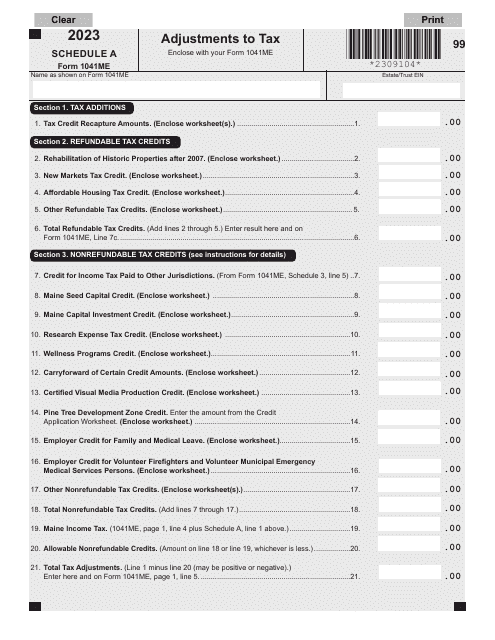

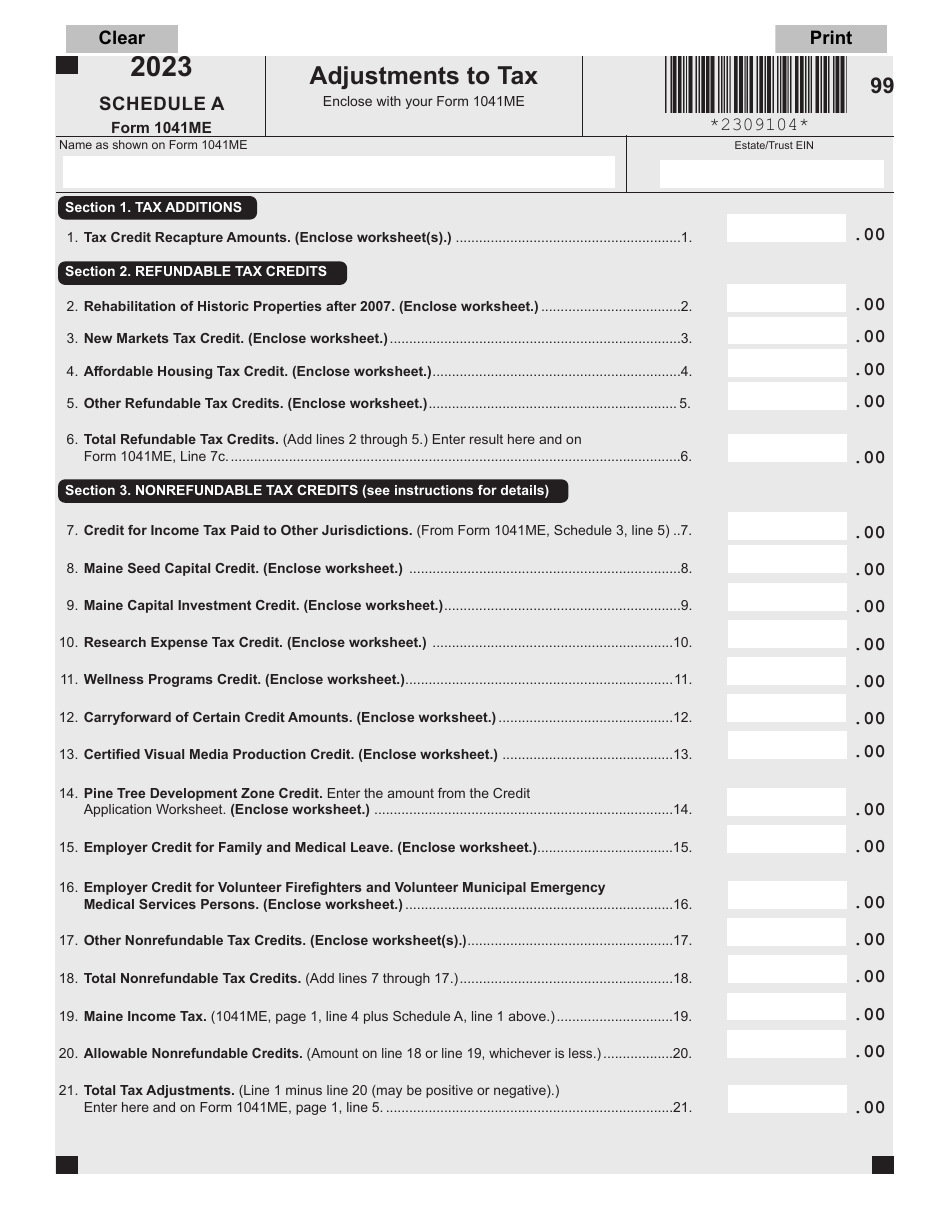

Form 1041ME Schedule A Adjustments to Tax - Maine

What Is Form 1041ME Schedule A?

This is a legal form that was released by the Maine Revenue Services - a government authority operating within Maine.The document is a supplement to Form 1041ME, Income Tax Return for Resident and Nonresident Estates and Trusts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1041ME Schedule A?A: Form 1041ME Schedule A is a tax form specifically for residents of Maine that is used to report adjustments to tax on the Maine fiduciary income tax return (Form 1041ME).

Q: Who should file Form 1041ME Schedule A?A: Individuals who need to report adjustments to tax on their Maine fiduciary income tax return (Form 1041ME) should file Form 1041ME Schedule A.

Q: What are some examples of adjustments to tax that should be reported on Form 1041ME Schedule A?A: Examples of adjustments to tax that should be reported on Form 1041ME Schedule A include additions to tax, subtractions from tax, and other adjustments required by Maine tax laws.

Q: Is Form 1041ME Schedule A the same as the federal Schedule A?A: No, Form 1041ME Schedule A is specific to Maine state taxes and should not be confused with the federal Schedule A, which is used for itemized deductions on the federal income tax return.