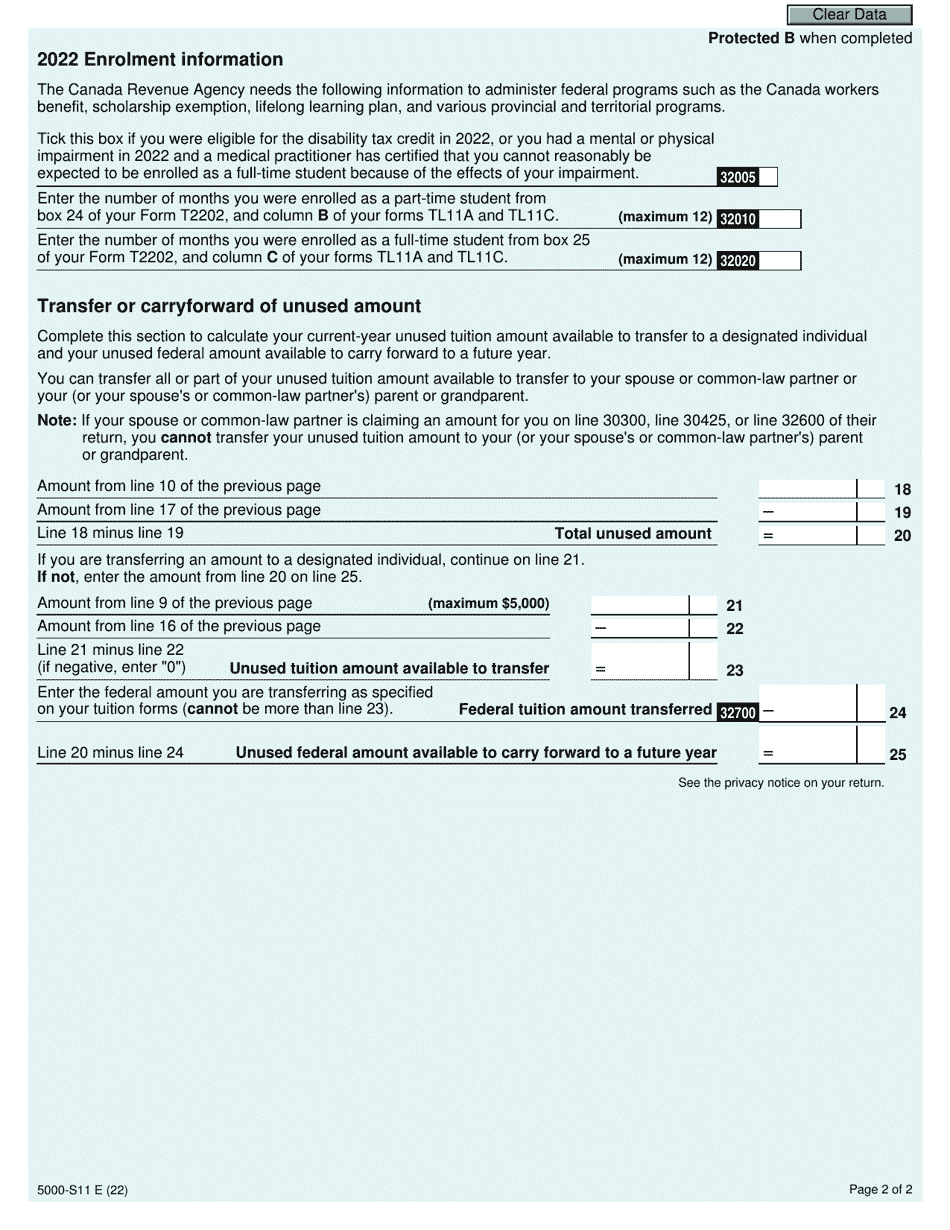

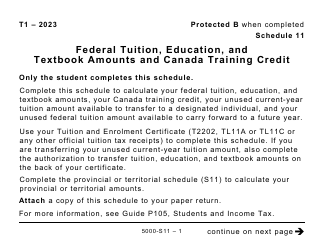

Form 5000-S11 Schedule 11 Federal Tuition, Education, and Textbook Amounts and Canada Training Credit (For All Except Qc and Non-residents) - Canada

Form 5000-S11 Schedule 11 is used in Canada for claiming federal tuition, education, and textbook amounts, as well as the Canada Training Credit.

The individual who is claiming federal tuition, education, and textbook amounts as well as the Canada Training Credit (for all except Quebec and non-residents) files the Form 5000-S11 in Canada.

FAQ

Q: What is Form 5000-S11?A: Form 5000-S11 is a tax form for reporting federal tuition, education, and textbook amounts and Canada training credit.

Q: Who needs to file Form 5000-S11?A: All individuals except residents of Quebec and non-residents of Canada need to file Form 5000-S11 if they want to claim federal tuition, education, and textbook amounts or the Canada training credit.

Q: What is the purpose of Form 5000-S11?A: The purpose of Form 5000-S11 is to calculate and report the amounts of federal tuition, education, and textbook amounts or the Canada training credit that can be claimed on an individual's income tax return.

Q: What are the federal tuition, education, and textbook amounts?A: The federal tuition, education, and textbook amounts are tax credits that can be claimed for eligible tuition fees and textbook costs.

Q: What is the Canada training credit?A: The Canada training credit is a new non-refundable tax credit that can be claimed on eligible tuition and fees paid for occupational skills courses.

Q: Do residents of Quebec need to file Form 5000-S11?A: No, residents of Quebec have their own provincial form for claiming tuition and education amounts.

Q: Do non-residents of Canada need to file Form 5000-S11?A: No, non-residents of Canada are not eligible to claim the federal tuition, education, and textbook amounts or the Canada training credit.